In this blog, EPFR’s Olivia Blaszkowski expands on a recent New York Times article, Bank Turmoil Is Paving the Way for Even Bigger ‘Shadow Banks’.

View from EPFR

Turmoil in the US banking industry has persisted into the second quarter, with interest rate hikes, skittish depositors and the scramble for tighter regulation heaping more pressure on major banks. These constraints, as the New York Times suggests, could cause businesses to look elsewhere for loans. Hence, there is a chance that borrowers turn to non-traditional banking or “shadow banking” options that are less constrained by existing regulations. But where does this present an opportunity for investors? In Money Market Funds that invest primarily in short-term, low-risk debt.

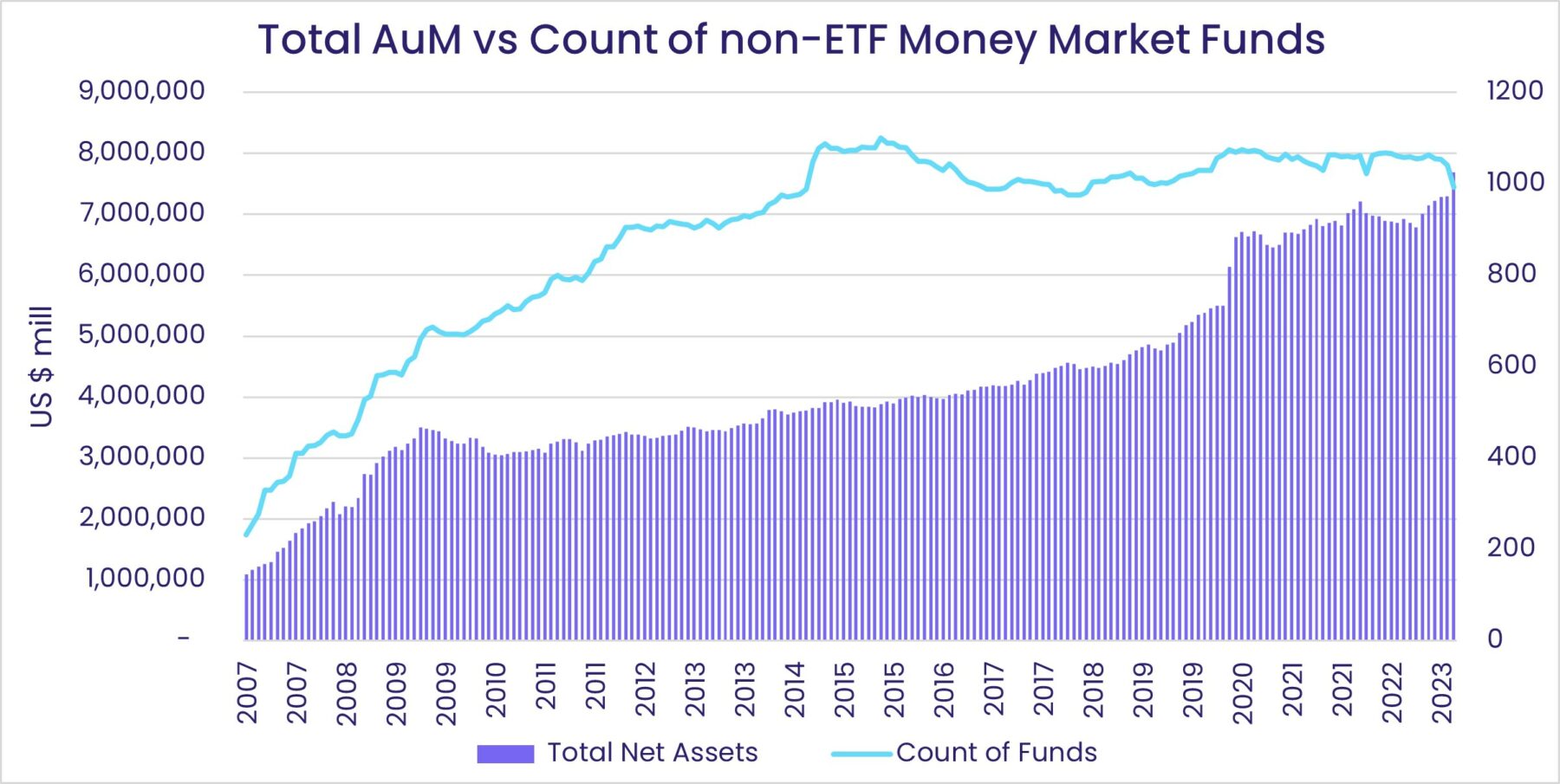

The assets managed by all Money Market Funds have grown substantially since EPFR started tracking them in 2007, and there has been another influx of new money this year. In March alone, Money Market Funds added $394 billion, the third highest month-over-month difference. The chart below shows the impressive climb over time by total assets and the number of funds tracked.

EPFR quant team and researchers have investigated how the wider market reacted to a change in interest rates and their investment trends over time. When interest rates are low, investors buy into bond funds. The picture becomes more unclear when interest rates are high. Does investor sentiment towards Money Market Funds pick up or slow down?

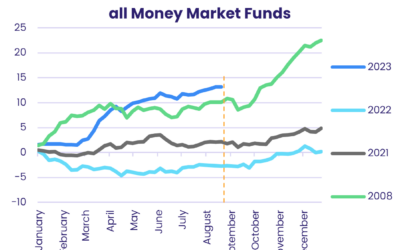

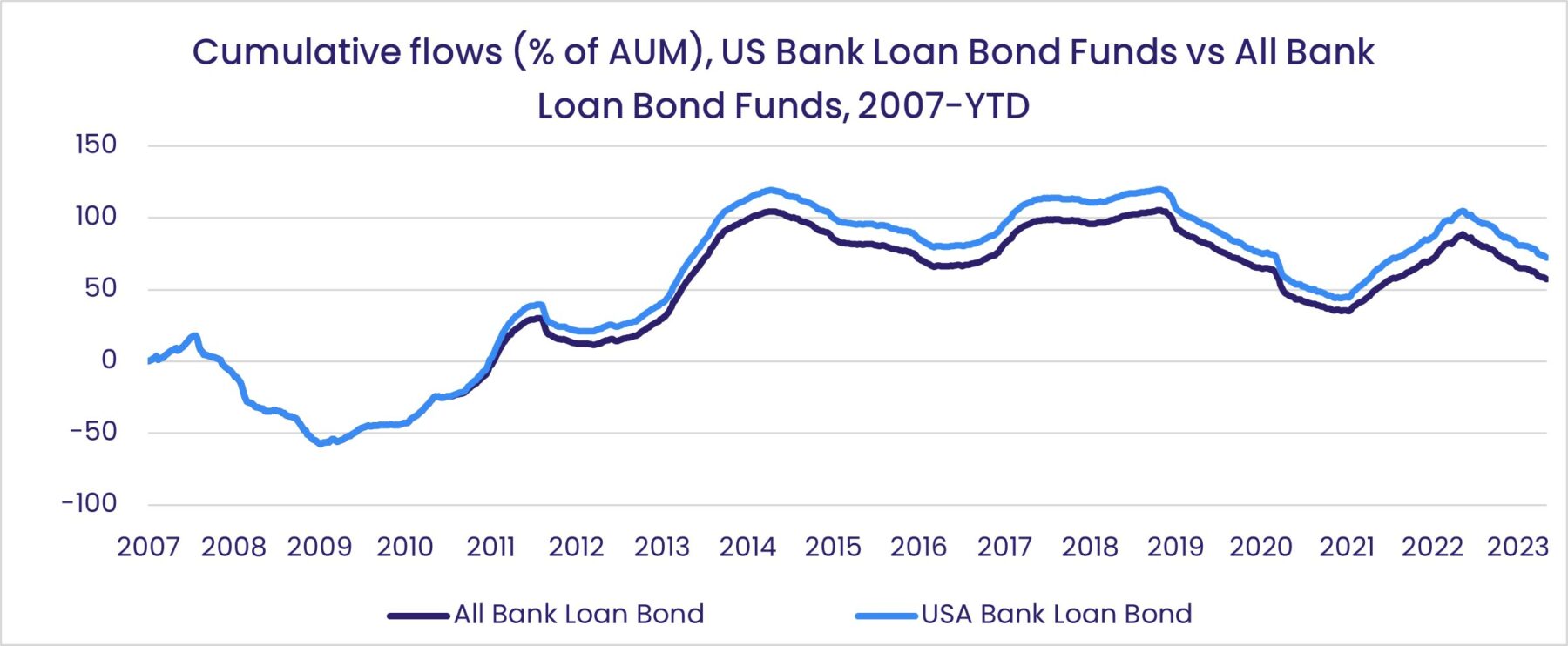

Looking at flows into bond funds investing in bank loans, which reset when key interest rates change, we see that they picked up when interest rates were at their lows (2009~2014 & 2020~2022). Additionally, we can see outflows from these bond funds when interest rates are falling (2007-2009 & 2019-2020). As of the recent trend, interest rates have only risen since 2022, yet Bank Loan Bond Funds have experienced consistent outflows. During this time Money Market Funds have picked up a lot of growth.

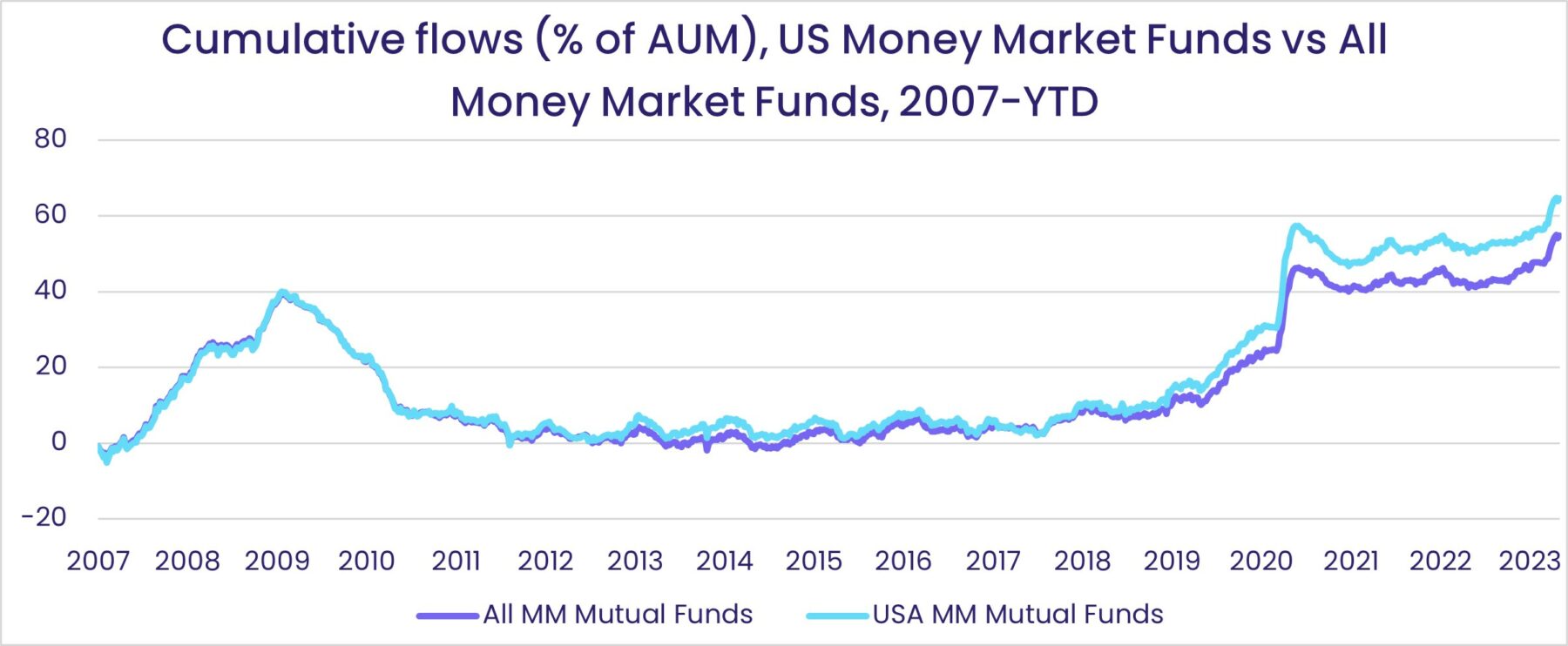

Money Market Funds, meanwhile, have received substantial inflows since 2012. If we take a closer look though, we notice that these funds – which are predominantly US based – received much higher flows during times where interest rates fluctuated (2016-2020 & 2022-current). Therefore, we can generally say that current shifts in key interest rates should translate into greater investor appetite for Money Market Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.