The fourth week of November saw US Equity and Bond Funds absorb another $45 billion while redemptions from Japan and Europe Equity Funds hit seven and eight-week highs, respectively, Emerging Markets Equity Funds extended their longest run of outflows since 4Q23 and another $2.6 billion flowed out of Emerging Markets Bond Funds.

Trump’s approval of cryptocurrencies, finance and Argentinian President Javier Milei were again reflected in the latest weekly flows and Global Equity and Bond Funds attracted solid inflows.

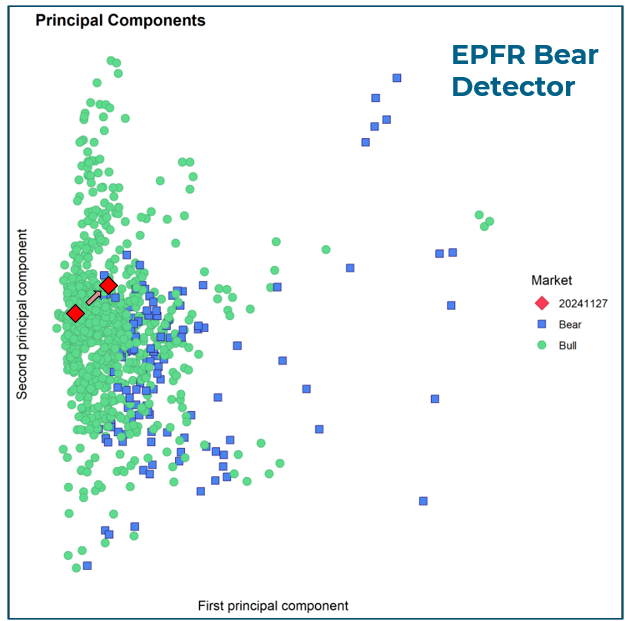

EPFR’s Bear Detector, which uses principal component analysis of factors derived from the company’s databases to generate a weekly plot point has seen that indicator move over the past month from deep in the bullish zone to the bearish frontier.

At the single country and asset class fund levels, flows into Dividend Equity Funds hit a 34-week high, Mortgage-Backed Bond Funds posted their second largest inflow year-to-date and High Yield Bond Funds recorded their first outflow since the second week of August. Both Turkey Money Market and Argentina Equity Funds enjoyed record-setting inflows, Spain Bond Funds saw another $300 million flow out and redemptions from Israel Equity Funds hit the highest level since mid-April.

Emerging Markets Equity Funds

There was little for EPFR-tracked Emerging Markets Equity Funds to be thankful for during the fourth week of November as they watched floods of fresh money bypass them on the way to US-mandated funds. Overall, the group posted its seventh straight outflow as three of the four major regional groups experienced net redemptions that ranged from $126 million for EMEA Equity Funds to $1.4 billion for the diversified Global Emerging Markets (GEM) Equity Funds.

The latest week also saw money flow out of retail share classes for the 19th week running, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates record their fourth outflow over the past five weeks, EM Collective Investment Trusts (CTIs) extend a redemption streak stretching back to the final week of August and EM Leveraged Equity Funds post their first outflow since the week ending Oct. 2.

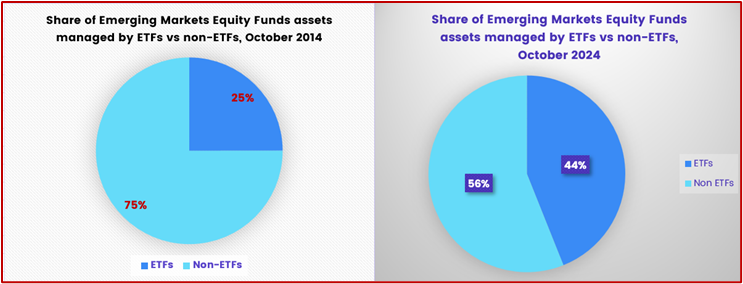

There were modest inflows to EM Equity ETFs, a reflection of the growing footprint of these generally passively managed vehicles. Over the past decade, the share of assets managed by ETFs has gone from 25% of the total for all EM Equity Funds to 44%.

Investors looking to Asia again favored markets with a foothold in the global . For the third week running, Korea and Taiwan (POC) Equity Funds posted inflows while varying amounts flowed out of China, India, Thailand, Malaysia and Indonesia Equity Funds.

The latest figures from shows amanaged GEM Equity Funds cut their average allocation to Korea for the fourth month running coming into November and sliced their exposure to India by 142 basis points. These funds also boosted Brazil’s weighting to a five-month high while Mexico’s fell to its lowest level since the first month of 1Q21.

Flows to Latin America Equity Funds followed this script in late November, with Mexico Equity Funds chalking up their third straight outflow, and seventh over the past eight weeks, while flows into Brazil Equity Funds rebounded to their highest level since mid-3Q23.

Developed Markets Equity Funds

US Equity Funds remained in the money during the week ending Nov. 27, adding another $36 billion to an eight-week run of inflows that has seen over $140 billion flow into the largest of the Equity Fund groups. Once again, these inflows offset redemptions from other groups, allowing all EPFR-tracked Developed Markets Equity Funds to rack up their 38th collective inflow of 2024.

Funds with large cap mandates again pulled in the largest amount in cash terms, but US Small Cap Equity Funds led the way in flows as a % of AUM terms. Retail share classes attracted fresh money for the second time in November, with the latest inflow the second largest since the beginning of 2022. Overseas domiciled US Equity Funds, which posted their biggest collective inflow in over two decades the previous week, pulled in another $7.1 billion this week.

Despite concerns about US President-elect Donald Trump’s intentions for the North America Free Trade Agreement (NAFTA), Canada Equity Funds ended the week with their biggest inflow in 11 months.

Looking ahead, US Equity Funds are moving into the ex-dividend season, a period that often produces big swings in headline flow numbers because of the gap between dividends being paid and re-invested. When funds pay out accumulated dividends they appear as outflows that are usually reversed when most of those dividends are reinvested. If a significant number of funds go ex-dividend towards the end of a given reporting period, the result is exaggeratedly large outflows one week and correspondingly outsized inflows the following week.

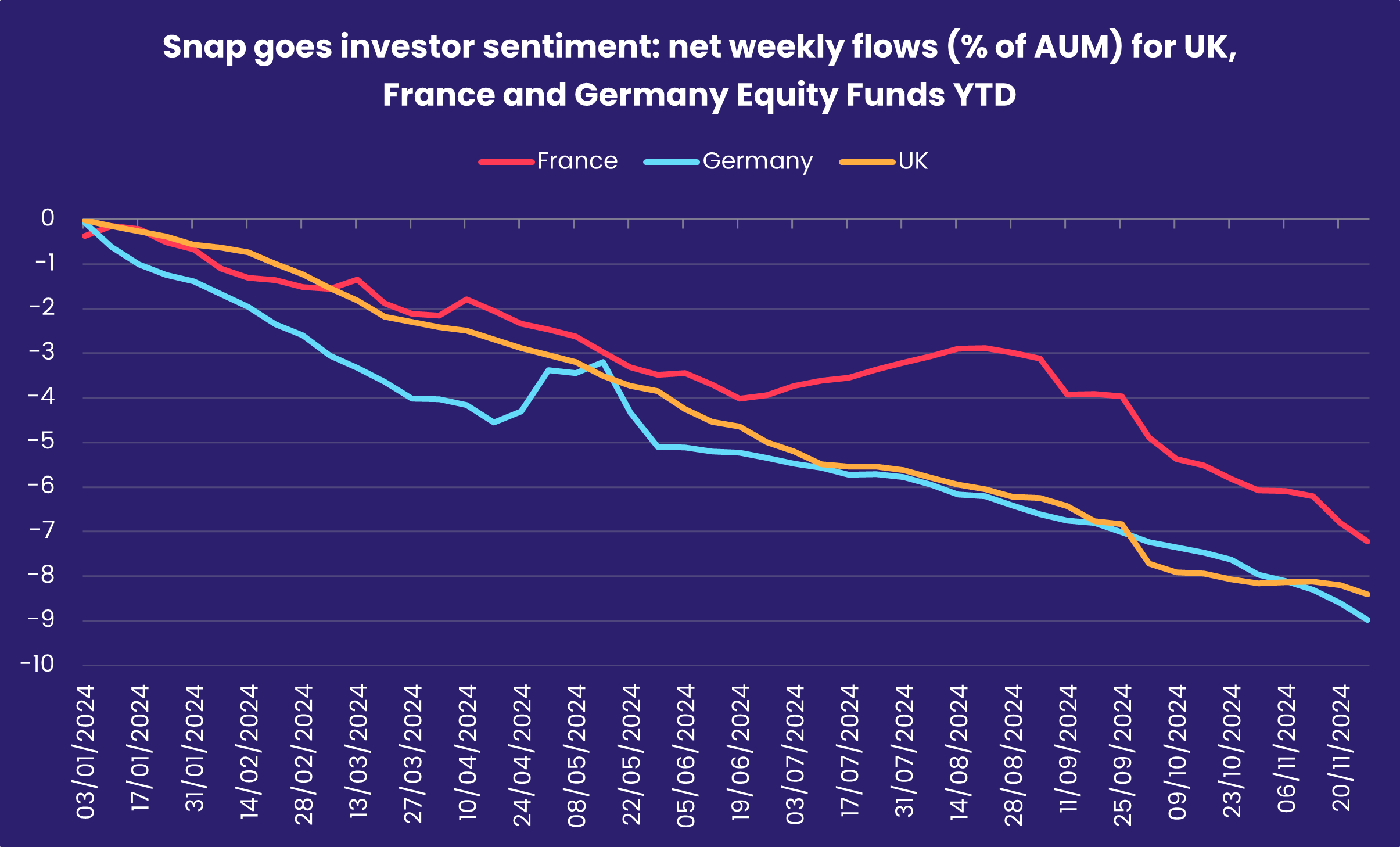

Europe Equity Funds tallied their ninth straight outflow as fiscal constraints, sluggish growth and the prospect of chillier relations – and terms of trade – with the incoming US administration weigh on investor sentiment. With Germany heading into a snap election early next year and France dealing with the aftermath of one in the middle of the year, appetite for direct exposure to the two ‘pillars’ of the Eurozone and European Union is at a low ebb.

Enthusiasm for Japan-mandated funds also stumbled in late November, with redemptions Japan Equity Funds from exceeding $4 billion for only the third time this year. Three of the four individual funds experiencing the biggest outflows are indexed to the TOPIX.

Global sector, Industry and Precious Metals Funds

Only three of the 11 major Sector Fund groups tracked by EPFR posted outflows during the fourth week of November as investors continue to position themselves for the lighter regulatory touch they expect from the next US administration. The other eight posted inflows that ranged from $188 million for Commodities Sector Funds to $3.1 billion for Technology Sector Funds.

Of the fresh money that flowed into Technology Sector Funds in the wake of another excellent quarterly earnings report from chipmaker Nvidia, the vast majority was absorbed by US-mandated funds. Drilling down, Semiconductor Funds attracted over $900 million and flows into dedicated Cloud Computing Funds hit a level last seen in mid-1Q22.

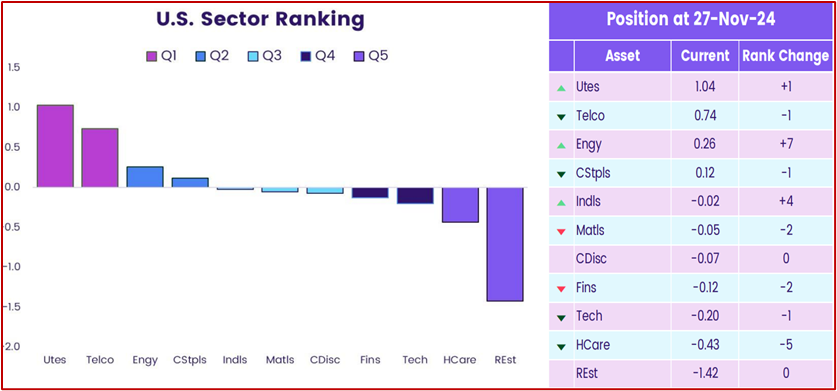

A ranking of US sectors based on factors that capture the flows and allocation trends of active fund managers with multi-sector mandates shows that technology is currently in the fourth quintile along with another recent investor favorite, financials, while utilities and telecoms occupy the top two spots.

Financial Sector Funds pulled in over $2 billion for the third time during the past four weeks. But funds dedicated to real estate, a prominent part of many second and third tier bank loan books, extended their longest outflow streak since 3Q23 as the average 30-year rate for mortgages in the US climbed over 6.8%.

Among fund groups with precious metals mandates, Physical Gold Funds snapped a three-week run of outflows, redemptions from Physical Silver and Palladium Funds hit their highest level since mid-April and mid-September, respectively, and Platinum Funds absorbed fresh money for the fifth straight week.

Bond and other Fixed Income Funds

Year-to-date flows for all EPFR-tracked Bond Funds climbed past the $770 billion mark during the week ending Nov. 27 as the relative safety of fixed income and the desire for reliable yield continues to outweigh the easing bias of North American and European central banks. Of the major groups by geographic focus, US, Europe and Global Bond Funds all attracted over $2 billion while Canada, Emerging Markets and Asia Pacific Bond Funds recorded net outflows.

At the asset class level, Convertible Bond Funds chalked up their ninth inflow over the past 11 weeks, Inflation Protected Bond Funds posted consecutive weekly inflows for the first time since late May, Municipal Bond Funds extended their current inflow streak to 22 weeks and $30.8 billion and Bank Loan Funds absorbed over $1 billion for the fourth straight week.

Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates continue to attract fresh money, racking their 45th inflow so far this year. Green Bond Funds snapped a seven-week outflow streak, posting the second largest inflow of the current quarter.

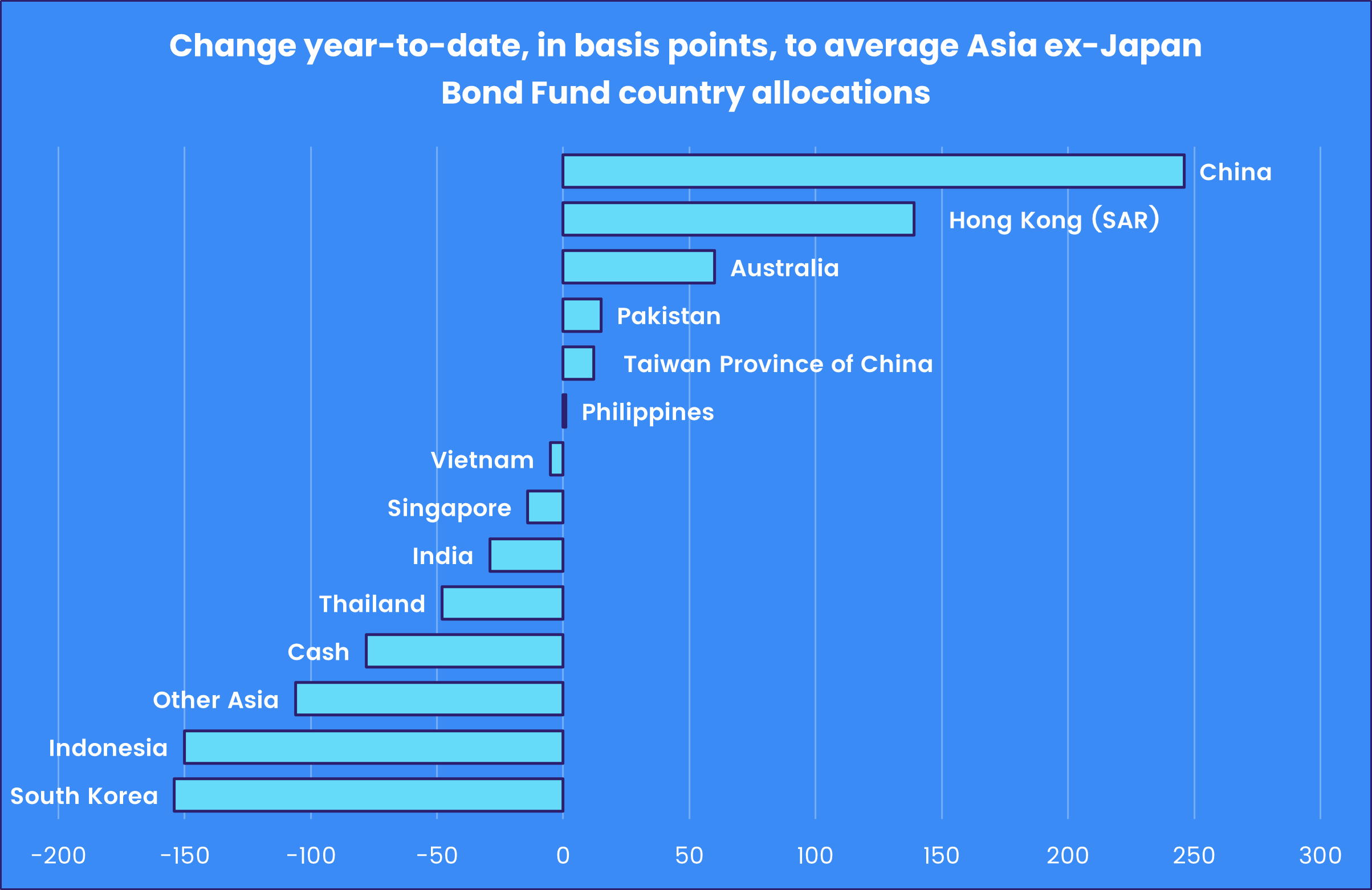

With the US dollar strengthening again in the wake of the US election earlier this month, hard currency funds bore the brunt of the latest redemptions from Emerging Markets Bond Funds as investors worried about the servicing costs of dollar-denominated credits. A single Chile-domiciled fund accounted for over half of the week’s headline number. At the country level, flows into China Bond Funds climbed to a six-week high while redemptions from Korea Bond Funds exceeded $250 million for the third straight week.

US Bond Funds added to a year-to-date total that currently stands at 94% of the full-year record set in 2021. For the third straight week, funds with corporate mandates outgained their sovereign counterparts, with Long Term Sovereign Bond Funds again experiencing the heaviest redemptions. Retail and overseas support remains solid, with retail share classes and foreign domiciled funds both recording inflows 17 of the past 20 weeks.

Strong flows into Europe ex-UK Regional Bond Funds offset heavy redemptions from several Europe Country Fund groups during late November. Redemptions from Switzerland and Germany Bond Funds hit five and 22-week highs and Spain Bond Funds saw another $300 million flow out. UK Bond Funds, however, recorded an 11th straight inflow for the first time since 1Q23.

Global Bond Funds, the largest of the diversified Developed Markets Bond Fund groups, posted their 45th inflow of the year. Over that period, funds with fully global mandates have taken in nearly three times the amount of fresh money devoted to Global ex-US Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.