Having steered over $200 billion into US Equity, Money Market and Bond Funds over a two-week period, investors took stock during the third week of November and revisited some of the themes – good and bad – that drove markets before the US presidential election earlier this month.

Among those themes were clean energy, Chinese fiscal and monetary policy, artificial intelligence (AI), conflicts in the Middle East and Ukraine, the likelihood of a ‘soft landing’ for the US economy and inflationary dynamics in key markets.

Of these, the war in Ukraine and AI garnered the most attention as the US eased some of the restrictions on where Ukraine can fire the missiles it is supplying and AI bellwether Nvidia released another compelling quarterly earnings report. Investors steered over $5 billion into Technology Sector Funds while Europe Equity Funds registered their second-largest outflow over the past 15 months.

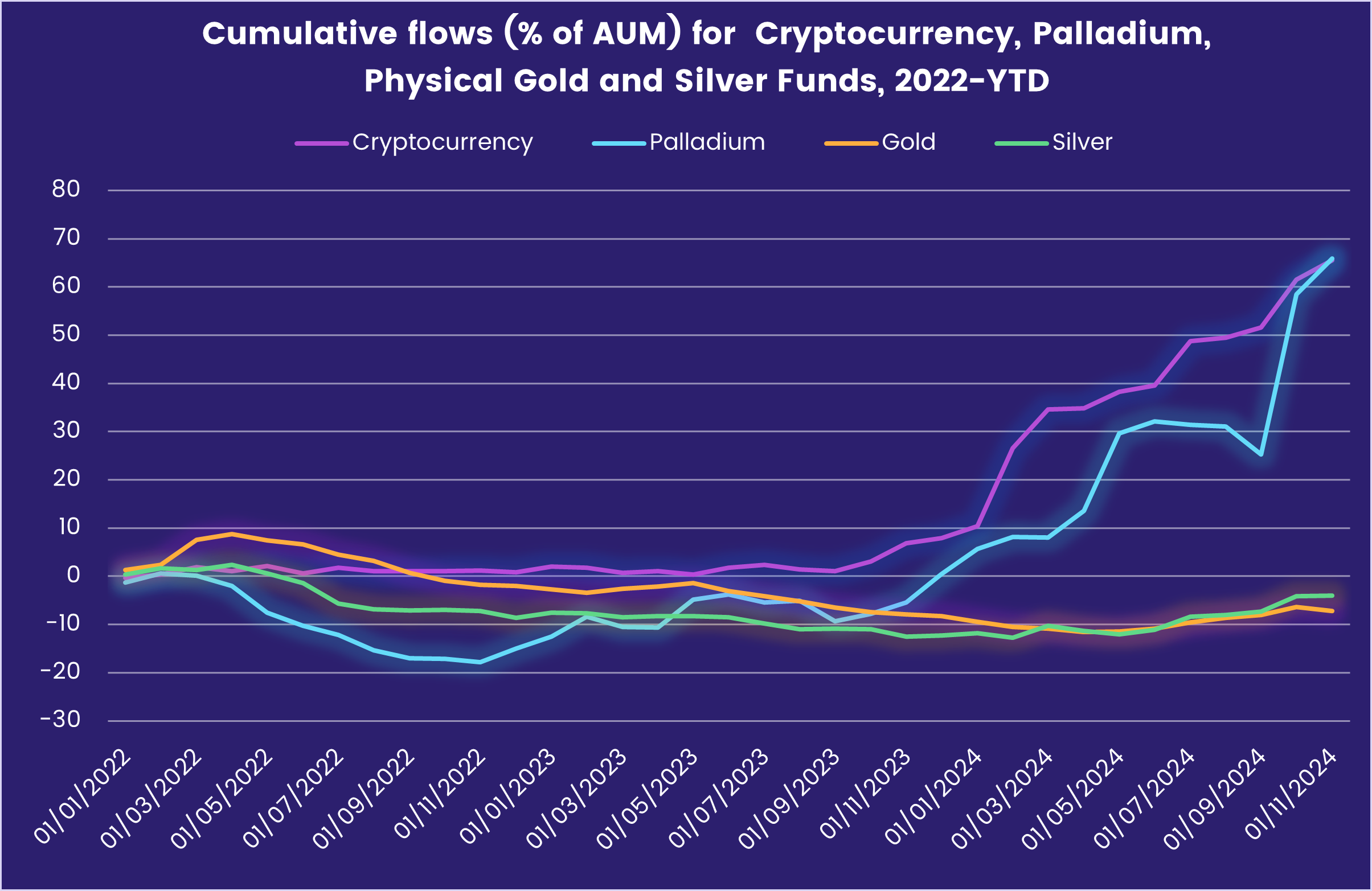

US Equity and Bond Funds still took in over $25 billion between them, but there was less interest in asset classes that might provide some protection from renewed inflationary pressures remains high. Physical Gold Funds posted their third straight outflow and flows into Cryptocurrency Funds were less than a sixth of the previous week’s record-setting total.

Overall, the week ending Nov. 20 saw a net $14.4 billion flow into all EPFR-tracked Equity Funds while Bond Funds pulled in $9.1 billion. The other major groups recorded outflows that totaled $872 million for Alternative Funds, $1.2 billion for Money Market Funds and $1.92 billion for Balanced Funds.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds continued to feel the aftershocks of Donald Trump’s impending return to the White House and the lukewarm response to the latest moves by Chinese policymakers, posting their sixth straight outflow during the third week of November.

While most of the major regional groups again suffered outflows, investors were willing to back some themes. Flows into Frontier Markets Equity Funds bounced back after the previous week’s record-setting redemptions, flows to EM Dividend Funds climbed to a 10-week high and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates snapped their longest redemption streak since the second quarter.

Among the major Asia ex-Japan Country Fund groups, China Equity Funds racked up their sixth straight outflow and Thailand Equity Funds their 47th while India Equity Funds posted their biggest outflow since 2Q22 as sticky inflation and higher commercial lending rates crimp the country’s eye-catching GDP growth.

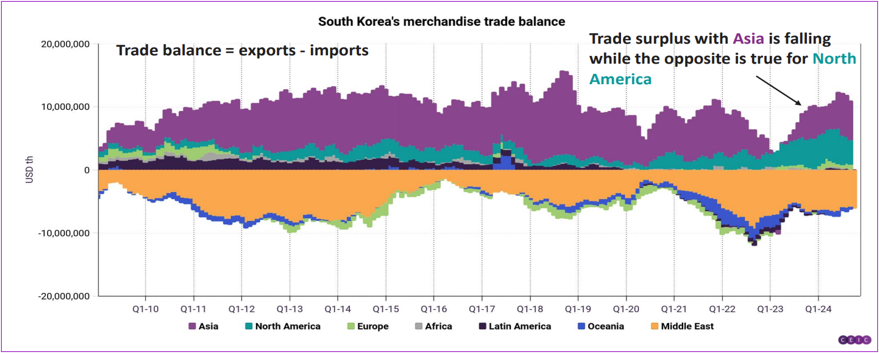

It was a different story for countries whose semiconductor industries are viewed as part of the overall artificial intelligence (AI) story. Taiwan Equity Funds added to their lengthy inflow streak and Korea Equity Funds pulled in another $275 million. In the case of Korea, data provided by EPFR’s sister company CEIC showing the bulk of its trade surplus coming from two countries – the US and China – illustrates the fine line the country must navigate if Trump’s proclivity for tariffs stokes Sino-US trade tensions.

Elsewhere, EMEA Equity Funds experienced further redemptions during a week when the US and UK gave Ukraine the green light to use their military aid in Russian territory. Poland Equity Funds posted their ninth outflow since the beginning of August and Emerging Europe Regional Funds extended their longest run of outflows since 3Q22. But flows to Russia Equity Funds, while still minimal, were positive for the third straight week.

Latin America Equity Funds also recorded another outflow overall as only Chile and Argentina Equity Funds attracted fresh money. In the case of Argentina Equity Funds, whose president Javier Milei is seen as the regional leader most ideologically aligned with Trump, the total was a new weekly record.

Developed Markets Equity Funds

Although major indexes lost ground mid-week, above average amounts of fresh money continued to pour into US Equity Funds. That was more than enough for all EPFR-tracked Developed Markets Equity Funds to record their sixth straight collective inflow and their 38th year-to-date.

Over the past three weeks, US Equity Funds have absorbed a net $105 billion, with the bulk of that money flowing into Large Cap ETFs. During the latest week, Leveraged US Equity Funds enjoyed record-setting inflows, US Dividend Equity Funds posted their seventh inflow over the past eight weeks and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest inflow streak since early 4Q23.

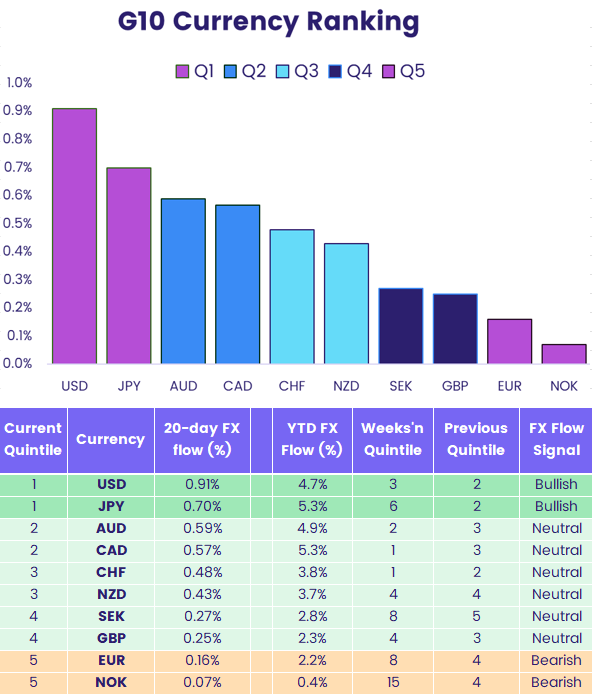

The flows into US-mandated funds are reflected in EPFR’s latest G10 currency rankings, with the US dollar at the top of the rankings along with the Japanese yen. While markets have been living with a strong dollar for some time, any strengthening of the yen brings the competitiveness of Japanese exporters into focus. Japan Equity Funds posted their first outflow since the second week of October, with foreign domiciled funds seeing money flow out for the 14th straight week.

Another of the Asia Pacific Country Fund groups had a better week. Singapore Equity Funds posted their biggest weekly inflow since mid-4Q21. The city state’s GDP growth accelerated during the third quarter, but its reliance on global trade makes it vulnerable to the ‘America first’ policies championed by US President-elect Donald Trump.

At the bottom end of the G10 currency rankings are the British pound and the euro, reflecting the bearish outlook for a continent caught between the US and China’s trade war and Russia and Ukraine’s real war. The latest week saw over $3.5 billion pulled out of Europe Equity Funds, with regional funds taking the biggest hit. At the country level, redemptions from France and Spain Equity Funds hit seven and 33-week highs, respectively, while Germany Equity Funds extended an outflow streak stretching back to the third week of July.

The largest of the major diversified Developed Markets Equity Fund groups, Global Equity Funds, tallied their 14th inflow since the beginning of August.

Global sector, Industry and Precious Metals Funds

A week that ended with AI chipmaker Nvidia unveiling a stellar earnings report saw EPFR-tracked Technology Sector Funds post their fourth-largest inflow so far this year. Six other Sector Fund groups attracted fresh money, as did Physical Silver Funds, while Healthcare/Biotechnology Sector and Physical Gold Funds both surrendered over $700 million.

Expectations of a lighter regulatory burden when US President-elect Donald Trump takes office in January helped Energy Sector Funds post their second inflow quarter-to-date and their biggest since the final week of July. Meanwhile, flows funds with master limited partnership (MLP) mandates climbed to their highest level since the second week of May. MLPs are tax-advantaged vehicles that finance US mid-stream assets such as pipelines and tank farms.

Financial Sector Funds have also picked up a tailwind from Trump’s election, with the latest week seeing another $1 billion flow into the group. Regional Bank Funds, which started November with their second largest inflow on record, attracted fresh money for the third time during the past four weeks as memories of the failures in late 1Q23 continue to fade.

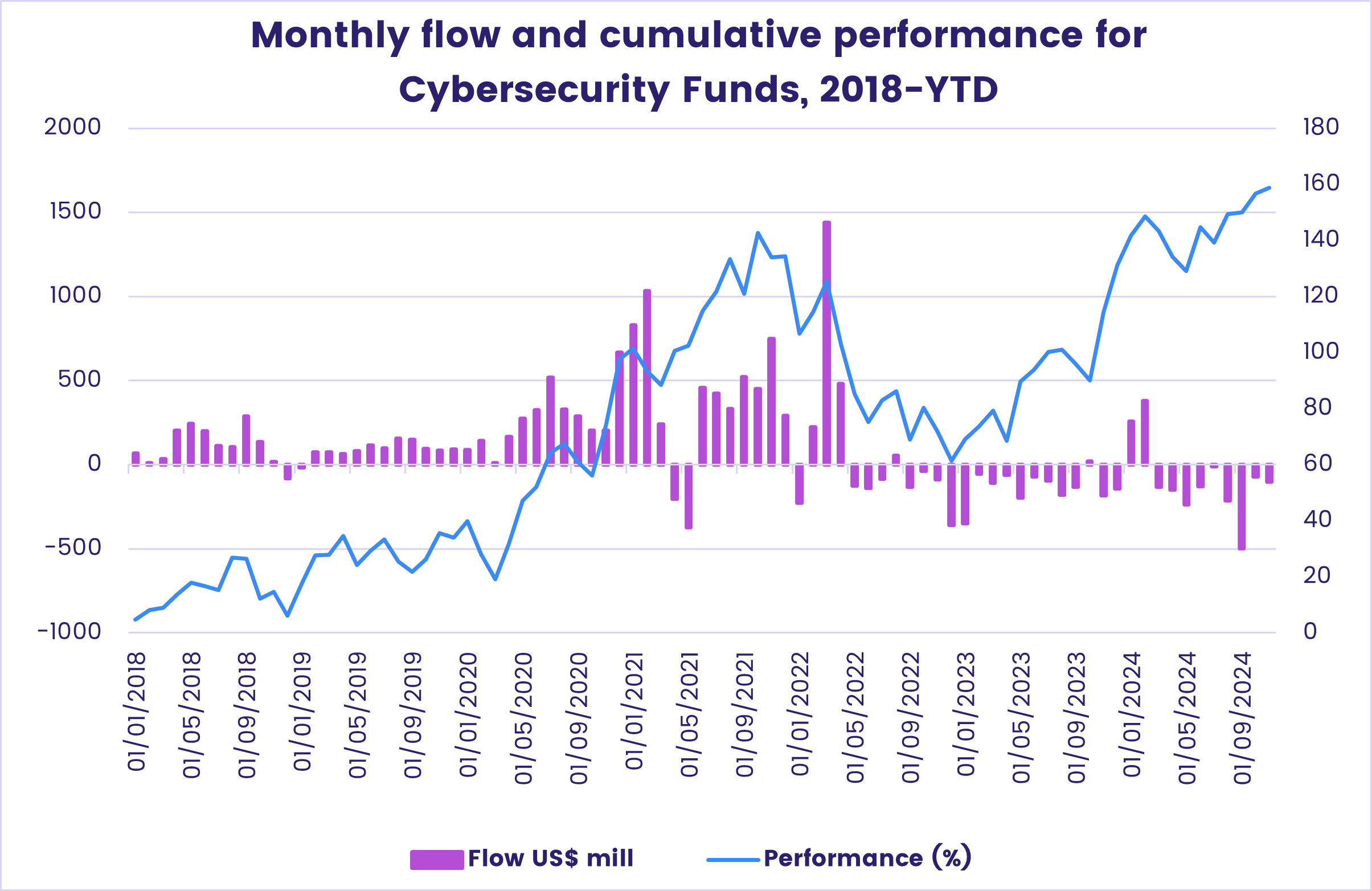

The latest flows into Technology Sector Funds favored funds offering leveraged exposure and those with a semiconductor focus. Among the sub-group that remain out of favor are Cybersecurity Funds, which have posted 28 weekly outflows since the beginning of the second quarter despite nearly daily reports of major data breaches.

Trump’s election has injected considerable uncertainty into the short term outlook for healthcare stocks, with his nominee for Health Secretary a vaccine skeptic and his administration now in a position to roll back Obama-era subsidies and mandates. The latest redemptions from Healthcare/Biotechnology Sector Funds were the largest since late 4Q23.

Bond and other Fixed Income Funds

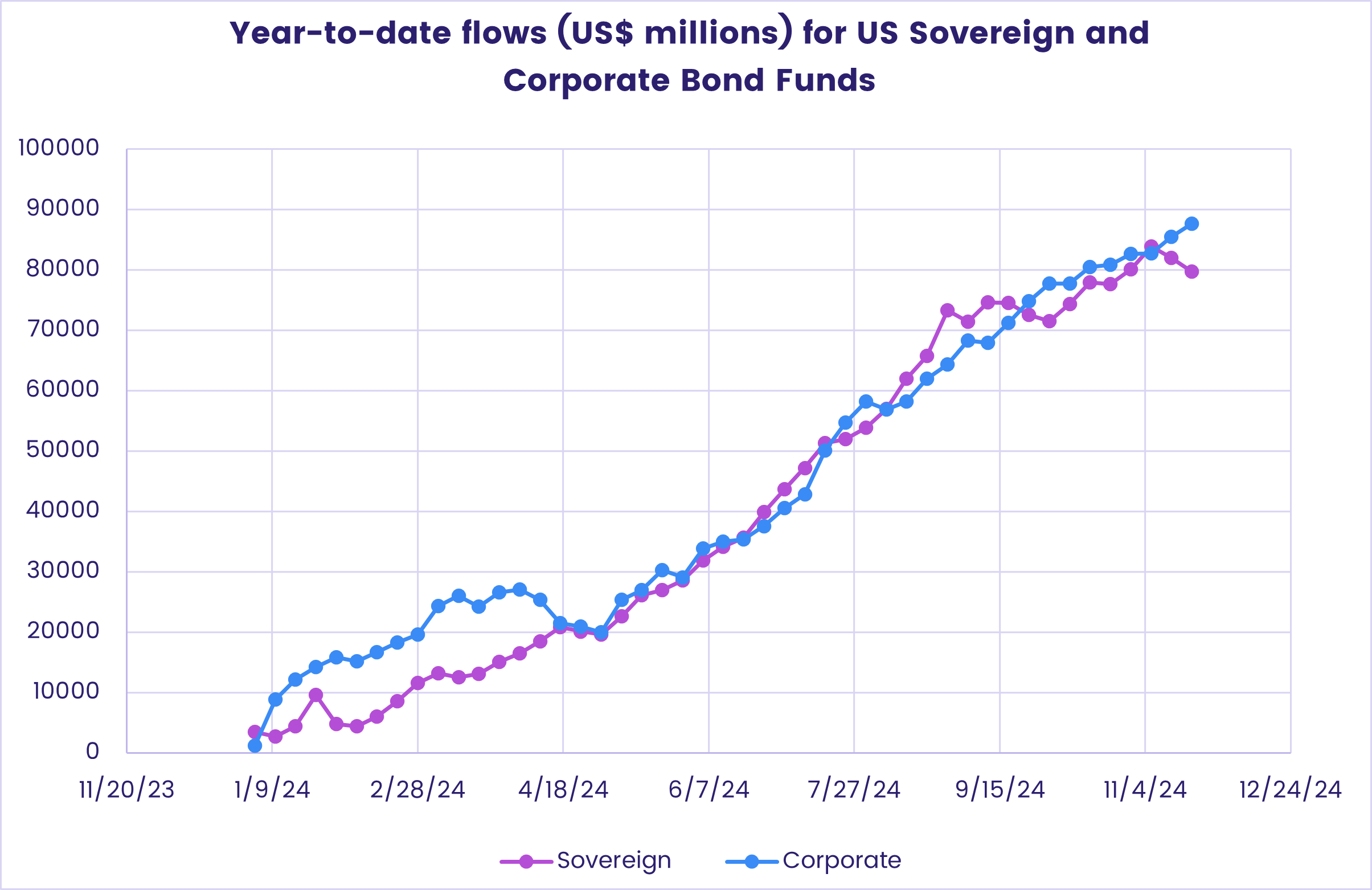

After slowing to a crawl the previous week, EPFR-tracked Bond Funds pulled in another $9 billion during the third week of November that left their year-to-date total at 98% of the full-year record set in 2021. The bulk of the latest inflows went to US Bond Funds, with Global and Europe Bond Funds also contributing to the headline number, while Emerging Markets Bond Funds posted their biggest outflow in nearly 20 months and Canada Bond Funds recorded their first outflow since early September.

At the asset class level, risk appetite in the developed markets space remained high with US Bank Loan and High Yield Bond Funds both attracting over $1.5 billion. Concerns that the economic agenda of US President-elect Donald Trump will prove inflationary were reflected in the latest inflows recorded by US Treasury Inflation Protected Securities (TIPS) Funds. It was their fifth inflow since late September for a group that only recorded five inflows during all of 2023.

Trump’s presumed agenda is also weighing on appetite for US sovereign debt, with US Sovereign Bond Funds experiencing their heaviest redemptions since the final week of January as money flowed out of both domestically and foreign domiciled funds.

Another widely anticipated shift in US policy, the downgrading of climate change goals, hit Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates which posted their fourth outflow of the year so far.

For the second week in a row, redemptions from Hard and Local Currency Emerging Markets Bond Funds were comparable and it was the diversified Global Emerging Markets (GEM) Bond Funds which made the biggest contribution to the headline number for all funds. Asia ex-Japan Bond Funds also had a tough week, with collective redemptions hitting levels last seen in late March as investors pulled over $300 million apiece out of Korea and Thailand-mandated funds.

There were also some big outflows from several Europe Country Bond Fund groups during a week when the European Central Bank’s annual stability report highlighted a range of risks that include political fragmentation, deteriorating credit quality, sluggish regional growth and poor fiscal dynamics. Outflows from Spain Bond Funds were the second highest since 1Q20 and Denmark Bond Funds set a new outflow record for the second week running.

Asia Pacific Bond Funds recorded a modest outflow as solid commitments to Australia and Japan Bond Funds were offset by the heaviest redemptions from Pacific Regional Bond Funds since EPFR started tracking the group in 4Q11.

Did you find this useful? Get our EPFR Insights delivered to your inbox.