Last week, investors homed in on recent data showing labor markets easing and price growth moderating and boosted flows to US Equity and Bond Funds. But there was a noticeable drop in risk appetite. This week, investors pumped more money into cash, gold and took on a more diversified approach.

Flows into Equity Funds were a third of the size of the previous week’s inflow at $8.7 billion and Bond Funds attracted a similar amount of $7.3 billion.

In the first four days of the reporting period, Money Market Funds were on track to absorb $18 billion but ended the week with a net $3.04 billion.

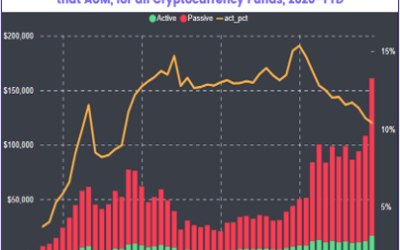

A fifth week of inflows out of the past seven for Gold Funds offset a second straight week of redemptions for Cryptocurrency Funds, resulting in a net inflow of $200 million for Alternative Funds. For the first time since early 2Q23, Silver Funds extended their inflow streak to three weeks. With the biggest inflow in roughly 10 months, Agriculture Funds were the most impressive relatively at 1.7% of assets.

Though flows for multi-asset ETFs climbed to a 23-week high, investors overall redeemed $2 billion from All Balanced Funds. For the first time in two months, redemptions from institutional investors outweighed those of retail.

Emerging Markets Equity Funds

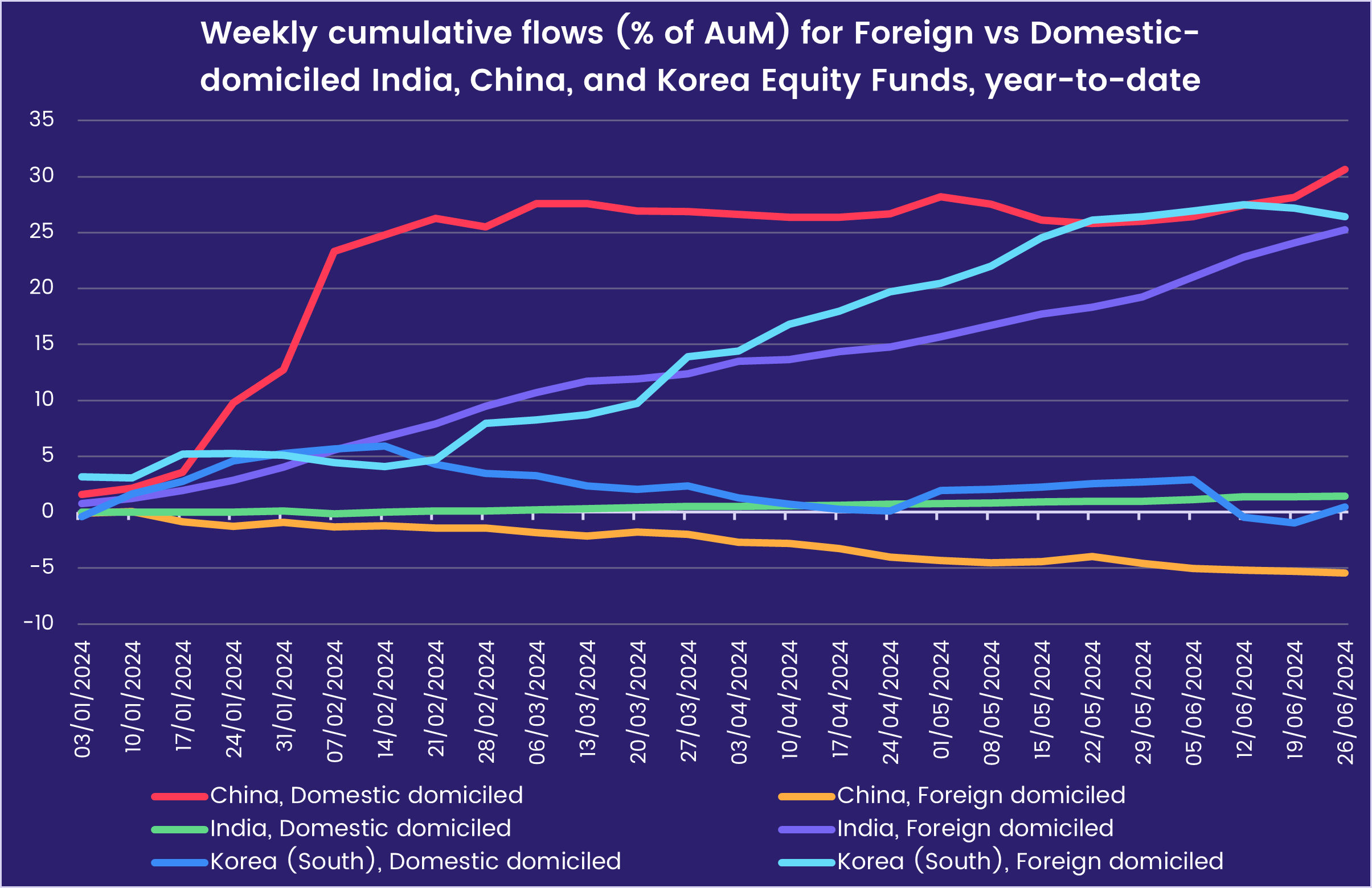

Among the Emerging Asian markets, flows into China and Korea Equity Funds hit 20 and eight-week highs, respectively, Taiwan (POC) Equity Funds absorbed their 12th inflow of the past 13 weeks, and India Equity Funds tacked on another week of inflows to their streak. Malaysia Equity Funds pulled in the biggest inflow since 3Q18 at 5% of assets.

Mexico and Brazil Equity Fund flows continued to move in opposite directions for the sixth straight week. For Mexico Equity Funds, it was the biggest outflow since early 2019, snapping a four-week inflow run that totaled over $800 million. Brazil Equity Funds brought an end to their four-week outflow run that totaled nearly $400 million with a 10-week high inflow. Overall, redemptions for Latin America Equity Funds climbed to an eight-week high.

EMEA Equity Funds managed to eke out an inflow as flows into South Africa and Turkey Equity Funds outweighed redemptions from Emerging Europe Regional and Saudi Arabia Equity Funds. For the first time since early 4Q23, funds dedicated to South Africa absorbed a second consecutive week of inflows, and it was the largest inflow since 4Q22.

Investors pulled over $1.1 billion from GEM Equity Funds, a nine-week high outflow.

Developed Markets Equity Funds

With stakes running high in France’s upcoming snap election, inflation slowing to its lowest level since 3Q21, and the Bank of England maintaining rates while GDP growth exceeds expectations has given investors plenty to ponder. Europe Equity Funds posted a 14-week high outflow as investors directed money out of UK Equity Funds, their fourth outflow above $1 billion over 31 straight weeks of outflows. A similar amount flowed out of Europe ex-UK Regional Equity Funds, their biggest outflow since early November. Among the other European dedicated fund groups, flows in either direction remained below the $100 million mark.

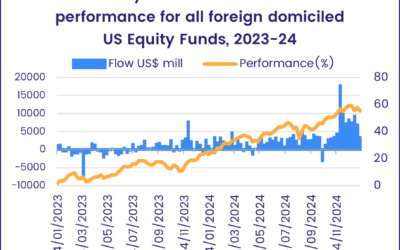

US Equity Funds brought an end to their nine-week inflow streak as investors pulled more from mutual funds than they added to ETFs for the first time since early May. Over that same period, demand has increased roughly 10% with a steady increase of 5% in June alone.

Flows into the diversified Global Equity Funds jumped to $6 billion, double the average level of inflows over the past eight weeks, and the biggest inflow since early 1Q23. Funds with Global ex-US mandates accounted for half of the headline number.

The headline number for Asia Pacific Equity Funds was drawn down by the sixth outflow of the past seven weeks for Japan Equity Funds, and by Australia Equity Funds posting their first outflow in three weeks and heaviest in nine weeks. However, Hong Kong SAR Equity Funds enjoyed their biggest inflow since mid-3Q23.

Global sector, Industry and Precious Metals Funds

Just two of the 11 EPFR-tracked Sector Funds groups saw inflows in the final week of June. US and China dedicated funds both contributed to Financials Sector Funds’ inflow this week, their third of the past four weeks.

Though Infrastructure Sector Funds extended their streak to four weeks, inflows were a quarter of the size of last week’s inflow. Flows were largely guided by two actively managed funds in the final week of June, one of which was Japan-domiciled and the other Canada.

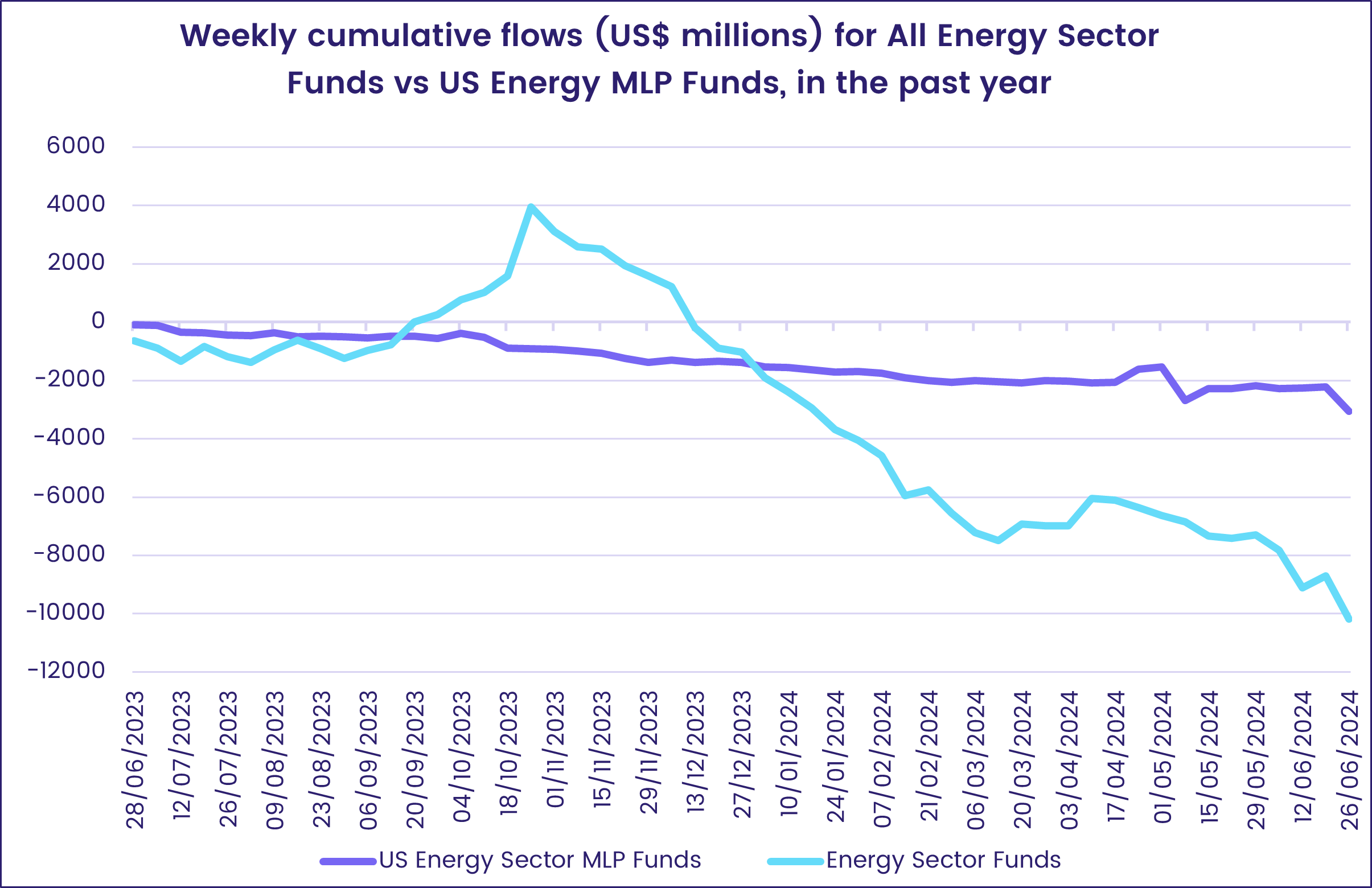

Nearly $1.5 billion flowed out of Energy Sector Funds as those dedicated to Master Limited Partnerships (MLPs), a tax advantaged vehicle for investing in US mid-stream assets, recorded their second-largest outflow since EPFR started tracking these funds in 2010. The week ending June 26 also saw Energy Sector Funds with SRI/ESG mandates post their biggest outflows since early 1Q22. Flows for this group have been negative in 38 of the past 40 weeks.

Redemptions for Real Estate Sector Funds hit a 10-week high, with REIT Funds mimicking their pattern over the past five weeks.

Bond and other Fixed Income Funds

Sovereign Bond Funds pulled in more money than funds with corporate mandates for the second time over the past eight weeks. Investors swung in the direction of bond funds with hard currency mandates and away from local currency.

For the first time since mid-4Q22, Intermediate-Term Bond Funds recorded outflows as funds dedicated to Europe and to a lesser extent the US, pulled the headline number down. Meanwhile, flows into funds dedicated to long-term debt climbed above $5 billion for the third time year-to-date, and for every $1 million committed to Europe dedicated funds, $3 million was added to US Long-term Bond Funds. Short-Term Bond Funds extended their inflow streak to 12 weeks.

In terms of bond quality and style, investors pulled a 10-week high redemption from both Municipal and High Yield Bond Funds, while Inflation Protected and Total Return Bond Funds posted a fourth and third consecutive week of outflows, respectively. Bond Funds with Bank Loan and Mortgage Backed mandates absorbed roughly $500 million each.

Did you find this useful? Get our EPFR Insights delivered to your inbox.