Electric vehicles (EVs) are often criticized for their relatively short range compared to ones powered by fossil fuels. But, when it comes to their place in the financial universe, they cover a lot of ground.

Though regarded by many as primarily a green play, EVs are an industrial product marketed to consumers that embody a mixture of technologies. The case can be made that they belong in one – or more – of fund groups that include Consumer Goods, Industrials, Technology and SRI/ESG Funds.

Where EVs belong is important from a number of perspectives. They sit at the intersection of several complex investment themes, from the transition to clean energy to the future of global trade, and assessing their value requires an understanding of their relationship to existing economic structures and models.

In this Quant’s Corner, we will look at EV Funds within the universe of ETFs and mutual funds tracked by EPFR and their relationship to the Sector Fund groups they are most commonly associated with.

Something new out of something old

To generate the custom group of Electric Vehicles (EVs) Funds from the 11 major EPFR-tracked Sector Fund groups, we searched for fund names with keywords: electric vehicles (EV), automatic and autonomous driving, intelligent vehicle, future mobility, and new energy vehicles (NEVs), among other equivalents.

Using these criteria, we identified 58 funds with a combined AuM of $6.67 billion. Among the key characteristics of this group are:

- A majority are passively managed ETFs

- Consumer Goods Sector Funds contributed the biggest number of EV Funds to the custom group

- Just shy of half have global rather than single country mandates

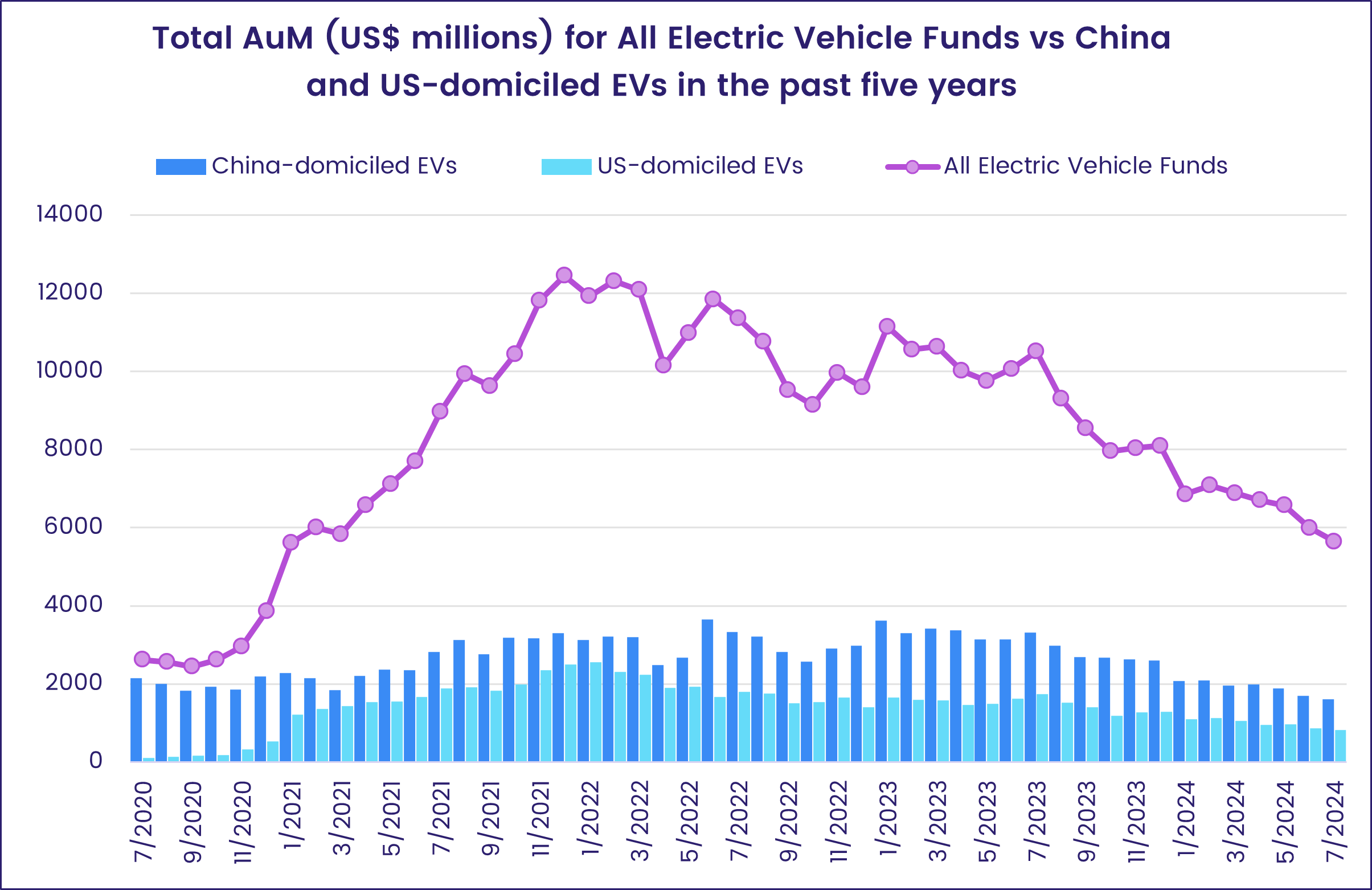

- China and Korea-domiciled funds represent almost 30% of the group, in terms of assets under management, accounting for $1.8 billion in AuM each. US, Taiwan and Ireland-domiciled funds each have a total AuM just below $1 billion, followed by Japan-domiciled EVs with a collective AuM of just $74 million.

It is worth noting that a majority of these EV Funds do not have SRI/ESG mandates despite the role EVs are slated to play in the reduction of greenhouse gas emissions. There are just 12 funds that have SRI/ESG mandates which, in terms of assets managed, account for 28% of the overall group.

Singing the vehicle electric

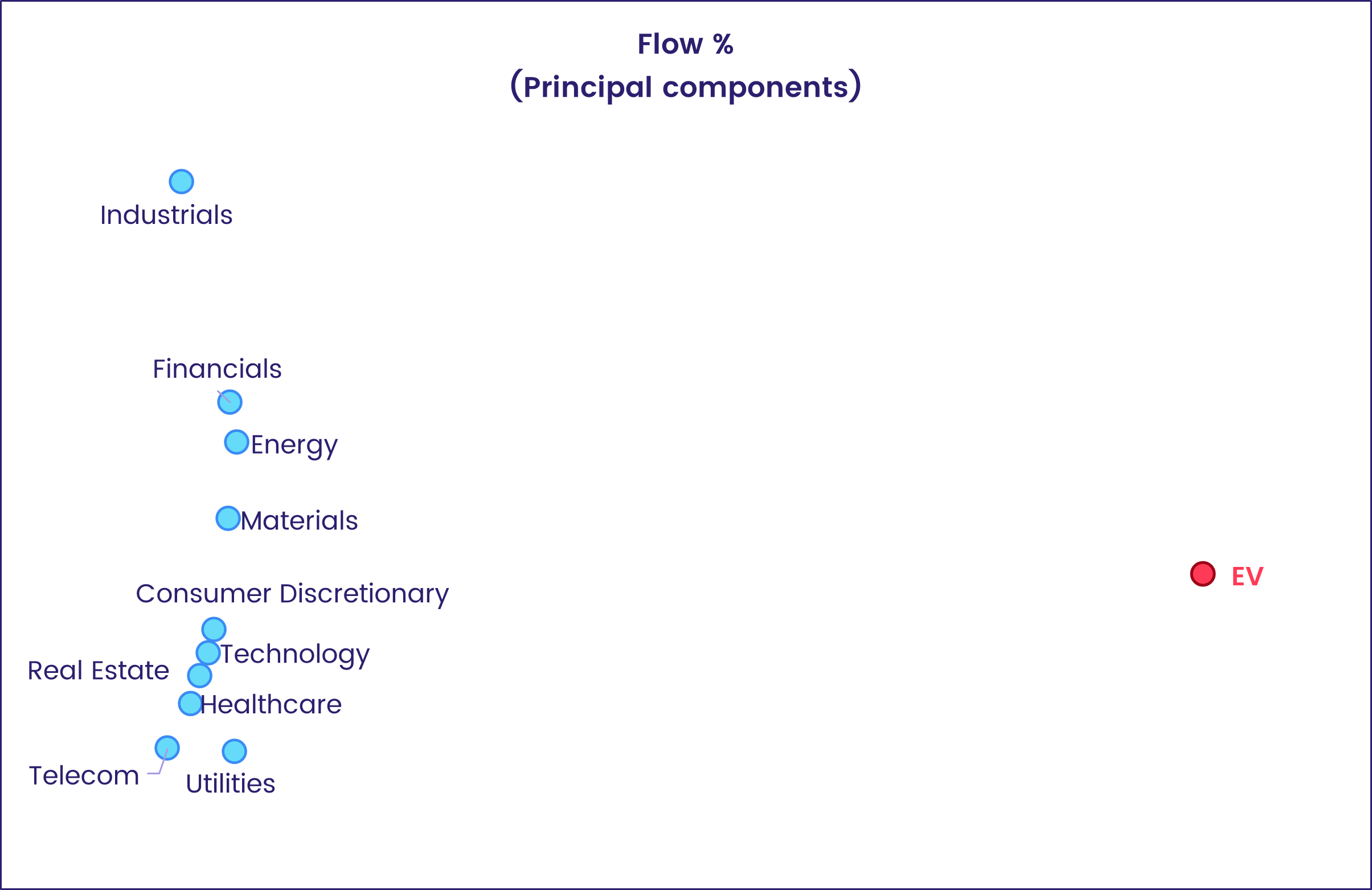

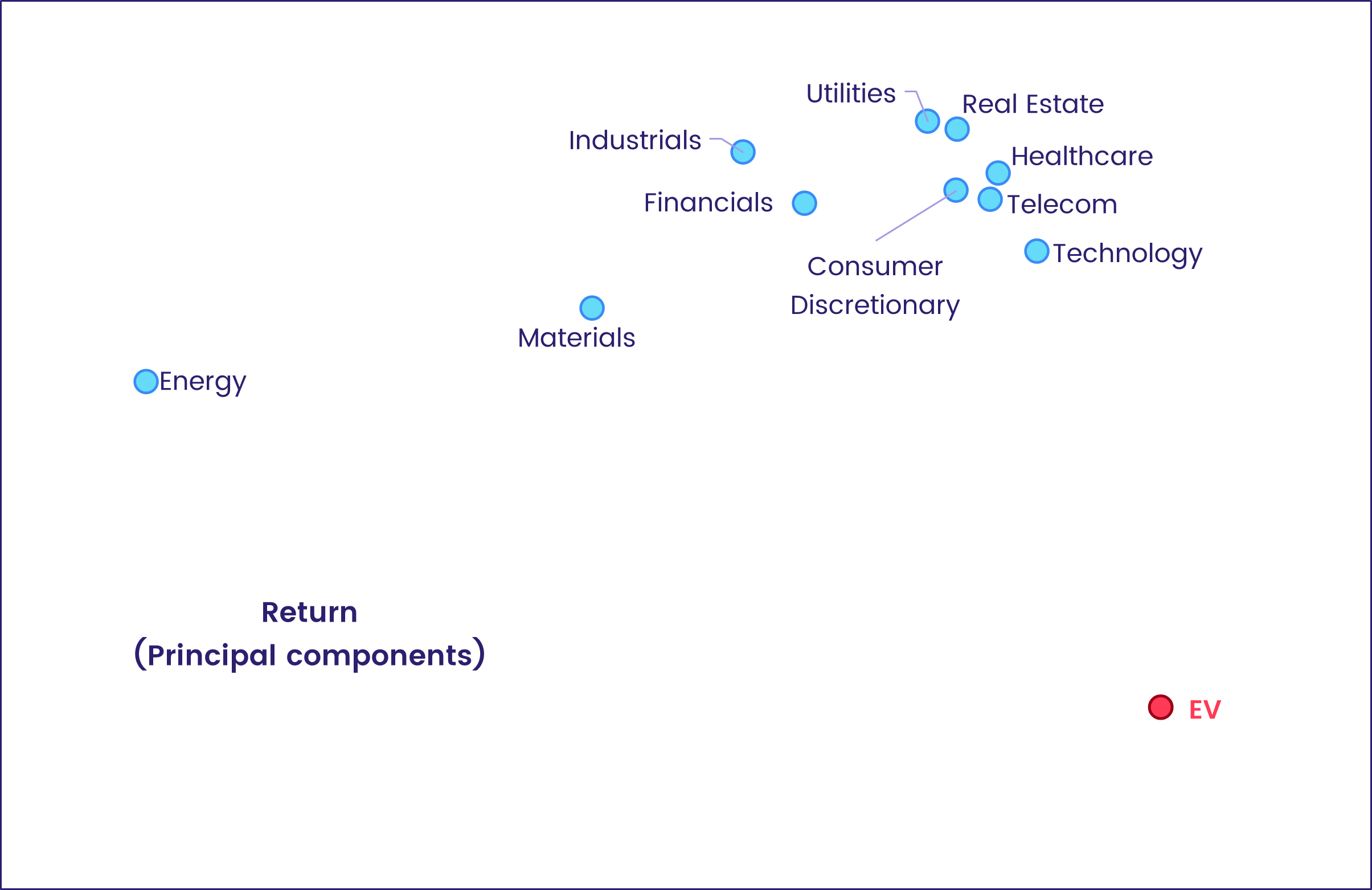

Having established our universe of EV funds, we can perform a deeper dive into their behavior. To do so, we employ the principal components analysis, previously utilized and explained in the Quant’s Corner “AI Funds: On which frontiers?”.

For our analysis, we looked at the returns of these funds since May 2019 compared with those of the 11 major equity Sector Fund groups tracked by EPFR.

Counting EV as a sector in its own right, each sector is characterized by 60 data points that represent every month’s return between May 2019 and May of this year. From this, we can establish 60 linear combinations or risk factors that encompass geography, volatility of returns, investment styles and other key risk metrics. The riskiest becomes the first principal component, with the next strongest becoming the second. The remaining, weaker risk factors are then discarded.

The two factors that make the cut are used as the axes that allow us to represent our data in two dimensions by way of a simple dot-plot chart. Once the dots are arranged along the two axes, the one that corresponds to EV funds is colored red while those relating to all other sectors appear as blue dots. The result is a visual representation (see chart below) showing the return profiles for each sector.

Unlike the AI Funds analyzed in the earlier Quant’s Corner, which remained within the Technology Sector Fund orbit, EV Funds sit well outside the pack even though they are generally classified as Consumer Goods Sector Funds.

Given that neither their flows nor return profiles are similar, we can draw the conclusion that the EV sub-sector has not yet made a huge impact on the broad consumer goods sector, and hence may not reflect the investment risks or opportunities that drive the larger group.

Always out there on their own?

As we mentioned at the start of this piece, EVs have been incorporated into a variety of investment themes, with one of the flagship EV companies – Tesla – a member of the tech-heavy Magnificent Seven stocks that have driven US markets over the past 18 months.

While we wait to see which theme, from green through next-generation transport to technology frontier, gains the upper hand, we will be watching to see how the headwinds that have been building around EVs affect the return profiles of the funds dedicated to them. It may be a case where this fund group continues to march to the beat of different drums.

Did you find this useful? Get our EPFR Insights delivered to your inbox.