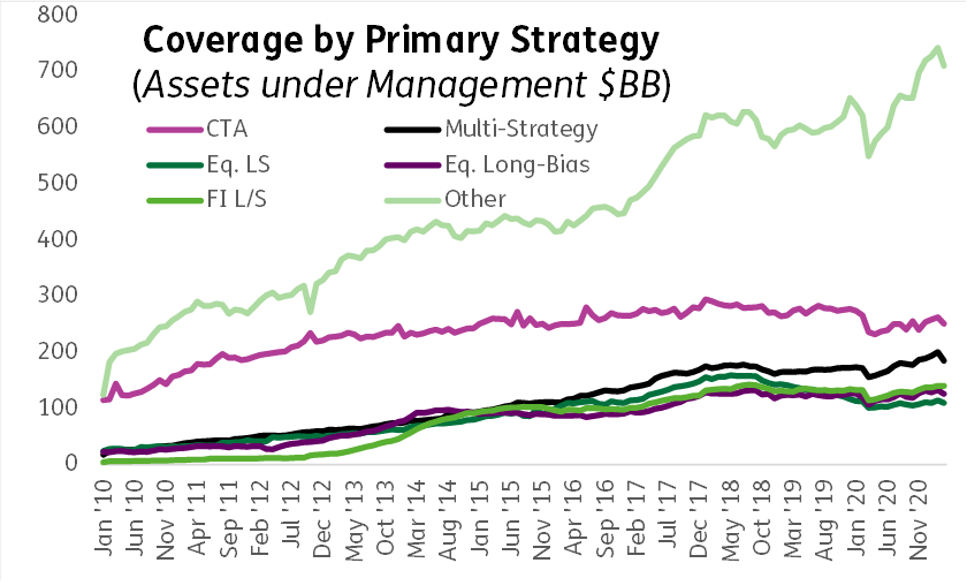

In the financial world, the search for the ‘new normal’ started in the aftermath the great financial crisis as central banks unleashed unprecedented levels of quantitative easing on global asset markets. Among hedge funds, those offering established strategies – long/short, commodity trading, multi-strategy – have seen modest asset growth over the past decade while those offering something different have fared much better.

EPFR recently launched a hedge fund flow product encompassing 3,500 funds managing $1.5 trillion. This represents just over 41% of the hedge fund universe. Nearly half of the AUM tracked by this new dataset resides with funds pursuing ‘other’ strategies.