Devotees of buying on the dip were presented with several handsome opportunities during the second week of September as investors tried to decide which way key events and datapoints will cut. Does Ukraine’s success on the battlefield mean the beginning of the end to the conflict? Or does it herald an even more extreme Russian reaction? Does the fact US headline inflation declined for the second straight month in August carry more weight than the jump in core inflation?

With questions like these whipsawing global asset markets, flows into EPFR-tracked Equity Funds were negative going into the final day of the latest reporting period. But, with key US indexes having their worst day since 2Q20 on Sept. 13, US Equity Funds recorded their biggest daily inflow since mid-June to pull the weekly number for all Equity Funds into positive territory.

The week ending Sept. 14 also saw Dividend Equity Funds record their 6th consecutive inflow, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates snap their longest outflow streak since 4Q16 and China Equity Funds absorb fresh money for the 13th time in the past 15 weeks.

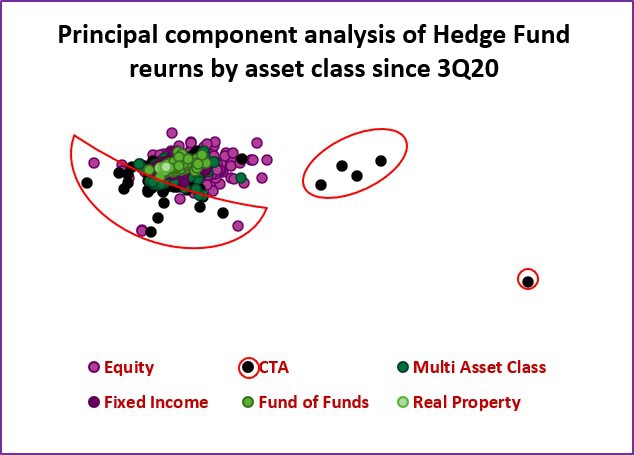

The latest Hedge Fund flows data shows that investors gravitated from discretionary to systematic funds coming into the third quarter, with Japan-domiciled funds seeing the heaviest redemptions in % of AUM terms. At the asset class level, Multi Asset Hedge Funds were the only group to see inflows while funds with commodity trading (CTA) strategies saw nearly $6 billion flow out. Quantitative analysis of hedge fund returns over the past 24 months show that those of CTA Funds are much less correlated compared to other groups.

Overall, investors committed a net $6.2 billion to EPFR-tracked Equity Funds during the week ending Sept. 14 and steered $1 billion into Alternative Funds while redeeming $1.9 billion from Balanced Funds, $2.7 billion from Bond Funds and $4.1 billion from Money Market Funds. In the case of the latter, two of the major emerging markets groups struggled with China Money Market Funds posting their first outflow since late June and Brazil Money Market Funds their biggest outflow since early June.

Did you find this useful? Get our EPFR Insights delivered to your inbox.