Investors, who were already struggling to digest the latest US interest rate hike, were confronted with more unappetizing fare during the fourth week of September. This included Italy’s marked shift away from centrist politicians, the sabotaging of pipelines connecting Europe with Russian natural gas fields, Hurricane Ian’s advance on Florida and a market-jolting budget from Britain’s new Chancellor of the Exchequer.

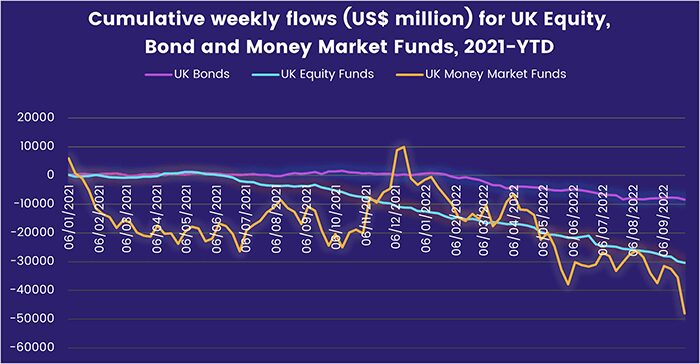

Chancellor Kwasi Kwarteng’s announcement of unfunded tax cuts and energy subsidies that will keep the UK’s annual borrowing requirement north of £100 billion sent the pound tumbling close to parity with the US dollar. It also triggered a sell-off in bond markets that spurred the Bank of England to resume its buying of British sovereign debt. UK Equity Funds posted their 34th outflow year-to-date, redemptions from UK Bond Funds hit a nine-week high and UK Money Market Funds chalked up their biggest weekly outflow since 3Q20.

British equity and debt were not the only ‘risk assets’ that investors sought to distance themselves from in late September. Alternative Funds experienced record-setting outflows, redemptions from both Hard Currency Emerging Markets Bond Funds and Balanced Funds hit levels last seen in late 1Q20, money flowed out of Global Emerging Markets (GEM) Equity Funds for the 16th time in the past 17 weeks and High Yield Bond Funds saw their current outflow streak hit six weeks and $26 billion.

Investors did remain on the lookout for income. Dividend Equity Funds posted their eighth consecutive inflow and 20th in the past 21 weeks while Short Term US Treasury Funds recorded their second largest weekly inflow since the beginning of 2Q20.

Overall, the week ending Sept. 28 saw EPFR-tracked Bond Funds post a collective outflow of $13.7 billion. A net $7 billion flowed out of Alternative Funds and $9.1 billion from Balanced Funds. Investors pulled $52.8 billion out of Money Market Funds with Global MM Funds recording their biggest outflow in over 30 months, and steered $7.5 billion into Equity Funds.

Bond and other Fixed Income Funds

The drumbeat of inflation-fighting interest rate hikes and the market volatility triggered by the UK’s latest mini-budget fueled another surge in redemptions from EPFR-tracked Bond Funds during the week ending Sept. 28. Investors pulled money out of this group for the sixth straight week, with the latest outflow the biggest since the final week of the second quarter.

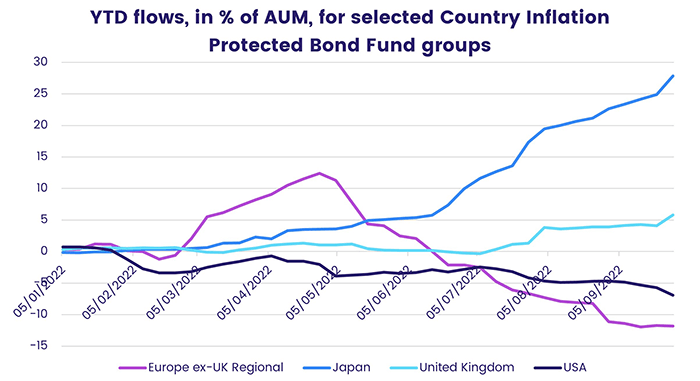

A handful of country-level groups escaped the general pull-back. These included France, Mexico, Germany, India and Japan Bond Funds. Investors also showed some enthusiasm for funds offering exposure to sovereign debt. But most of the major regional and asset class groups recorded their biggest outflows since the final two weeks of the previous quarter.

At the asset class level, Bank Loan Funds saw redemptions hit a 16-week high as concerns about credit quality in this asset class trumped any desire to play rising short-term interest rates. Mortgage-Backed and High Yield Bond Funds both posted their sixth straight outflow, investors pulled over $3 billion out of Municipal Bond Funds and Inflation Protected Bond Funds recorded their biggest outflow since early May.

With the latest UK budget and the electoral victory of Eurosceptic Italian parties, investors pulled over $3.5 billion – a 13-week high – from Europe Bond Funds. Investors pulled money out of Italy Bond Funds for a fifth consecutive week and redeemed $565 million from UK Bond Funds. Coming into September, Europe Regional Bond Fund allocations to these two markets were heading in different directions with exposure to the UK at its highest level since EPFR started tracking this data while Italy’s average weighting fell to its lowest level.

Emerging Markets Bond Funds experienced their heaviest redemptions since mid-May, as Hard Currency EM Bond Funds posted their biggest weekly outflow since late 1Q20. Retail investors were net redeemers for the 37th time in the past 40 weeks. EM Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their fourth straight outflow and their biggest since late June. At the country and regional level, flows into Mexico Bond Funds climbed to an 11-week high while China Bond Funds saw more money flow out and outflows from Frontier Markets Bond Funds hit a 46-week high.

Retail investors kept their year-to-date redemption streak intact when it came to US Bond Funds, which last attracted retail cash in the final week of 2022. Once again, US Short Term Sovereign Bond Funds stood out, absorbing over $6 billion for the third time so far this year, but Long Term US Corporate Bond Funds recorded their biggest outflow since mid-June and over $3 billion flowed out of both US High Yield and Municipal Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.