Five weeks into President Donald Trump’s first term, flows to EPFR-tracked Europe Equity Funds were coming out of a long slump, investors were rediscovering the charms of diversified exposure, Alternative Funds were posting their fourth straight inflow and a combined $52 billion had flowed into US Equity and Bond Funds. Eight years later, the final week of February saw Europe Equity Funds extend their longest inflow streak since mid-2Q24, Global Equity and Bond Funds both pull in over $1.5 billion, Alternative Funds post their fifth consecutive inflow and combined flows into US Equity and Bond Funds since Inauguration Day hit $130 billion.

Emerging Markets and Money Market Fund flows provide the major points of difference between the start of Trump’s first administration and the first five weeks of his second. In 2017, Emerging Markets Equity and Bond Funds had absorbed fresh money seven and eight of the nine weeks year-to-date, respectively going into March while this year, Emerging Markets Bond Funds have recorded five weekly inflows and Emerging Markets Equity Funds only two.

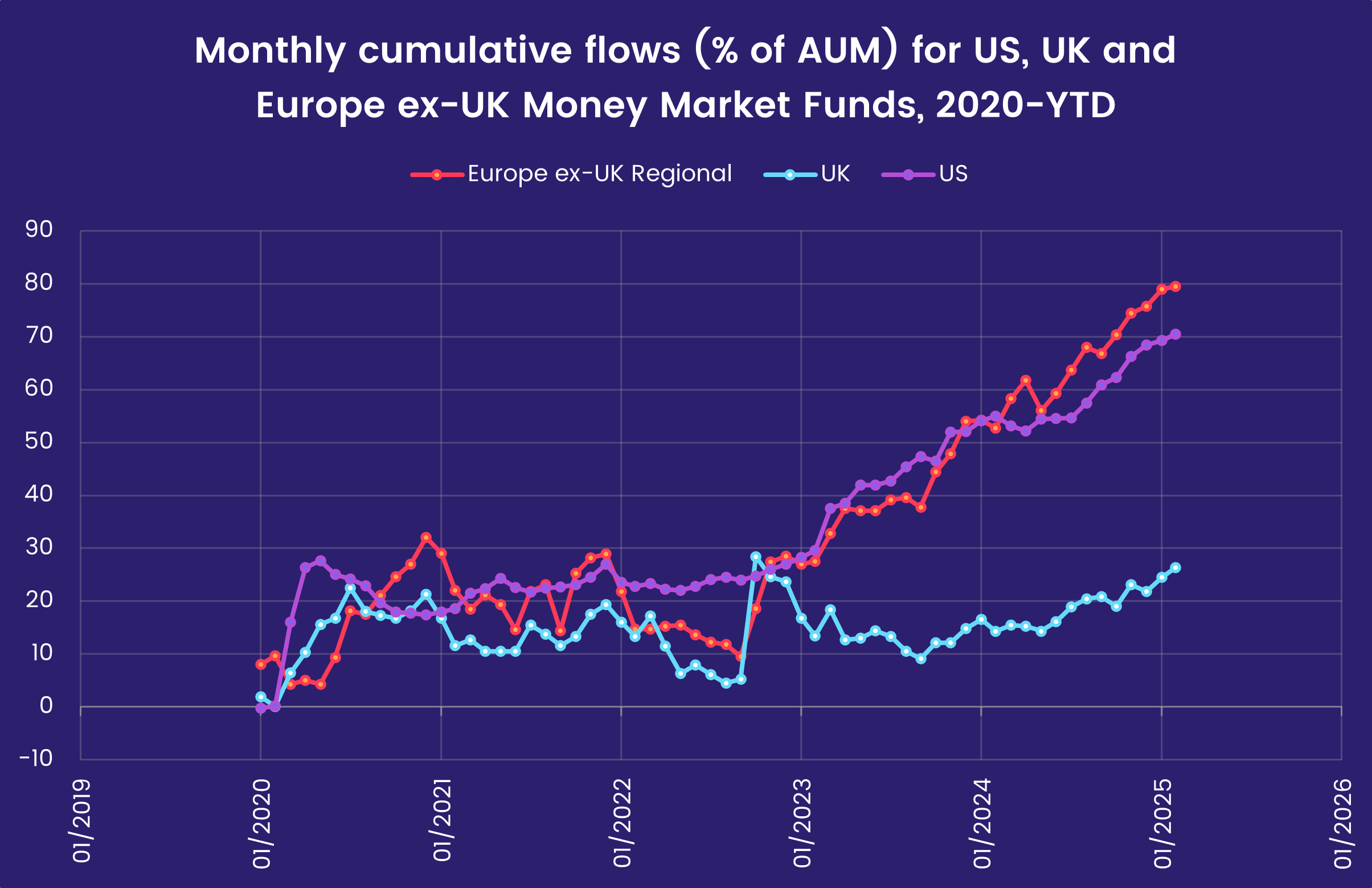

When it comes to Money Market Funds, a net $12 billion flowed out in 2017 as rock-bottom interest rates and new regulatory frameworks clipped the industry’s wings. During the latest week, US Money Market Funds absorbed another $73 billion as the post-inauguration total for all Money Market Funds climbed past 160 billion. Redemptions from Europe Money Market Funds, however, hit a six-week high with UK-mandated funds accounting for half of the headline number.

Overall, the week ending Feb. 27 saw EPFR-tracked Equity Funds absorb $27.2 billion, their biggest total since mid-December, while Bond Funds took in a net $23.9 billion and Money Market Funds $53.7 billion. Flows into Alternative Funds totaled a modest $678 million as news of a major hack hit appetite for cryptocurrencies, with redemptions from funds dedicated to this evolving asset class hitting a record high.

Emerging Markets Equity Funds

The final week of February saw Chinese equity markets offering profits and, with Sino-US trade tensions running high, investors taking them. With more than $6 billion flowing out of China Equity Funds, EPFR-tracked Emerging Markets Equity Funds overall experienced net redemptions for the fourth week running despite the inflows recorded by Latin America, EMEA and diversified Global Emerging Markets (GEM) Equity Funds.

Collectively, retail share classes extended a run of outflows stretch back to mid-July, Emerging Markets Collective Investment Trusts (CITs) posted their biggest weekly outflow since late 2Q24 and redemptions from Leveraged EM Equity Funds hit a new record high.

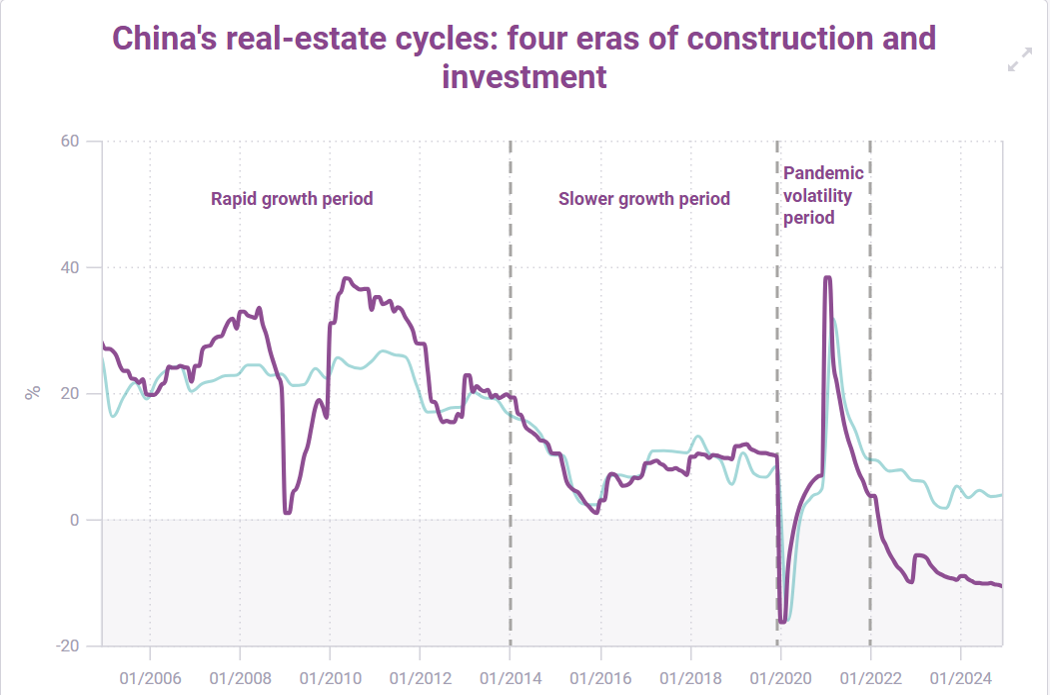

China Equity Funds have now posted outflows for four straight weeks, and six of the past seven, despite the domestic market’s strong performance this month, expectations of further policy support and signs that the key property sector is beginning to stabilize. Research by EPFR’s sister company CEIC shows positive construction growth has decoupled from negative investment trends, with construction of industrial facilities taking up some of the residential slack.

Among the other Asia ex-Japan Country Fund groups, flows into Indonesia Equity Funds hit a 10-week high as they collectively extended their longest inflow streak since 4Q22. Indonesian President Prabowo Subianto’s new administration is pursuing policies aimed at generating higher GDP growth by shifting government expenditure from capital projects to current social programs.

EMEA Equity Funds recorded their fifth inflow over the past six weeks, with Saudi Arabia Equity Funds the biggest contributor to the headline number. But, over the past 12 months, it is another energy play – the United Arab Emirates – that has seen the biggest increase among EMEA markets in its average GEM Equity Fund allocation, followed by South Africa and Poland. The markets seeing the biggest declines are Kazakhstan and Nigeria.

Although Argentina Equity Funds posted their biggest outflow since early 2Q21, those redemptions were offset by a modest rebound in flows to Brazil Equity Funds.

Developed Markets Equity Funds

With flows into US Equity Funds hitting a year-to-date high, Global Equity Funds absorbing another $2 billion and flows into Japan Equity Funds rebounding, EPFR-tracked Developed Markets Equity Funds ended February by posting their biggest inflow since mid-December.

The latest flows into US Equity Funds came despite lackluster market performance, fears that inflation is regaining traction and uncertainty about the impact of the new administration’s tariff-centric economic policies. Large Cap Blend ETFs corralled the bulk of the fresh money during a week when funds with a value style outperformed their growth counterparts across all capitalizations. Leveraged US Equity Funds pulled in over $2 billion while redemptions from US Bear Funds climbed to a 15-week high.

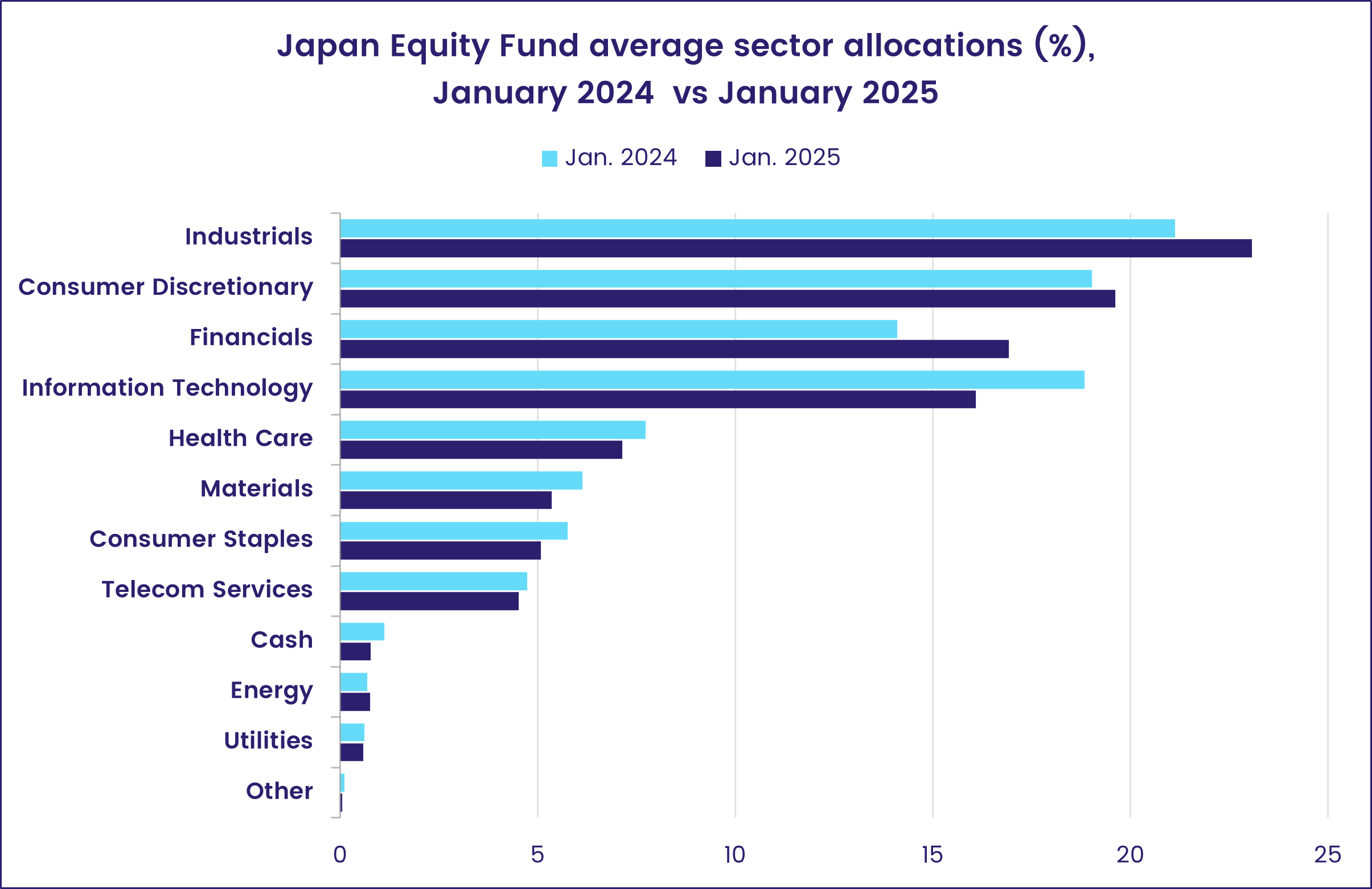

Japan Equity Funds saw inflows rebound to a 17-week high after US investor Warren Buffet reaffirmed his faith in its reflation story. Managers of these funds have increased their exposure to financial, industrial and consumer discretionary stocks over the past year at the expense of technology, materials and consumer staples plays.

Investors committed more money to Europe Equity Funds in late February, with the two diversified regional groups pulling in a combined $2.1 billion ahead of a European Central Bank policy meeting in early March that is expected to end with another 0.25% interest rate cut. At the country level, redemptions from France, Spain and Austria Equity Funds hit their highest levels since 4Q24, 2Q20 and 2Q18, respectively, and more than $800 million flowed out of UK Equity Funds while Sweden Equity Funds posted their biggest inflow since November 2020.

Global Equity Funds, the largest of the diversified Developed Markets Equity Funds groups, saw year-to-date inflows push north of the $33 billion mark. At the same point last year, they had absorbed a net $18.1 billion.

Global sector, Industry and Precious Metals Funds

Over $700 million apiece flowed into three Sector Fund groups – Consumer Goods, Telecom and Healthcare/Biotech Sector Funds – during the week ending Feb. 26, with the latter seeing inflows hit an 81-week high. Investors also put fresh money into Utilities Sector Funds while an average of $200 million flowed out of the remaining seven Sector Fund groups.

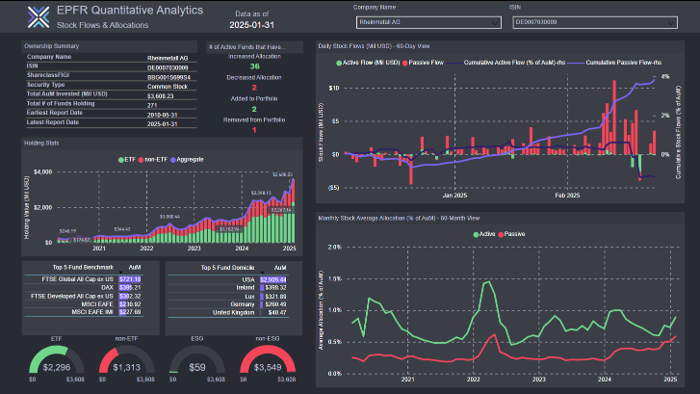

Talks of a European rearmament were very much in the air in late February, with expectations of increased defense spending following Germany’s recent election boosted defense stocks. Rheinmetall – a German-based automotive and arms manufacturer, and one of Europe’s leading defense contractors – saw a 21% rise in its stock price over the past 5 days.

The 60-day view from EPFR’s Stock Flows and Allocations data ending Feb 25th – top right chart of the dashboard below – highlights a buy-and-hold mentality for Rheinmetall AG stocks. Passive flows picked up on Feb 6 – attracting over 2% of assets since – in anticipation of the switch in Germany’s government.

Taking a broader view, the Aerospace & Defense Funds subgroup within Industrials Sector Funds posted their biggest inflow in nearly four months as they ran their current inflow streak to eight weeks. The group has reported just 10 weeks of redemptions over the past year, with flows climbing to 31.5% of assets during that time and performance keeping pace, up 25.5%. The latest monthly inflow of $1.1 billion in January was the largest since March 2022, and third largest on record.

While guns got plenty of attention, investors also backed the butter side of the coin with Consumer Goods Sector Funds enjoying their sixth inflow of the past eight weeks as they snapped a two-week run of outflows that totaled $1.4 billion.

Fund-level data provide a more nuanced perspective of the overall flows into Consumer Goods Sector Funds. Some $250 million flowed into a Leveraged 2x ETF tracking the performance of Tesla while an ETF providing exposure to a broad range of US retail companies pulled in $180 million and $123 million was directed into a China-domiciled fund focused on the alcohol industry.

This week, the rebound of inflows into Healthcare/Biotech Sector Funds recuperated about a third of the total outflows from the previous six consecutive weeks, but just over a tenth of the total redeemed since 4Q24. China Healthcare/Biotech Sector Funds brought in a 15-week high inflow, Hong Kong (SAR) Healthcare/Biotech Sector Funds attracted their second-highest inflow of the past four years and brought an end to one of their longest redemptions streaks on record at eight weeks straight.

Bond and other Fixed Income Funds

Flows into all EPFR-tracked Bond Funds hit their highest total in over 52 months during the week ending Feb. 26 as Europe Bond Funds set a new weekly inflow record and US Bond Funds added $15 billion to their year-to-date total.

Fixed income investors remain both yield-hungry and willing to take risks to secure that yield. Flows into High Yield Bond Funds hit a 22-week high, Emerging Markets Bond Funds recorded their fourth inflow over the past five weeks, Collateralized Loan Obligation (CLO) Funds extended an inflow streak stretching back to early August and Catastrophe Bond Funds attracted fresh money for the 12th consecutive week.

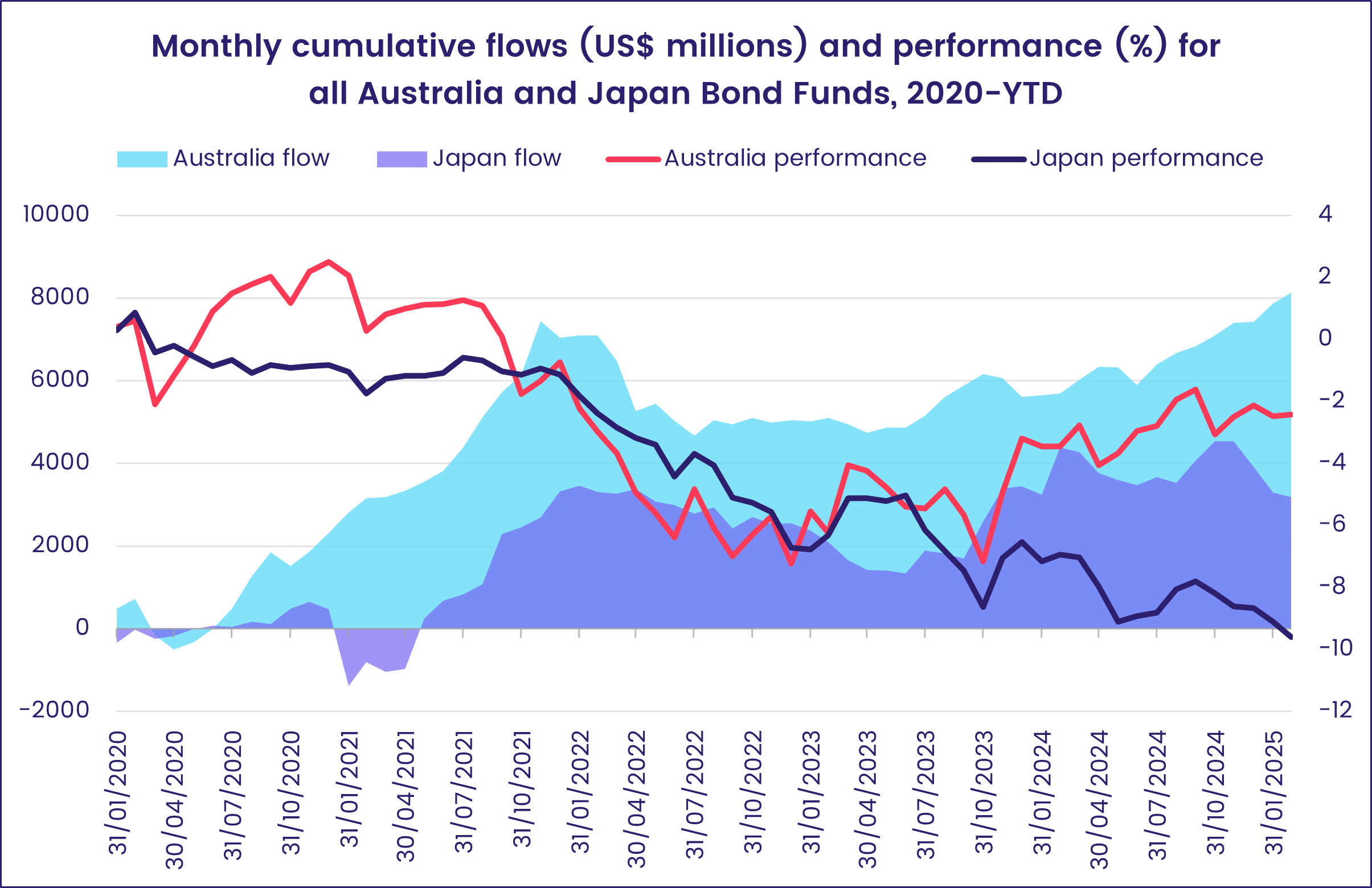

Among the few major groups to record a significant outflow were Japan Bond Funds. Supportive comments from widely followed US investor Warren Buffet about the country’s reflation story suggest that the Bank of Japan’s current tightening cycle could go further than anticipated. Meanwhile, on the heels of the Australian central bank’s first rate cut in four years, Australia Bond Funds extended an inflow streak that started in late 1Q24.

At the other end of the scale, a single institutional Switzerland Bond Fund with a sovereign mandate accounted for half of the headline number for all Europe Bond Funds. Despite that, Europe Corporate Bond Funds overall pulled in twice the amount of fresh money absorbed by their sovereign counterparts.

For the third straight week, more money went into Hard Currency Emerging Markets Bond Funds than funds with local currency mandates. Funds domiciled in Europe and Asia drove the headline number, with Korea Bond Funds recording their biggest inflow since late 2022.

US Bond Fund retail share classes saw flows climb to a 16-week high going into March, with a third of the week’s total going into Municipal Bond Funds. Overseas domiciled funds absorbed another $2 billion. When it came to duration, investors favored Short and Intermediate Term US Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.