The glow from October’s better-than-expected US inflation data did not take long to fade. Going into the Thanksgiving holiday, investors found themselves digesting record levels of Covid infections in China, rising levels of industrial action, falling temperatures in Central Europe, imploding cryptocurrency markets and more layoffs in America’s previously high-flying technology sector.

Against this backdrop, overall flows to EPFR-tracked fund groups during the third week of November were subdued. Having taken in over $22 billion the previous week, Equity Funds posted a collective outflow of $3.9 billion, with Europe Equity Funds racking up their 41st consecutive outflow. Commitments to Bond Funds were half of the previous week’s total and Alternative Funds pulled in only $33 million while more than $4 billion flowed out of Balanced Funds. A net $13.4 billion flowed into Money Market Funds.

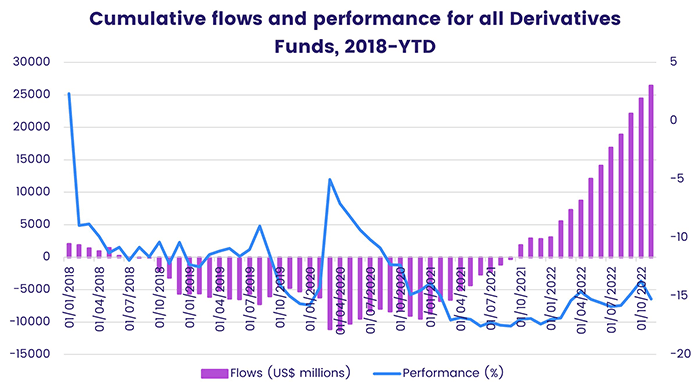

The uncertain outlook remains a boon to Derivatives Funds, which recorded their 35th inflow in the past 36 weeks, and prompted investors to revisit the case for precious metals with Gold Funds posting their first inflow since mid-June.

At the single country and asset class fund levels, Convertible Bond Funds posted their 13th outflow since the third week of August, Inflation Protected Bond Funds added to their longest redemption streak in over three and a half years and outflows from Cryptocurrency Funds hit a 10-week high. Germany Equity Funds recorded their biggest outflow since 1Q21 and Spain Equity Funds their biggest inflow since late May, investors steered money into Poland Equity Funds for the eighth time in the past nine weeks and redemptions from China Bond Funds hit a level last seen in mid-May.

Emerging Markets Equity Funds

Fresh money flowed into Emerging Markets Equity Funds during the week ending Nov. 23 for the 10th time in the past 11 weeks as the diversified Global Emerging Markets (GEM) Equity Funds extended their longest run of inflows since the first quarter and China Equity Funds absorbed another $1.5 billion. Retail flows were, however, negative for the 12th week running.

The latest flows into China Equity Funds came despite a resurgence in the number of Covid infections that triggered a fresh round of lockdowns. Year-to-date, this fund group has attracted over $63 billion while turning in a collective performance that has cut the value of the average portfolio by a quarter.

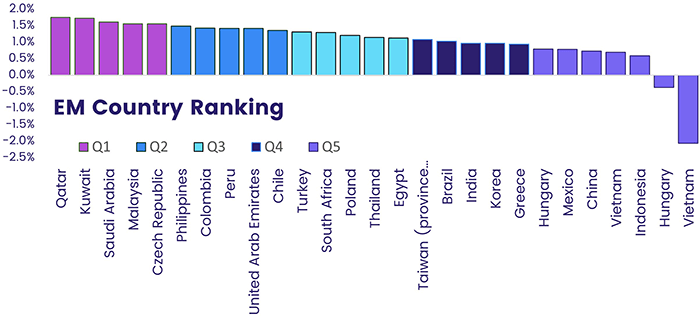

While investors, especially domestic ones, continue to buy into China-dedicated funds, the managers of diversified funds are more skeptical. The latest allocations data shows China’s average weighting among BRIC (Brazil, Russia, India and China), GEM, Asia ex-Japan Regional and Global ex-US Equity Funds at seven, 65, 70 and 94-month lows, respectively. China is also in the bottom quintile of EPFR’s weekly EM rankings.

Among the other Asia ex-Japan Country Fund groups, encouraging numbers from its key tourism sector was not enough to stop redemptions from Thailand Equity Funds hitting a 10-week high and Indonesia Equity Funds seeing a six-week inflow streak come to an end with the biggest outflow in nearly five months. But investors see value in Korean equity, which has been battered by regional tensions, rising US interest rates and a range of domestic issues, committing over $450 million to Korea Equity Funds.

Latin America Equity Funds recorded their sixth consecutive inflow as hopes for an end to the US rate hiking cycle and, in the case of Brazil, to its monetary tightening, helped Mexico and Brazil Equity Funds to attract solid amounts of fresh money.

Russia’s ongoing assault of Ukraine, now in its 10th month, and expectations of lower oil prices kept the pressure on EMEA Equity Funds. During October, managers of those funds lifted their exposure to the financial sector to a fresh record high.

Developed Markets Equity Funds

A week after EPFR-tracked Developed Markets Equity Funds posted their biggest inflow since late May, redemptions from US, Europe and Global Equity Funds saw them record their biggest collective outflow since the third week of September. Uncertainty about the impact of higher Covid rates on China’s economy, fresh signs of economic stress in Europe and uncertainty about the US Federal Reserve’s willingness to shift gears on monetary tightening contributed to the rapid cooling of investor sentiment.

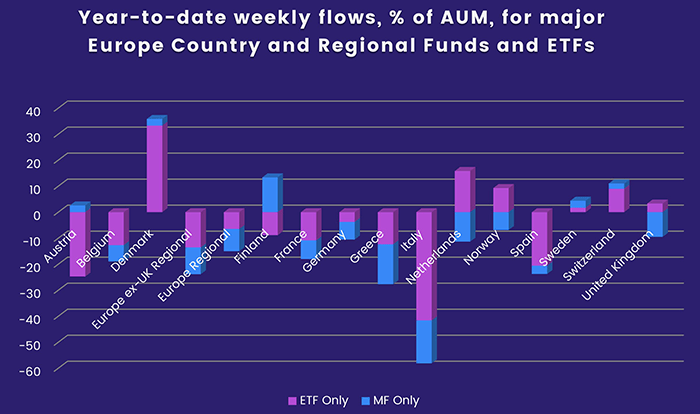

Cooling temperatures added to the angst surrounding Europe, where households and industry may be in competition for electricity and natural gas if a cold winter drives up demand. Although European manufacturers have shown considerable resilience, their scope for further energy savings is limited and anti-Covid lockdowns in a key export market, China, threaten export demand. Redemptions from Germany Equity Funds during the week ending Nov. 23 hit their highest level since late 1Q21 and investors pulled money out of Italy Equity Funds for the 20th week running as Europe Equity Funds overall chalked up their 41st consecutive outflow.

Also experiencing net redemptions were US Equity Funds, with Large Cap Blend and Value Funds the biggest contributors to the week’s headline number. US Dividend Funds racked up their 15th inflow in the past 16 weeks, but US Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their fourth outflow in the past five weeks. In 2021, US SRI/ESG Equity Funds posted an inflow every week of the year.

Japan Equity Funds recorded a modest inflow as the country’s central bank continues to defend its ultra-accommodative policies. Retail commitments to this group climbed to a seven-week high. Japanese investors are looking overseas: yen-denominated flows to US Equity Funds are on track to set a new full-year record.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, saw their latest inflow streak come to an end as retail investors pulled money out for the eighth time in the past 11 weeks.

Global Sector and Precious Metals Funds

With the holiday shopping and winter heating seasons looming, Russia’s assault of Ukraine heading into its 10th month and the Covid pandemic refusing to lie down, sector-oriented investors had plenty to chew on during the third week of November as the 3Q22 earning season winds down. Only four of the 11 major EPFR-tracked Sector Funds recorded an inflow while seven posted outflows that ranged from $35 million for Infrastructure Sector Funds to $343 million for Commodities Sector Funds.

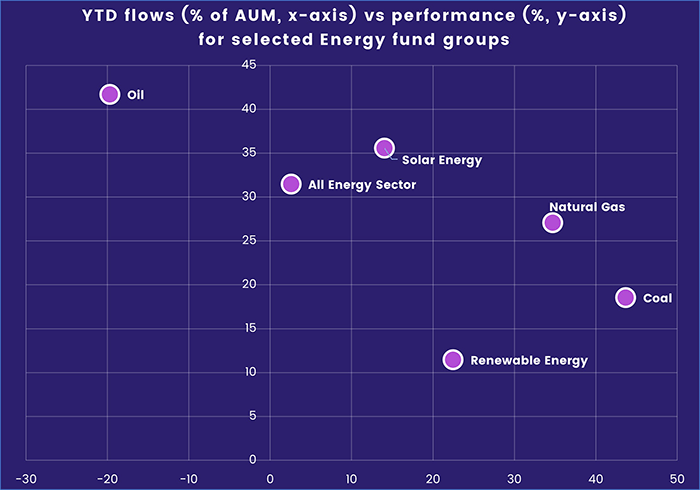

Among the groups posting an outflow were Energy Sector Funds, which continue to offer a very mixed bag for investors as high prices and profits trigger windfall taxes and demand destruction. Just how far Russia will go in its effort to “weaponize” its energy exports to Europe also remains an open question. The latest week saw this group’s longest inflow streak in over a year come to an end. But investors are showing more conviction among energy sub-groups, especially in the green and renewable spaces.

While Commodities Sector Funds chalked up their ninth outflow in the past 12 weeks, flows into Silver and Gold Funds jumped to nine and 22-week highs, respectively. Flows to Silver Funds often track industrial demand, and Industrial Sector Funds have posted inflows in four of the past five weeks. For Gold Funds, it was the first inflow since mid-June.

Elsewhere, Technology Sector Funds recorded their sixth inflow in the past seven weeks and Healthcare/Biotechnology Sector Funds their sixth in a row. Among the Technology Sector Fund sub-groups, Cloud Computing Funds have gone off the boil. Their latest outflow was the eighth in a row and their biggest since mid-July.

Bond and other Fixed Income Funds

Although the pace of inflows moderated, EPFR-tracked Bond Funds extended their longest inflow streak since August during the third week of November. Flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates jumped to a 15-week high but retail flows remain conspicuous in their absence – the last time there was a net retail inflow was the final week of 2021.

Among the major groups by geographic focus, Global, Europe and US Bond Funds recorded inflows. At the asset class level, High Yield Bond Funds clocked their fourth inflow in the past five weeks – although investment grade corporate funds outgained them by a 5-to-2 margin – while the other major groups posted outflows ranging from $33 million for Mortgage-Backed Bond Funds to $774 million for Bank Loan Funds.

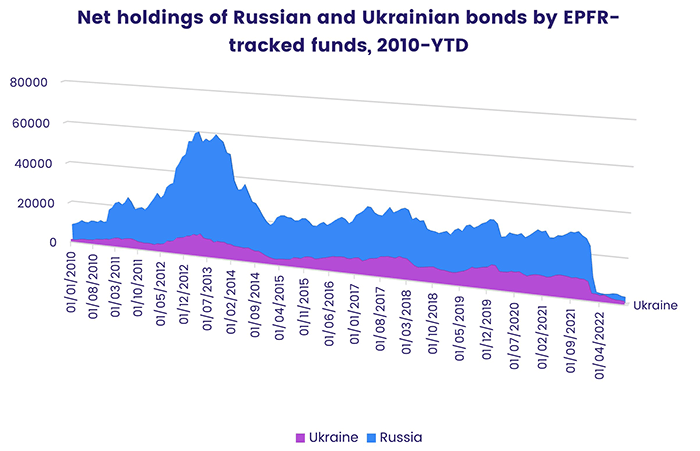

Emerging Markets Bond Funds saw money flow out for the 14th straight week and the 30th time in the past 33 weeks. Redemptions from China Bond Funds surged to a 27-week high as investors capitulated in the face of a major selloff triggered by rising Chinese sovereign yields. Russia Bond Funds, meanwhile, recorded their 43rd outflow year-to-date.

Europe Bond Funds had a solid week, absorbing over $1.5 billion that went primarily to funds with diversified geographic and investment grade corporate mandates. At the country level, flows into Spain Bond Funds hit a 25-week high and Italy Bond Funds extended their longest run of inflows since 4Q21.

Investors looking to the US also favored funds dedicated to investment grade corporate debt, with Long Term US Corporate Funds posting their fifth straight inflow and flows into Short Term Corporate Funds climbed to a 40-week high. Redemptions from US Bond Funds domiciled outside the US touched their highest level in six weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.