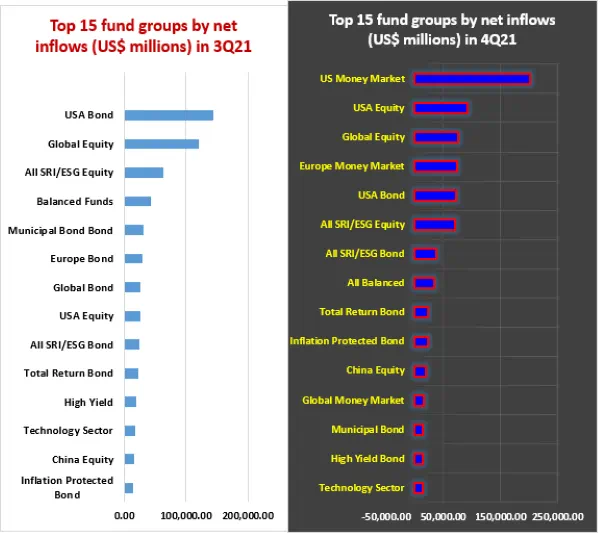

Continuing the pattern that emerged in the final quarter of 2021, flows to EPFR-tracked funds had a star-spangled bias to them early in the New Year. Between them, US Equity, Bond and Money Market Funds – which absorbed nearly $360 billion in 4Q21 — pulled in over $25 billion during the week ending January 5.

Despite the US Federal Reserve’s more hawkish tone and the derailing of the Biden administration’s Build Back Better spending package, investors believe there is more to come from America’s economy and stock market. This stems in part from the cash accumulated by corporations and individuals over the past 19 months which, potentially, is available to boost consumption and investment. Since the start of the pandemic, the assets held by US Money Market Funds have increased by $1.3 trillion and estimates of the ‘excess’ savings accumulated by American consumers range from $2 trillion to $3.5 trillion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.