EPFR-tracked Bond Funds started August by posting their biggest inflow since mid-4Q21 as investors translated mixed earnings reports and macroeconomic data into an early end to the current tightening cycle in the US.

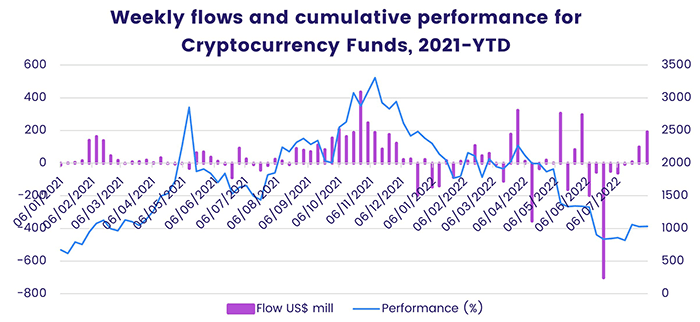

This optimistic view of the US interest rate cycle – which does not appear to be shared by key members of the US Federal Reserve – helped maintain the recent rebound in risk appetite. Emerging Markets Bond Funds snapped a run out outflows stretching back to the first week of April, High Yield Bond Funds absorbed another $4.2 billion, and Cryptocurrency Funds posted their biggest weekly inflow since late May.

The latest week also saw both of the major multi-asset groups, Balanced and Total Return Funds, take in fresh money, with the latter recording their first inflow since early February and their biggest since late 3Q21.

Overall, investors committed $864 million to Balanced Funds and $11.7 billion to Bond Funds during the week ending August 3. Alternative Funds recorded a collective outflow of $1.2 billion while $2.6 billion flowed out of Equity Funds and $4 billion from Money Market Funds.

At the asset class and single country fund levels, France Equity Funds posted their 14th outflow in the past 15 weeks, redemptions from Italy Bond Funds hit a 24-week high and Greece Equity Funds chalked up their 16th consecutive outflow. Inflation Protected Bond Funds saw money flow out for the fourth week running, Mortgage-Backed Bond Funds posted their 28th outflow year-to-date and High Yield Bond Funds posted consecutive weekly inflows for the fourth time in 2022.

Did you find this useful? Get our EPFR Insights delivered to your inbox.