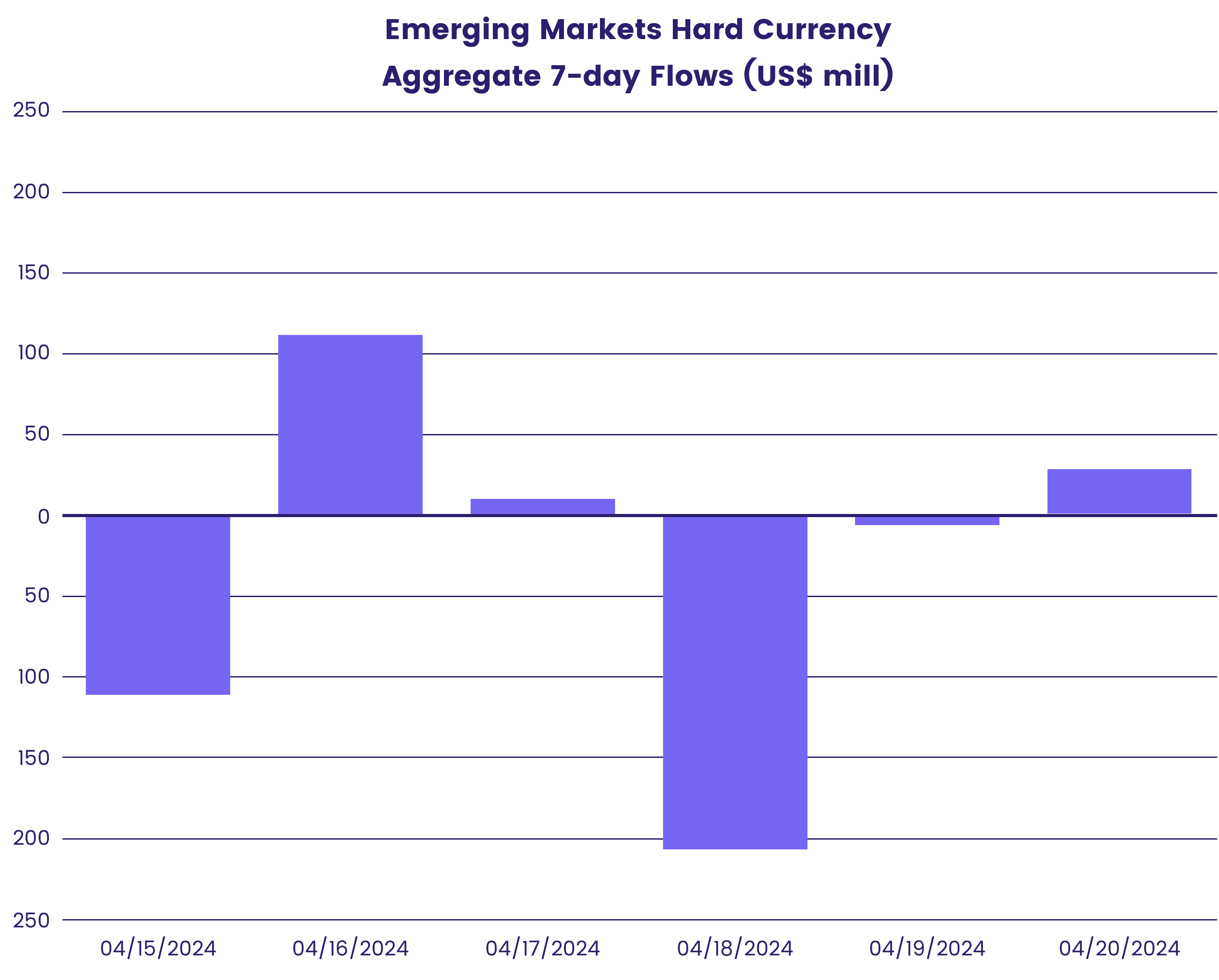

EPFR Pre-Market Fund Flow Data | Investor Insights

Be first and move faster with EPFR’s Early Edge Fund Flows

EPFR’s leading pre-market Fund Flow data empowers your team to harness actionable insights and spot pivotal fund flows and investor sentiment trends earlier and quicker, unlocking new growth opportunities for your business.

By relying on the most-timely fund level and aggregate flow report available, users can get a first glance at the previous day’s trading data just four hours after the US market closure.

As Wall Street opens, you can access up to 83% of the $38 trillion in AUM covered by EPFR from the previous trading day.

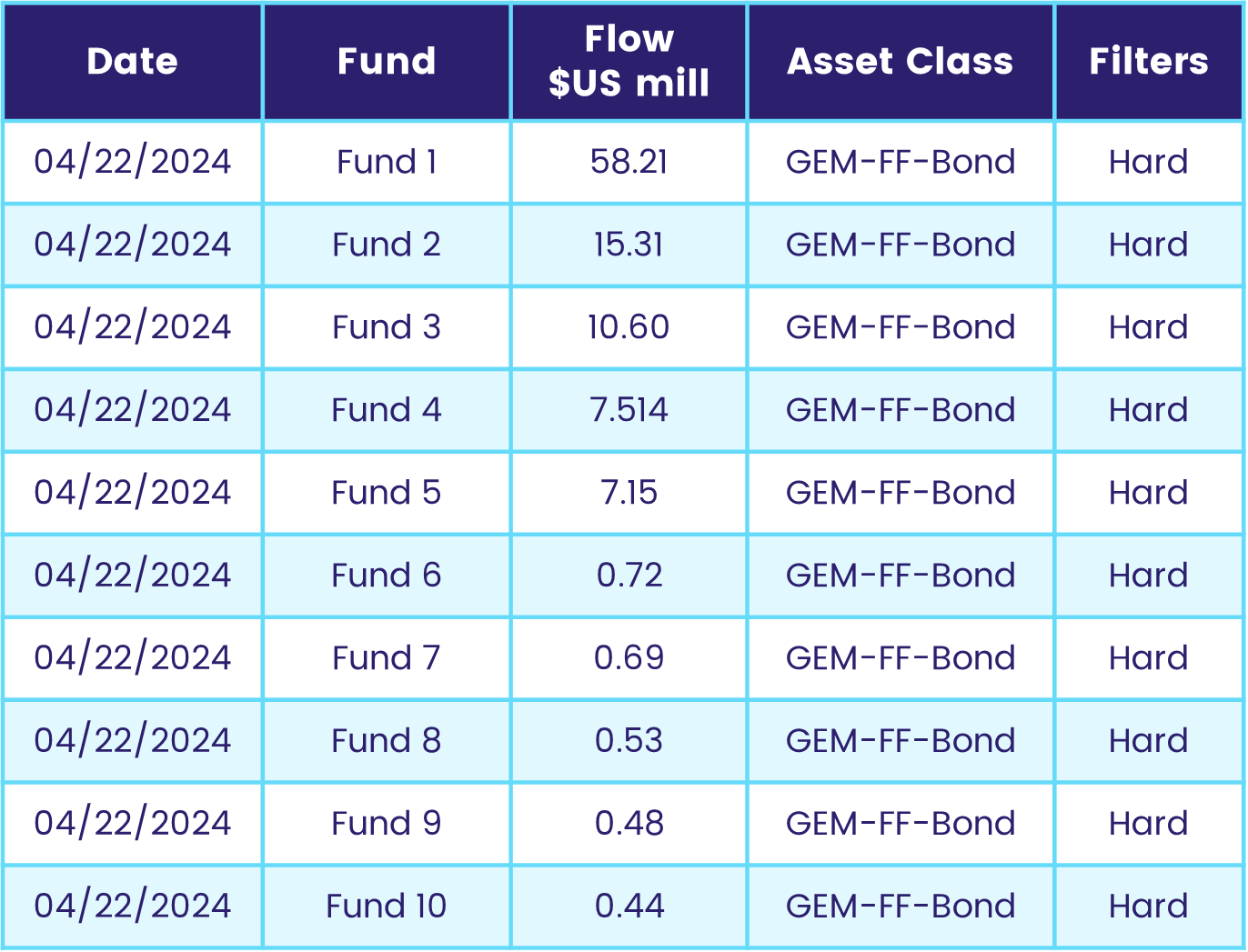

GEM Debt Hard Currency – Top 10 Funds

Fund names have been anonymized.

EPFR pre-market trading report coverage

With numerous filtering options available, we make it easier to tailor the data to your mandate, so you spot flow trends in developed and emerging markets with ease, such as:

- Investment Grade (IG) or High Yield (HY)

- Active vs Passive

- Mutual Funds and ETFs

Why use EPFR’s early market data?

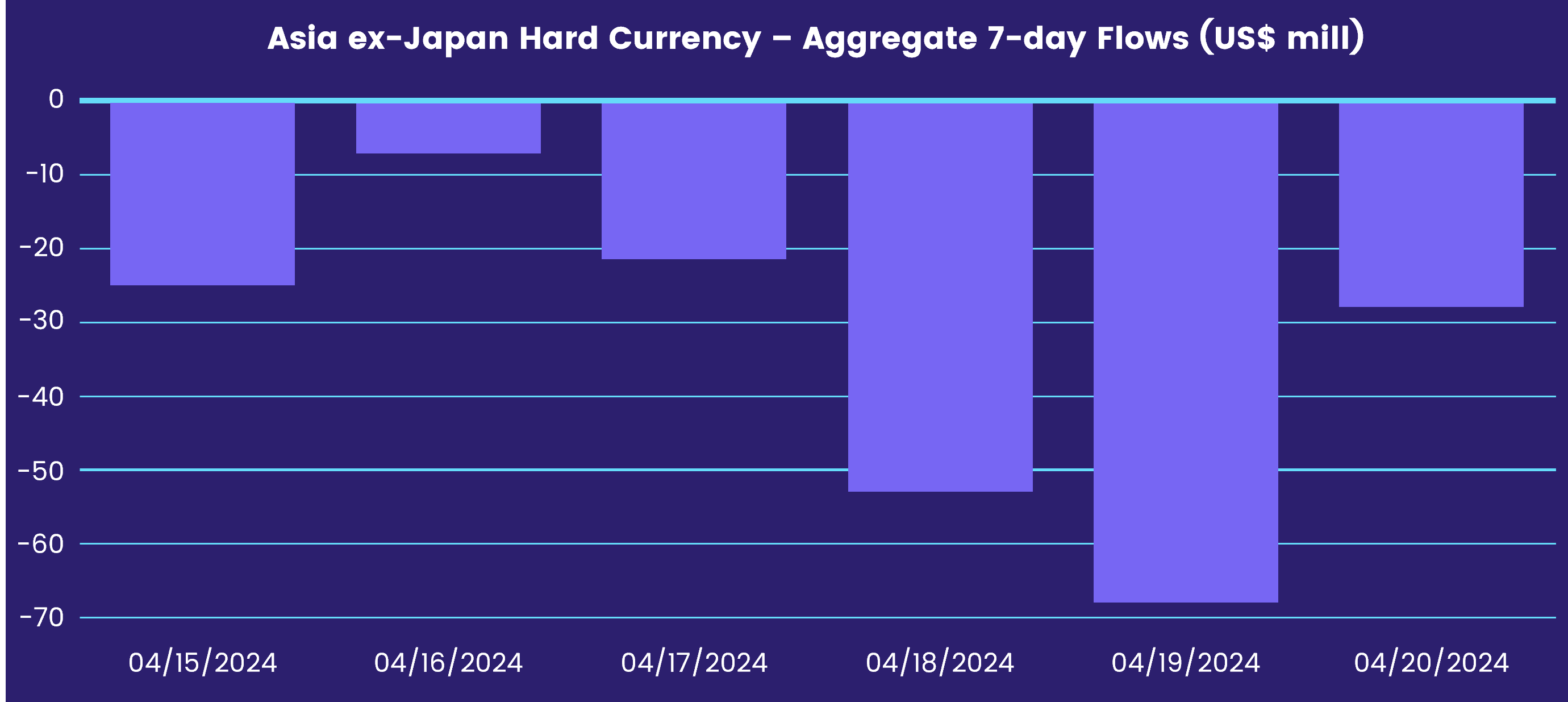

- Get first access to the daily general market direction with the most-timely report available

- Spot short and medium-term market trends faster with our easy-to-use filtering options

- Make a difference to your daily outreach by prioritizing clients with the largest flows

Learn more about Early Edge Fund Flows

We are on hand to discuss your team’s needs and answer any questions you might have.