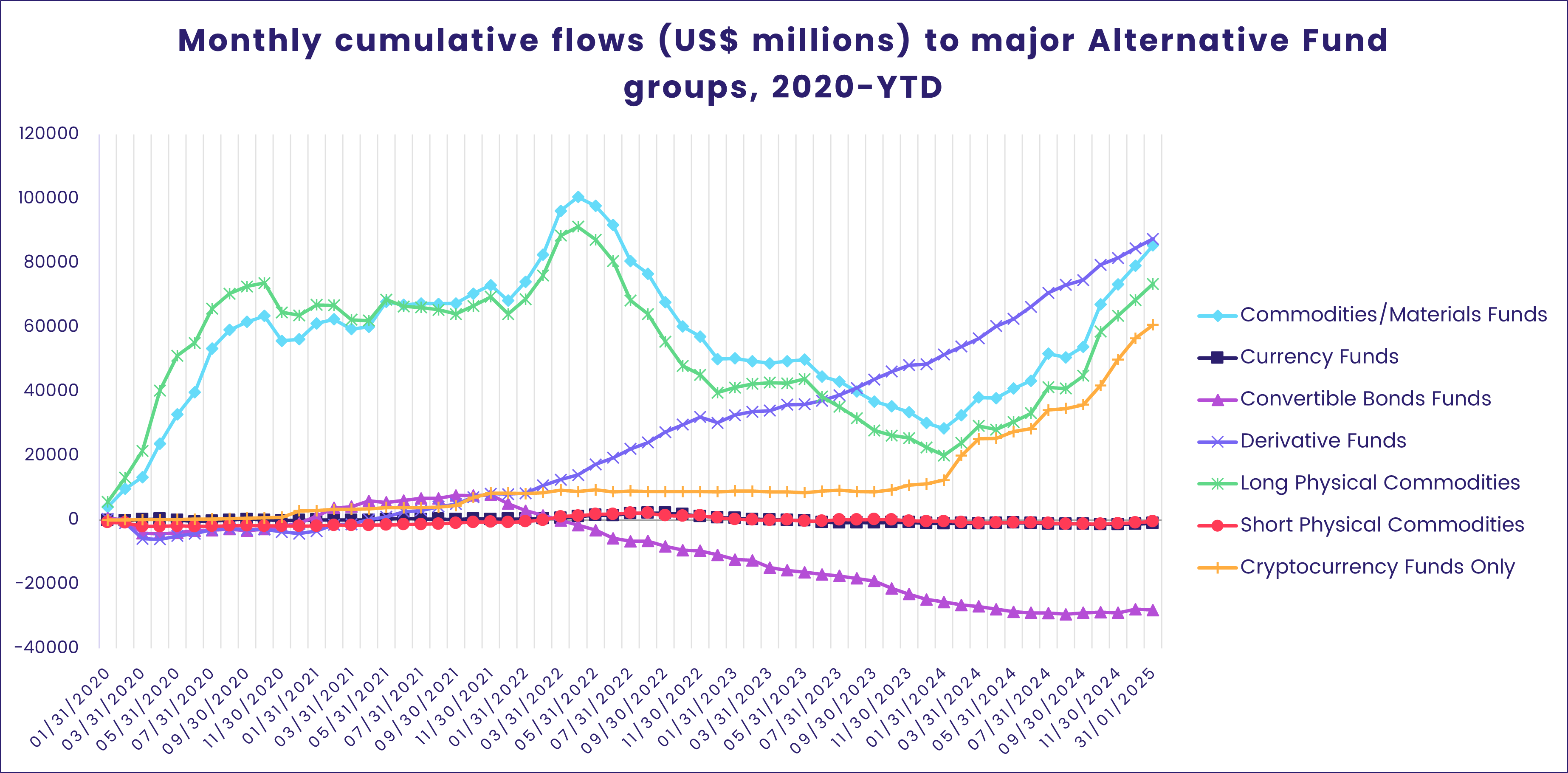

Amidst a flurry of executive orders from President Donald Trump, issued in the wake of his inauguration and days after he launched a new meme coin, investors steered over $5 billion into Alternative Funds during the third week of January with over $4 billion of that total going to Cryptocurrency Funds.

Investors also added to their exposure for the more conventional US assets, with US Equity, Bond and Money Market Funds absorbing a combined $68.8 billion. But Technology Sector and Taiwan (POC) Equity Funds attracted minimal inflows as investors continue to reassess the promise of artificial intelligence (AI), both Emerging Markets Equity and Bond Funds added to their respective outflow streaks and Europe Equity Funds experienced net redemptions for the 17th consecutive week.

Overall, EPFR-tracked Equity Funds posted a collective inflow of $5.9 billion during the week ending Jan. 22, with Dividend Equity Funds absorbing fresh money for the 14th time over the past 15 weeks, while Bond Funds pulled in $13.4 billion and Money Market Funds $61.5 billion. Balanced Funds, meanwhile, saw another $2 billion flow out.

At asset class and single country fund levels, outflows from China Money Market and Bond Funds climbed to 15 and 17-week highs, respectively, Greece Equity Funds recorded their biggest inflow since 1Q24 and Argentina Equity Funds took in fresh money for the 13th straight week. US Treasury Inflation Protected Securities (TIPS) Funds posted consecutive inflows for only the fifth time since the beginning of 2023, flows into High Yield Bond Funds hit a year-to-date high and Platinum Funds extended their longest redemption streak since 3Q24.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds ended the third week of January by posting their 13th outflow since the beginning of 4Q24 as US President Donald Trump took the oath of office, embarking on a four-year term with a flurry of remarks about tariffs, ownership of the Panama Canal and the need for lower oil prices.

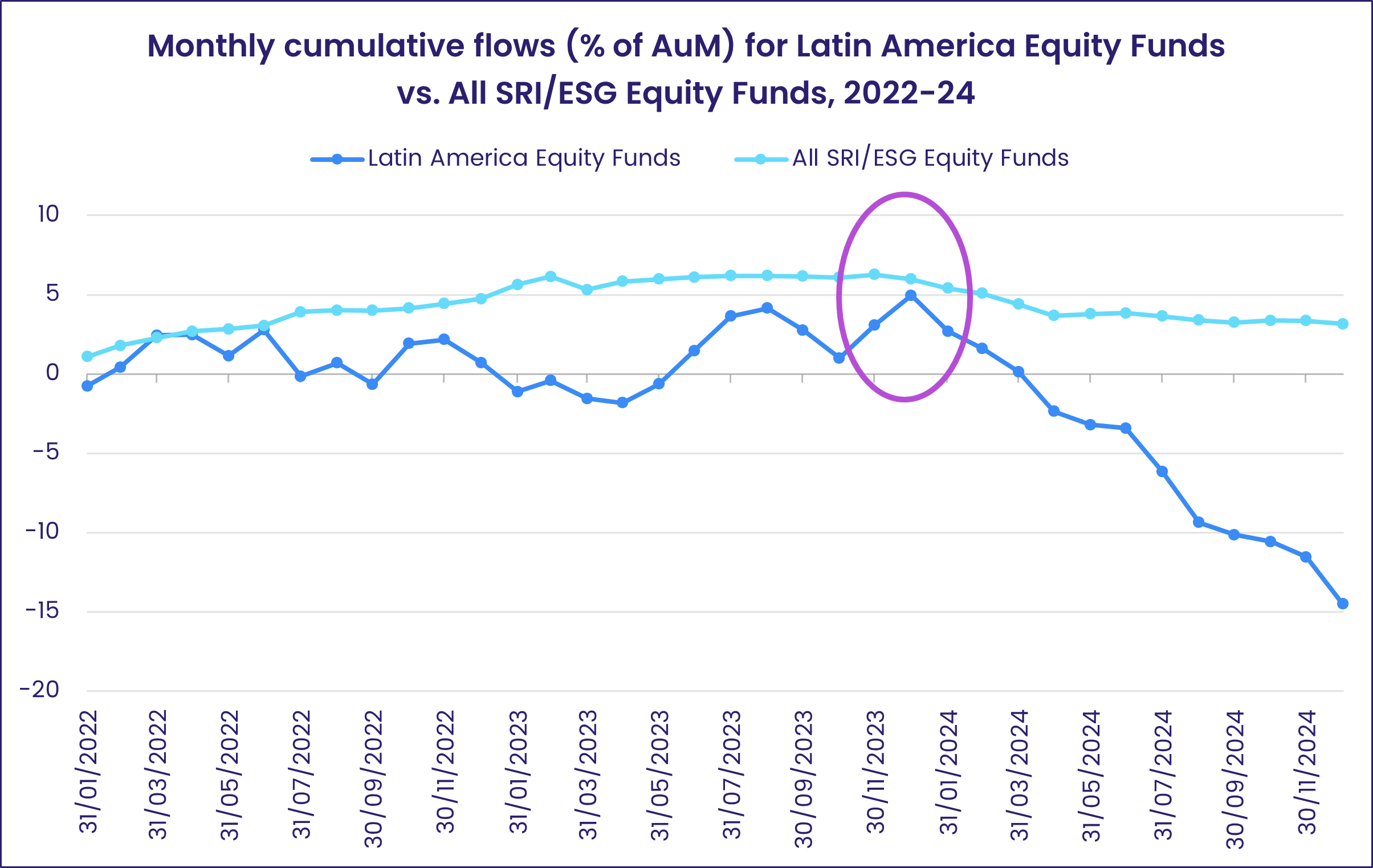

With uncertainty about US trade and economic policy a given in the weeks ahead, retail share classes experienced net redemptions for the 26th straight week. But institutional money flowed into Latin America and EMEA Equity Funds, and EM Dividend Funds added to their current inflow streak.

Asia ex-Japan Equity Funds had the greatest bearing on the headline number for all EM Equity Funds, with over $2 billion redeemed from China Equity Funds ahead of the Lunar New Year holiday and India Equity Funds chalking up their 12th outflow during the past four months. Thailand Equity Funds, meanwhile, chalked up their 54th straight outflow as investors pull back from an economy hobbled by an aging, indebted workforce, a dependence on the automobile industry and political instability.

Actively managed Global Emerging Markets (GEM) Equity Funds are also avoiding politically volatile markets where they can. These funds aggressively cut their exposure to Thailand between 4Q22 and 3Q24 and, in the wake of President Yoon Suk Yeol’s short-lived declaration of martial law last month, dropped their average allocation for Korea to its lowest level since the first quarter of 1999.

The week ending Jan. 22 was a better one for Latin America Equity Funds, which posted their biggest collectively inflow in over two years, with Brazil, Mexico and Argentina Equity Funds all attracting solid amounts of fresh money. The possibility that Trump’s rhetoric on trade will exceed reality, and that obituaries for clean energy initiatives may be premature, drew some investors back to a region whose fortunes are heavily linked to demand for the raw materials needed for green transportation and power grids.

Flows to EMEA Equity Funds also bounced back as Trump reiterated his willingness to push for an end to the fighting in Ukraine and a fragile ceasefire in Gaza was marked by the release of several Israeli hostages. With oil prices firming, flows into Saudi Arabia and Kuwait Equity Funds climbed to 27 and 39-week highs, respectively.

Developed Markets Equity Funds

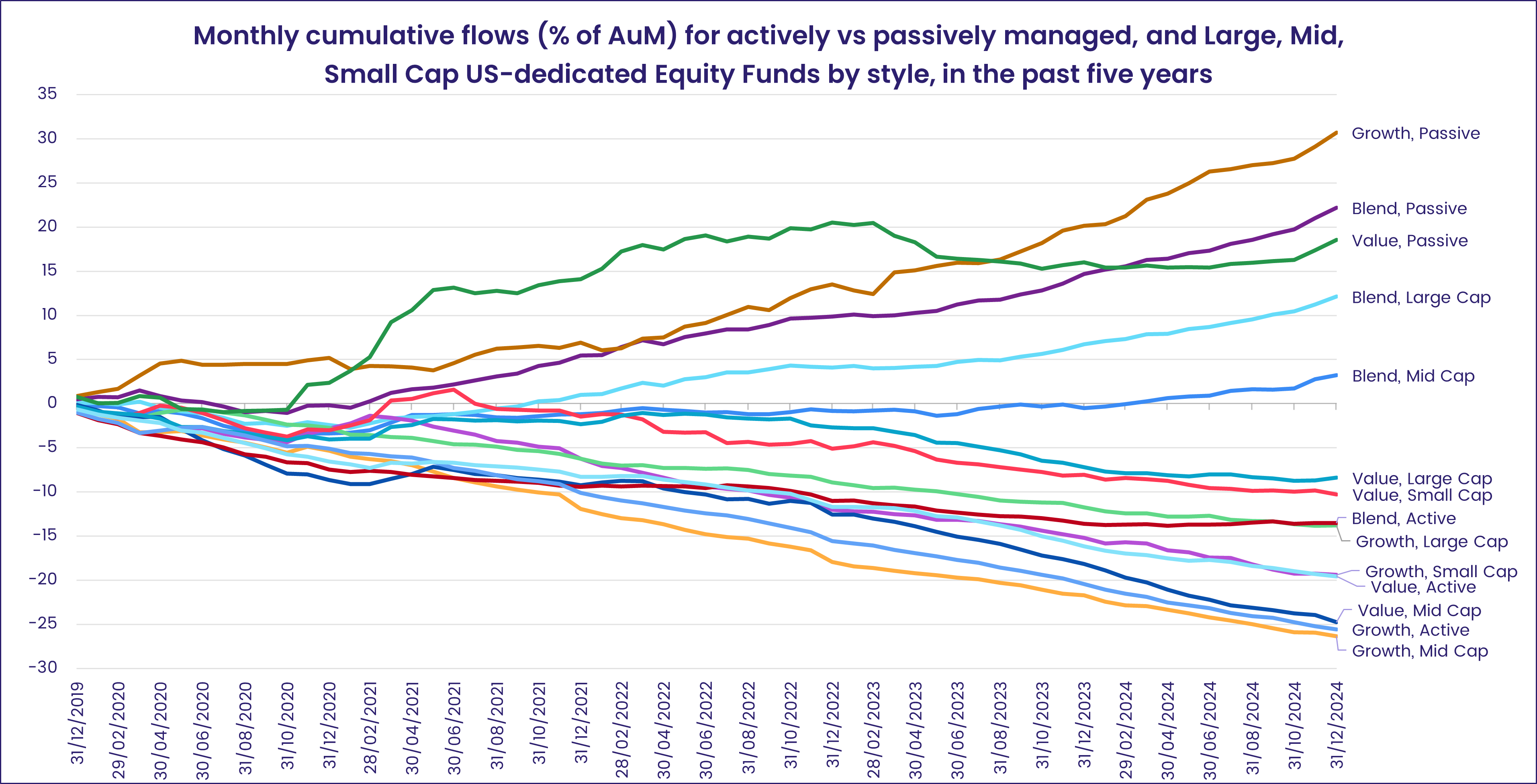

US-mandated funds remained in pole position among EPFR-tracked Developed Markets Equity Funds going into the final week of January. During the latest week, flows into US Equity Funds outstripped those bound for the second most popular group, Global Equity Funds, by a 3.5-to-1 margin as investors position themselves for the expansionary economic agenda promised by incoming President Donald Trump.

That agenda has already propelled the benchmark S&P 500 index to a fresh record high. US Large Cap Blend ETFs were the vehicle of choice, absorbing over $5 billion, while actively managed Growth and Value Funds both saw around $2 billion flow out.

Also in the money were Japan Equity Funds, which posted consecutive weekly inflows for the first time since early November. Markets are expecting another 0.25% interest rate hike when the Bank of Japan wraps up its latest policy meeting. Despite the usual reservations about a stronger yen’s impact on Japanese export competitiveness, investors see benefits from cheaper material and energy input costs for both businesses and consumers.

Energy costs are pinching European businesses and consumers. But redemptions from Europe Equity Funds fell to their second lowest total since late September and could have been positive but for the obvious desire of investors to cut their UK exposure. They pulled nearly $700 million out of dedicated UK Equity Funds while flows into Europe ex-UK Regional Funds climbed to a 22-week high. But managers of fully regional funds came into this year with average allocations for the UK close to the pre-pandemic high they hit in November.

Global Equity Funds, the largest of the diversified Developed Markets Equity Funds groups, are also holding the line on their UK allocations despite the fiscal and policy issues dogging that market. The overall group posted its fifth straight inflow, with retail share classes recording their fourth inflow over that period.

Global sector, Industry and Precious Metals Funds

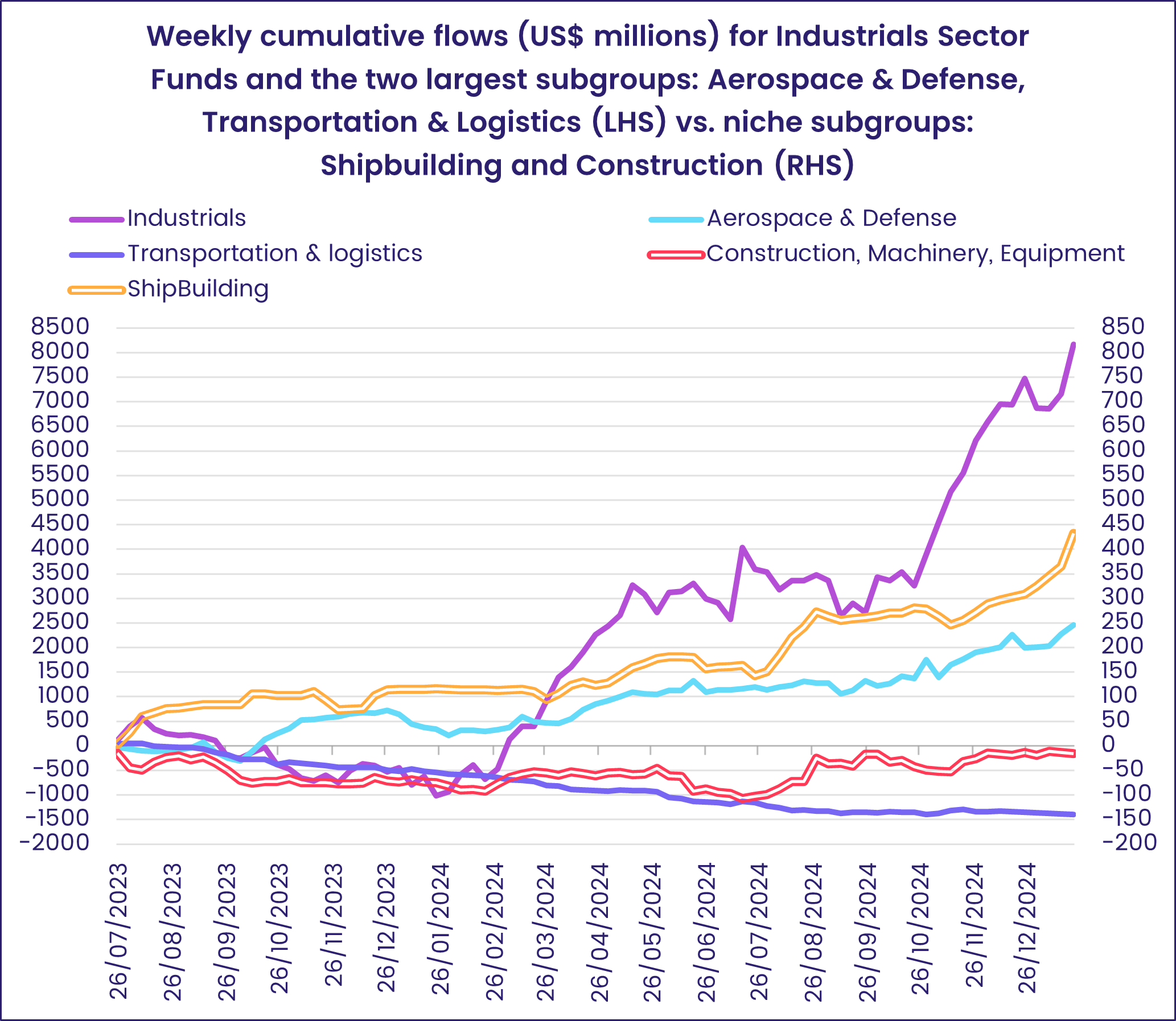

For the second week running, six of the 11 EPFR-tracked Sector Funds posted inflows that ranged from $35 million for Technology Sector Funds to $1 billion for Industrials Sector Funds. But flows for two groups – Infrastructure and Real Estate Sector Funds – saw a change in direction during the third week of January.

The US fourth quarter earnings season has – so far – seen positive surprises for the financial sector and upbeat reflections from airline companies, offset by underwhelming reports from energy plays and mixed reviews for healthcare firms, all of which has colored this week’s flows.

The headline number for Industrials Sector Funds was the biggest in 27 weeks and included another $200 million inflow for Aerospace & Defense Funds. These funds, by AuM, represent roughly 25% of the overall group, and have seen assets nearly double since September 2023. A niche group of five Shipbuilding Funds pulled in the biggest weekly inflow on record since EPFR started tracking these funds in 2022. Overall, the total AuM for Industrials Sector Funds reached a record $75 billion in November 2024.

Flows for Real Estate Sector Funds have shifted from week to week over the past two months, with redemptions outweighing inflows over the period. US 30-year mortgage rates hovering near 7% have not helped, and a custom group of US REIT Funds endured a third consecutive week of outflows.

Investors aggressively exited funds looking to amplify returns of the major tech stocks, with Leveraged Technology Sector ETFs experiencing their second-largest outflow on record at $1.8 billion. A single semiconductor ETF seeking 3x returns accounted for nearly 90% of that total, almost $400 million flowed out of funds tracking the NVIDIA stock price (seeking 2x returns) and sentiment dropped for funds tracking the Hang Seng tech markets. On the other hand, six Technology Sector Funds – one of which was magnificent seven themed – pulled in more than $130 million with one semiconductor fund absorbing over $600 million.

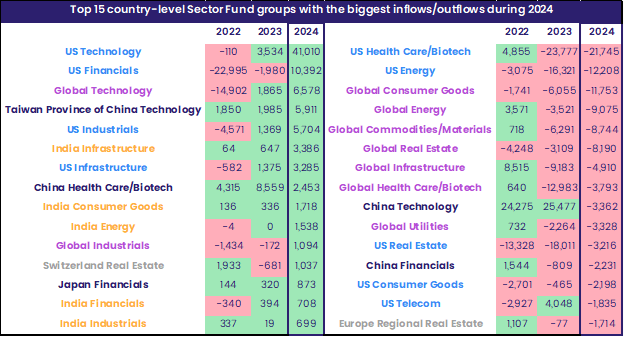

Despite their recent loss of momentum, US Technology Sector Funds ended last year at the top of the inflow rankings followed by US Financials and Global Technology Funds.

p>

At the country-level last year, beyond US-mandated funds there were notably strong flows into India and Japan-dedicated Financial Sector Funds with the latter taking in flows more than double the previous year’s record-setting inflows. Funds with mandates to India appeared four other times in the list of country-level sector fund groups with the biggest inflows in 2024.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds added another $14 billion to their 2025 total during the third week of January as fixed income investors continue to focus on the rewards – decent yields – rather than the risks. High Yield Bond Funds posted their biggest collective inflow in two months, Bank Loan Funds took in over $1.5 billion for the third week running and Collateralized Loan Obligation (CLO) Funds extended an inflow streak stretching back to early August.

Investors did steer clear of diversified geographical exposure, with Global Bond Funds posting their first outflow of the year, Global Emerging Markets (GEM) Bond Funds chalking up their 14th straight outflow and Pacific Regional Bond Funds experiencing modest redemptions.

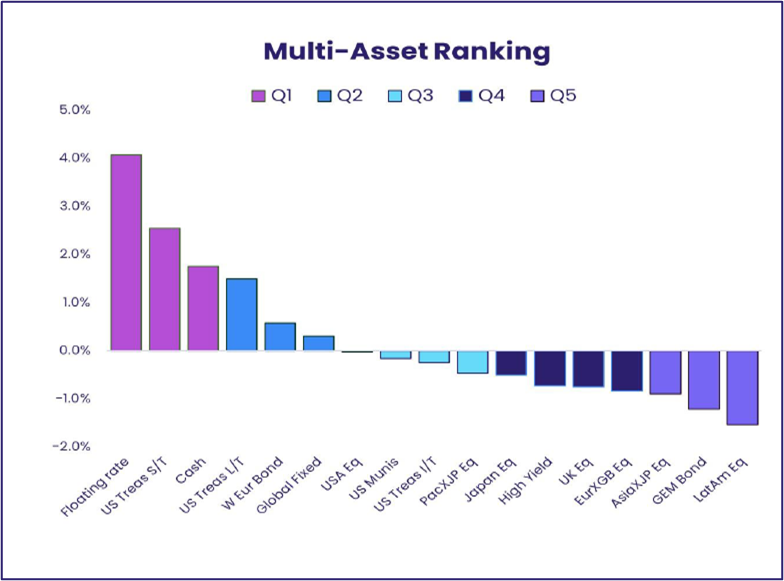

EPFR’s weekly Multi-Asset Rankings currently have global bonds in the middle of the pack, with floating rate debt, short-term Treasuries and cash occupying the top quintile. At the same point last year, cash, intermediate term treasuries and cash occupied the top three slots.

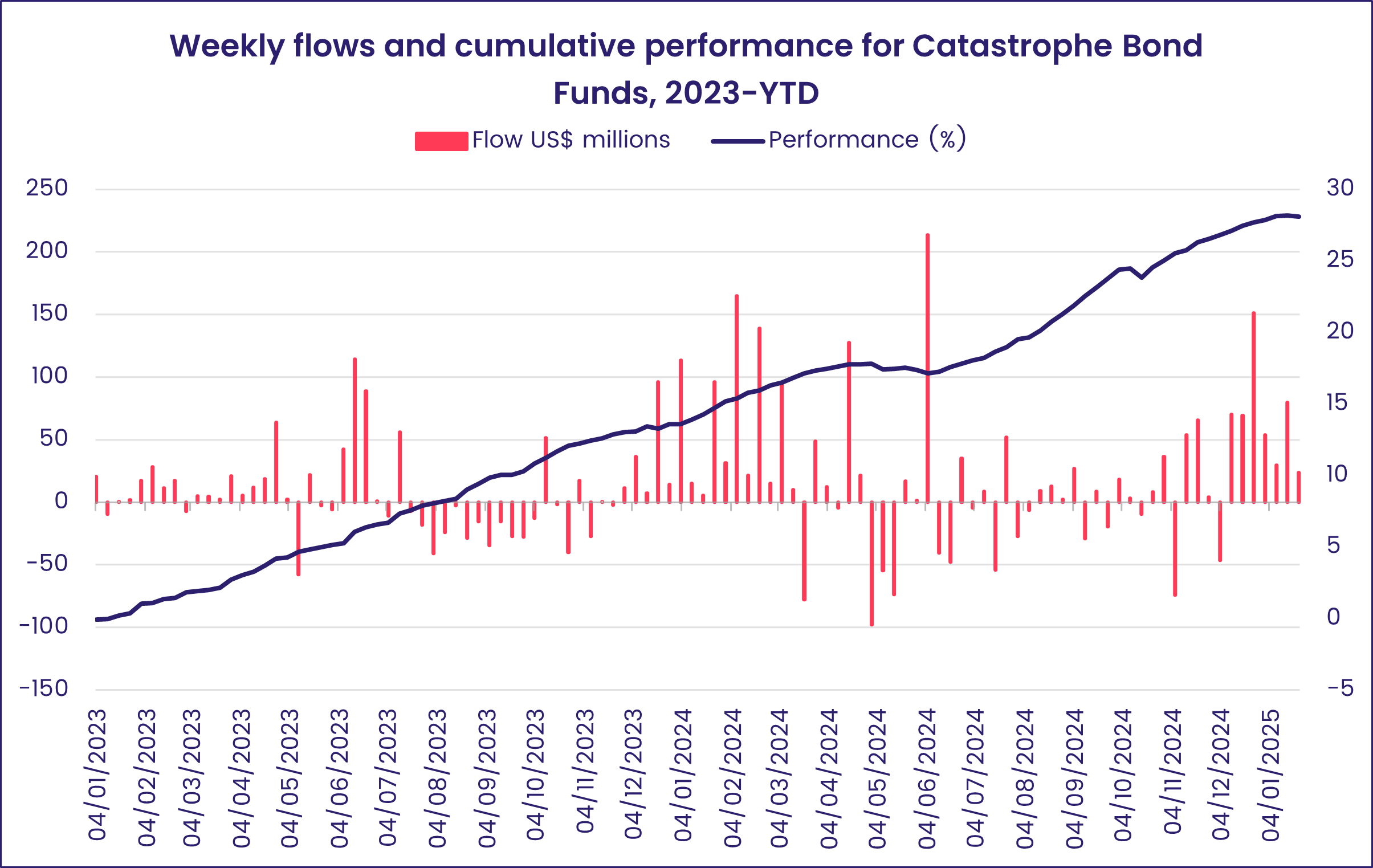

With fires still burning in and around Los Angeles, catastrophe bonds have found themselves in the spotlight again. Issued as a way of spreading the risk of extreme events from insurers to investors, the triggers have proved hard to pull, limiting the hit to investors from several major hurricanes. Despite the fires in California, the Catastrophe Bond Funds tracked by EPFR have now posted inflows for seven straight weeks.

Elsewhere, Europe Investment Grade Corporate Bond Funds remain popular, attracting fresh money for the 27th week since the beginning of 3Q24. Funds with corporate mandates have recorded a bigger collective inflow than their sovereign counterparts during three of the past four weeks. Several major dedicated country groups saw significant movement, with redemptions from both Spain and UK Bond Funds exceeding $250 million and flows into Italy Bond Funds climbing to a seven-week high.

Among the drivers of the headline number for US Bond Funds were Municipal Bond Funds, which recorded their biggest weekly inflow since EPFR started tracking them in 1Q04, and funds with short duration mandates.

Both Hard and Local Currency Emerging Markets Bond Funds posted modest outflows during a week when redemptions from Asia ex-Japan Bond Funds hit a nine-week high and EMEA Bond Funds extended their longest inflow streak since early 3Q24 on the back of record-setting flows into Turkey Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.