November closed with one benchmark US equities index returning to ‘bull’ territory. It also ended with Federal Reserve Chair Jerome Powell remarking in a speech that “it seems to me likely that the ultimate level of [US interest] rates will need to be somewhat higher than thought at the time of the September meeting” but going on to say the pace of hikes to get there could slow as soon as December.

Investors responded by pulling money out of US Equity and Bond Funds, with both groups experiencing the heaviest redemptions since the third week of June, and steered over $30 billion into US Money Market Funds.

Elsewhere, a more optimistic view of inflationary trends in Europe saw Europe Bond Funds post their biggest inflow in over 16 months while redemptions from Europe Equity Funds dropped to a four-week low. There was a noticeable pick-up in flows to funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates and to funds dedicated to markets expected to benefit from the relocation of supply chains currently anchored in China also fared well

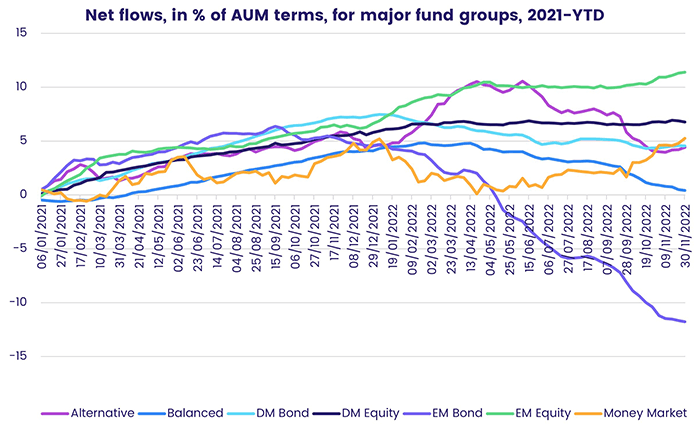

Overall, the week ending Nov. 30 saw a net $14.1 billion flow out of all EPFR-tracked Equity Funds, with Dividend Equity Funds posting only their fifth outflow year-to-date. Net redemptions from Balanced Funds hit $1.4 billion and investors pulled $2.4 billion out of Bond Funds. The bulk of the $31 billion that flowed into Money Market Funds went to US-dedicated funds as Europe MM Funds snapped a six-week inflow streak and China MM Funds extended their longest run of outflows since 4Q21.

At the asset class and single country fund levels, flows into Sweden Bond, Peru Equity and Turkey Equity Funds hit 13, 46 and 49-week highs respectively while Vietnam Equity Funds extended their longest inflow streak since 1Q20. Gold Funds posted consecutive weekly inflows for the first time since mid-April, redemptions from Cryptocurrency Funds climbed to a 15-week high and Bank Loan Funds recorded their 24th outflow in the past 25 weeks.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds continued to defy the gravity of higher US interest rates in late November, racking up their 11th inflow in the past 12 weeks on the back of another solid week for China Equity Funds and the fifth consecutive inflow recorded by the diversified Global Emerging Markets (GEM) Equity Funds. It was also a good week for Frontier Markets Equity Funds. Flows to that group hit a level last seen in early 1Q14.

Retail commitments to all EM Equity Funds jumped to their highest level since late March and flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates climbed to an 18-week high.

Although China is beset with a range of problems ranging from the impact of Covid-containment lockdowns to deteriorating trade relations with the US, investors continue to position themselves for the rebound they expect when the anti-Covid restrictions are eased. The widespread protests against those restrictions are being viewed as another catalyst for their at least partial lifting.

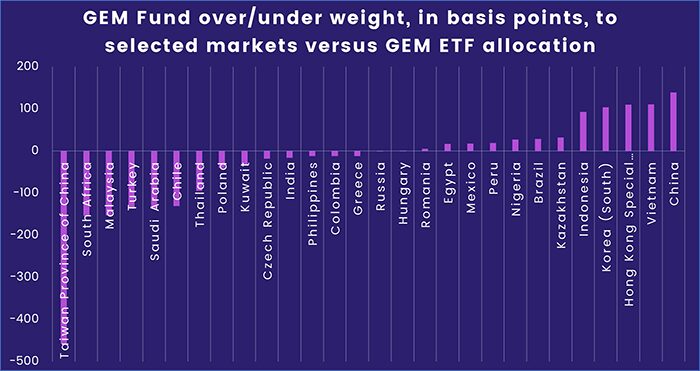

China is one of the markets where actively managed GEM Equity Funds are over-weight relative to their passively managed peers. Asia and Latin America account for the bulk of the active GEM Fund over-weights while Taiwan (POC) and several EMEA markets account for the biggest underweights.

During the latest week, investors also gravitated toward funds offering exposure to supply chain relocation stories. Vietnam Equity Funds pulled in over $90 million as they extended their longest inflow streak since 1Q20, Philippines Equity Funds absorbed fresh money for the fifth week running and Mexico Equity Funds posted their fifth inflow in the past seven weeks.

Despite the appetite for Mexico Funds and flows into Peru Equity Funds hitting a 20-week high, Latin America Equity Funds overall saw a six-week inflow streak come to an end. Brazil Equity Funds experienced their heaviest redemptions in over two months.

Turkey Equity Funds stood out among the EMEA Equity Fund groups, with inflows hitting a 49-week high, as investors continue to buy into a market that is cheap for those with hard currency.

Developed Markets Equity Funds

Redemptions from EPFR-tracked Developed Markets Equity Funds accelerated during the final week of November, hitting a 23-week high as US focused investors took advantage of the latest market rally to cash out. In addition to US Equity Funds, money flowed out of Japan, Canada, Europe and Pacific Regional Funds, handily offsetting the inflows recorded by Australia and Global Equity Funds.

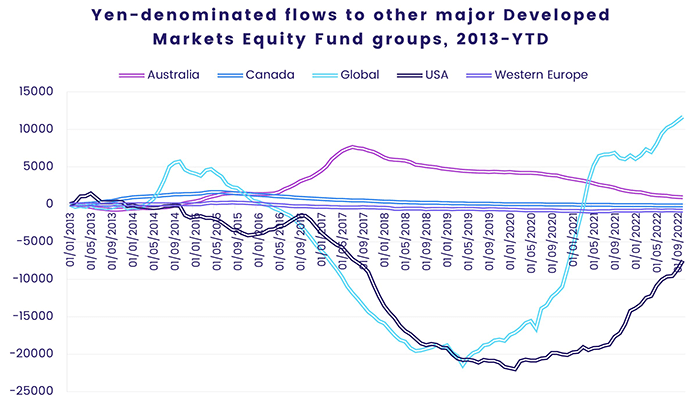

The outflows from Japan Equity Funds were the fourth in the past five weeks even though retail flows were positive for the third straight week. With inflation currently at a 40-year high, the pressure on Japan’s central bank to end its ultra-accommodative, anti-deflationary policies continues to grow. How the world’s third largest economy will respond to any change is an open question. Meanwhile, Japanese investors are looking overseas: yen-denominated flows to Global and US Equity Funds have accelerated since mid-2020.

Any interest from Japanese investors was swamped during the latest week as US Equity Funds experienced heavy, broadly based outflows with 55 funds seeing $50 million or more flow out. Research by EPFR analyst Winston Chua indicates that investors were not the only ones selling into the rising market. Net selling by corporate insiders in November hit an 11-month high while insider buying fell to a two-year low.

Europe Equity Funds closed the book on November with their 42nd consecutive outflow, a run that has seen over $110 billion redeemed. At the country level, Italy Equity Funds saw their 20-week outflow streak come to an end, flows into Spain Equity Funds climbed to a 20-week high, Sweden Equity Funds racked up their 14th straight inflow and redemptions from Denmark Equity Funds hit their highest level in six months.

Flows to Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, were positive for the fourth time in the last five weeks. Funds with fully global mandates drove the headline number as redemptions from Global ex-US Equity Funds hit their highest level since late April.

Global Sector and Precious Metals Funds

For the second week running, only four of the 11 major EPFR-tracked Sector Funds posted inflows as investors sought clues about the US Federal Reserve’s appetite for further interest rate hikes, the willingness of China’s government to ease Covid-related restrictions and the trajectory of the war in Ukraine. While Commodities, Healthcare, Infrastructure and Utilities Sector Funds attracted fresh money, the other seven posted outflows ranging from $35 million for Telecoms Sector Funds to $609 million for Financial Sector Funds.

Utilities Sector Funds stood out among the groups recording an inflow during the final week of November. Commitments to this group, which had posted outflows six of the previous eight weeks that totaled $1.3 billion, soared to a 46-week high. Of the top 10 funds ranked by inflows for the week, six have diversified mandates and four are dedicated to water supply and treatment.

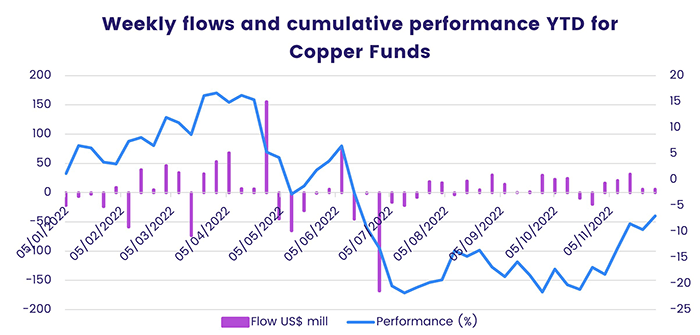

Investors also steered fresh money into Commodities Sector Funds, which have been stuck in a week-on, week-off pattern of flows over the past two months as investors balance a weaker global growth outlook with tight supplies of key commodities. A case in point is copper, which traditionally sees demand ebb in line with economic activity but is expected to see a surge in future demand as clean energy systems proliferate.

Redemptions from Industrials Sector Funds climbed to a nine-week high, ending a two-week inflow streak, with a single US transportation fund pushing the headline number down and a China-related one doing the contrary. Aerospace and defense funds recorded their longest stretch of inflows since the end of April, with the sub-group picking up another tailwind in the form of the recent signing of a contract by the US to purchase air-defense systems for Ukraine.

Elsewhere, Real Estate and Telecoms Sector Funds both posted their fourth consecutive outflow while flows to Infrastructure Sector Funds rebounded after they posted back-to-back outflows for the first time since late 3Q21.

Bond and other Fixed Income Funds

Investors struggling to reconcile the US Federal Reserve’s still hawkish signals and the growing inversion of the two and 10-year Treasury yield curves with an early pivot on US monetary tightening and a soft landing for the US economy pulled over $6.5 billion – a 23-week high – from US Bond Funds during the final week of November. That was enough to end the latest inflow streak for all EPFR-tracked Bond Funds despite strong flows into Global and Europe Bond Funds.

Appetite for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates remained strong, with these funds recording their biggest collective inflow since early April.

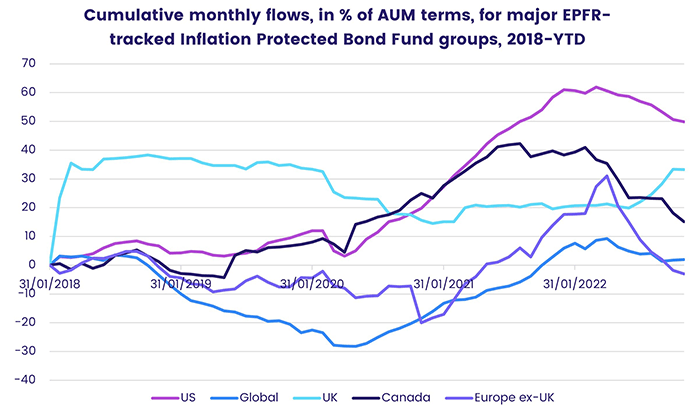

At the asset class level, redemptions from High Yield Bond Funds hit a six-week high, over $1 billion flowed out of Total Return Funds for the 28th time year-to-date, Mortgage-Backed Bond Funds chalked up their 13th outflow in the past 15 weeks and Inflation Protected Bond Funds added to their longest redemption streak since 4Q18.

Hopes that inflation has peaked in Europe, allowing the European Central Bank and other major central banks to end their tightening cycles, helped Europe Bond Funds to record their biggest inflow since early 3Q21. Funds with corporate mandates attracted twice as much fresh money as their sovereign debt counterparts. At the country level, Italy Bond Funds saw a seven-week inflow streak snapped, UK Bond Funds posted their fourth inflow in the past five weeks and flows into Sweden Bond Funds came in at a 13-week high.

Hard Currency Funds continue to pull in fresh money, but not enough of it to offset redemptions from Local Currency Funds and stop Emerging Markets Bond Funds from racking up their 15th consecutive outflow. Another $850 million flowed out of China Bond Funds.

Among US Bond Fund groups, Municipal, High Yield, Short Term Mixed and Long Term Corporate Funds all saw over $1 billion redeemed while Long Term Sovereign Funds topped the smaller list of groups receiving inflows.

Global Bond Funds recorded their biggest inflow since early April. The latest country allocations data shows that, among Global ex-US Bond Funds, exposure to Japan, Brazil, Canada and France is at 17, 33, 36 and 45-month highs, respectively, while China’s average weighting has fallen to a 19-month low.

Did you find this useful? Get our EPFR Insights delivered to your inbox.