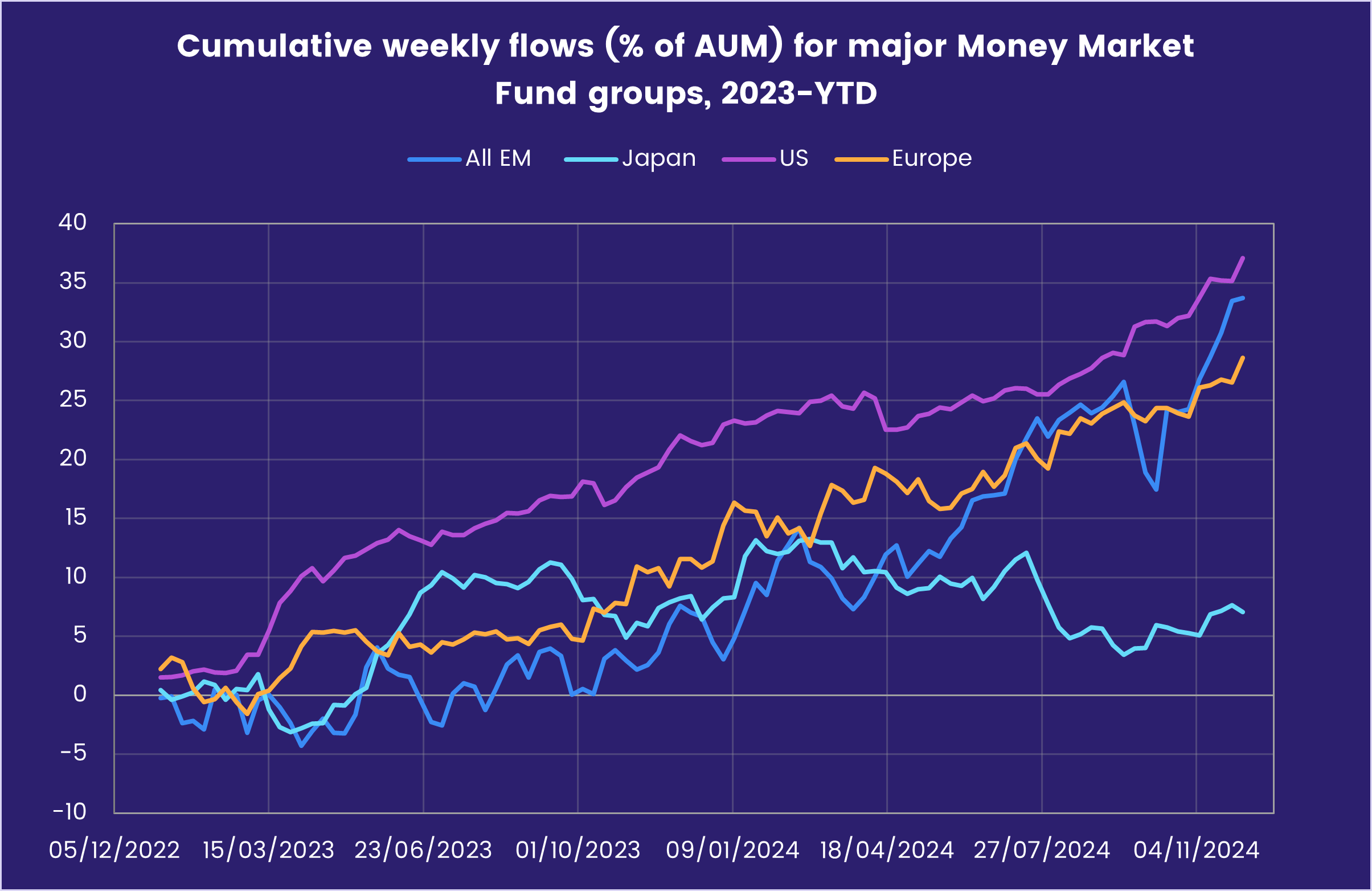

During the week ending Dec. 4, EPFR-tracked Money Market Funds absorbed over $130 billion and Cryptocurrency Funds chalked up their third-largest inflow year-to-date while redemptions from Europe Equity Funds hit a nine-week high and flows into US Bond Funds fell to their lowest level since late April.

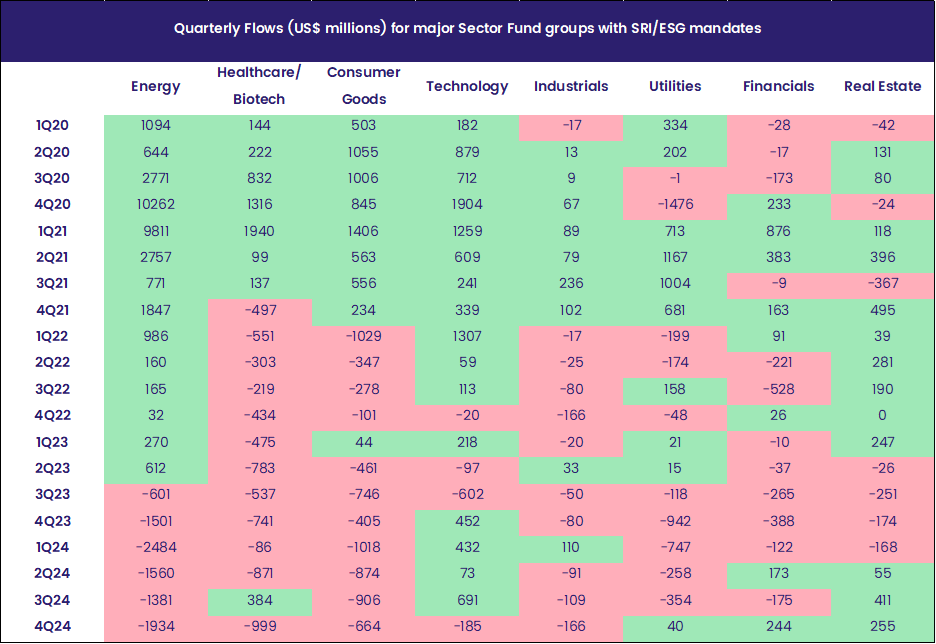

US President-elect Donald Trump’s antipathy towards the environmental, social and governance (ESG) theme added to the headwinds facing funds with SRI and ESG mandates. SRI/ESG Equity Funds recorded their biggest collective outflow since the fourth week of August and SRI/ESG Bond Funds posted their second outflow over the past three weeks.

At the single country and asset class fund levels, redemptions from UK and Belgium Equity Funds hit nine-week highs, South Africa Money Market Funds tallied their biggest outflow in four months and Thailand Equity Funds extended a run of outflows stretching back to the beginning of the year. Flows into Convertible Bond Funds climbed to an eight-week high, Physical Gold Funds chalked up their fourth outflow over the past five weeks and Municipal Bond Funds took in fresh money for the 23rd straight week.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds saw their longest run of outflows since 4Q23 come to an end in early December despite the resurgence of civil conflict in Syria, political turmoil in Korea and the threat of higher US tariffs in the New Year. Modest flows into Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds drove the latest headline number.

EM Leveraged and Bear Funds saw inflows climb to seven and eight-week highs, respectively, during the week ending Dec. 4, with the former posting their eighth inflow over the past nine weeks, and fresh money flowed into EM Equity Collective Investment Trusts (CITs) for the first time since mid-August.

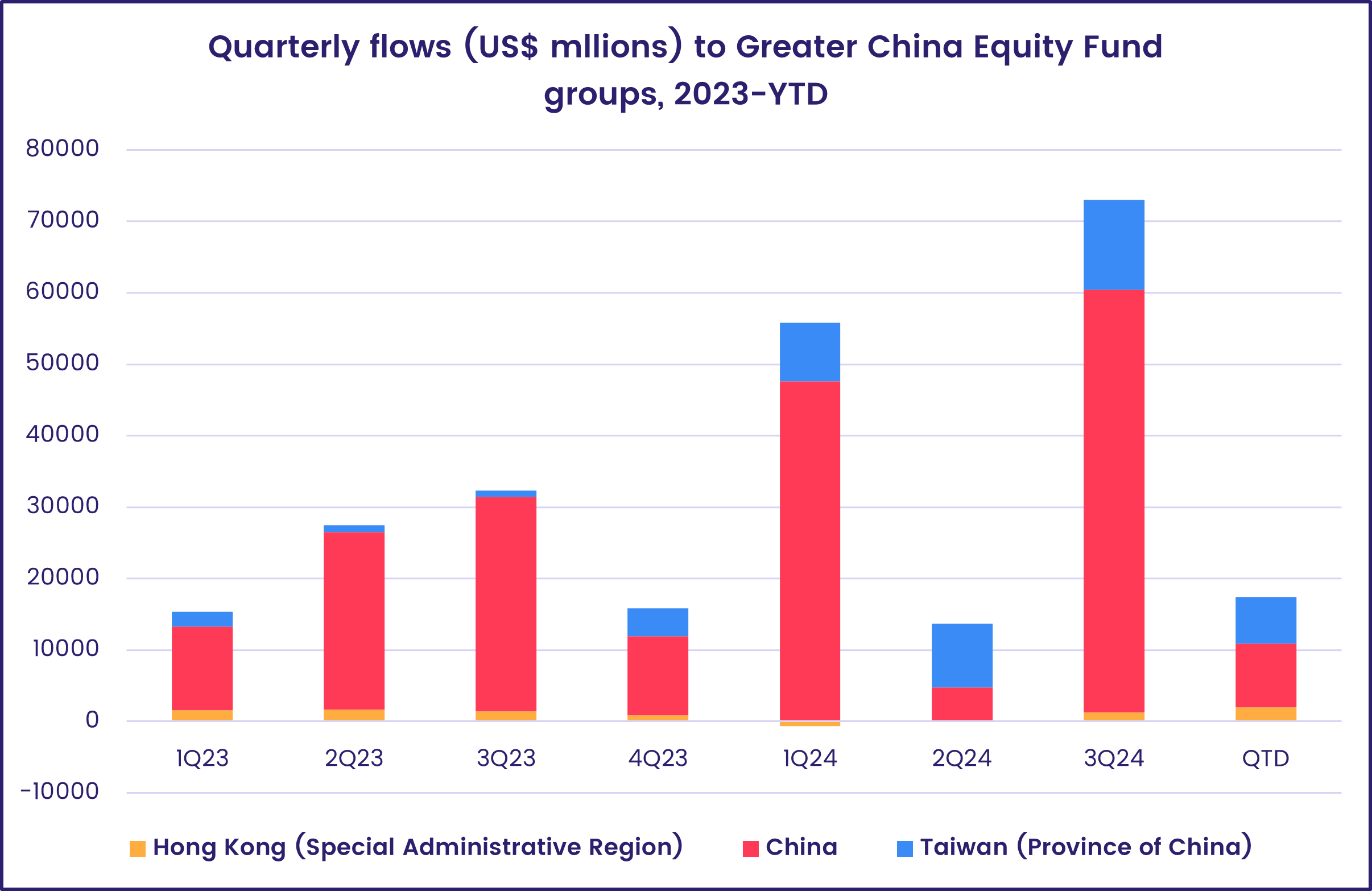

South Korean President Yoon Suk-Yeol’s declaration of martial law, swiftly repealed by lawmakers, did not stop Korea-mandated funds from chalking up their biggest collect inflow since late April. The bulk of that money went to domestically domiciled Korea Equity ETFs. There were also flows into Taiwan (POC) and India Equity Funds that offset the extension of China Equity Funds’ longest redemption streak since 2Q20.

Investors focused on the EMEA universe have been no strangers to conflict over the past two years. The sudden, and so far successful, offensive by Syrian anti-government forces adds a new twist to their geopolitical calculations, with events seen as easing some of the pressure on Israel while increasing the risks that Turkey will become more deeply engaged in Syria’s civil war. Flows into Israel Equity Funds climbed to a 38-week high while Turkey Equity Funds posted their biggest outflow since early September.

Flows for Latin America Equity Funds remain at the mercy of perceptions about US President-elect Donald Trump’s attitude towards key markets. Argentina-mandated funds again benefited from the assumed affinity between Trump and the country’s reformist, right-of-center government. Average allocations among actively managed Latin America Regional Equity Funds are, however, at their lowest level since 3Q16.

Developed Markets Equity Funds

Although US Equity Funds again led the way, in flow terms, coming into December, the magnitude of those flows was well down in the past four weeks. But that, combined with another week of solid flows into Global Equity Funds, ensued that all EPFR-tracked Developed Markets Equity Funds posted their eighth consecutive inflow and 39th year-to-date.

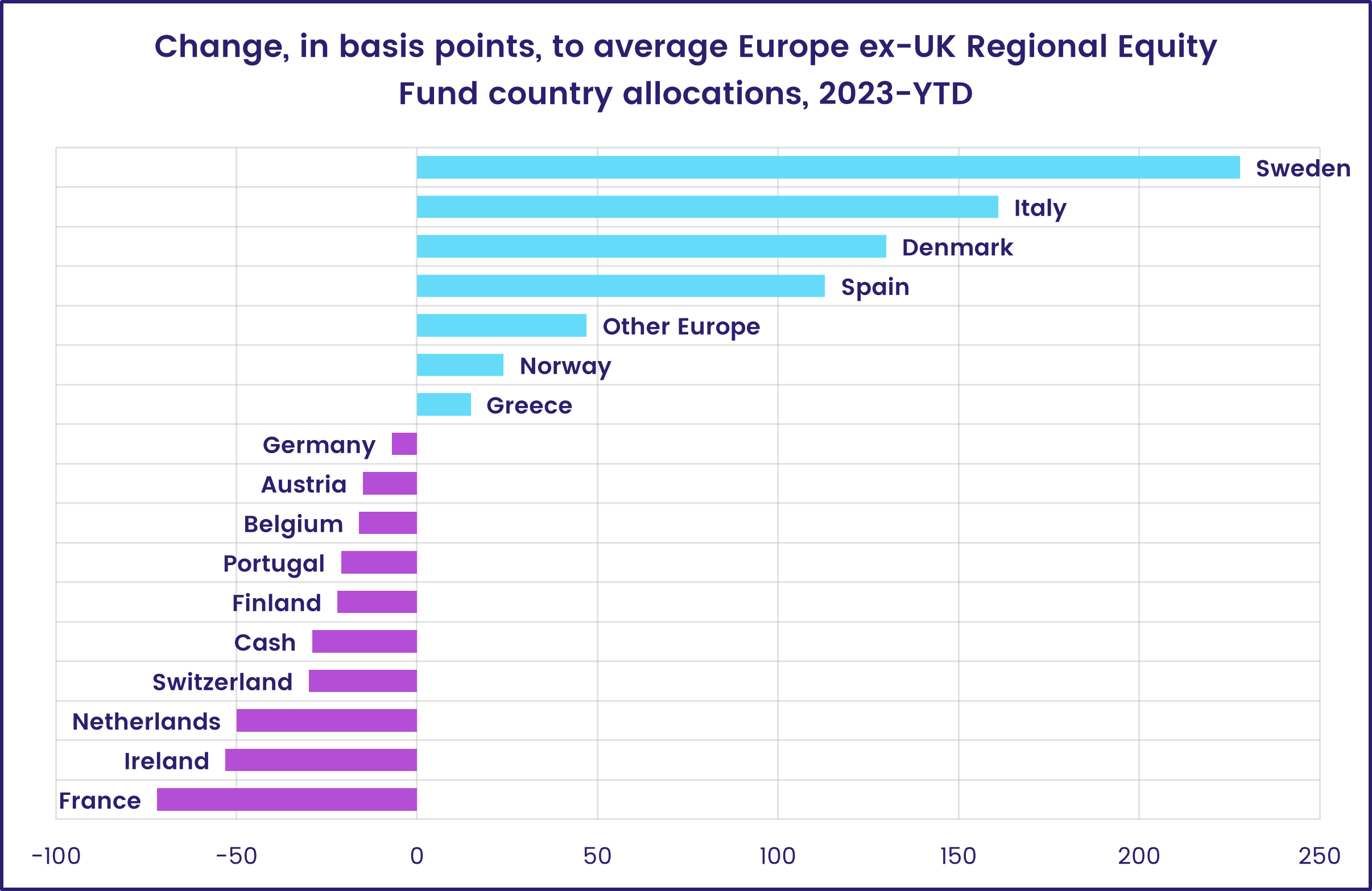

Europe Equity Funds were again the outliers, with investors pulling over $5 billion out of the group for only the second time over the past 28 months. Sentiment towards the region took another hit in early December when France’s minority government lost a vote of confidence triggered by its efforts to get the country’s deficit under control. With both of the continent’s “pillars” struggling economically and politically, Europe Equity Funds have posted outflows for 10 straight weeks and 26 of the past 30.

At the country level, Switzerland Equity Funds were the only major single-country group to record meaningful inflows. France and Germany Equity Funds posted their 11th and 19th consecutive outflow, respectively, while more than $1 billion flowed out of UK Equity Funds. Preliminary data indicates that UK Equity ETFs posted their sixth monthly inflow of 2024, but redemptions from actively managed funds more than offset those inflows.

Japan Equity Funds posted a third straight outflow for the first time since early July, with overseas domiciled funds making the biggest contribution to the headline number ahead of the Bank of Japan’s final policy meeting of 2024. Japan Dividend Funds did post their fourth straight inflow, but redemptions from funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates climbed to a 17-week high.

It was a better week for Australia Equity Funds, which chalked up their biggest collective inflow since July despite money flowing out of retail share classes for the 47th time so far this year. The country’s benchmark stock index hit a fresh record high in the middle of the latest reporting period before falling back.

US Equity Funds added another $8 billion to the inflows – over $145 billion – that they have seen since the first week of November. US Small Cap Funds attracted more fresh money than their large cap peers for the first time since the week ending Oct. 2.

The largest of the major diversified Developed Markets Equity Fund groups, Global Equity Funds, recorded their fifth straight inflow and 24th over the past six months.

Global sector, Industry and Precious Metals Funds

For the second straight week only three of the 11 EPFR-tracked Sector Fund groups reported redemptions as investors doubled down on their positioning strategies. The only two groups that saw flows change direction were Real Estate Sector Funds, which snapped a seven-week redemption streak, and Technology Sector Funds which saw nearly $1.4 billion flow out during the week ending Dec. 4.

Funds with leveraged mandates have been instrumental to the headline number for Technology Sector Funds over the past three weeks, accounting for roughly 50-60% of the total each week. Though a bullish semiconductor ETF topped the list in terms of the heavy inflows seen in late November, investors took a turn by pulling nearly $400 million from that fund this week. The single-stock focused leveraged ETFs seeing outflows this week also included MicroStrategy, Coinbase, and Nvidia.

Looking at sectors through the socially responsible (SRI) or environmental, social and governance (ESG) lenses, Real Estate SRI/ESG Sector Funds recorded an inflow that was both a 14-week high and the second-largest of the past year. A single mutual fund primarily investing in Swiss commercial and residential properties that aim to meet social and governance standards dominated the headline number this week. That helped the overall Real Estate Sector Fund group’s headline number move into positive territory.

Though Healthcare/Biotechnology SRI/ESG Sector Funds brought in nearly $400 million (1.8% of assets) during the third quarter, flows have been consistently negative in the last 10 weeks with redemptions reaching nearly $1 billion (over 5% of assets). The overall group extended their outflow streak to three weeks and $2.6 billion, the heaviest and longest since a 10-week run ending late May.

Investors have also been dumping Energy Sector Funds with SRI/ESG mandates during all but two weeks since 3Q23, and are on track to post total outflows of nearly $2 billion this quarter.

Bond and other Fixed Income Funds

With a slew of central bank meetings on the immediate horizon, among them the final Bank of Japan, US Federal Reserve and European Central Bank policy meetings of 2024, flows to EPFR-tracked Bond Funds slowed in early December, coming in at less than half the previous week’s total and a quarter of the average inflows during the first six weeks of the current quarter.

Among the major groups by geographic mandates, Global Bond Funds narrowly claimed the top spot in flow terms from US Bond Funds which posted their smallest weekly inflow since the second week of 2Q24.

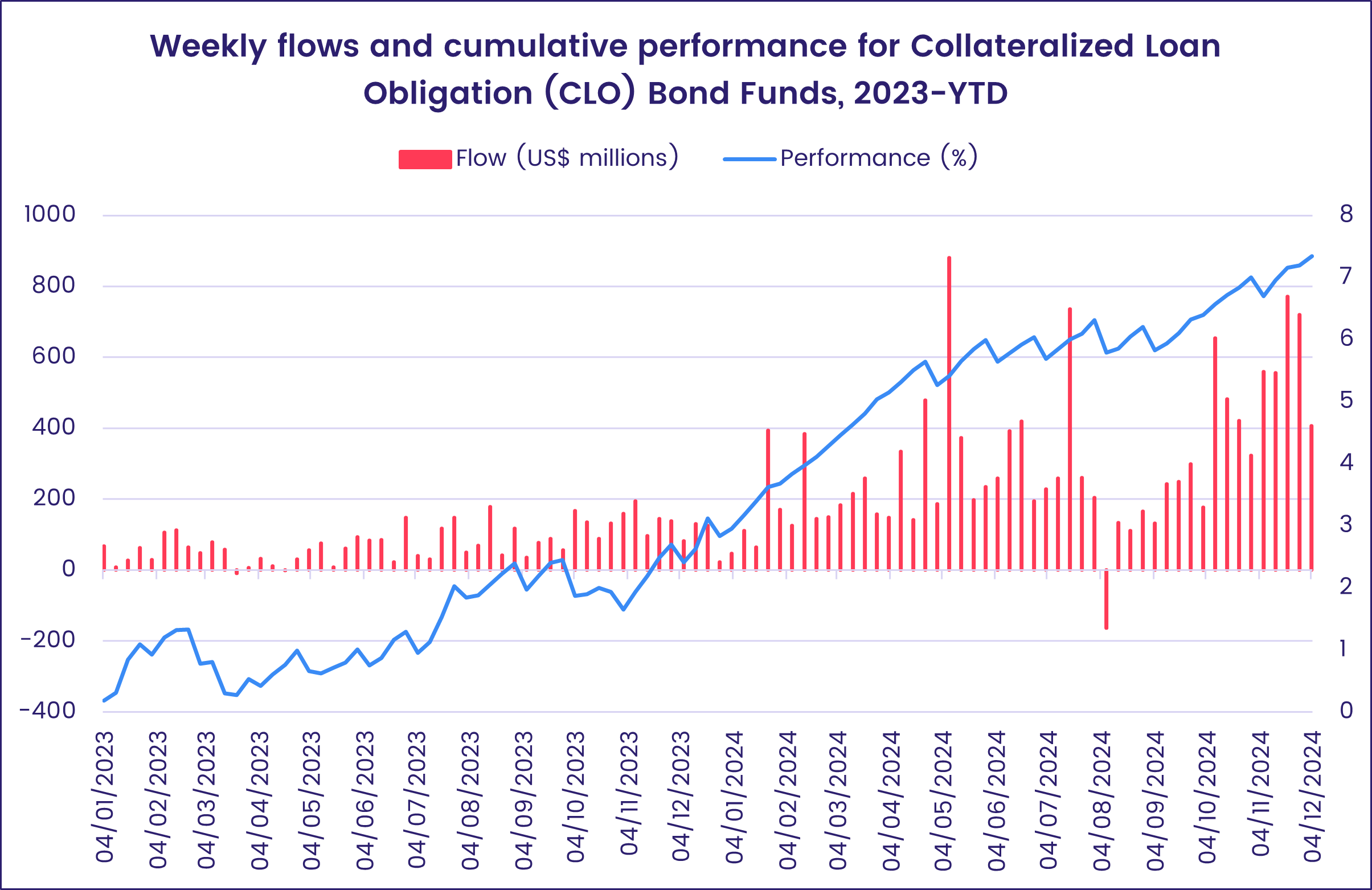

At the asset class level, Inflation Protected Bond Funds saw their two-week inflow streak snapped, Total Return Funds pulled in over $1 billion for the 21st time over the past 22 weeks, Bank Loan Bond Funds absorbed another $1 billion and Mortgage-Backed Bond Funds posted their 16th straight inflow. Collateralized Loan Obligation (CLO) Funds, which invest in securities created from pools of corporate loans, extended an inflow streak stretching back to early September.

Emerging Markets Bond Funds recorded another outflow as redemptions from hard-currency mandated funds more than offset the modest amounts of fresh money committed to local currency funds. Intermediate Term EM Bond Funds posted their biggest collective inflow since the second week of May.

Although France’s struggles to reign in its deficit regained center stage with the current government’s loss of a no confidence vote, Europe Bond Funds attracted solid amounts of fresh money. That money, however, went mainly to funds with corporate debt mandates.

Investors showed conviction at the country level, with Italy Bond Funds recording their biggest inflow since the fourth week of July and UK Bond Funds posting their 12th straight inflow while redemptions from Norway Bond Funds hit a level last seen in 1Q23 and another $122 flowed out of Spain Bond Funds.

Among Global ex-US Bond Funds, which have recorded inflows every week since early April, came into November with average allocations for Spain and Sweden at 40-month and 10-year lows, respectively, while France’s weighting stood at a 14-month high. Funds with fully global mandates, meanwhile, are still allocating over 40% of their portfolios to US debt. That is down from a peak of nearly 50% in 4Q21.

Although US Bonds Funds maintained their record of posting inflows every week year-to-date, redemptions from Sovereign Bond Funds hit their highest level since late January and funds domiciled overseas posted their biggest collective outflow in over a year.

Did you find this useful? Get our EPFR Insights delivered to your inbox.