The freedom to deploy fiscal policy unfettered by the European Union’s budgetary rules may prove to be a godsend for the UK as it battles the economic impacts of the current pandemic.

On the other side of the channel, however, this ‘fiscal space’ is scarcer. It is also the subject of heated debates between that markets hardest hit by Covid-19 and a group of fiscally conservative countries who believe the EU’s rules represent a vital bulwark against rampant abuse of the social contract between taxpayers and governments.

It remains to be seen if this bloc, dubbed The Frugal Four and comprised of Austria, Denmark, Netherlands and Sweden, are destined the save the EU from itself or, as their critics argue, will cement its destruction by tying the hands of economic policymakers while seeking rebates and exceptions for themselves.

While the final answer is years into the future, the tension between the countries that want to preserve existing fiscal space and those who believe now is the time to use it poses so investment challenges and opportunities that we will explore in this blog.

Looking for gold on both sides of the coin

The tendency of the Frugal Four to err on the side of caution when it comes to public spending and taking on debt has made these markets popular with risk averse fixed income investors. But is simply pumping money into these markets the best way to maximize returns?

To address this question, we are going to run a simple flow strategy to trade bonds of the Frugal Four (+ Germany and Finland) versus those issued by a set of other, less ‘frugal’ European countries. To do so, we utilize the relative flows for funds mandated to invest in the debt from these two groups.

The first step in building the quantitative framework for this particular signal is the summing of daily bond flows to the two groups. Belgium, France, Greece, Italy, Spain and Ireland comprise the non-frugal group. Then, we normalize this summation by the total assets invested by all EPFR-tracked funds in the same set of countries.

This indicator serves as our ‘daily sentiment proxy’ for European countries. This metric is the same as our quant team discussed in their 2018 paper, Fund Flows as Country Allocator (1).

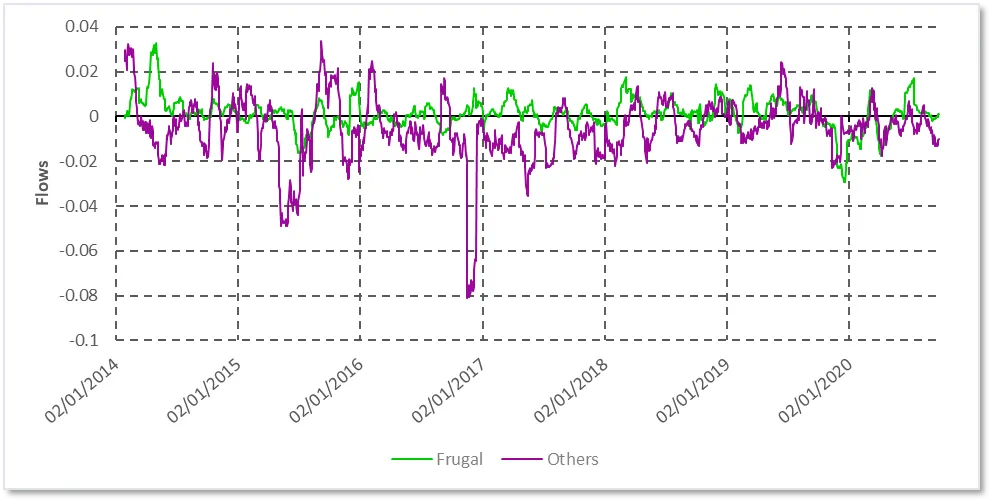

With these flow percentage factors in hand, we calculate 20-day trailing summations for both. The percentage flow indicator over the past 7 years are summarized in Figure 1 below.

Finally, we run a simple contrarian strategy. When 20-day flows to the Frugal countries are higher than the non-Frugal flows, we go long on the Frugal countries bonds (equal weighted portfolio) and short on non-Frugal countries (equal weighted portfolio), and vice-versa when the non-Frugal flows are higher.

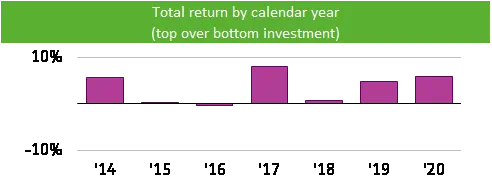

This simple strategy generates a long-term Sharpe ratio of 0.63 and per-annum excess returns of 3.5% (See Figure 1 below). The return post-2017 has been particularly eye-catching, with the Sharpe ratio jumping to 1.38 and the annualized excess returns to 4.8% per annum.

Figure-1 – The cumulative return of the strategy

Frugal on, frugal off

This indicator serves as an exemplary proxy for comparing the risk appetite, with the Frugal Four and the other group staking out the spectrum, and can help investors navigate the shifts between risk-on and risk off in the European bond market.

Looking at fund flows and investing from a contrarian perspective, based on the fiscal disagreements within Europe, provides an investible perspective and enables fund managers and investors to respond when shifts start to become excessive.

EPFR data, and the use case highlighted in this post, can help investors navigate through these uncertain times.

Did you find this useful? Get our EPFR Insights delivered to your inbox.