Leveraged Funds use borrowed money to magnify generally short-term directional bets. These investment vehicles are generally used by “high conviction” traders and investors who have the means to make large, short-term investments in the underlying assets.

Leveraged Funds also have a well-deserved reputation for blowing up investors whose hunch, calculation or model is wrong. As such, they appear at first blush to be unlikely candidates for a reliable quantitative strategy – especially when the focus of that leverage is narrowed to a single security.

Due to the risk and complexity involved, not just anyone is willing to navigate the nuances of Leveraged Funds, making the flows into these funds quite an interesting indicator for investor confidence and market timing. In this Quant’s Corner, we will look at the growing number of Single-Security Leveraged Funds in EPFR’s database and explore ways to generate alpha-creating signals from their unique characteristics.

The nature of the beast

Leverage Funds seek to amplify the returns of their underlying index, and will typically aim for a 1:1, 2:1, 3:1 ratio. Similarly, inverse leverage or “bear” funds aim to have the opposite performance of the market.

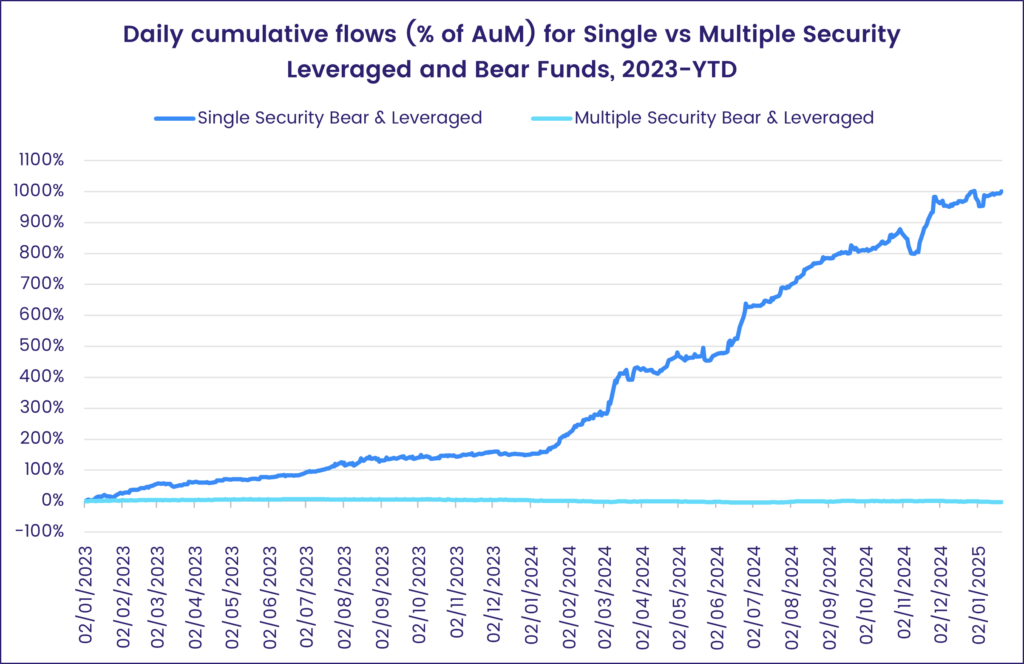

EPFR tags Bear and Leverage Funds separately as well as assigns each with 1/2/3x leverage factor. We define Single-Security Leveraged Funds as those that have either a security ticker or stock name within the name of the fund or its benchmark. Over the past two years, the number of new Single-Security and Diversified Leveraged Funds has been roughly equal, but relative flows show that there has been much greater investor sentiment towards Single-Security Leveraged and Bear Funds.

EPFR tracks a total universe of 234 funds tied to single securities with an AuM of nearly $20 billion. Of those, 98 are Bear Funds and the remaining 136 are Leveraged Funds.

The securities with the most Leveraged Funds are large cap US technology names: Tesla (19), Nvidia (16), Apple (13), Microsoft (12), Amazon (11), Google (10), Meta (10), Netflix (9), MicroStrategy (8), and Advanced Micro Devices (7).

For alpha, does X mark the spot?

What can the flow from highly sophisticated investors into these niche funds tell us? Can they be turned into factors, combined and used as an indicator in a quant strategy?

When comparing asset classes to one another, we typically consider normalizing flows as a percentage of the total Assets under Management (AuM), which allows us to compare flows across assets regardless of the groups’ size. For our analysis, we will aggregate our signal across a given ticker, for each day, using daily fund flow data.

Flow Percentage ticker = sum(flow) / sum(AuM)

To further our analysis using flows, we also considered incorporating additional layers of investor sentiment with respect to risk such as the leverage factor and directionality of the fund into our signal.

First, we will modify our signal to represent the investors’ risk and borrowed assets, by scaling each fund’s flows and AuM by its leveraged factor (X).

Flow Percentage X ticker = sum(flow * X) / sum(AuM * X)

To compare a fair normalized signal across all tickers, both Flow and AuM were multiplied by each fund’s leveraged factor. Single-Stock Leveraged Funds are still relatively new, so in our strategy we did not want to create any bias to tickers that have 2/3x single stock funds tied to them versus tickers that may only have 1x fund options available.

Turning to the question of directionality, we work with the assumption that flows into a Bear Fund represents negative sentiment about a stock. Hence, we reversed the sign of the flows from these funds.

Flow Percentage Net ticker = sum(bear flow * -1 + leverage flow) / sum(AuM)

The final step will be to combine these elements to create flow percentage which considers both the leveraged factor (X) and directionality of each fund.

Flow Percentage Net X ticker = sum(bear flow * -1*X + leverage flow*X) / sum(AuM*X)

With the finalized factor in hand, we back tested factor-adjusted flows against standard, unadjusted measures in a basic long/short, equal weight and quintile-based stock-rotation strategy.

Going against the flow

We tested the strategy using daily, weekly, and biweekly holding periods, as well as within three different stock universes. The signals were all tested from January 2019 through November 2024, which is when the universe of Single-Security Leveraged Funds hit a credible mass.

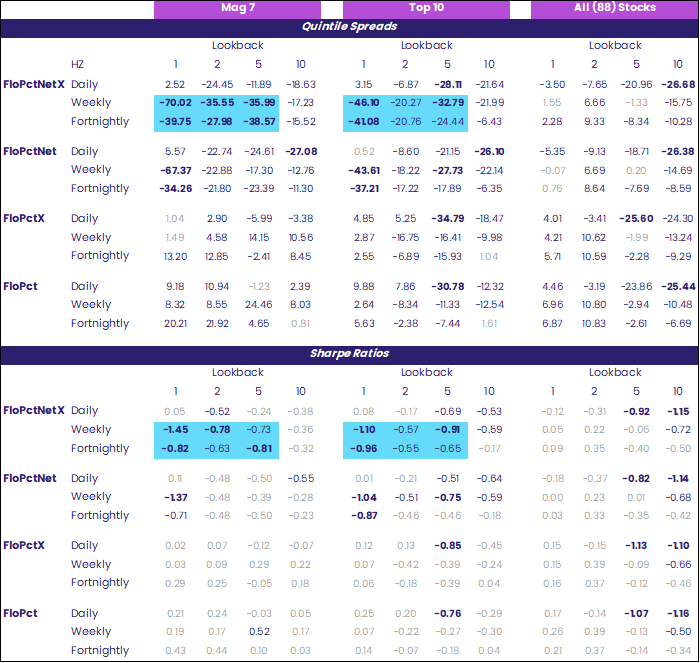

The table below shows the back test results when compounding our signal over a variety of lookback periods (1, 5, 10 days). After compounding the signal over X number of days, each ticker is ranked based on the compounded indicator (Q1 will have the highest flows, Q5 will have the lowest flows), then go long the stocks which are in Q1 and short the stocks which are in Q5.

The results appear in the table below, with the ones we will focus on highlighted in blue.

Sharpe ratios +/- 0.5-0.75 are in dark font and anything above +/- 0.75 are bolded.

Our standard Flow Percent methodology produced decent results overall but shows fairly low Sharpe ratios, and both Flow Percentage X and Flow Percentage Net yield showed very minimal improvements in the results from our original signal. Flow Percentage Net X, which incorporates the leverage and directionality signals, has the best performing results on a Q1-Q5 basis.

Fashionably late works just fine

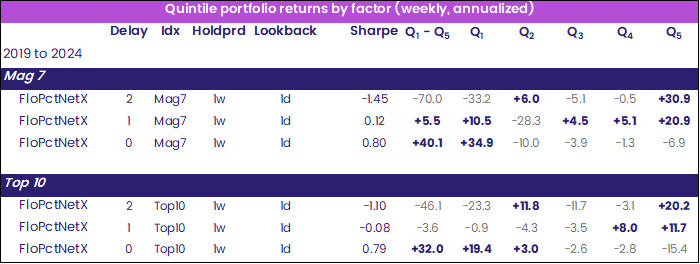

Given that our results have inverse sign, to achieve positive returns in practice we would instead use a long/short contrarian strategy (Q5-Q1). We can conclude that the key reason for the reversal is due to the critical timing of flows and re-investment into their assets.

Since EPFR daily fund flows are published T+1 at around 5pm EST, we assume a 2-day delay in trading on our signal. This means any “bandwagon” signal will be old by the time we are able to execute on the information since leveraged positions are very short lived.

Despite the perception that we might be “late to the party” using lagged flow data, our research shows that the Flow Percentage Net X strategy results presented greater alpha than current trading. Shown below are the back test results showing the reversal market effect when trading on T-2 flows.

Based on our initial work, incorporating the directionality and magnitude sentiment of a given EPFR-tracked Bear or Leveraged Fund with single stock mandates creates better performing investor sentiment signals. Further research will look at the Flow Net X signal’s impact on more diversified funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.