EPFR’s Quant Analyst Azalea Micottis expands on Bloomberg’s article, Turkish Stocks Extend World-Leading Slump Amid ‘Fear and Panic’.

View from EPFR

2022 was, for the most part, a year where stock markets suffered in the midst of rising inflation and tightening of monetary policy to combat it. Indeed, North American and European equities struggled to generate returns as short-term interest rate hikes took hold.

Turkish stocks, however, were one of the few not subject to the same misfortunes. Even with elevated levels of inflation, Turkey was the world’s top-performing market. Due to other contributing factors like decreased short-term interest rates and the Lira tumbling against the Dollar, the Istanbul Bourse rallied by over 100% in US dollar terms, or around 190% in local terms last year. Comparably, MSCI EM equity baskets collectively fell by around 20% over the same time frame.

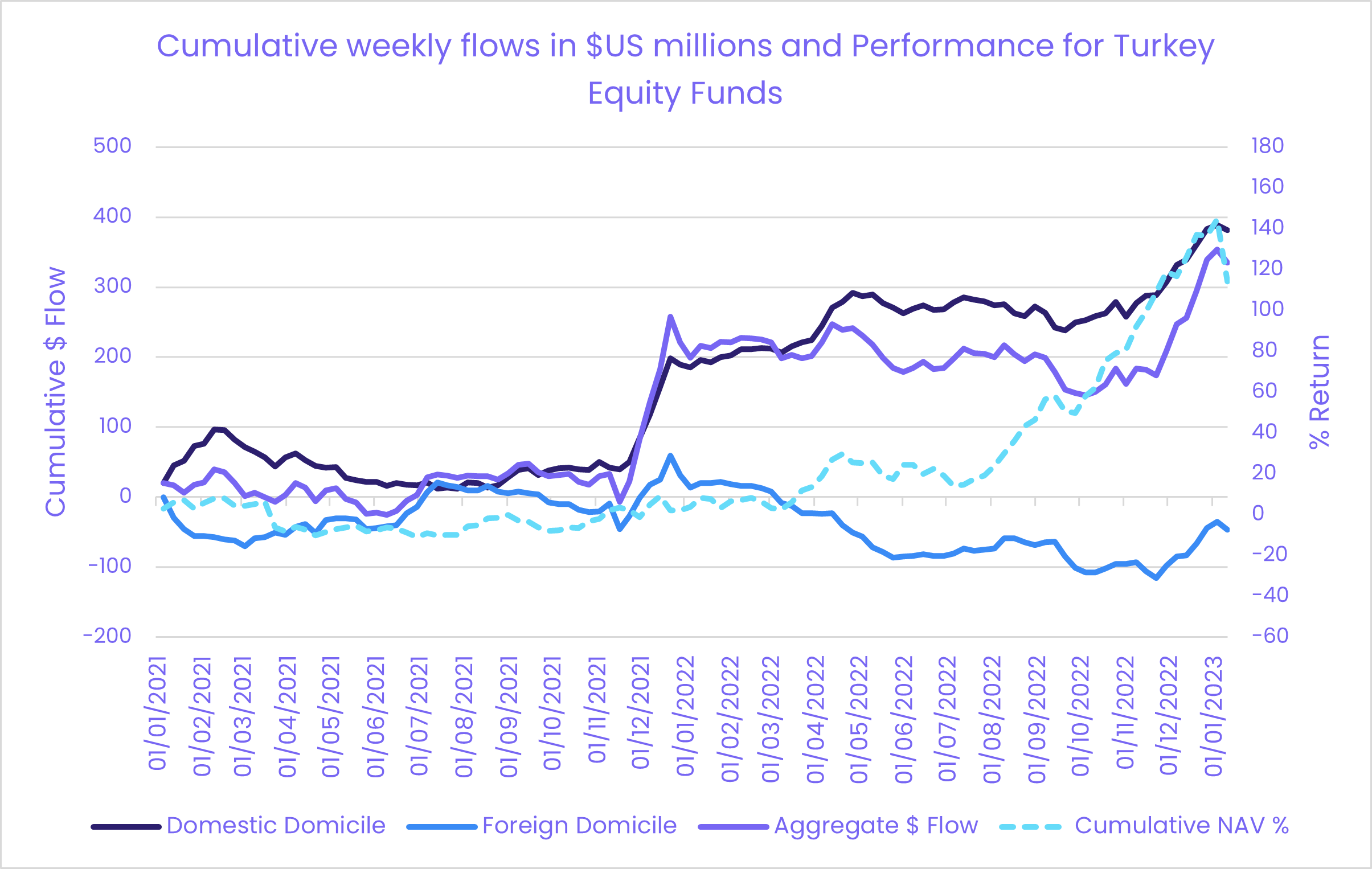

Per the chart below, this rally of Turkish stocks was also captured in EPFR’s Fund Flow data. All mutual funds and ETFs focusing on Turkish equities received $139 million of new client money in 2022. Of this universe of funds, this net inflow was largely supported by investment into the subset that are domiciled in the same country.

What the first chart above also shows us, however, is that these gains appear to have come to abrupt end within the first couple of weeks of the new year. Wide-spread price volatility has triggered trading halts, induced by panic-selling by local investors. As a result, a month’s worth of gains has been wiped out in just a few days.

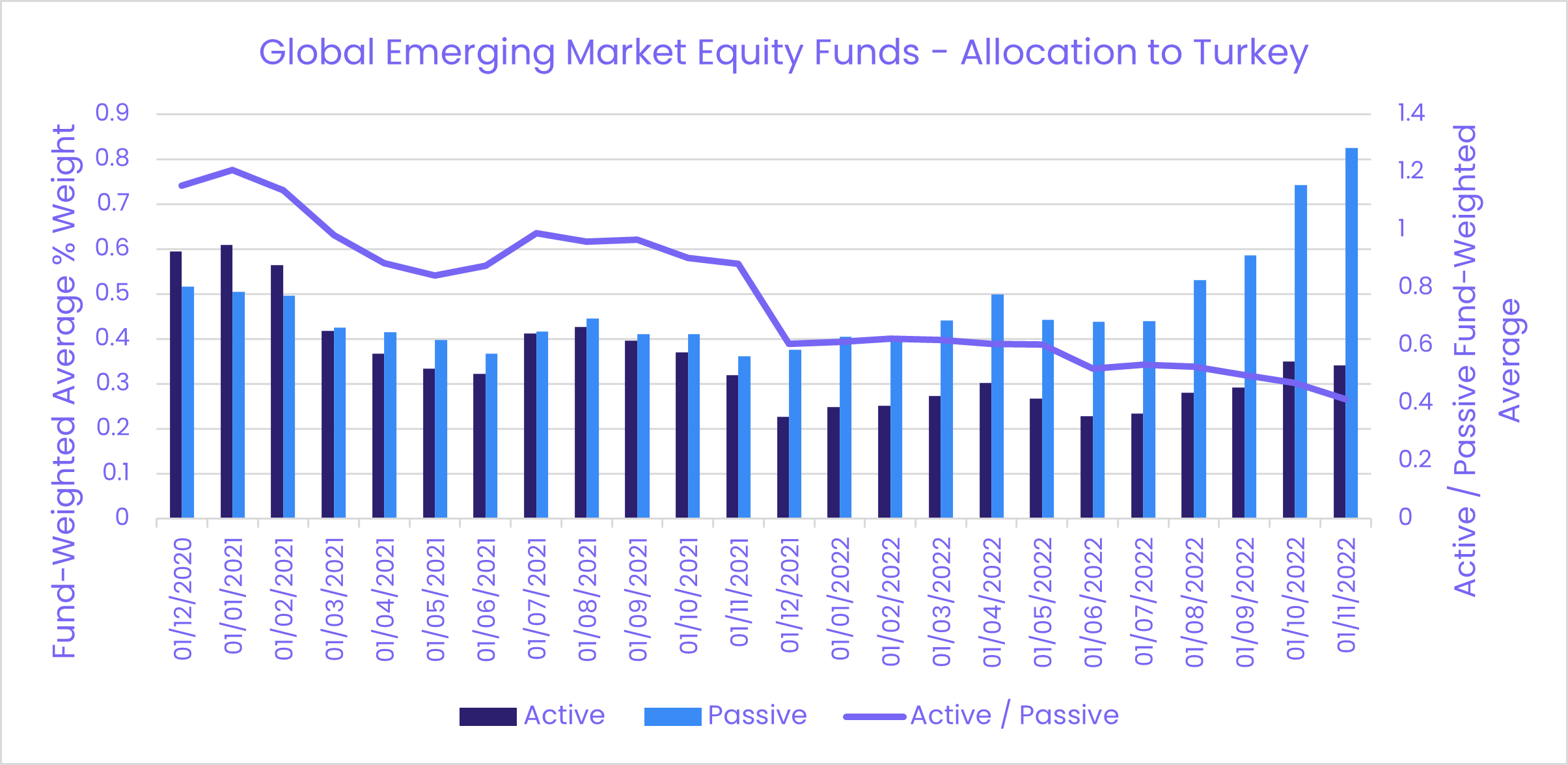

Using EPFR’s Country Allocations data, we are able to understand whether equity fund managers have been positioning themselves in anticipation for this recent crash. Overall, during the same time that Turkish equities rallied last year, active GEM managers had already begun withdrawing their positions in Turkish markets as early as March 2021.

Did you find this useful? Get our EPFR Insights delivered to your inbox.