The decade that started in 2020 has, so far, been a bumpy one for emerging markets bonds and those that invest in them. The Covid pandemic, interest rates in Europe and North America at multi-year highs, major defaults in China’s troubled property sector and Russia’s pariah status following its attack on Ukraine have all sent shockwaves through the asset class.

EPFR’s Fund Flows and Allocations data has certainly captured the impact of those shocks, from the 25-week outflow streak compiled by China Bond Funds in 2H22 to the near zeroing of Russia’s average allocation among Global Emerging Market (GEM) Bond Funds. But how did the data perform when it came to alerting users ahead of inflection points in Emerging Market debt markets?

In this Quant’s Corner, we will look at the potential for comparative analysis of active and passive fund manager country allocations to predict these shifts. To do so, we will look at the GEM Bond Fund allocations data for four countries that have seen significant changes in the fundamentals underpinning their sovereign and corporate bond markets.

China: Red lines and red ink

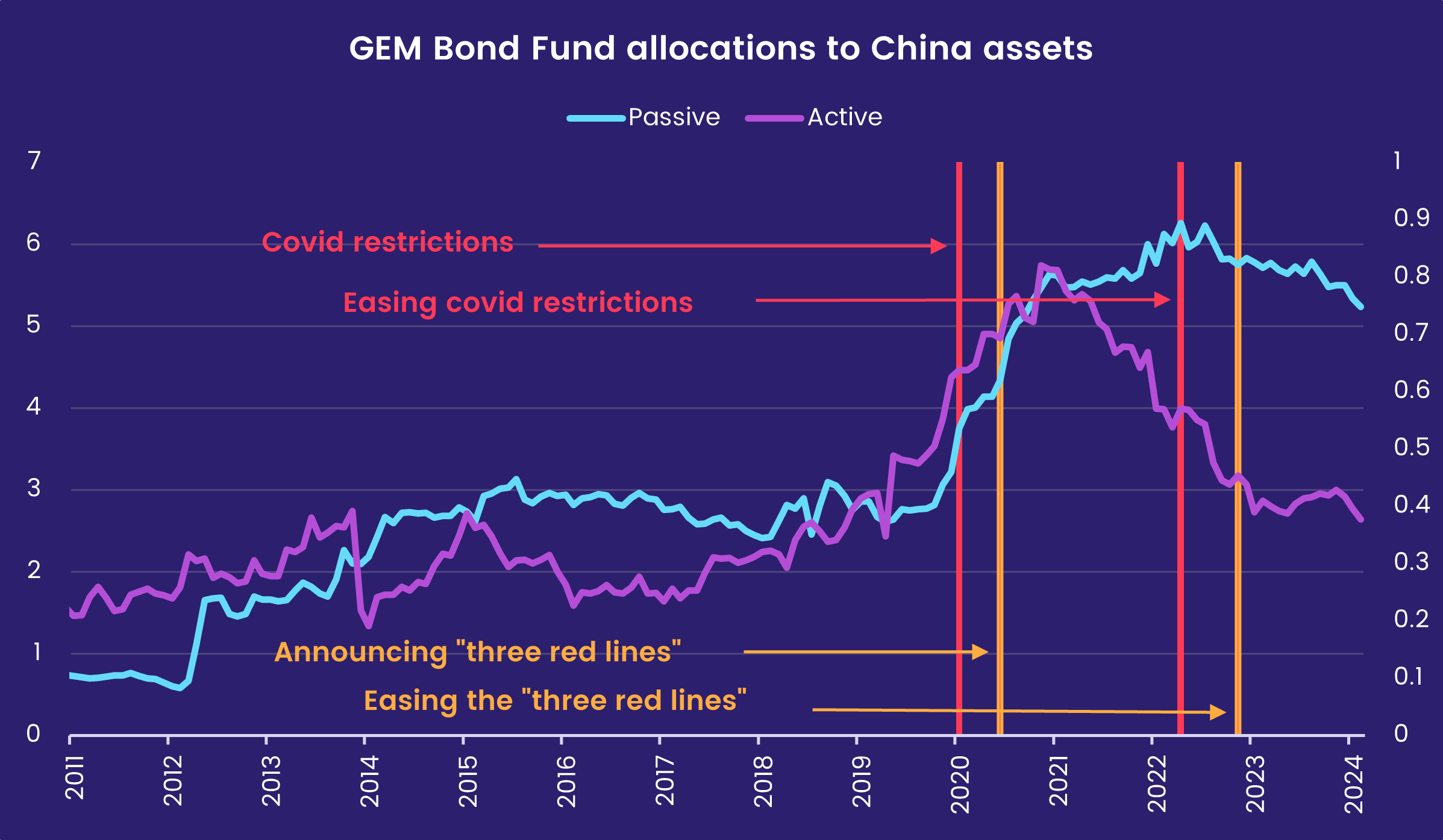

In 3Q20, Chinese authorities introduced the “three red lines” policy to curb excessive borrowing and improve the financial health of the country’s real estate sector. This policy set strict debt thresholds for developers, including a 70% ceiling on liabilities to assets, a 100% cap on net debt to equity, and a cash to short-term borrowing ratio of at least 1.

When combined with the draconian Covid containment policies, the ‘red lines’ pushed several major property companies into bankruptcy and severely dented domestic consumer sentiment. Many foreign investors assumed the government would step in to limit the damage to China’s economy and foreign creditors. This proved to be an overly optimistic assessment.

Active GEM Bond Fund managers were first to reach this conclusion. Their average allocation to Chinese bonds fell from 5.68% in March 2021 to 2.72% by March 2023. Meanwhile, passive allocations remained relatively stable despite market volatility before rolling over in mid-2023.

Investors who reacted to the shift in active GEM Fund manager sentiment in 3Q21 avoided – or mitigated – the impact of significant underperformance by Chinese bonds in 2022 and again last year.

Russia: Pulling the trigger early

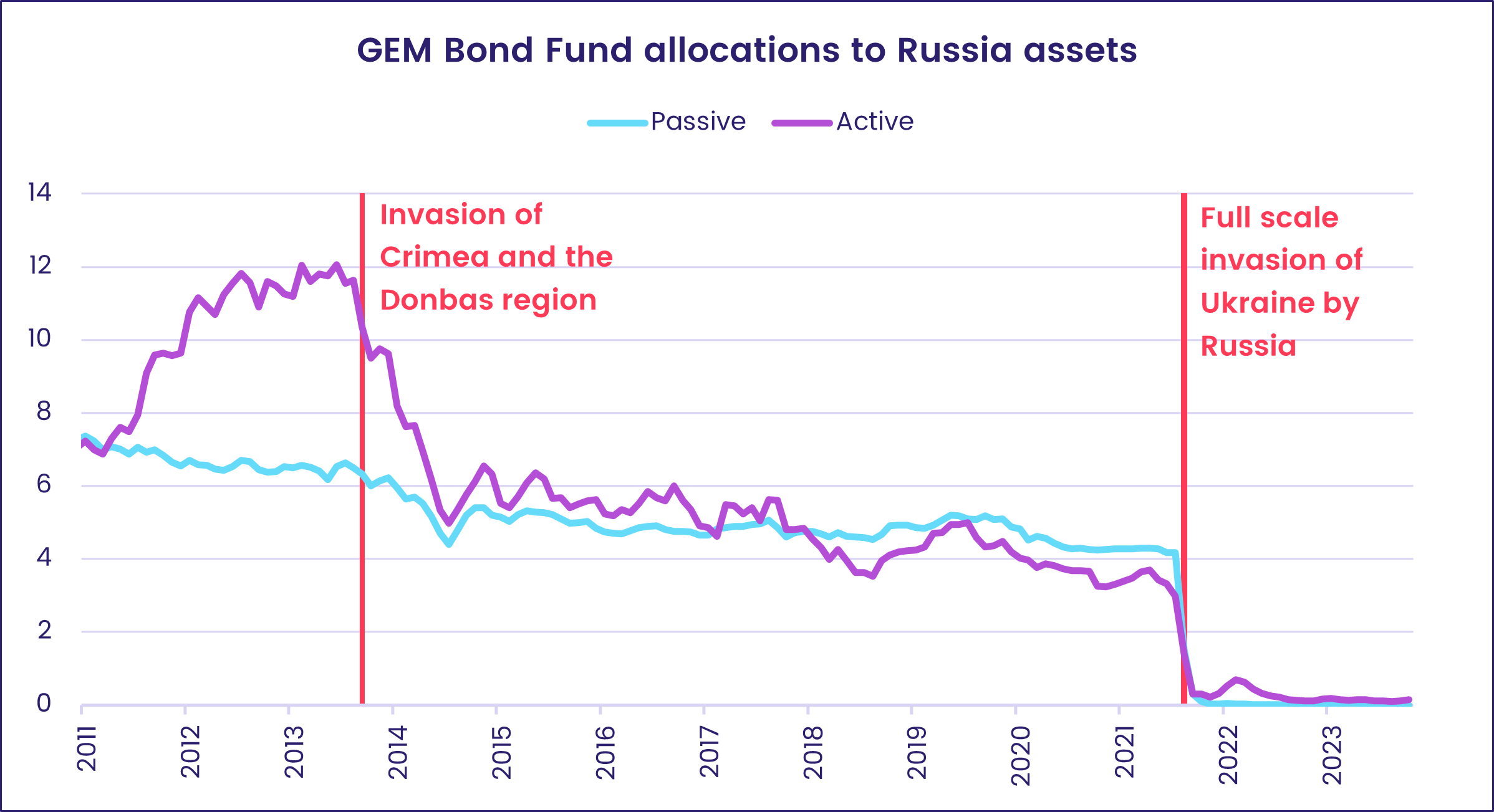

Prior to Russia’s initial attack on Ukraine in 2014, active bond funds were significantly overweight Russian bonds. This confidence was rooted in Russia’s attractive yield environment and the perceived stability of its financial system.

Following the annexation of Crimea, however, there was a noticeable decline in active allocations, indicating that managers had reassessed the risks of investing in Russia and decided they were high.

In the lead-up to the full-scale invasion of Ukraine by Russia in February 2022, active managers moved pre-emptively to cut their exposure to Russian bonds. Although passive funds broadly followed the same path, both before and after the actual invasion, active managers sent a stronger signal that credible risks were multiplying.

Egypt: Following the script

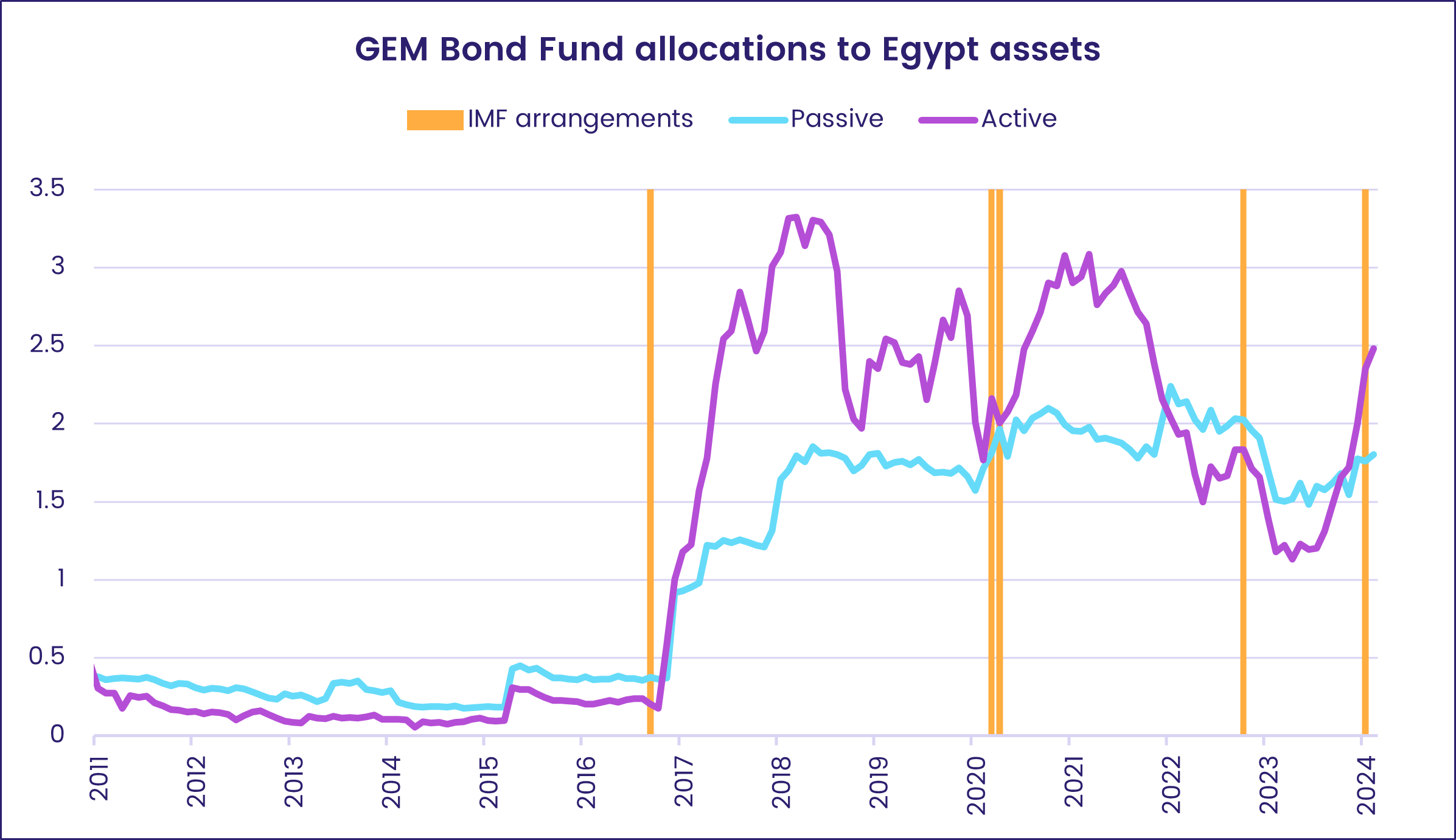

The first four years of the current decade have presented Egypt with severe economic and political challenges that ranged from high inflation through the closure of the Suez Canal to the ongoing conflict in Gaza. These factors – and others – have exacerbated the country’s financial instability, putting immense pressure on the Egyptian pound and government spending.

Egypt is, however, no stranger to volatile economic conditions and has a history of getting back on its feet with the help of neighbors, the US and multilateral lenders.

Aware of this well-thumbed playbook, active GEM Bond Fund managers are taking a more reactive approach to the Egyptian exposure, lifting it when Egypt is adhering to the conditions attached to the various rescue packages.

During the latest crisis, Egypt has again turned to the International Monetary Fund (IMF) for financial support in return for structural reforms. It has also secured a significant investment deal with one of UAE’s sovereign investment funds, ADQ, to develop the Ras El Hekma peninsula. In response, the country’s average allocation among actively managed GEM Bond Funds has climbed from 1.72% in January 2024 to 2.48% by April 2024.

Argentina: Remembering the previous tears

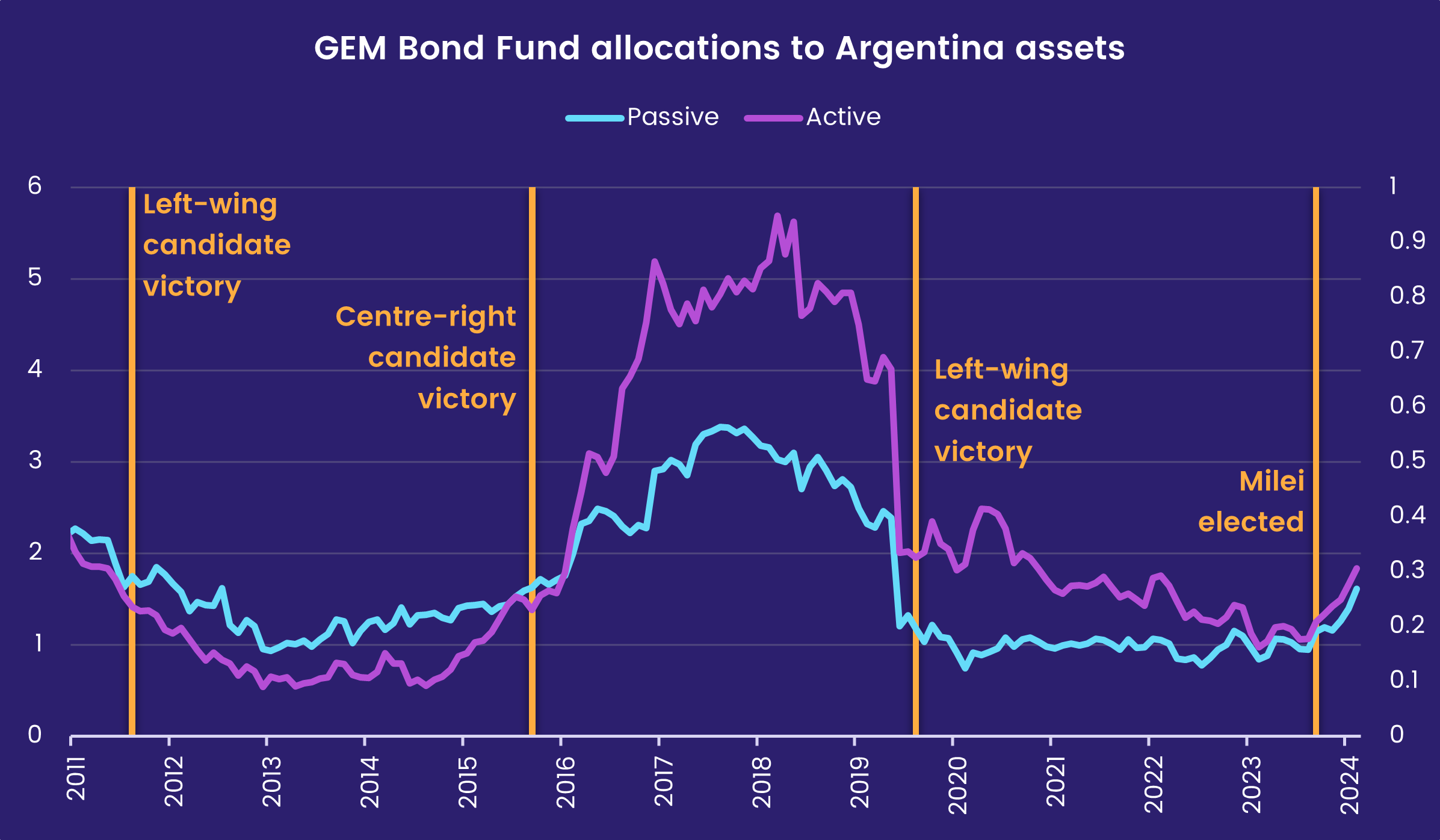

So far this year, sentiment towards Argentina’s equity markets has hit serial highs as new President Javier Milei’s pursues a radical – for Argentina –economic reform agenda.

But active bond fund managers have been here before, and their recent decisions suggest that they rate the chances that Milei’s agenda will succeed as lower than Mauricio Macri’s unsuccessful efforts between 2015 and 2019.

Argentina faces monumental challenges in stabilizing its economy that includes inflation running at over 140%, a $10 billion deficit in its foreign exchange reserve, the prospect of another painful recession and the weight of a history that has seen it default on its sovereign debt nine times.

A jewel that needs polishing

The analysis of four major Emerging Market debt markets shows that the allocations data from actively managed GEM Bond Funds provide useful predictive signals about market shifts. These signals offer valuable insights into early changes in market sentiment and risk.

However, whilst the allocation data provide some predictive market insights, they are currently broad and require careful interpretation. The potential to refine these signals exists, and with further analysis, they can be honed into even more precise tools for investors. This enhancement will be the subject of future research in EPFR’s Quants Corners.

Did you find this useful? Get our EPFR Insights delivered to your inbox.