The debate among investors over China’s place in the emerging markets universe and the appropriate level of exposure to the world’s second-largest economy is not a new one. EPFR started tracking its first Global Emerging Markets (GEM) ex-China Fund in 2015. But the debate has sharpened in the wake of China’s aggressive Covid-containment lockdowns, its deteriorating relations with the US, and its unwillingness to embrace Western levels of market transparency.

In response to the growing reservations about China’s dominant position in many nominally diversified portfolios, asset managers are taking steps to address what they see as a growing need for funds with ex-China mandates. But, as the history of BRIC (Brazil, Russia, India and China) Equity Funds shows, trends and themes in the emerging markets space often burn brightly for a short while and then burn themselves out.

That said, what can we say about the rapid growth of GEM ex-China Equity Funds? Are they adding value? Will they still be with us a decade from now?

Customizing a new bucket

While EPFR has yet to formally bucket GEM ex-China Funds in their own group, the breadth and depth of EPFR’s fund-level ETF and Mutual Fund data make it possible – and easy – to create a custom basket of funds that can be used to analyze the ex-China trend.

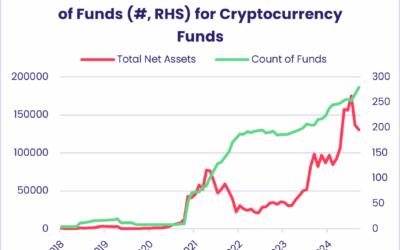

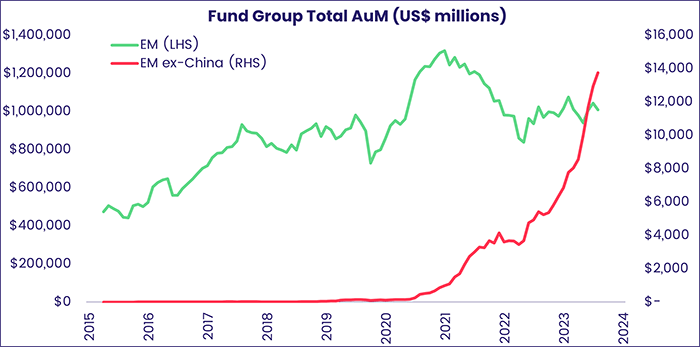

For this Quants Corner piece, we created custom fund groups by filtering fund names and benchmarks using relevant keywords. Although the oldest fund in the custom group dates back to 2015, it was not until 2017 that MSCI launched an EM ex-China index, and it was not until 2021 that the theme really gained momentum.

From the end of 1Q21 to the end of January 2024, the total assets of GEM ex-China Equity Funds reached $13.7 billion – an astonishing 2,373% increase over that period.

Gauging the degrees of separation

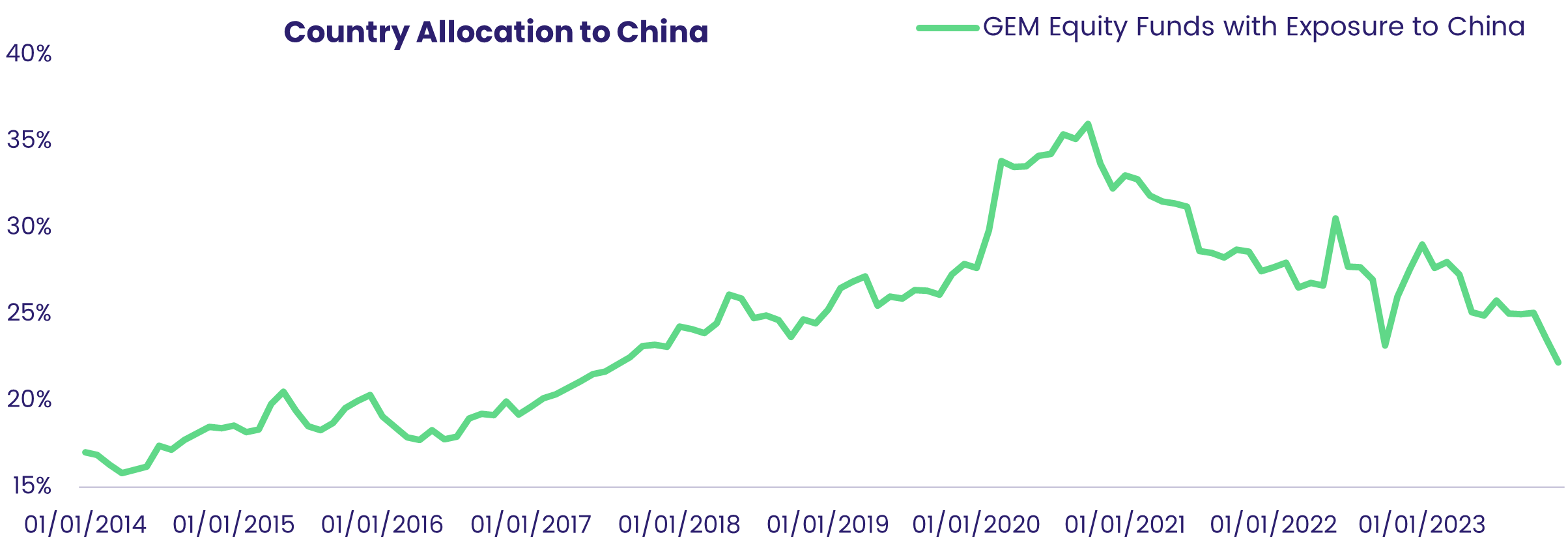

What was the picture before 2021? If we exclude those equity funds with EM ex-China mandates from the GEM Equity Fund group and look at their average exposure to China over the past decade, the concerns about over-exposure become clear. Between 2Q14 and 4Q20, allocations rose from just under 16% of the average portfolio to 35%. Then, as lockdowns employed by Chinese authorities to contain the pandemic began to bite, it started a decline that has taken it to its current level of just over 20%.

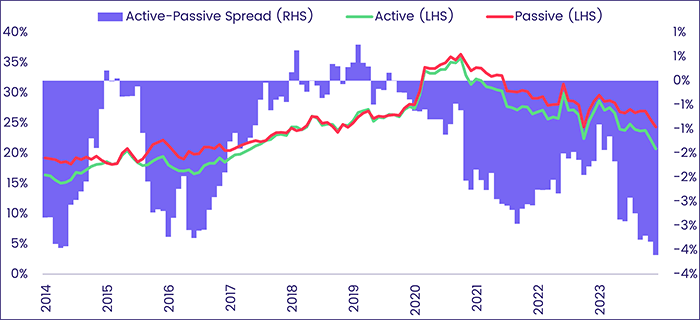

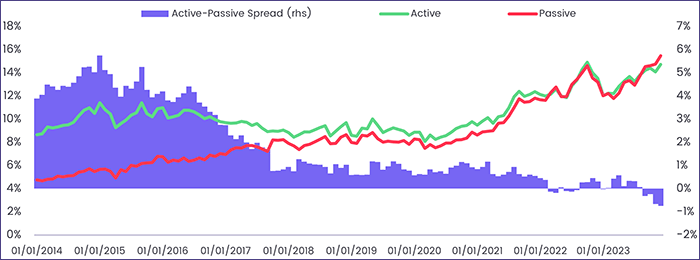

Drilling deeper into those top-level numbers, actively managed ETFs and mutual funds kept pace with their passively managed peers and were generally overweight China – relative to those passive funds – between 2017 and 2020. That changed after Covid-19 hit.

According to the most recent country allocation data, going into February actively managed GEM Funds were underweight passively managed ones by an average of 3.6%.

And the winner is…

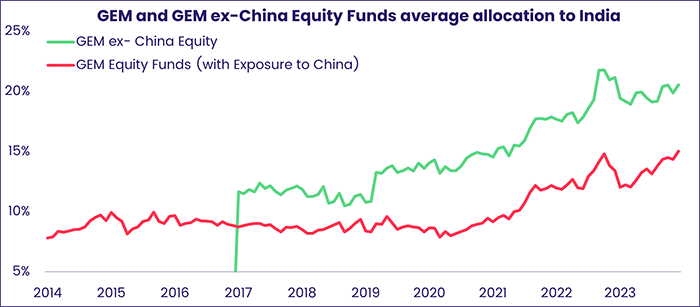

Investors and fund managers looking beyond China often shift their gaze to India, emerging Asia’s second-largest economy. GEM Equity Funds (both those with ex-China mandates and those that are fully global) have been increasing their exposure, whose GDP growth has surpassed China’s, to India since 2019. It is worth noting that India’s average allocation started to increase several months before funds started pulling back from China.

However, managers of actively allocated funds are more convinced about the need to cut their exposure to China than they are about India’s ability to fill the resulting gaps in their portfolios. They were underweight India relative to their passively managed peers for the first time in 2022 and are currently 0.74% down on those passive funds.

Turbulence ahead

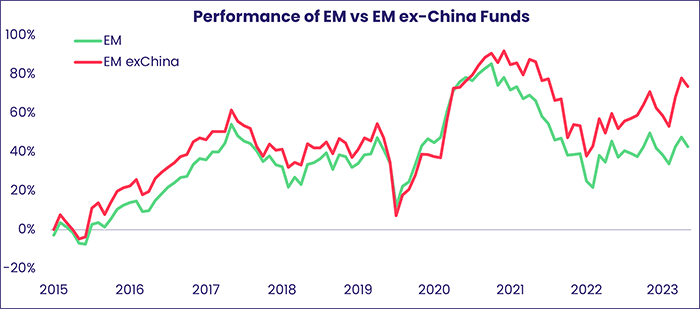

Classical finance theory suggests that, as long as investors can tolerate the ups and downs that go with taking on more risk, they are likely to enjoy higher returns. GEM Equity Funds with mandates excluding China, who must cast a wider net in the emerging markets universe to compensate, have outperformed funds with exposure to China over the past eight years. Their performance has also, to a degree, been more volatile.

The GEM ex-China Fund outperformance has not been consistent and, at first glance, looks dependent on market timing. But that is a subject for a future Quants Corner.

Did you find this useful? Get our EPFR Insights delivered to your inbox.