Given the raft of unsettling news and data thrown at them during the second week of July, investors showed considerable fortitude.

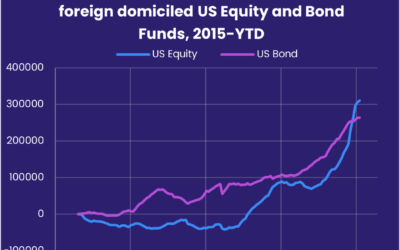

Despite the latest US inflation reading coming in at a 40-year high, thereby raising the odds the Federal Reserve will match the 100 basis point rate hike delivered by their Canadian counterpart, EPFR-tracked Bond Funds posted consecutively weekly inflows for the first time since the opening week of 2022. Emerging Markets Equity Funds posted their third inflow in the past five weeks during a week when Russia’s invasion of Ukraine entered its 16th week, Sri Lanka’s president was physically chased out of office and rising Covid numbers in Shanghai raised the specter of more economically debilitation lockdowns in the world’s second largest economy.

Many fund groups did experience outflows during the week ending July 13. But the magnitude of those outflows was, in many cases, modest in light of the general market conditions. Redemptions from US Equity Funds came in at 0.02% of total assets under management and 0.015% for Global Equity Funds while outflows from Alternative Funds fell to their lowest level in a month.

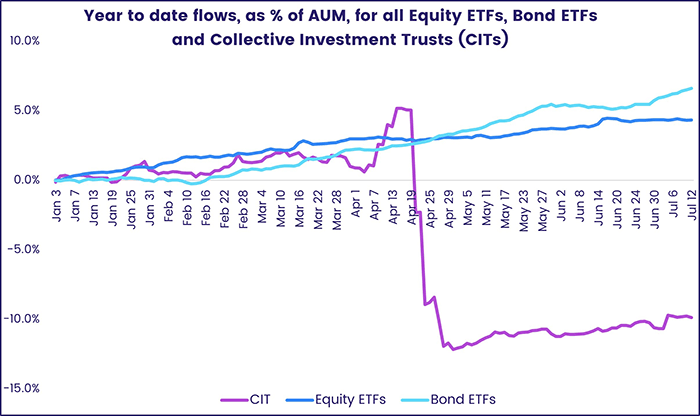

Rather than bail out completely, many investors continue to look for ways to trim their investment costs by shifting money into vehicles with lower operating costs. Both Equity and Bond exchange traded funds (ETFs) continue to attract fresh money, albeit at a snail’s pace, and Collective Investment Trusts (CITs), which endured a brutal April, have seen flows slowly recover since May.

At the single country and asset class fund levels, China Bond Funds posted their 22nd outflow in the past 23 weeks and Romania Bond Funds for the 27th straight week, Italy Bond Funds chalked up their biggest inflow since early May, Spain Equity Funds snapped a five-week outflow streak and Turkey Equity Funds extended their longest run of inflows since mid-April. Municipal Bond Funds recorded consecutive weekly inflows for the first time in over four months, Mortgage-Backed Bond Funds posted their first inflow since late April and year-to-date redemptions from Total Return Funds passed the $76 billion mark.

Global Sector and Precious Metals Funds

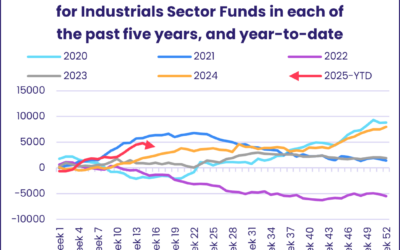

Ahead of the second quarter corporate earnings season kicking off in earnest, flows to and from major EPFR-tracked Sector Fund groups largely mirrored the previous week’s pattern. Four of the six groups recording outflows saw over $500 million flow out for the second straight week. The only changes to the line-up week-on-week were Infrastructure Sector Funds, which saw a 20-week run of inflows snapped, and Real Estate Sector Funds which eked out a minimal inflow.

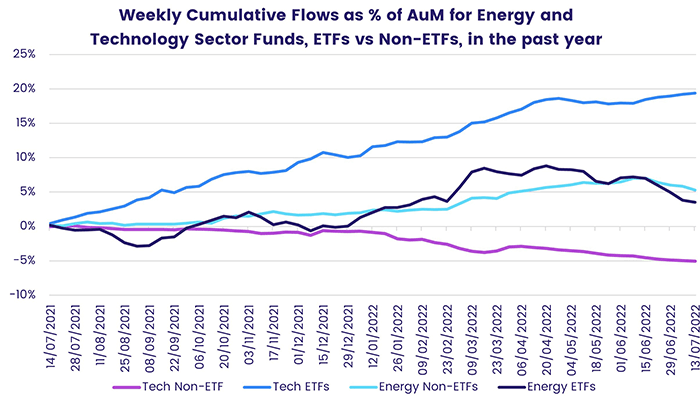

Technology Sector Funds, meanwhile, racked up their fifth straight inflow on the back of silicon chip bellwether Taiwan Semiconductor Manufacturing reporting resilient sales and a positive outlook. In contrast to other Sector Fund groups, ETFs continue to be the vehicle of choice for investors looking for technology sector exposure.

Flows into Energy Sector mutual funds and ETFs have rolled over as Russia’s ongoing assault of Ukraine, growing state intervention and the possibility of recession complicate forecasts. At the country level, China, Japan, South Korea and Pacific Regional Energy Sector Funds all carried inflows steaks of varying lengths into the third quarter while US, Global and Europe Energy Funds are seeing money flow out.

Utilities Sector Funds, a historic refuge during periods of market turbulence, recorded an inflow of over $700 million. That was the fourth largest weekly inflow in the past two years. US Utilities Sector Funds, which have taken in $5.3 billion so far this year, have generally underpinned the headline number for all funds. During the latest week Global Utilities Sector funds racked up their fourth straight inflow while those dedicated to Canada snapped a four-week inflow streak.

Did you find this useful? Get our EPFR Insights delivered to your inbox.