Investors anticipating that recent interest rate cuts in North America and Europe will drive a rotation from bonds to stocks, especially emerging markets stocks, were partially vindicated in late September when EPFR-tracked Emerging Markets Equity Funds posted their second-largest weekly inflow of the year.

That headline number, however, came with several caveats. China-mandated funds accounted for nearly all of those inflows. It was also, in terms of flows to all Equity Funds, largely offset by redemptions from US and Europe Equity Funds which ran into fresh geopolitical, transportation and energy headwinds. Overall, the week ending Oct. 2 saw Equity Funds post a collective inflow of $4.9 billion, while Money Market Funds attracted $13.2 billion and Bond Funds a net $15.7 billion.

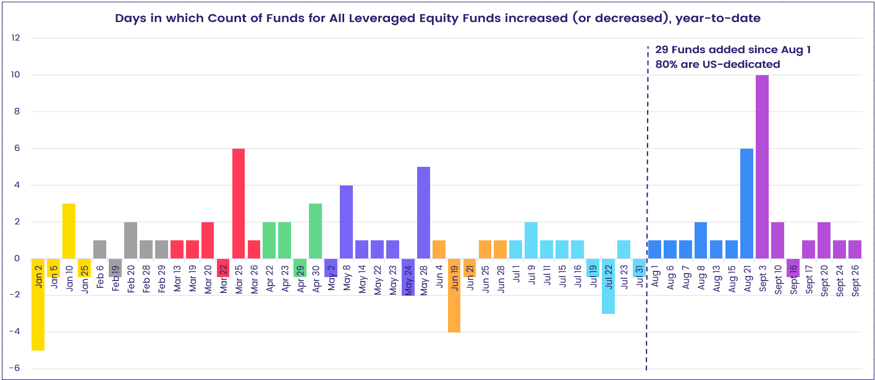

Coming into October, fund groups tied to riskier asset classes generally fared well. High Yield Bond Funds pulled in over $4 billion, flows into dedicated Cryptocurrency Funds climbed to a 10-week high and Emerging Markets Bond Funds recorded their third straight inflow. But redemptions from Leveraged Equity Funds, which have seen significant growth in new launches during the past quarter, chalked up their biggest outflow since late May.

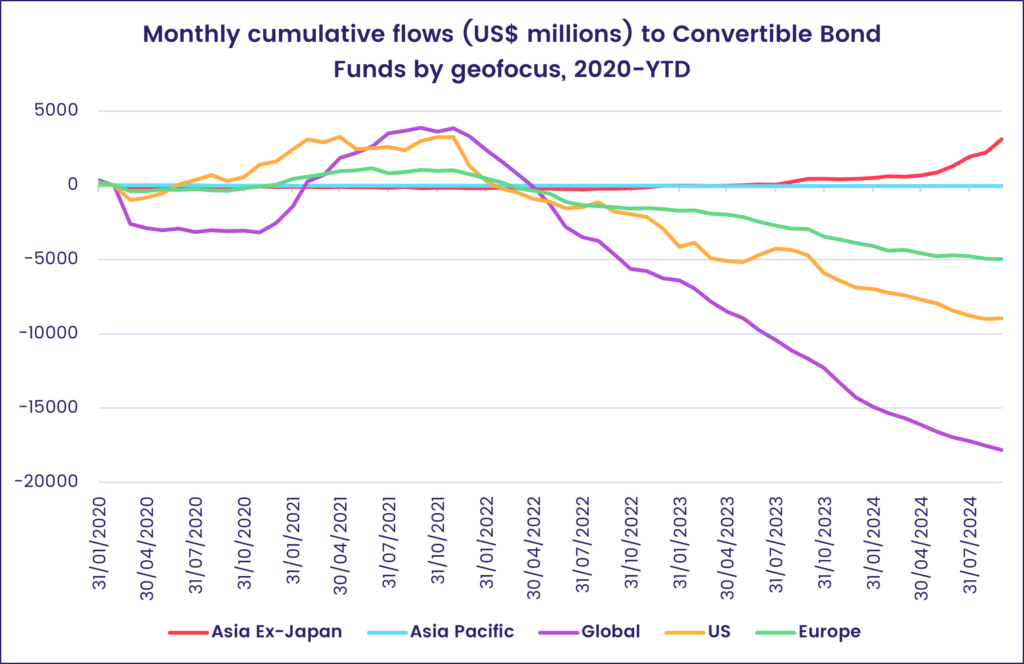

At the single country and asset class fund level, flows into Convertible Bond Funds hit their highest level since 4Q21, Derivatives Funds racked up their 36th inflow of the year so far and Gold Funds saw their longest inflow streak since 2Q23 come to an end. Redemptions from Brazil Money Market Funds jumped to a 121-week high, Australia Bond Funds took in fresh money for the 27th week running and year-to-date flows into Argentina Equity Funds exceeded 145% of their AuM on Jan. 1.

Emerging Markets Equity Funds

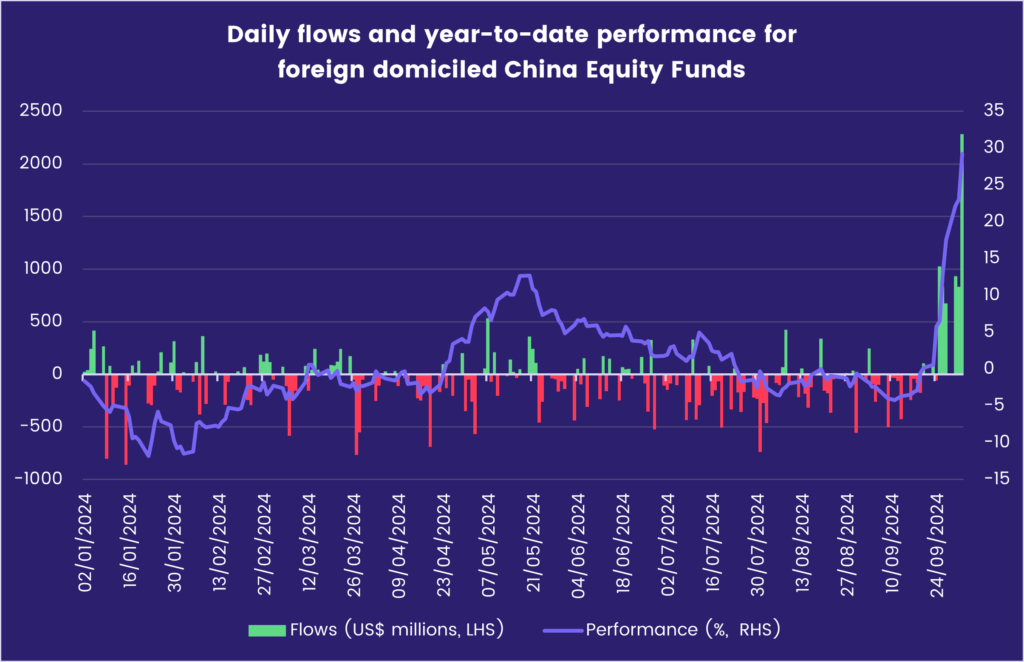

The week ending Oct. 2 saw EPFR-tracked Emerging Markets Equity Funds post their 18th consecutive inflow, and their biggest since the first week of February, as investors chased the furious rally that saw key Chinese equity indexes jump 25% in a week.

Despite a headline number for all funds that exceeded $15 billion, retail share classes saw money flow out for the 11th straight week and Emerging Markets Collective Investment Trusts (CITs) recorded their biggest outflow since mid-June while EM Dividend Funds tallied their biggest weekly outflow since EPFR started tracking the group in 4Q00. Investors have warmed to funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which extended their longest inflow streak since 2Q23.

The latest flows into China Equity Funds included the biggest weekly total on record for overseas domiciled funds. Sentiment, buoyed by a raft of stimulatory adjustments to interest rates, bank reserve requirements and mortgages, has been further boosted by rumors of additional fiscal measures. Global Emerging Markets ex-China Equity Funds did post their 15th straight inflow, but the amount they took in was a tiny fraction of the new money that flowed into China-mandated funds.

Elsewhere, flows into India Equity Funds were less than 1% of China Equity Fund’s weekly total but allowed the group to extend their record-setting inflow streak. Also enjoying a lengthy inflow streak that stretches back to mid-April are Malaysia Equity Funds which are benefiting from Malaysia’s structural reform story and growing technology sector.

While China’s recent stimulus measures lit a fire under the domestic stock market, any impact they had on the investment case for Latin America faded quickly. Latin America Equity Funds ended the latest week by posting their 14th outflow over the past 16 weeks. Fears that looser fiscal policy and inflationary pressures will force Brazil’s central bank to tighten monetary policy continue to weigh on sentiment towards the region’s biggest economy, and appetite for exposure to Mexico is constrained by the statist policymaking of the country’s ruling Morena Party.

EMEA Equity Funds also experienced net redemptions as the specter of war stalked the ME portion of the group’s universe. During a week when Israel launched a limited invasion of Lebanon and was targeted by Iranian ballistic missiles, Israel Equity Funds posted their biggest outflow since the second week of June.

Developed Markets Equity Funds

After the euphoria of the first US interest rate cut in over four years, EPFR-tracked Developed Markets Equity Funds found themselves navigating a variety of sobering developments in early October. Foremost among these was the escalating conflict between Israel, Iran and Iran’s proxies in Lebanon, Gaza and Yemen and the potential knock-on effects for oil prices, global shipping and inflation. The result was the biggest collective outflow recorded by the group since the beginning of the second quarter.

In the case of the US, fears about inflationary impact of higher shipping costs if transiting the Suez Canal were compounded by a three-day strike by longshoremen that paralyzed most East Coast ports. US Equity Funds ended the latest week by posting their third outflow during the past five weeks. ETFs indexed to the S&P 500 figured prominently at either end of the flow spectrum, with one surrendering over $14 billion and one taking in over $9 billion.

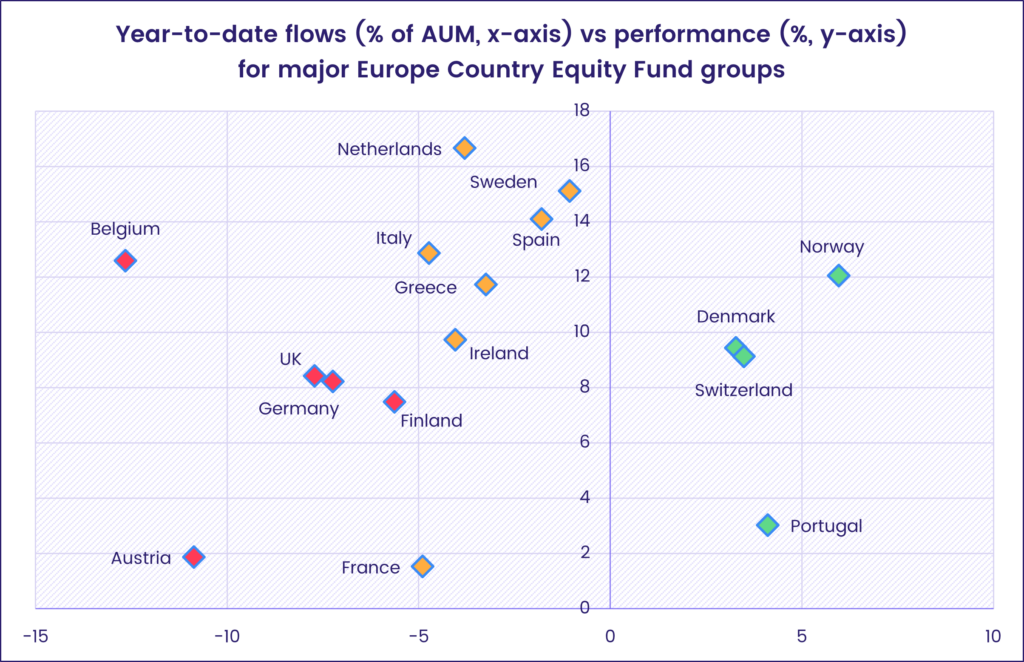

Europe Equity Funds also posted a collective outflow, their biggest since the first week of March 2022, as the possibility of another energy price shock added to negative investor sentiment fueled by weak growth, fiscal slippage and the lack of credible reform stories. With the German economy struggling and governments in France, Italy and the UK looking to increase the tax burden on their more successful citizens and companies, the outlook for regional growth is cooling.

At the country level, redemptions from Italy, Finland, Portugal and France Equity Funds hit 15, 27, 40 and 42-week highs, respectively, while UK Equity Funds posted their biggest outflow since 2Q22 as investors act ahead of the new Labour government’s first budget.

Japan Equity Funds started October with a solid inflow during a week that ended with a new prime minister being sworn in and starting to set out his economic policy stall ahead of a snap election on Oct. 27. Among Shigeru Ishiba’s first steps was to instruct his new cabinet to start work on a new fiscal stimulus package, the seventh since 2020.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, posted their eighth consecutive inflow. Both Global ex-US Funds and those with fully global mandates pulled in over $1 billion. Europe domiciled funds outgained those based in the US for the first time since early September.

Global sector, Industry and Precious Metals Funds

With another corporate earnings season due to kick off in two weeks, a US presidential election now five weeks away and tensions in the Middle East hitting fresh peaks, investors took an active approach to their sector exposure coming into October.

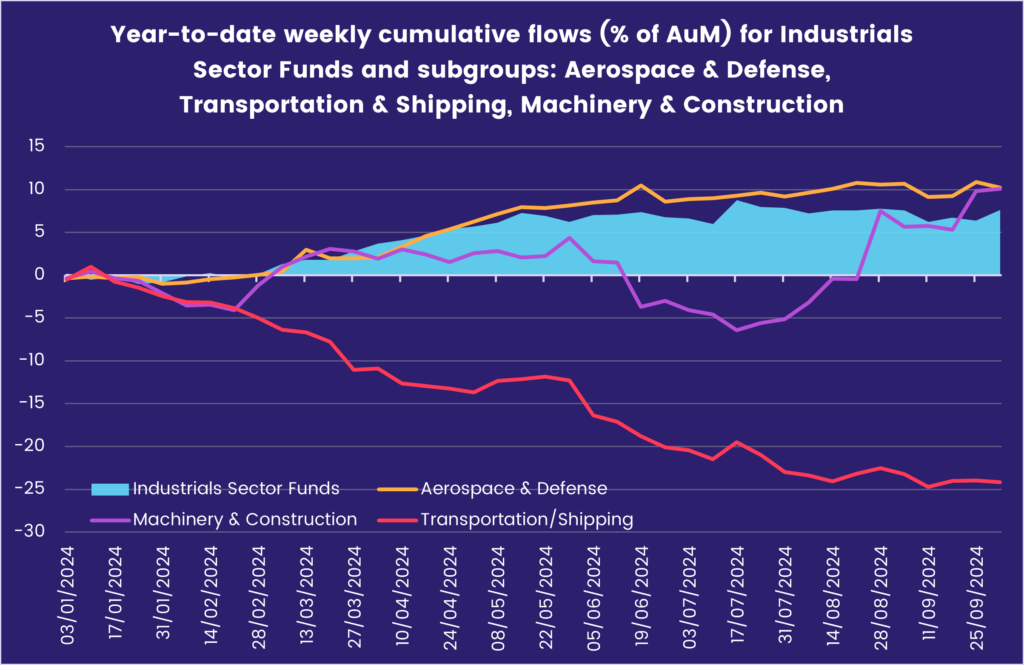

Of the 11-EPFR tracked Sector Fund groups, eight attracted fresh money during the week ending Oct. 2. Inflows ranged from another $46 million for Commodities Sector Funds to $718 million for Industrials Sector Funds. Redemptions hit those groups dedicated to sectors operating in tightly regulated environments: healthcare, energy and financials.

Flows into Industrials Sector Funds climbed to their second highest mark since mid-4Q21 despite the potential supply chain disruptions promised by a short-lived strike by US dock workers. Year-to-date flows for major sub-groups show investors retreating from Transportation/Shipping Funds quite consistently while inflows for Machinery/Construction Funds are back up nearly 3.6% in assets since mid-July.

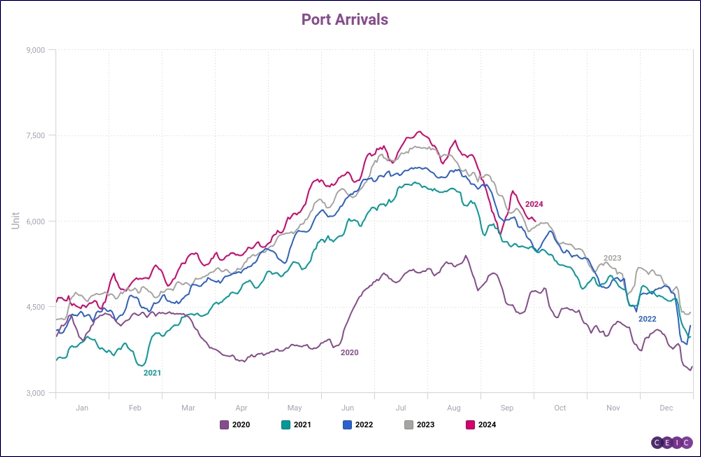

Port activity data sourced by Marine Traffic and offered by our sister company CEIC suggests that 2024 bas been a notably “robust year for port activity – and, by extension, US trade.” The current year has outperformed the previous four (see chart below) with the pandemic lull of 2020 a logical outlier, and any impact of the recent industrial action will, like the collapse of the bridge in port of Baltimore, be relatively short lived.

Flows into Consumer Goods Sector Funds overall exceeded $500 million for the third time in the past four weeks, with a mix of consumer staples and discretionary ETFs driving the latest headline number. After experiencing outflows more-often-than-not over the past 18 months, China Consumer Goods Sector Funds logged their seventh largest inflow since EPFR started tracking these funds in 2009. That was behind record setting weekly inflows in 2021 and a single week in 2023.

Energy Sector Funds extended their current outflow streak to nine weeks and $5.6 billion total. A single US-domiciled ETF has accounted for over $2 billion of the overall outflows during this run and another almost $600 million has been pulled from two oil production and services funds.

A four-week outflow streak ended for Telecoms Sector Funds driven by a single US-dedicated ETF benchmarked to one of the Russell 1000 Telecommunications indices. Only 25% of the funds we track in this sector posted net inflows, 28% saw no activity while the majority 47% left over posted net outflows.

Bond and other Fixed Income Funds

Year-to-date flows for EPFR-tracked Bond Funds in early October hit 79% of 2022’s record-setting total as investors continue to buy into a wide range of fixed income fund groups. The latest week saw US Bond Funds absorb fresh money for the 41st consecutive week, Global Bond Funds post their 45th inflow since mid-4Q23 and Europe Bond Funds chalk up their biggest inflow since mid-May.

At the asset class level, flows into High Yield Bond Funds hit an 11-week high while redemptions from Bank Loan Funds hit their highest level since early August. Municipal Bond Funds extended their longest inflow streak since a 30-week run ended in late 3Q21, Mortgage Backed Bond Funds racked up their 38th inflow of 2024 and Convertible Bond Funds took in over $400 million for the first time in over three years.

Emerging Markets Bond Funds posted modest net inflows as commitments to funds with hard currency mandates more than offset redemptions from their local currency counterparts. Frontier Markets Bond Funds recorded their biggest inflow since the third week of 2Q23 despite sentiment towards African debt taking a turn for the worse, with redemptions from Africa Regional and South Africa Bond Funds hitting 31 and 100-week highs, respectively.

The latest flows into Europe Bond Funds again favored funds with corporate mandates over Europe Sovereign Bond Funds, though flows into the latter climbed to a 17-week high. The group continues to enjoy strong retail support, with retail share classes posting only one weekly outflow over the past year. At the country level, UK Bond Funds recorded their biggest inflow since late 3Q21.

US Bond Funds tallied retail inflows for the ninth consecutive week, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their current inflow streak to 14 weeks and $19 billion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.