In this blog, EPFR’s Azalea Micottis expands on NIKKEI Asia’s recent article, Nike, Adidas shoe supplier to cut up to 3,000 jobs in Vietnam this month.

View from EPFR

Continuously rising inflation in the US and Europe has seen the demand for Taiwanese shoe manufacturer Pou Chen’s products drop since November 2022. As a result, in the second month of this year the company was forced to eliminate thousands of jobs – most notably in one of their largest factories in Vietnam.

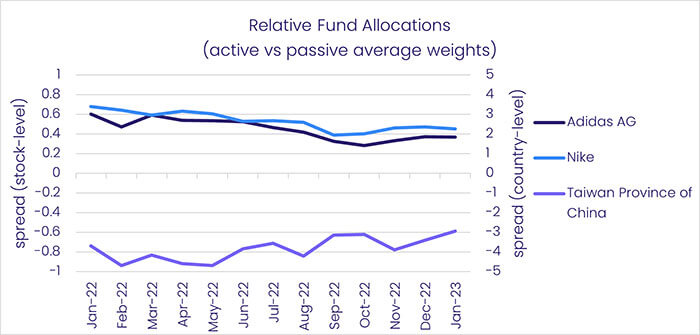

Prior to the announcement of these job cuts, EPFR’s stock-level allocations data signaled that active fund managers were factoring in a dampening in demand. Over the preceding 12 months, their allocations to the global brands that Pou Chen supplies were gradually unwound relative to passive fund holdings. Meanwhile, over the same period active managers with an Asia ex-Japan equity mandate have remained significantly underweight Pou Chen’s home market, Taiwan.

Another clue that Asian manufacturers, relocated or not, face tougher times surfaced in EPFR’s sector allocations data. After peaking at a 63-month high going into November, the average Asia ex-Japan Equity Fund allocation to industrial plays has fallen for three straight months.

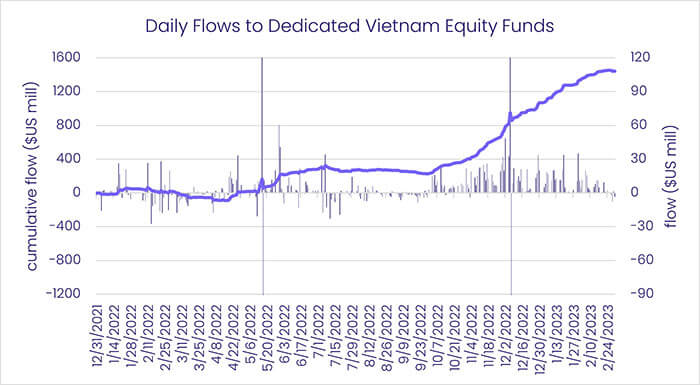

The Nikkei article also raises the fact that, having benefited from the desire of Western companies to reduce their reliance on Chinese supply chains, Vietnam has recently experienced a decline in its exports and re-exports of many labor-intensive products.

EPFR’s fund flow data captured this shift. Flows to Vietnam Equity Funds picked up a significant tailwind from the supply chain relocation story coming into 2023, but recently those funds posted their first collective weekly outflow in almost six months after several weeks of declining inflows.

Did you find this useful? Get our EPFR Insights delivered to your inbox.