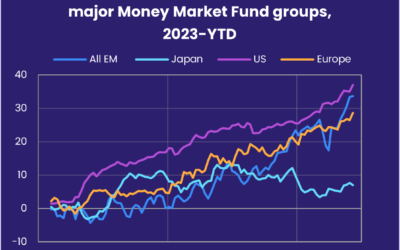

Ahead of a nine-day window encompassing policy meeting by the European Central Bank, US Federal Reserve and Bank of Japan, investors steered another $16.6 billion into EPFR-tracked Bond Funds and $30 billion into Money Market Funds while Equity Funds posted their first collective outflow since mid-April.

Fund flows during the week ending Sept. 11 sent mixed signals about investors’ risk appetite. Technology Sector Funds posted consecutive weekly outflows for only the third time over the past 12 months, Emerging Markets Bond Funds chalked up their seventh straight outflow and Cryptocurrency Funds experienced net redemptions for the second week running. But Global Emerging Markets (GEM) Equity Funds extended their longest run of inflows in over 15 months, High Yield Bond Funds absorbed more than $1 billion for the third time since mid-August and Alternative Funds posted their fourth straight inflow.

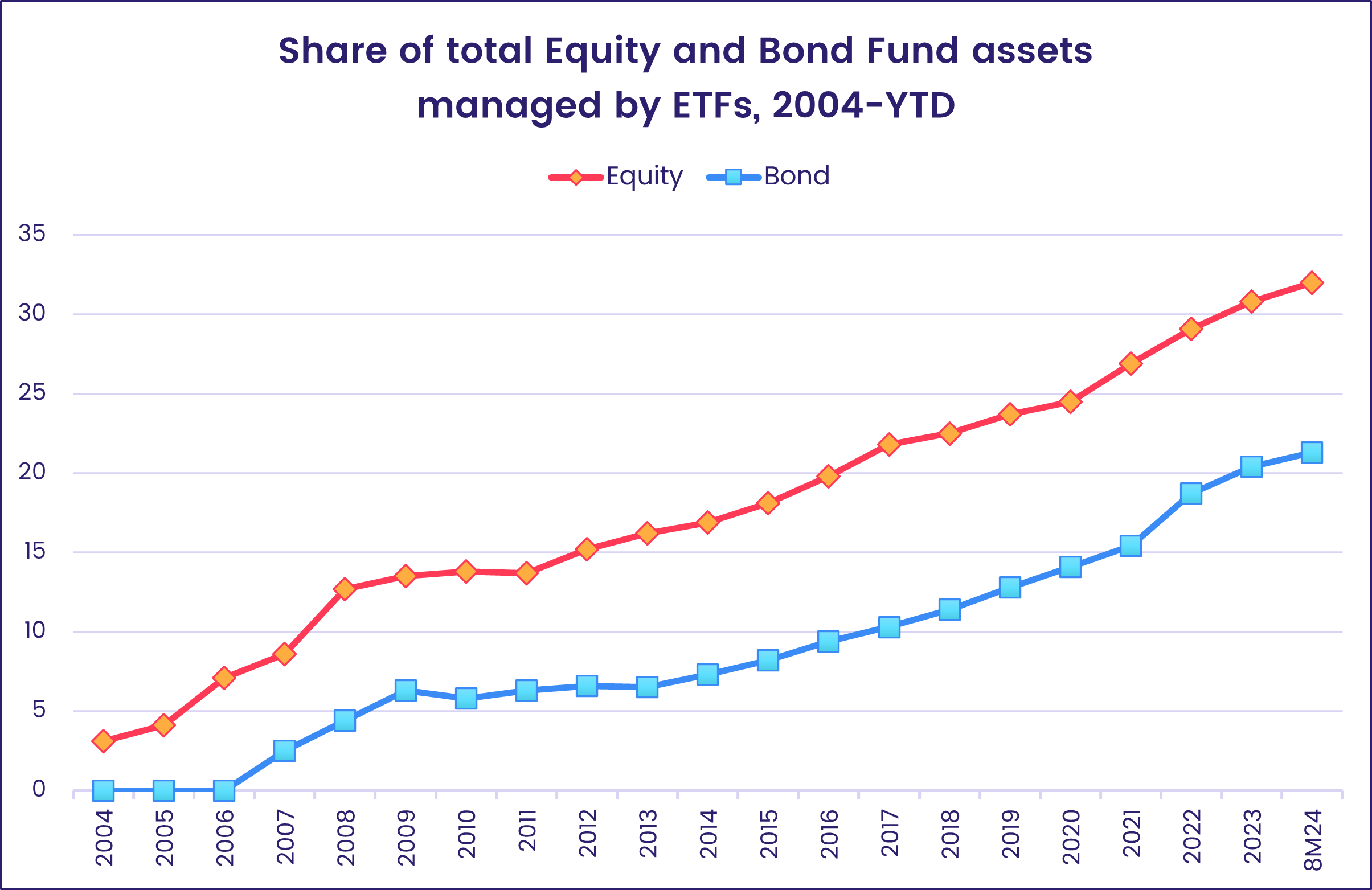

As has been the case for much of the past decade, the headline number for all Equity Funds reflected the balance between flows into Exchange Traded Funds (ETFs) and redemptions from mutual funds. During the current quarter, the share of all Equity Fund assets in ETFs has exceeded a third of the overall total and the combined AuM of all EPFR-tracked Equity, Bond and Balanced ETFs has climbed past the $13 trillion level.

At the asset class and single country fund level, redemptions from Austria Equity Funds climbed to a 30-week high, Turkey Money Market Funds posted a new weekly inflow record and Australia Bond Funds absorbed fresh money for the 24th straight week. Dividend Equity Funds added to their longest run of inflows since 2H14, Total Return Funds enjoyed record-setting inflows and Convertible Bond Funds posted their 30th outflow year-to-date.

Emerging Markets Equity Funds

The week ending Sept. 11 saw EPFR-tracked Emerging Markets Equity Funds post their 15th consecutive inflow thanks to the usual suspects. Asia ex-Japan Equity Funds absorbed another $2.4 billion and the diversified Global Emerging Markets (GEM) Equity Funds narrowly extended their current inflow streak while EMEA and Latin America Equity Funds both saw over $100 million redeemed.

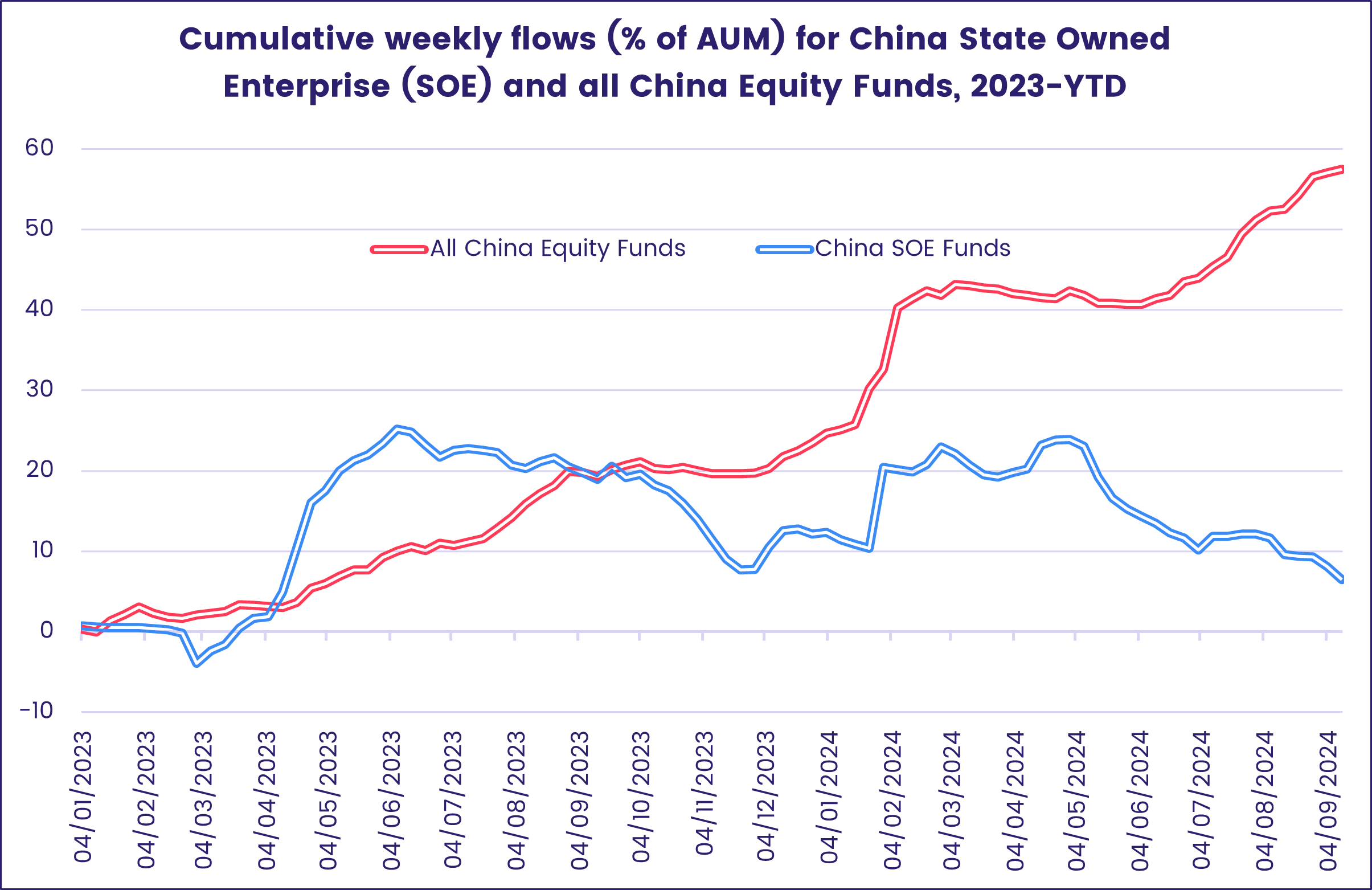

Flows into China Equity Funds so far this year total $88.3 billion despite the long slide in the country’s benchmark CSI 300, which recently closed at its lowest level since late 4Q18. Investors have been avoiding funds dedicated to state owned enterprises (SOEs), but China Dividend Funds compiled a 14-week inflow streak before stumbling during the latest week.

Funds dedicated to Taiwan, which China regards as a province of the mainland, continue to attract solid inflows even though one of the key drivers – the artificial intelligence (AI) theme – has lost some of its shine during the current quarter. Taiwan (POC) Equity Funds have now recorded inflows for 13 straight weeks.

Elsewhere, redemptions from Thailand Equity Funds jumped several notches to their highest level since mid-4Q21 as the group extended a redemption streak stretching back to early January. New Thai Prime Minister Paetongtarn Shinawatra faces an economy where political uncertainty, high levels of household debt and regional competition have sapped GDP growth.

After a thaw coming into the third quarter, EMEA Equity Funds have come under pressure again, posting outflows five of the past seven weeks. Many of the markets in this universe depend on oil exports, several are directly or indirectly involved in major conflicts, and those within the European Union are linked to core markets such as France and Germany that are struggling.

Also struggling are Latin America Equity Funds, with both Brazil and Mexico Equity Funds seeing over $90 billion redeemed as weaker growth in key export markets, statist policymaking, demographic challenges and structural issues limit investor appetite for exposure to the region.

Developed Markets Equity Funds

With a round of major central bank meetings looming, the latest corporate earnings season largely in the rearview mirror and markets struggling for purchase on a wall of worry, investors with a developed markets focus hit the brakes during the latest week. As a result, EPFR-tracked Developed Markets Equity Funds saw their 20-week inflow streak come to an end as redemptions from US, Europe and Japan Equity Funds offset flows into Global, Pacific Regional and Canada Equity Funds.

Flows into Global Equity Funds climbed to a 10-week high, helped by the biggest inflow for Global ex-US Funds since late June and solid investor support for both Global ex-US Funds and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. This interest in diversified exposure also lifted Pacific Regional Equity Funds, which posted their second inflow quarter-to-date.

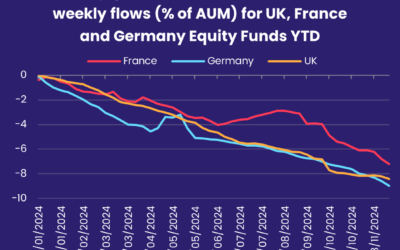

Europe Equity Funds posted another collective outflow on the back of neutral flows for the two major regional groups and a noticeable lack of appetite for direct country exposure. Sentiment towards France, where a caretaker government can do little about a growing fiscal deficit, finally took a significant dip with France Equity Funds chalking up their biggest outflow since last December.

Eye-catching flows into retail share classes, which posted their biggest collective inflow in over two decades, did not stop US Equity Funds overall from recording their first outflow in 11 weeks and their biggest in 22 weeks. Large Cap Growth Funds took the biggest hit among the major style and capitalization groups in terms of flows while Small Cap Value Funds turned in the worst performance.

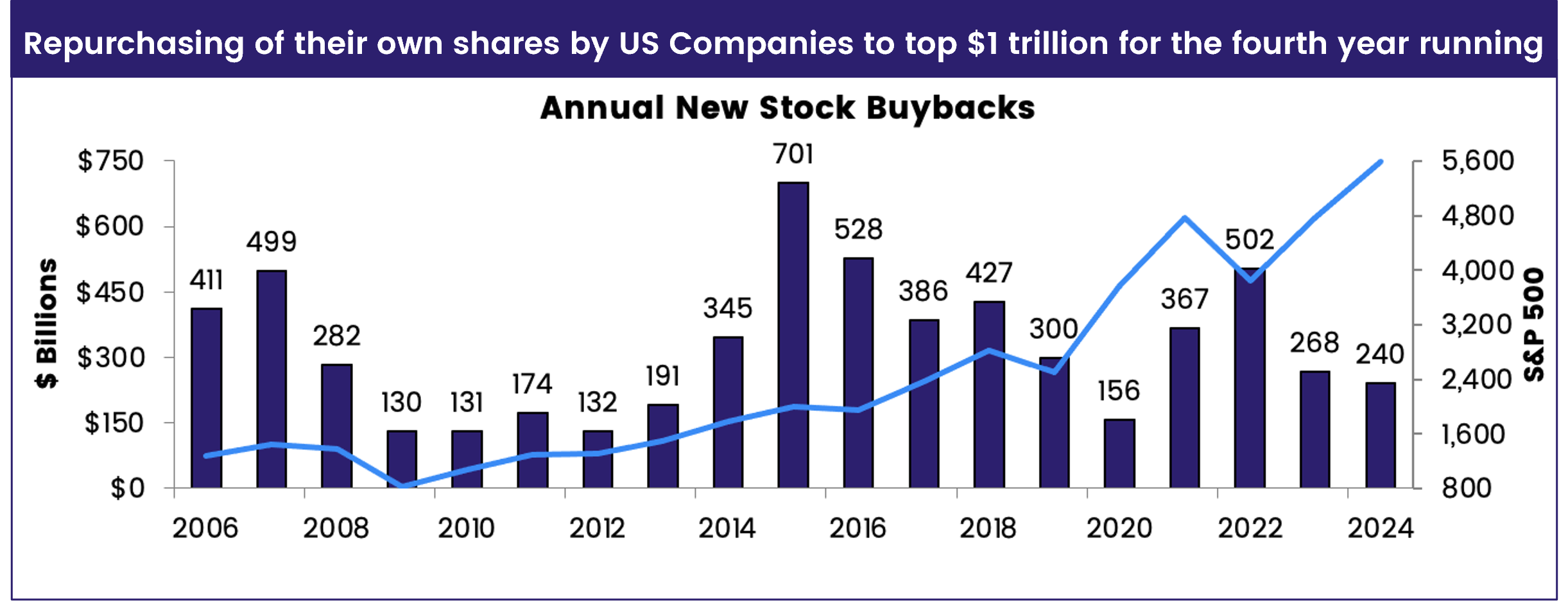

US companies continue to aggressively shrink the amount of shares on open markets – the ‘free float’ – with announced buybacks year-to-date closing in on the $1 trillion mark.

Redemptions from Japan Equity Funds climbed to a nine-week high ahead of the Bank of Japan’s next policy meeting that ends Sept. 20. Although the BOJ is expected to keep interest rates on hold, its tone in recent weeks has been hawkish, fueling fears of a stronger yen that hits the competitiveness of Japanese exporters and cools their appetite for higher wage bills. Redemptions from foreign domiciled funds hit their highest level in over four years.

Global sector, Industry and Precious Metals Funds

With a deluge of events and data points to digest during the week ending Sept. 11, investors opted for just a few sectors that have defensive characteristics (Consumer Staples, Utilities) or offer a hedge against inflation (Real Estate, Gold). That left eight of the 11 EPFR-tracked Sector Fund groups reporting outflows that ranged from $$36 million for Infrastructure Sector Funds to $1.65 billion for Financials Sector Funds.

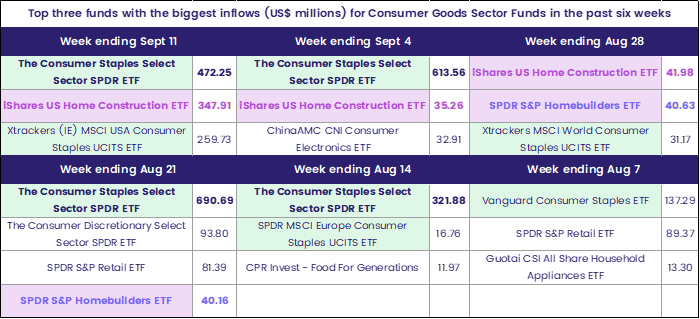

Among the groups attracting fresh money were Consumer Goods Sector Funds, which posted inflows for only the second time during the past six weeks after better-than-expected retail spending by US consumers. Over that period, a single consumer staples-focused ETF has figured prominently among the individual funds with the biggest inflows.

Technology Sector Funds endured a second consecutive week of inflows for the first time since mid-May during a week where Apple faced tax troubles in Ireland. Retail and Europe Technology Sector Fund redemptions hit six- and 12-week highs, respectively. At the stock level, EPFR’s Stock Flows data shows that, between September 2-10, funds sold $700 million worth of Apple shares after adding $2.5 billion worth to their portfolios during August.

Flows for Physical Gold Funds remained positive for a fifth straight week, and for the 15th time in the last 18 weeks, as geopolitical tensions remain high in the Middle East, Pacific and Eastern Europe. Gold Mining Funds also posted their biggest inflow in nearly four months. The price of gold is sneaking closer to the $2,600 per ounce mark again, up $44 since last week.

Meanwhile, Financials Sector Funds posted their biggest outflow since mid-4Q23. A single passively-managed US ETF accounted for a lion share of the headline number this week.

Bond and other Fixed Income Funds

The likelihood of lower Eurozone and US interest rates in the second half of September did nothing to steer flows away from EPFR-tracked Bond Funds during the latest week. Year-to-date flows into all funds now stand at 149% of last year’s total and 72% of the full-year inflow record set in 2021. US Bond Funds extended a run of inflows stretching back to the third week of December, Asia Pacific Bond Funds posted their 10th inflow over the past three months, Europe Bond Funds absorbed another $1.4 billion and Global Bond Funds racked up their 42nd inflow since mid-4Q23.

At the asset class level, High Yield Bond Funds pulled in another $2.3 billion, Mortgage Backed Bond Funds recorded their 35th inflow YTD and Municipal Bond Funds absorbed fresh money for the 11th consecutive week while Inflation Protected Bond Funds extended their longest redemption streak since 4Q23.

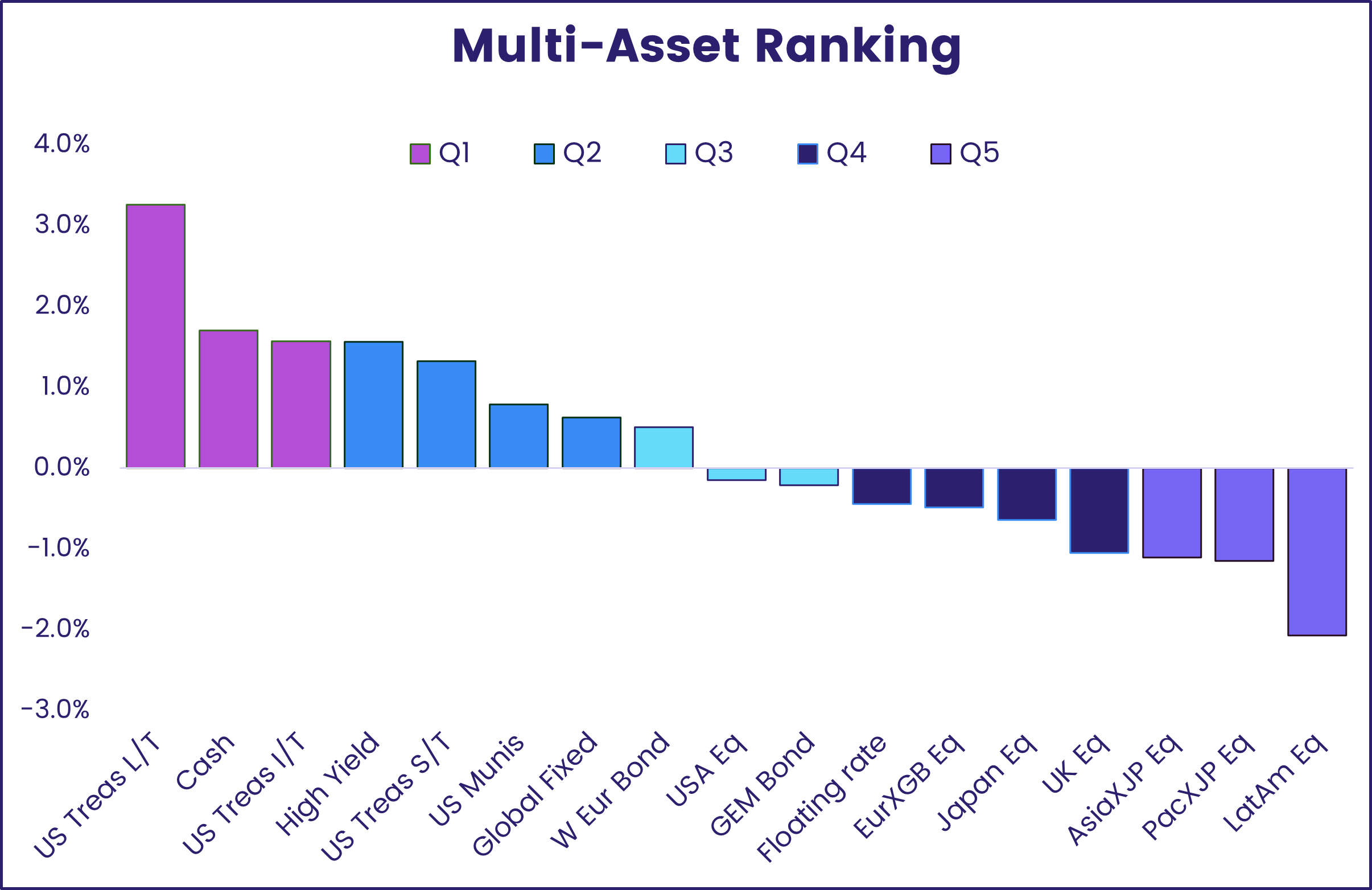

EPFR’s weekly multi asset rankings continue to show a marked preference for cash and fixed income among managers who invest across multiple asset classes, with Treasuries, cash, junk bonds and municipal debt filling six of the seven slots in the top two quintiles.

The only fixed income classes in the lower half of the latest ranking are floating rate and emerging markets debt. In the case of the latter, investors continue to exit Emerging Markets Hard Currency Bond Funds and cautiously rotate exposure to their local currency counterparts. During the latest week, flows into China Bond Funds climbed to a five-week high while redemptions from India Bond Funds hit their highest weekly total since early March.

The latest flows into US Bond Funds spanned most of the major groups, with Long Term Corporate Funds the exception as they posted their biggest outflow in just under a year. As was the case with their equity counterparts, US Bond Funds saw unusually strong flows into retail share classes with the collective total hitting a level last seen in early 4Q17.

Europe Bond Funds also attracted solid retail inflows for the 51st time over the past 12 months. In contrast to recent weeks, flows into Corporate and Sovereign Europe Bond Funds showed only a modest bias towards the former.

Flows into the two major multi asset groups tacked by EPFR, Balanced and Total Return Funds, took very different tacks with the former racking up their biggest outflow since late April while Total Return Funds set a new inflow record.

Did you find this useful? Get our EPFR Insights delivered to your inbox.