For the past six months it has been impossible to avoid headlines trumpeting some aspect of artificial intelligence (AI) – what it means, how it is being regulated, its criminal applications, the potential impact it may have on job security. For investors, however, it is the practical applications that people will pay for that count in the here and now.

There are no shortages of ideas about the best way to monetize recent developments in AI and its most talked about offspring, ChatGPT, from self-driving cars to the automation of routine administration. There is also a lot of talk, from Elon Musk’s call for a pause in further AI development to the latest debate on the EU’s AI Act, about how AI can – and should – be regulated and restrained.

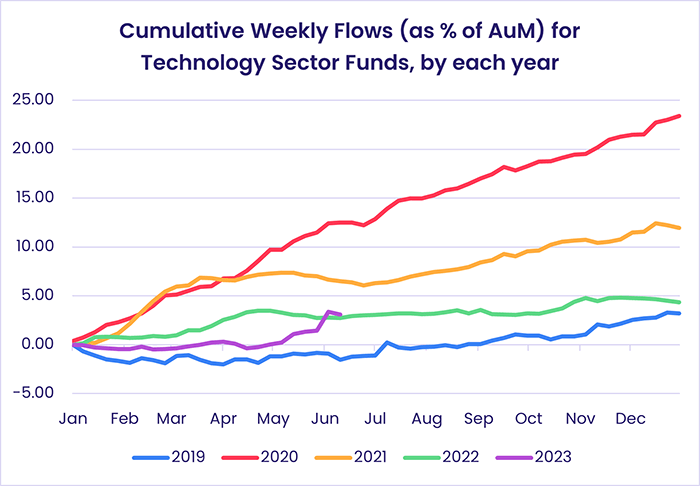

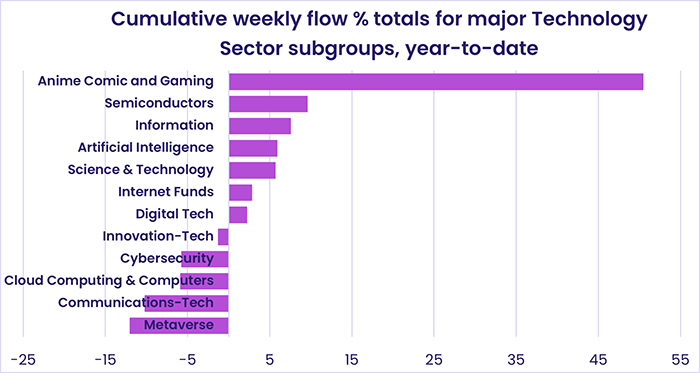

In the broadest sense, investors are buying into the AI story. EPFR-tracked Technology Sector Funds, a broad and diversified group including funds related to science, cybersecurity, cloud computing, semiconductors and the metaverse, have absorbed over $16 billion year-to-date, four times more than the next most popular Sector Fund group. The other groups to see inflows have been defensive ones, with Consumer Goods, Telecom and Industrials Sector Funds attracting $4 billion (2.6% of assets), $2.5 billion (10.7% of assets) and $1 billion (2.2% of assets), respectively.

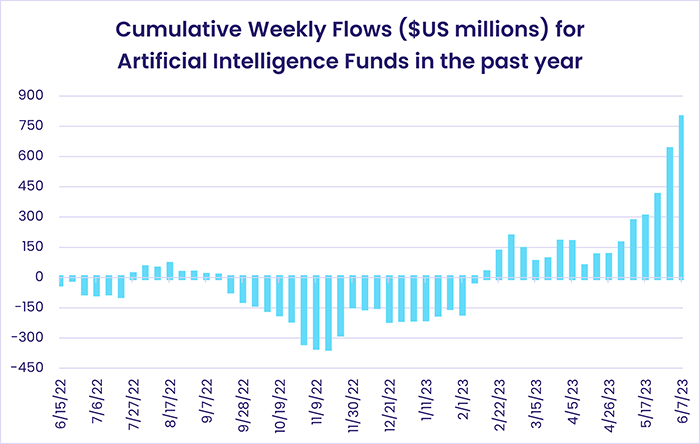

Although flows to Technology Sector Funds have been impressive, they are nowhere near the levels seen in 2020 when the pandemic-induced shift of millions to remote working, home entertainment and online shopping sent major technology stocks soaring. But funds with AI mandates, and the assets they manage, are enjoying brisk growth.

Among the sub-groups that soared on the pandemic tailwinds, Anime, Comic, Gaming and e-Sports Funds stood out with flows growing exponentially before trailing off in 2Q21. This year, the interest in the group has returned with inflows hitting nearly $800 million and nearly doubling the assets collectively managed by these funds. In the week to May 10, Anime Comic and Gaming Funds recorded an all-time week high inflow of $311 million.

With the pandemic no longer the major variable, a range of other factors are currently driving flows into Anime, Comic and Gaming Funds. Investors see this as an area that can harness AI in the service of increased profits with limited regulatory interference – except in China, which limits the competition in this space that Chinese firms can offer their Western counterparts.

There is less optimism about the prospects for other sub-sectors within the technology universe. The largest by total assets is Semiconductor Funds, with 41 funds managing some $40 billion. Although the first five months of the year saw this group pull in $4.4 billion, the pace of those inflows has waned in recent weeks. The first week of June saw the heaviest outflow in the last two years, and roughly $600 million total has flowed out since May.

While the future of AI remains the subject of intense discussion and debate about its promise and profitability, investors see profit in the much-improved virtual gaming experience that AI is opening the door to.

Did you find this useful? Get our EPFR Insights delivered to your inbox.