During the first week of July, the UK held, and France concluded, general elections that resulted in significant changes to both countries’ political center of gravity. In the UK, the Labour Party’s resounding victory ended 14 years of Conservative rule while France’s two-round contest ended with no party securing a clear majority.

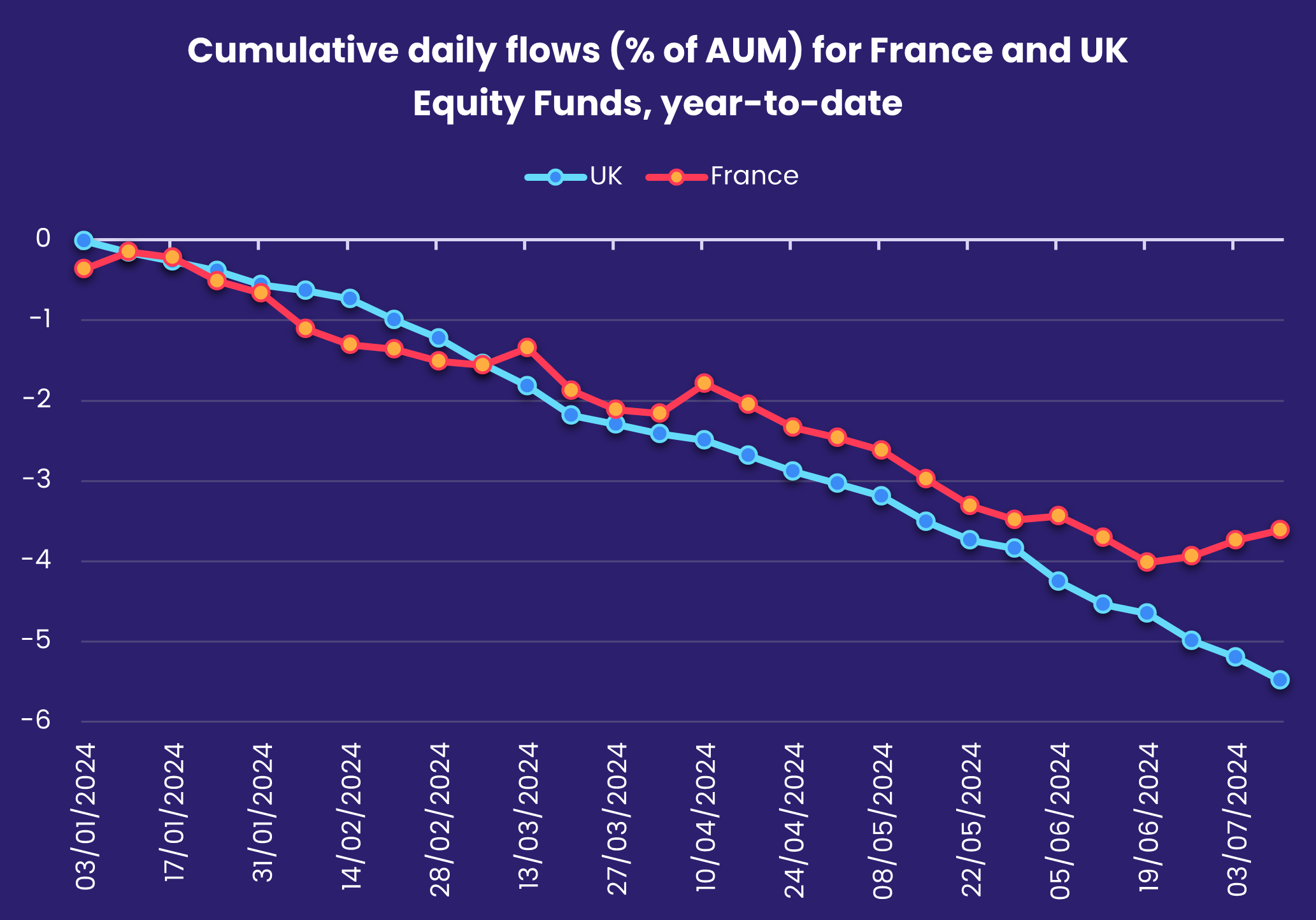

EPFR’s bluntest measure of investor sentiment, net flows to the respective Country Equity Fund groups, appears to contradict the market narrative of orderly, predictable transition in the UK versus France’s uncertain, risky road to a new government.

But, if we apply quantitative analysis and some of EPFR’s standard filters to recent data, a more nuanced story emerge

Worrying about the right things

It is worth asking if the reaction captured by basic fund flows data is illogical. After all, the Labour Party’s victory was widely anticipated, the party campaigned on a platform that emphasized competence and fiscal responsibility and the party has an ample majority. In France, meanwhile, a fractious coalition of left-of-center parties are united – as are their right-of-center counterparts – in their desire for earlier retirement and more public spending.

While Labour’s victory sparked a positive market response, with UK bonds and sterling experiencing gains, investors are right to wonder how a government with a large majority and unchecked by a written constitution will behave. Will the new government maintain stability and fulfill its economic promises without giving into its core supporters’ demands for more spending, demands that could easily lead to higher taxes and excessive borrowing?

In the case of France, the legislative elections resulted in a fragmented National Assembly, with no party securing a clear majority. This unusual political stalemate – effectively a hung parliament – has sparked concerns over France’s ability to address its economic challenges, including a budget deficit that hit 5.5% of GDP in 2023 and high public debt levels around 110% of GDP.

Among the questions this raises, given that France-mandated funds are still attracting fresh money, are ones about the perspective of the people who manage this money – especially those with diversified mandates whose job it is to make judgements about how investible a market is relative to others within the portfolio.

The grass is browner on both sides of the English Channel

The information provided by EPFR’s Country Flows dataset captures flows for a given market from all funds whose mandates allow them to invest in that country. In this case, that includes Europe Regional, Europe ex-UK Regional, Global and Global ex-US Equity Funds.

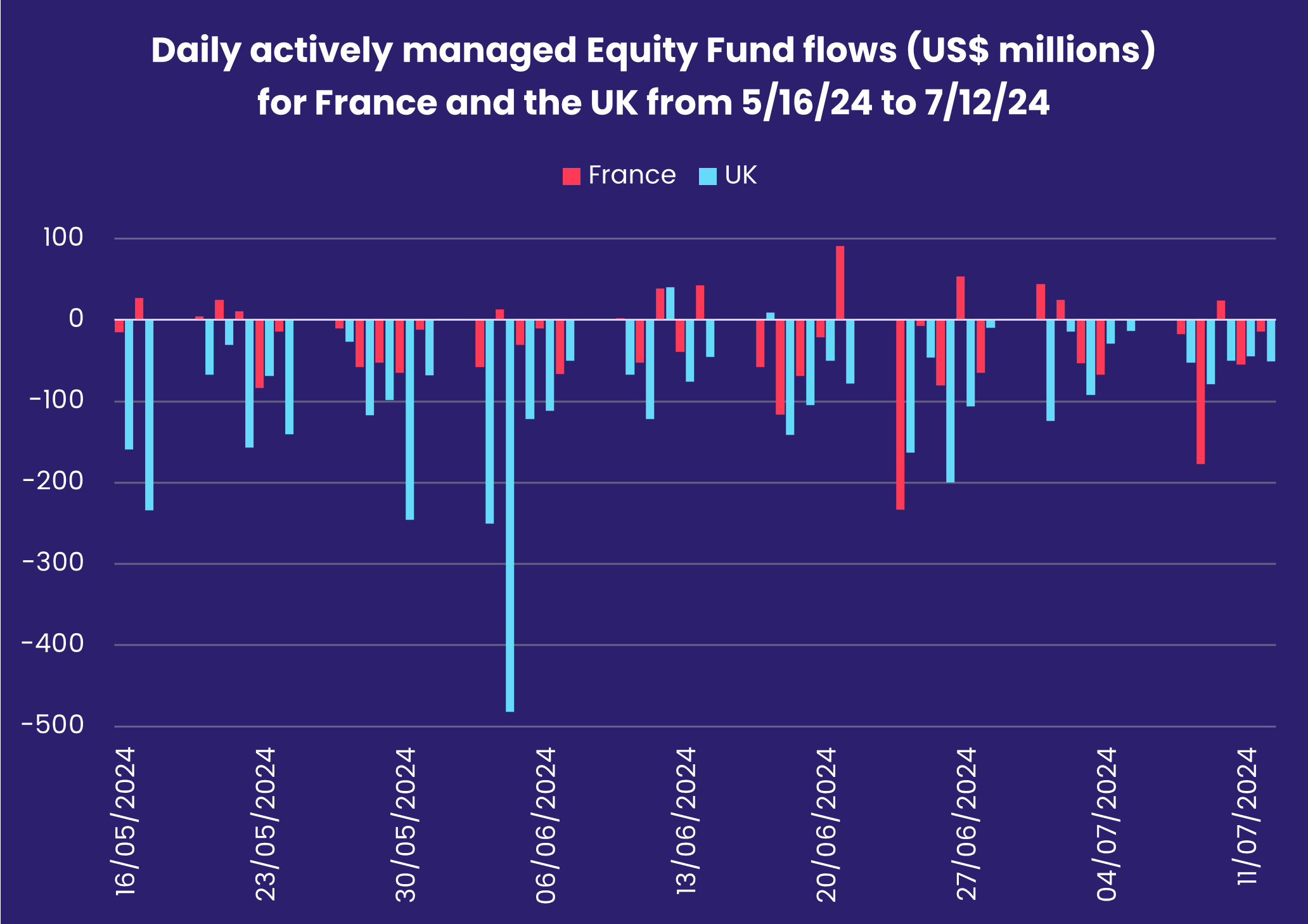

With flows of passively managed funds tied to indexes or processes that are slow to respond to externalities, we limit our analysis to the actions of funds that are actively managed. As seen in the chart, Equity Fund flows to both markets were depressed heading into the respective elections and in the immediate aftermath.

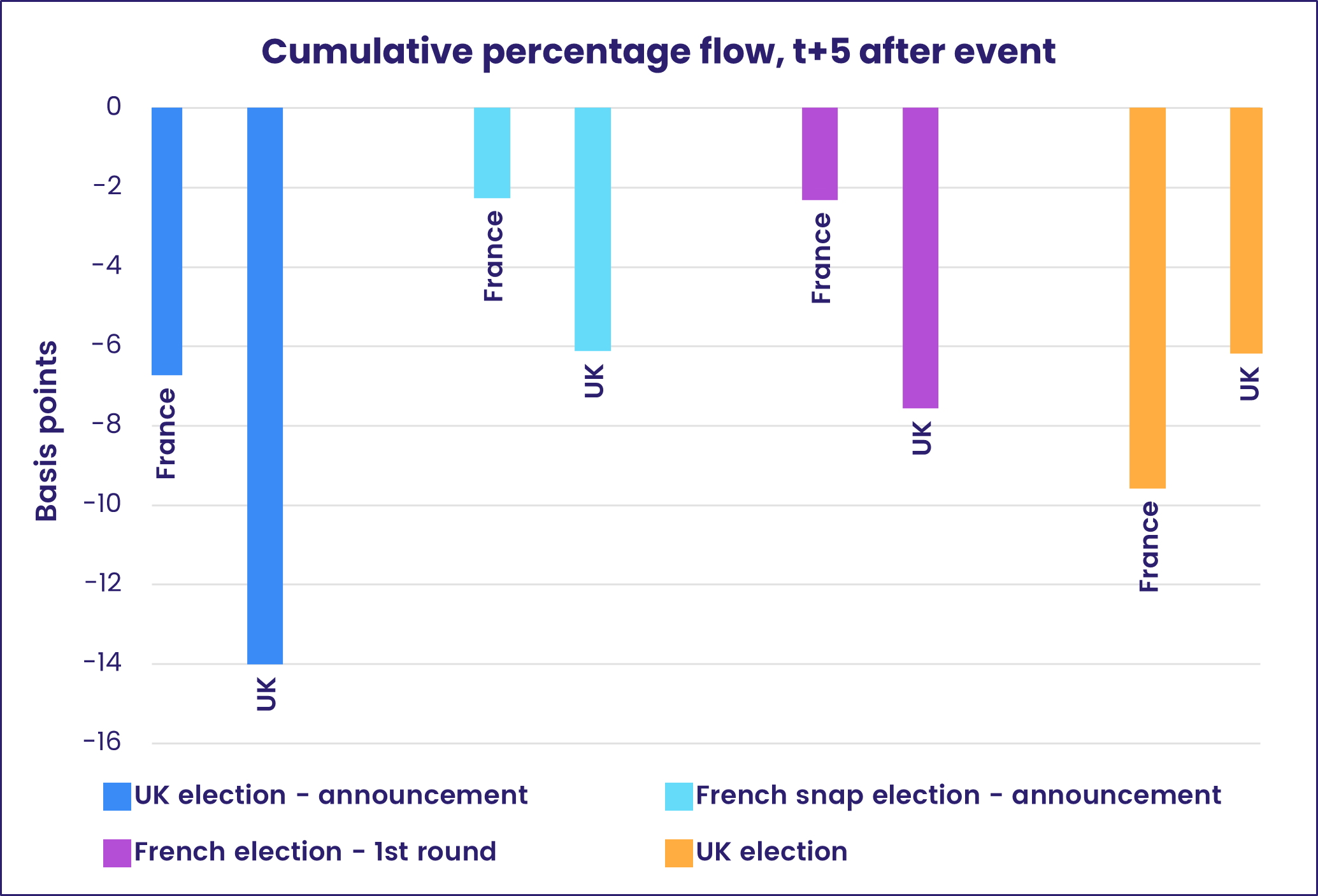

Both in aggregate, and when plotted on a T+5 basis following the announcement of the elections and their actual dates, the recent political events in Europe have led to tangible outward percentage flows from both France and the UK. European funds divested from both markets, with France experiencing a less severe outflow compared to the UK – except for after the UK election which resulted in a stable parliamentary outcome, unlike in France

However, US-domiciled funds have largely held their positions, with a slight relative difference in favour of the UK right after the respective elections were announced and towards post-election France. Overall, investor sentiment towards both the UK and France is on the backfoot at this point.

Politics and Flows

The recent political events in Europe have underscored the impact they can have on market confidence. Recent outflows from both UK and French markets, from both active ETF and mutual funds, underscores this dynamic. Thus, though the importance of political developments is often overstated, the importance for monitoring those developments and their effect on investor sentiment remains undiminished.

Future research will delve deeper into refining politically triggered signals. Avenues for exploration include dissecting response functions through the lens of style, size, and sector mandates.

Did you find this useful? Get our EPFR Insights delivered to your inbox.