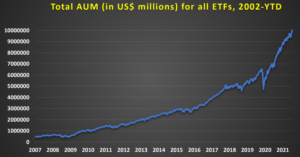

Boston, MA – (November 11, 2021) – EPFR, worldwide industry leader in providing fund flows and allocation data to financial institutions, announces today that total global ETF assets have surpassed $10 trillion according to EPFR’s proprietary database. This milestone is a proof point of accelerated investor interest in ETFs, globally, a trend that began in the wake of the 2008 Great Financial Crisis.

EPFR has tracked ETF flows since 2002 when collective ETF assets totaled approximately $2 billion. Since then, ETF assets have continued to grow exponentially:

- $1 trillion in December 2009

- $2 trillion in April 2013

- $3 trillion in March 2016

- $4 trillion in May 2017

- $5 trillion in January 2018

- $6 trillion in November 2019

- $7 trillion in October 2020

- $8 trillion in January 2021

- $9 trillion in May 2021

- $10 trillion in November 2021

Since Q4 2020, when EPFR-tracked ETFs reached the $7 trillion mark, the pace of inflows accelerated dramatically, growing by another $3 trillion in assets during 2021. Equity ETFs now account for 25 percent of the assets held by all equity funds, while 15 percent of all bond fund assets are lodged in ETFs.

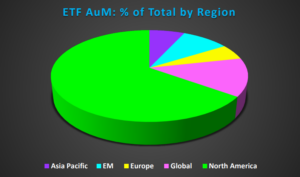

ETFs with North American mandates currently have the largest footprint, accounting for 65 percent of the total AUM for all ETFs. The remaining regional breakdown is as follows: global ETFs at 13 percent, emerging market ETFs at 9 percent, Asia Pacific ETFs at 7 percent and Europe ETFs at 5 percent.

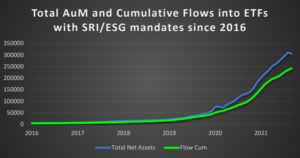

Among the trends to emerge over the past 12 months, helping to propel ETF inflows are a Bitcoin ETF that set a new record for accumulating $1 billion in assets, along with the surge of flows into ETFs with socially responsible or environmental, social and governance mandates (SRI/ESG) mandates.

“Investors have undoubtedly shown an accelerated interest in ETFs on a global scale, highlighting what’s become the investment vehicle of choice for a large portion of the investing population,” said Cameron Brandt, Director of Research at EPFR. “If each trillion dollars represents a milestone, our proprietary industry leading data shows we’ve crossed an astounding three milestones in 2021 alone. Furthermore, one quarter of all funds EPFR tracks are ETFs, another significant indicator of a rapid global growth story that shows no signs of slowing down.”

About EPFR:

EPFR provides fund flows and asset allocation data to financial institutions around the world. Tracking over 138,000 traditional and alternative funds domiciled globally with more than $53 trillion in total assets, we deliver a complete picture of institutional and retail investor flows and fund manager allocations driving global markets. Our market moving data services include daily, weekly and monthly equity and fixed income fund flows and monthly fund allocations by country, sector and industry.

For more information, visit epfr.com.