If 2020 read like a gothic novel, the second year of the Covid-19 pandemic belonged to the suspense genre. At what point would central banks decide inflation is not transitory? Will the new variants of Covid-19 do more or less damage than earlier waves? What consequences will perceptions of US weakness have in Europe and Asia?

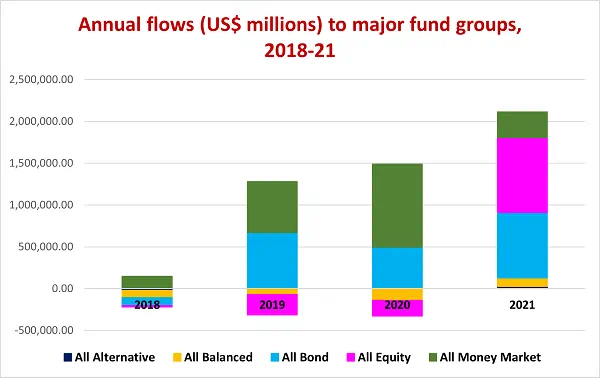

Mutual fund investors reacted to these uncertainties – and other potential problems – by throwing money at them. Going into the final days of the year, a slew of fund groups look set to post new full-year inflow records. These included Global Equity, Cryptocurrency, Financial and Real Estate Sector, Europe and Municipal Bond and all Balanced Funds. In response to the growing Sino-US tensions, those investors committed record setting sums to US Equity and Bond Funds and to China Equity and Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.