As a catalyst for market optimism, artificial intelligence (AI) and the productivity gains it promises was arguably the runaway leader in 2023. The share price of Nvidia – the chipmaker that has rapidly become the bellwether for the AI industry – jumped 220% over the course of the year.

Viewed at a remove, the narrative about AI rapidly evolved into one about a sector in its own right driven primarily by US actors and businesses. But has AI really broken free of the technology majors that are behind many of the latest advances? And is it really shackled, in terms of returns, to the US?

To explore these questions, we can make use of the granularity offered by EPFR’s sector-level fund data.

The geese that lay these golden eggs

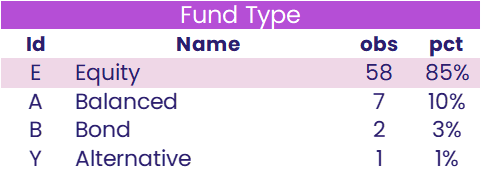

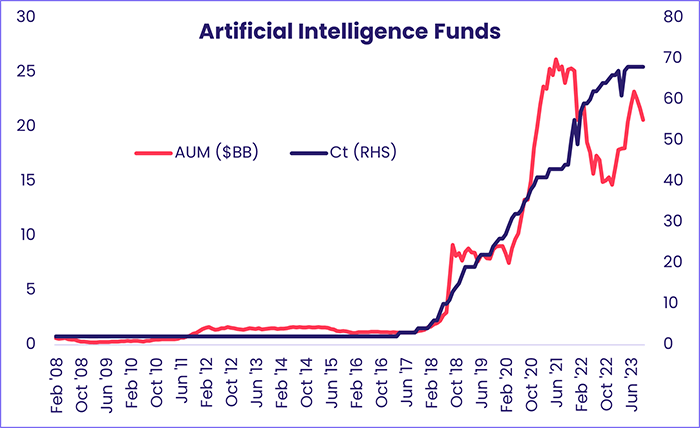

By filtering existing, broader fund groups, EPFR is able to isolate a discrete group of funds whose primary mandate is to invest in companies involved in the development and deployment of AI. Most of these are equity funds.

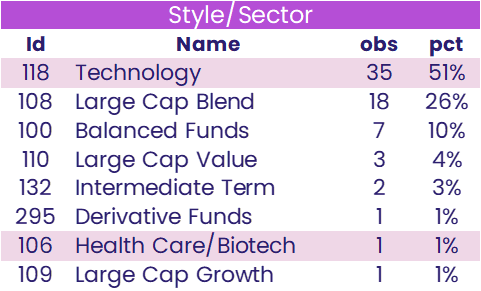

Around half of these funds fall into the Technology Sector Fund bucket.

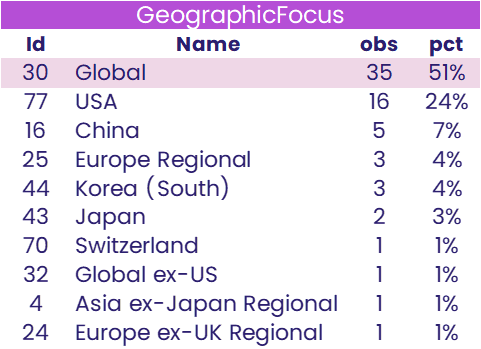

What is surprising is that the remaining half are diversified, non-sector-specific funds. Furthermore, when it comes to geographic focus, more than half have global mandates.

There is one caveat to the strong showing by funds with global mandates: funds reporting country exposure in 4Q23 were allocating – on average – a third of their portfolios to the US.

Counting principal components

Having established our universe of AI funds, we can perform a deeper dive into their behavior. To do so, we employ principal components analysis.

For this kind of analysis to produce credible results, we need a reasonable number of these funds reporting over a reasonable period of time. Although the count of AI funds has climbed sharply in recent years, there are still at least 50 funds whose returns can be plotted every month over the past two years.

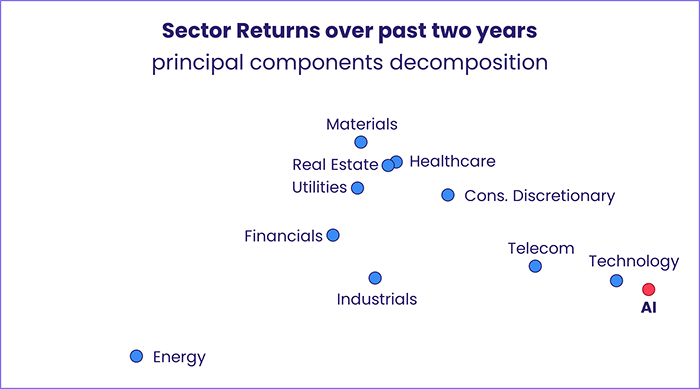

For our analysis, we looked at the returns of these funds over the past 24 months compared with those of the 11 major equity Sector Fund groups tracked by EPFR.

Counting AI as a sector in its own right, each sector is characterized by 24 data points that represent every month’s return between November 2021 and October 2023. From this, we can establish 24 linear combinations or risk factors that encompass geography, volatility of returns, investment styles and other key risk metrics. The riskiest becomes the first principal component, with the next strongest becoming the second. The remaining, weaker risk factors are then discarded.

Connecting the dots

The two factors that make the cut are used as the axes that allow us to represent our data in two dimensions by way of a simple dot-plot chart. Once the dots are arranged along the two axes, the one that corresponds to AI funds is colored red while those relating to all other sectors appear as blue dots. The result is a visual representation (see chart below) showing the return profiles for each sector.

As you can see from the exhibit, AI Funds behave like Technology Sector Funds, only more so. By this we mean that, when graphed, they are even further down the road that separates Technology Sector Funds from the ruck of Sector Funds.

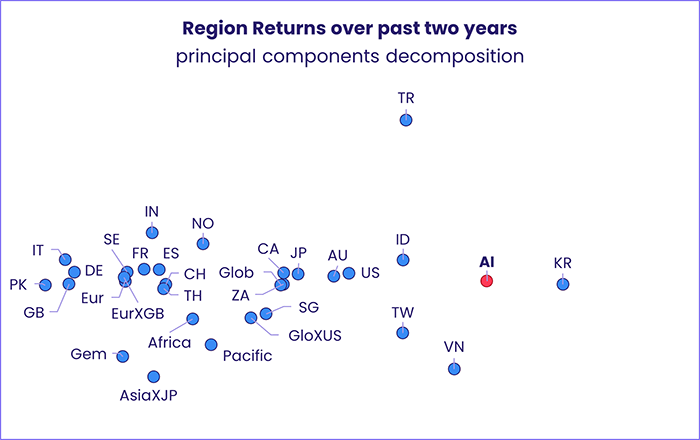

Performing the same analysis, but comparing AI Fund returns to the returns of fund groups by geographic mandate, we can see that AI funds have the same risk profile as Asian Tigers.

They are closest to the country returns of South Korea, Indonesia, Taiwan (POC) and Vietnam. The closest Western countries are the U.S. and Australia, arguably the most tigerish of markets in the developed nations universe.

More to come

While the sheer pace of change makes AI a moving target for analysis, after our dive into 2023’s dominant investment theme we can draw one conclusion, pose one important question and make a statement.

The conclusion is that AI has not broken free of the technology sector’s orbit, and hence deals with similar investment risks and opportunities. The question is that, given return profiles of artificial intelligence funds have more in common with the dominant Emerging Asian market players in the technology space, is AI’s future expected to be shaped by that part of the world?

The statement is a simple one: this piece was not written by ChatGPT or something similar.

Did you find this useful? Get our EPFR Insights delivered to your inbox.