The week leading into the New Year provided an exclamation point for two of the most successful fund groups, in flow terms, during 2023. China Equity Funds, which absorbed over $75 billion last year, started 2024 by taking in another $3.2 billion while US Money Market Funds added to the $1.2 trillion they took in with their biggest inflow since late 1Q23.

In further echoes of the previous year, India Equity Funds extended their record-setting inflow streak, Europe Equity Funds racked up their 42nd outflow over the past 43 weeks and Cryptocurrency Funds posted their 14th consecutive inflow.

The week ending Jan. 3 did see Convertible Bond, Balanced and Austria Equity Funds snap redemption streaks stretching back to late June, early April and late February, respectively, while China Bond Funds posted consecutive weekly inflows for the first time in over seven months.

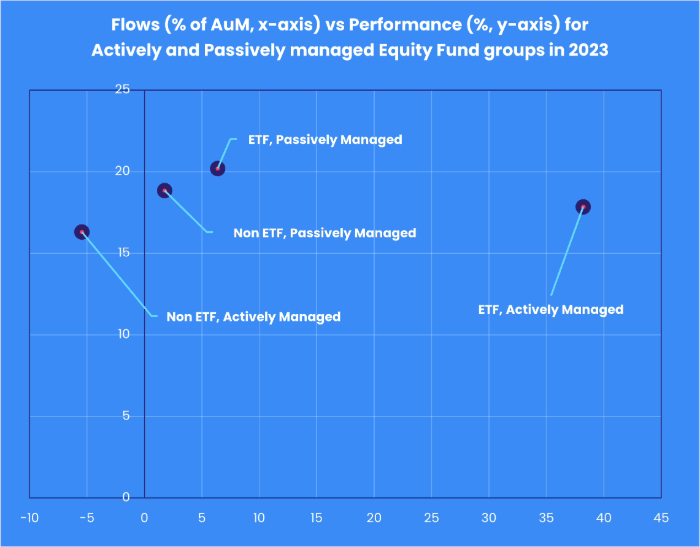

ETFs, as they did in 2023, continue to absorb the lion’s share of the fresh money committed to both Equity and Bond Funds. Over the past six months, Bond ETFs have only posted one weekly outflow and Equity ETFs two.

At the country and asset class fund levels, Korea Equity Funds snapped their longest run of outflows since 2Q20, flows into Thailand Bond Funds climbed to a 91-week high and investors committed fresh money to India Equity Funds for the 42nd week running. Redemptions from Gold Funds hit their highest level since mid-November, High Yield Bond Funds saw their eight-week inflow streak come to an end and Inflation Protected Bond Funds posted their first inflow in over three months.

Emerging markets equity funds

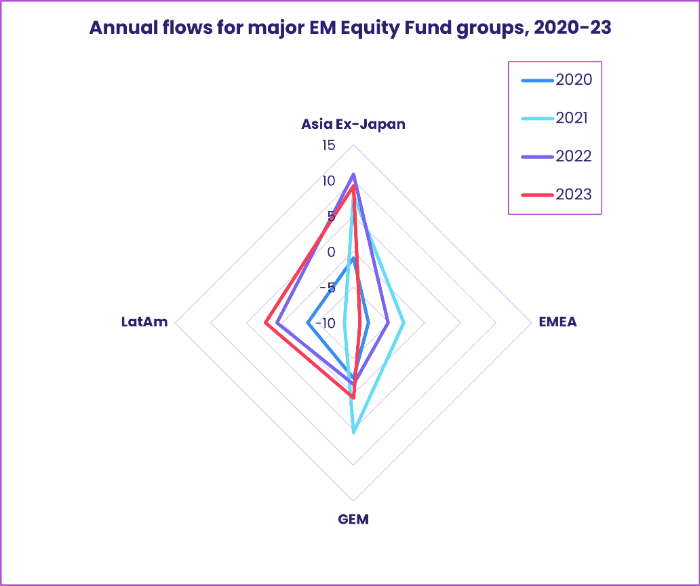

EPFR-tracked Emerging Markets Equity Funds started 2024 by posting their fifth straight inflow. Once again, strong flows to China and India Equity Funds underpinned the headline number as a broad pivot among emerging markets investors to Asia enters its fourth year.

The week ending Jan. 3 saw EMEA Equity Funds post consecutive weekly inflows for the first time since early July, redemptions from Latin America Equity Funds jump to a 10-week high and the diversified Global Emerging Markets (GEM) Equity Funds chalk up their 20th outflow over the past 23 weeks.

Strong flows to domestically domiciled funds allowed China Equity Funds to record their sixth consecutive inflow despite a start to the New Year that included the worst single day for Chinese stocks since 2019 and more lackluster data from the manufacturing and property sectors. Funds dedicated to Taiwan, which China views as a renegade province, attracted fresh money for the seventh straight week and 20th time over the past 22 weeks ahead of a general election on Jan. 13.

India will hold a general election in the second quarter which is widely expected to give incumbent Prime Minister Narendra Modi and his ruling National Democratic Alliance another five years in power. Investors appear sanguine about the prospect: India Equity Funds last posted an outflow in late 1Q23.

Flows into Latin America Equity Funds hit the buffers in early January as Brazil, Mexico and Chile Equity Funds all posted outflows. The redemptions from the latter two groups were the biggest in 22 and 52 weeks, respectively. In the case of funds dedicated to Mexico, investors took a more cautious view of the US Federal Reserve’s appetite for rate cuts this year while the same Chilean fund was behind the outflows experienced by Chile Equity Funds in early 1Q23 and the latest week.

EMEA Equity Funds recorded their biggest collective inflow since early September as Poland Equity Funds chalked up their eighth consecutive inflow, flows into Saudi Arabia and Israel Equity Funds hit 15 and 23-week highs and Turkey Equity Funds posted consecutive weekly inflows for the first time in over six months.

Developed markets equity funds

The tailwind generated by the US Federal Reserve’s dovish commentary following their mid-December policy meeting continued to fade in early January. The benchmark Nasdaq index posted six consecutive declines between Dec. 28 and Jan. 4 as minutes from the Fed’s meeting suggested the first interest rate cut could be further down the road than markets hope and expect.

EPFR-tracked Developed Markets Equity Funds ended the latest week having posted their ninth inflow since the beginning of November. But the headline number was a quarter of the previous week’s total. As before, it was driven by commitments to US Equity Funds, although Global Equity Funds managed to attract $1 billion as they snapped a five-week run of outflows.

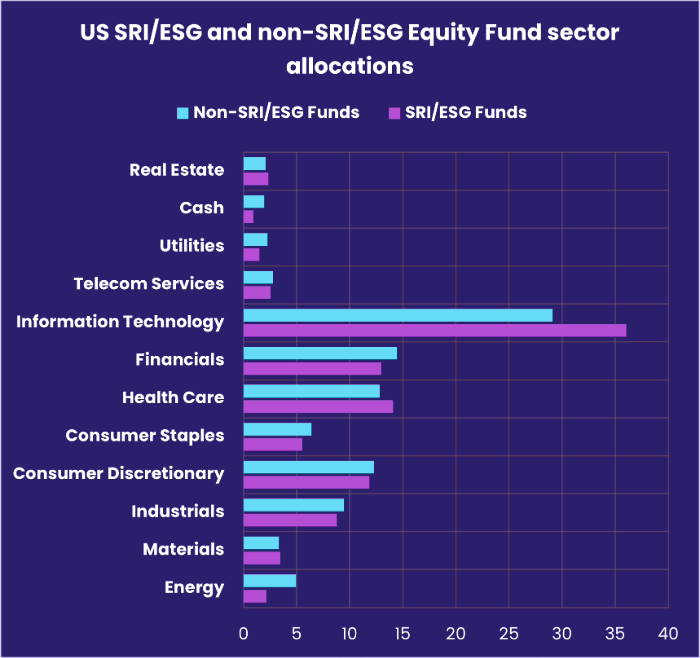

For the third week running Large and Small Cap Funds absorbed the bulk of the fresh money attracted by US Equity Funds. Investors pulled money out of Large, Mid and Small Cap Growth Funds and hit funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates – which are heavily exposed to technology plays – with net redemptions for the third time in the past four weeks.

A week after they posted their first inflow since late 1Q23, Europe Equity Funds chalked up their 42nd outflow in the past 43 weeks as investors digested data showing slower growth and higher inflation in France and Germany. Redemptions from Europe SRI/ESG Funds hit a 21-week high.

Japan Equity Funds eked out a modest net inflow for the second week running as foreign-domiciled funds snapped a seven-week redemption streak. Leveraged funds posted their third straight outflow, and investors pulled money out of retail share classes for the eighth time in the past nine weeks. Sluggish domestic consumer spending, a government distracted by a campaign finance scandal and the Bank of Japan’s delay in normalizing monetary policy are all giving investors pause for thought.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, started 2024 with their first inflow since the third week of November. For Global ex-US Equity Funds, it was their first inflow since mid-October and biggest since late July.

Global sector, industry and precious metals funds

As was the case during the previous week, only three EPFR-tracked Sector Fund groups reported inflows coming into the New Year. Of those three, only one – Financial Sector Funds – managed to record an inflow both weeks as uncertainty about the upcoming corporate earnings season and the timing of interest rates kept the lid on investor appetite for additional sector exposure.

Also weighing on sector-oriented investors are the political risks that come with 2024’s crowded electoral calendar and the potential disruptions as businesses harness artificial intelligence (AI).

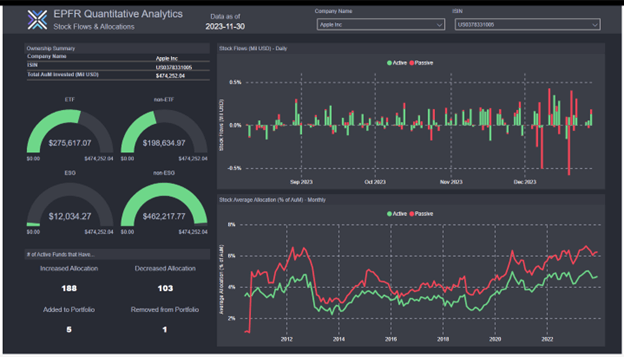

It was a bumpy week for funds dedicated to the two sectors most commonly associated with AI, with both Technology and Telecoms Sector Funds experiencing net redemptions. Concerns about these sectors were crystalized by the hammering US bellwether Apple, one of the ‘Magnificent Seven’ technology plays, took thanks to patent disputes, inventory concerns and diminishing expectations for the Chinese consumer. EPFR’s stock level data shows flows from actively managed funds into Apple stock held up in December while passive outflows were notably heavier than the rest of the year.

Telecoms Sector Funds endured their first outflow after five straight weekly inflows totaling $1 billion. At the country level, redemptions from US Telecoms Sector Funds hit a nine-week high.

After a seven-week outflow streak that cost the group $5.7 billion, Healthcare/Biotechnology Sector Funds chalked up their largest inflow since late August. Drilling down, Genomics Funds, which invest in companies benefiting from advances in DNA research and sequencing, saw their third straight inflow and largest since 3Q22 and pure Biotechnology Funds enjoyed their second inflow of the past three weeks. Cannabis Funds posted their biggest outflow in a year and Life Science Funds saw a 13th straight week of outflows.

Financials Sector Funds enjoyed their second straight inflow backed by US-dedicated funds, and a net $2.65 billion has flowed into this group over the past eight weeks. European country fund groups guided the overall story for Real Estate Sector Funds, with Switzerland-dedicated funds redeeming over $100 million, a 20-week high.

Investors continued to opt for crypto over gold as redemptions from Physical & Derivative Gold Funds hit an eight-week high and Gold Miners & Mining Funds posted their fifth consecutive outflow.

Bond and other fixed income funds

For only the second time since the beginning of August, EPFR-tracked Bond Funds pulled in over $10 billion during the week ending Jan. 3 as flows into US and Global Bond Funds hit eight and 11-week highs, respectively, and Emerging Markets Bond Funds posted consecutive weekly inflows for the first time in over five months.

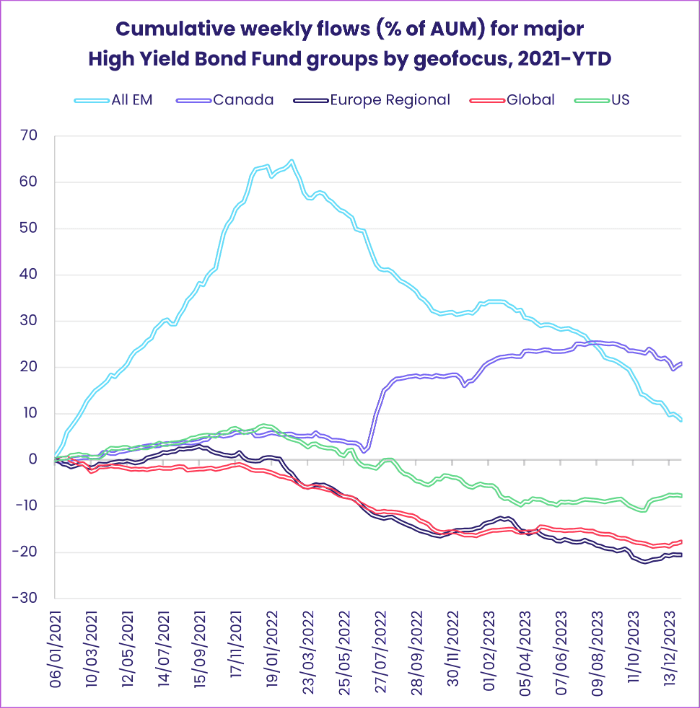

At the asset class level, Inflation Protected Bond Funds posted only their second inflow since the beginning of 4Q23, Municipal Bond Funds experienced net redemptions for the fourth time in the past five weeks, Convertible Bond Funds snapped their longest outflow streak since a 36-week run ended in 2Q19 and High Yield Bond Funds posted their first outflow in nearly two months.

With yields on the 10-year US Treasury falling over 1% during 4Q23 and the Federal reserve signaling easier credit this year, flows into US Sovereign Bond Funds jumped to a nine-week high as flows into funds with short term mandates hit their highest level since the final week of October.

US Bond Fund retail share classes attracted fresh money for the third time over the past four months, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest inflow since late 1Q23 and flows into overseas domiciled funds climbed to an eight-week high.

The latest headline number for Emerging Markets Bond Funds was underpinned by flows into Local Currency Asia ex-Japan Fund groups. China Bond Funds posted back-to-back inflows for the first time since mid-2Q23, flows into Thailand Bond Funds hit levels last seen in mid-2022 and Korea Bond Funds absorbed over $200 million. Investors pulled money out of Africa Regional Bond Funds for the sixth time over the past seven weeks after Ethiopia became the latest country to default on its sovereign debt.

Europe Bond Funds with corporate mandates continue to pull in more money than their sovereign counterparts as recent consumer price data from France and Germany raised questions about the timing of cuts in the Eurozone’s interest rates.

Both of the major EPFR-tracked multi asset fund groups started 2024 by posting inflows as Balanced Funds snapped a lengthy outflow streak and Total Return Funds posted their third straight inflow. The last time that happened was the first week of 2Q23.

Did you find this useful? Get our EPFR Insights delivered to your inbox.