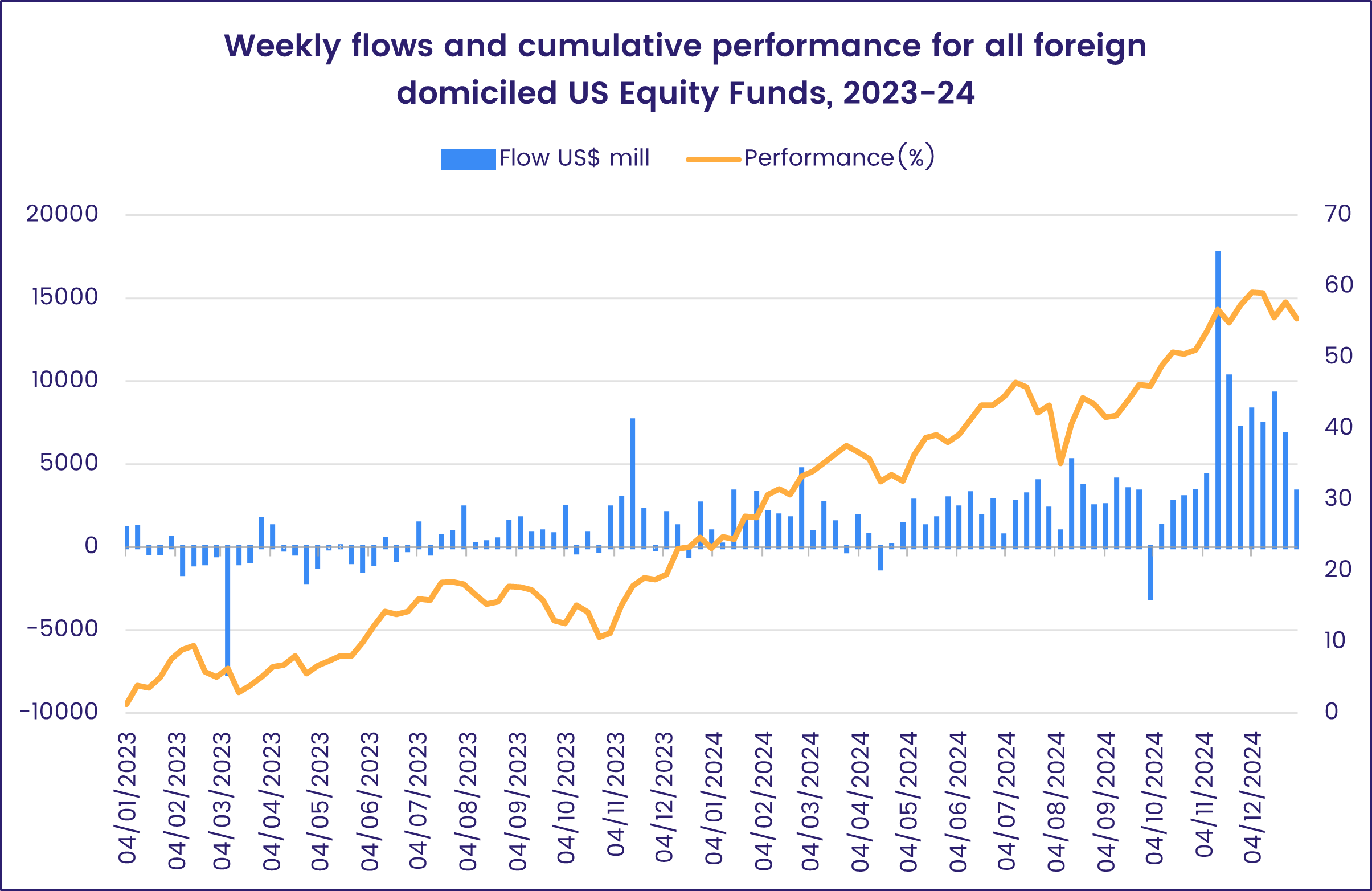

The first two months of 2024 saw Japan, India, Technology and China Equity Funds absorb a net $5.2 billion, $10.7 billion, $14.1 billion and $44.6 billion, respectively, while US Equity Funds pulled in a minimal $3.4 billion. During the final two months of last year, however, US Equity Funds added $174 billion as they set a new full-year inflow record while flows to the other groups ranged from an outflow of over $10 billion for Japan Equity Funds to an inflow of $2.2 billion for China Equity Funds.

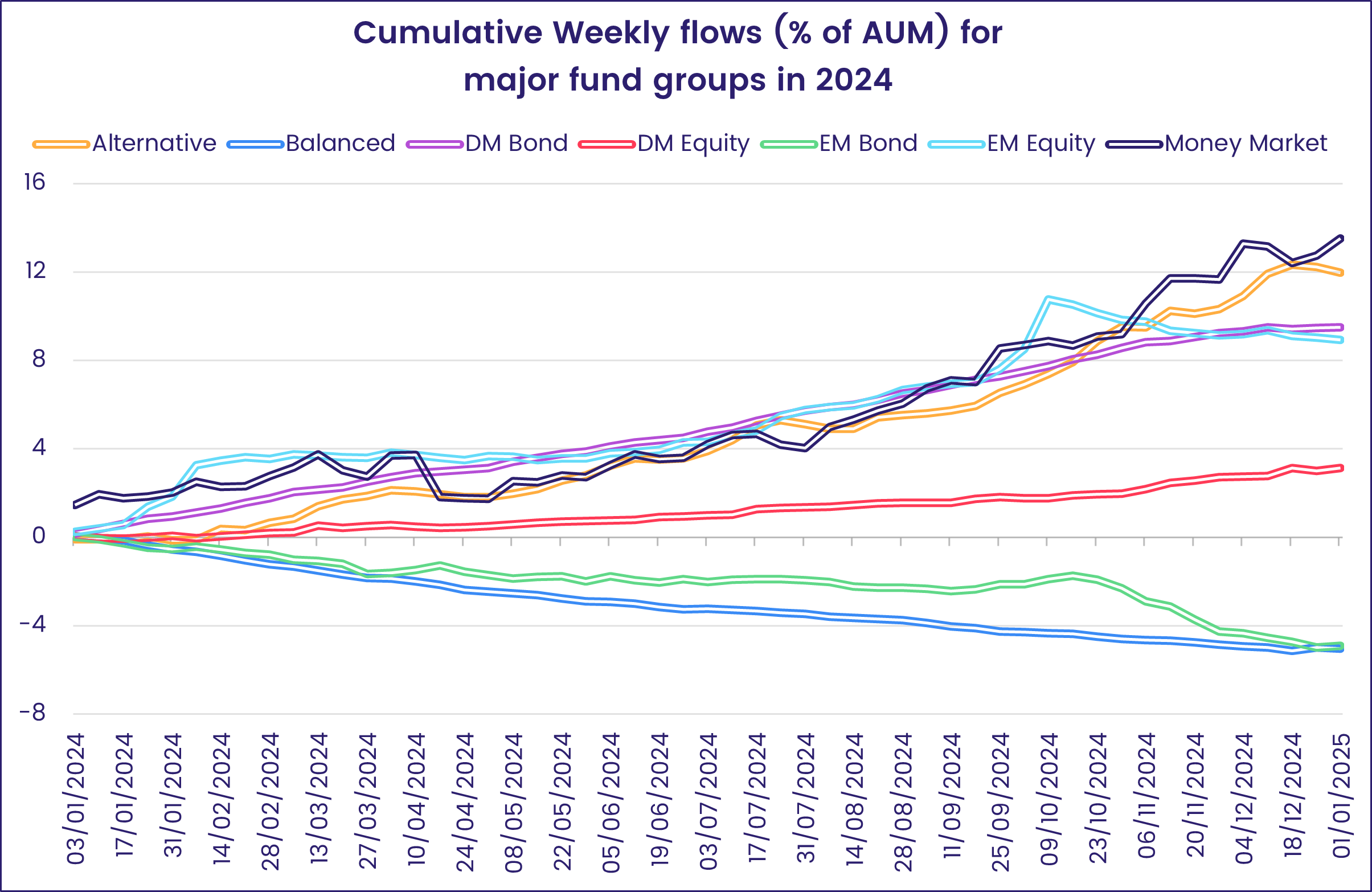

With Europe Equity Funds out of favor for most of 2024, a year that started with investors positioning themselves for Indian growth, a Chinese rebound, Japanese normalization and the artificial intelligence story ended in a star-spangled burst that saw a combined $503 billion flow into US Equity, Bond and Money Market Funds between Nov. 1 and Dec. 31.

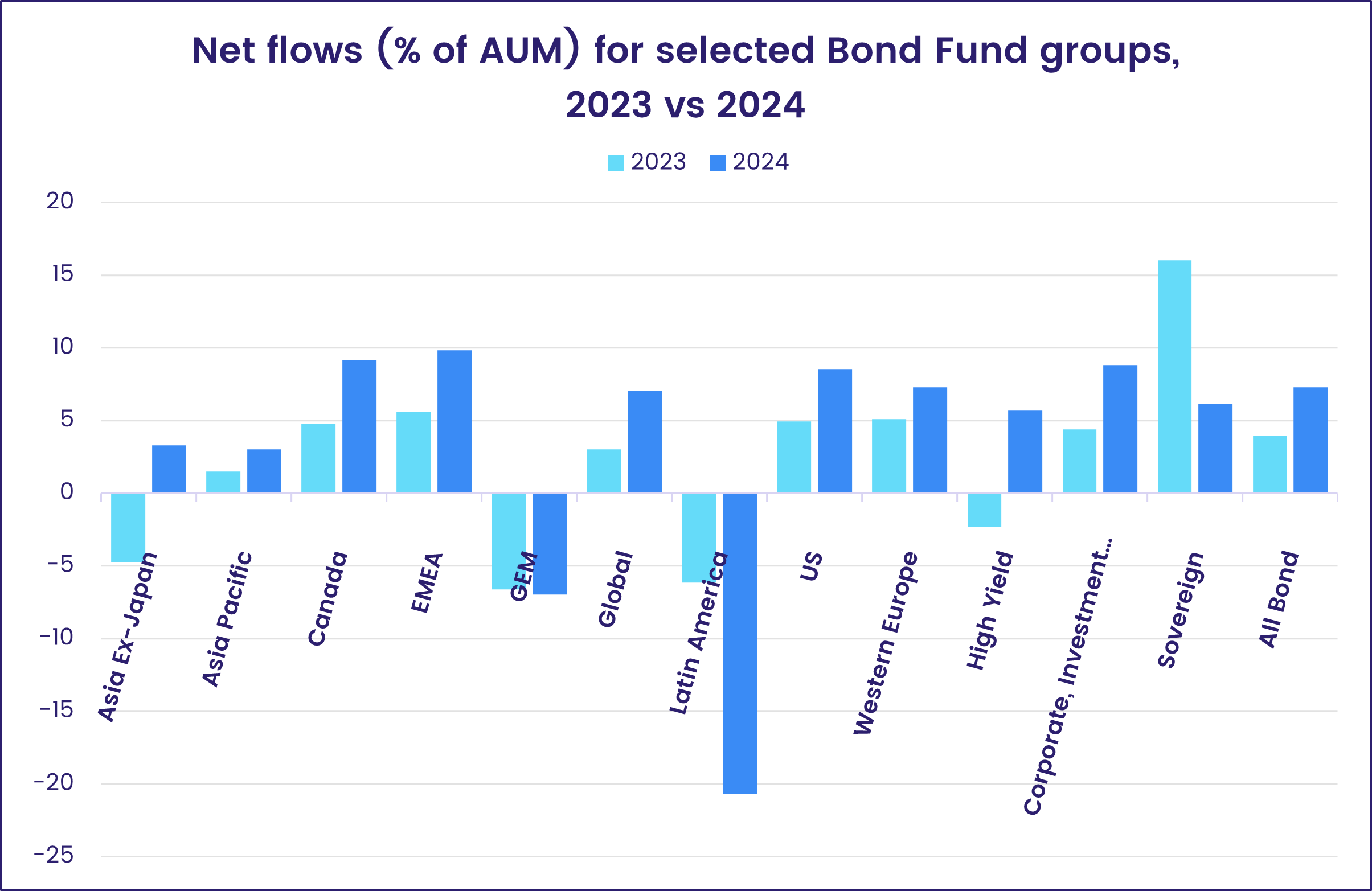

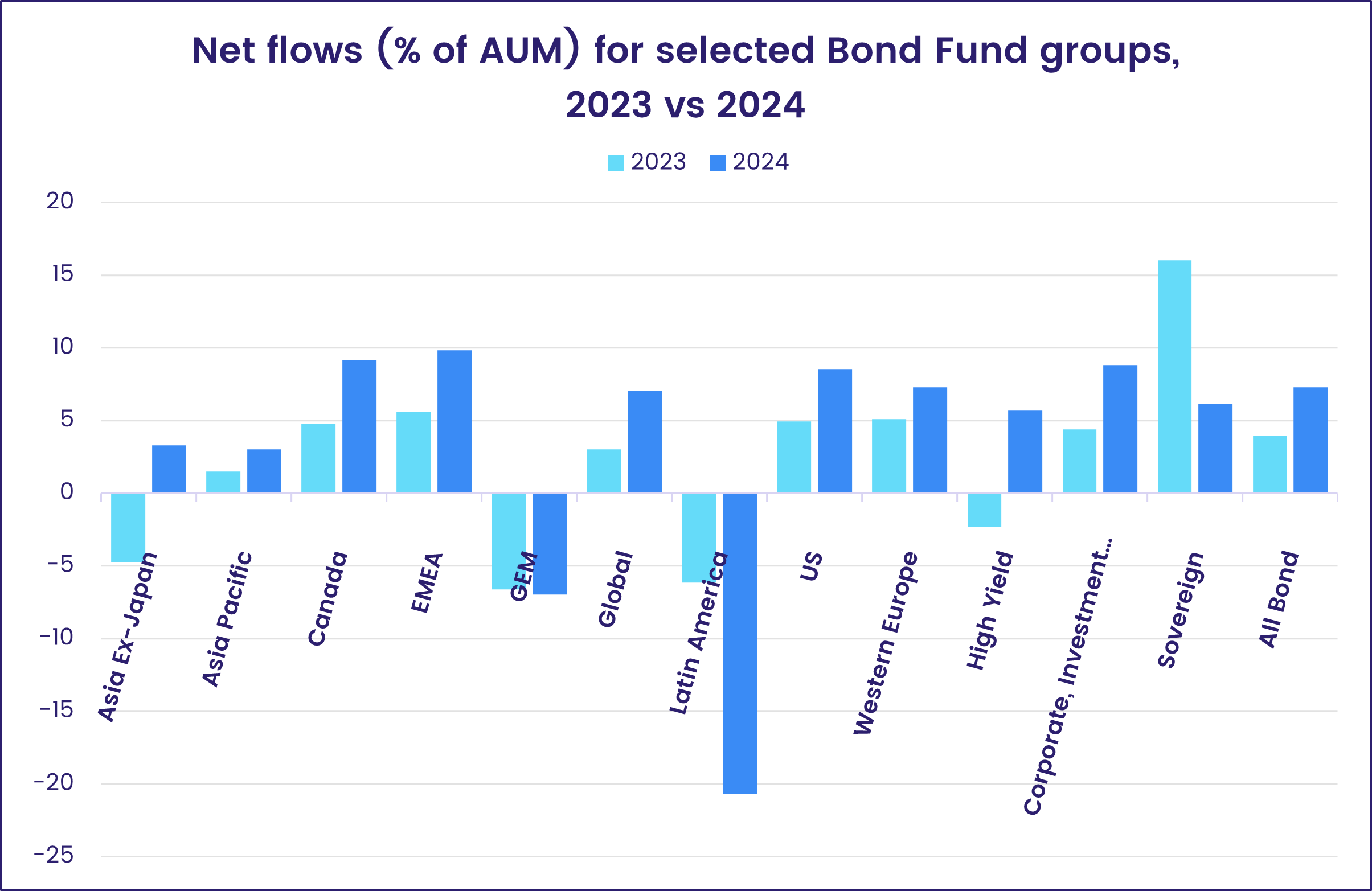

US exceptionalism was less pronounced in the fixed income space where, despite a marked loss of momentum as the fourth quarter progressed, EPFR-tracked Bond Funds collectively set a new annual inflow record.

Last year was also a record-setting one for exchanged traded funds (ETFs), with both Equity and Bond ETFs setting new inflow records.

Overall, Equity Funds pulled in a net $24.9 billion during the final week of December, with Bond Funds absorbing $2.1 billion and Money Market Funds $65.2 billion. Both Balanced and Alternative Funds experienced net redemptions.

At the single country and asset class fund level, China Bond Funds posted their biggest inflow since mid-1Q22, redemptions from South Africa Money Market Funds hit a 21-week high and Greece Equity Funds extended an outflow streak stretching back to the second week of June. Dividend Funds posted their 27th inflow during the past 30 weeks, Cryptocurrency Funds recorded consecutive weekly outflows for the first time since early September and Mortgage-Backed Bond Funds chalked up their first outflow in over four months.

Emerging Markets Equity Funds

EPFR-tracked

Emerging Markets Equity Funds started 2024 with their fifth straight inflow. They ended the year by posting 10 outflows over the final 12 weeks as Europe’s economic struggles, the lukewarm response to

China’s stimulus measures and less bullish forecasts for US interest rate cuts took their toll on investor sentiment.

The final week of the year was marked by the 24th consecutive outflow from retail share classes, the third straight inflow for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates and 44th inflow year-to-date for EM Dividend Funds.

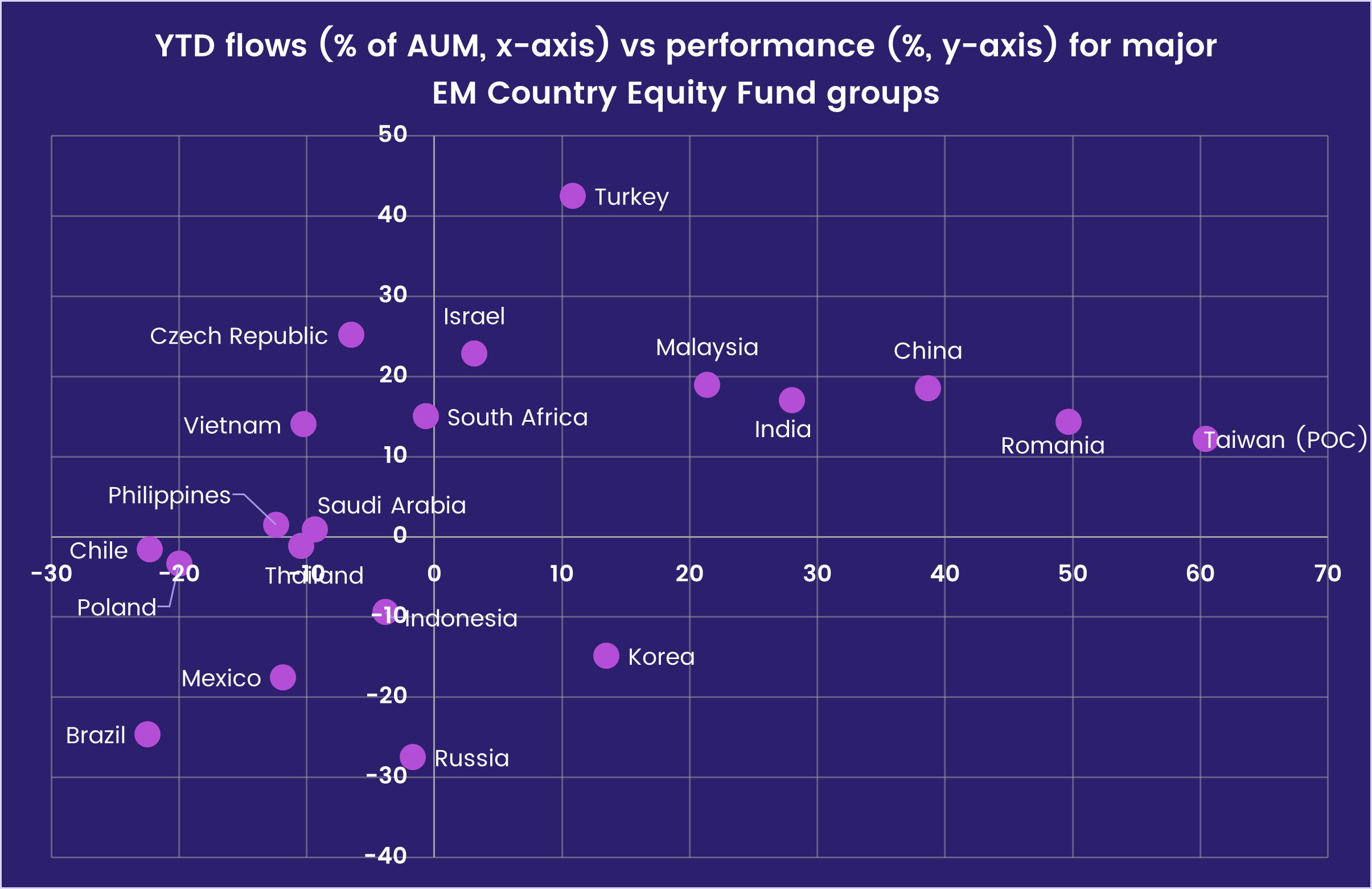

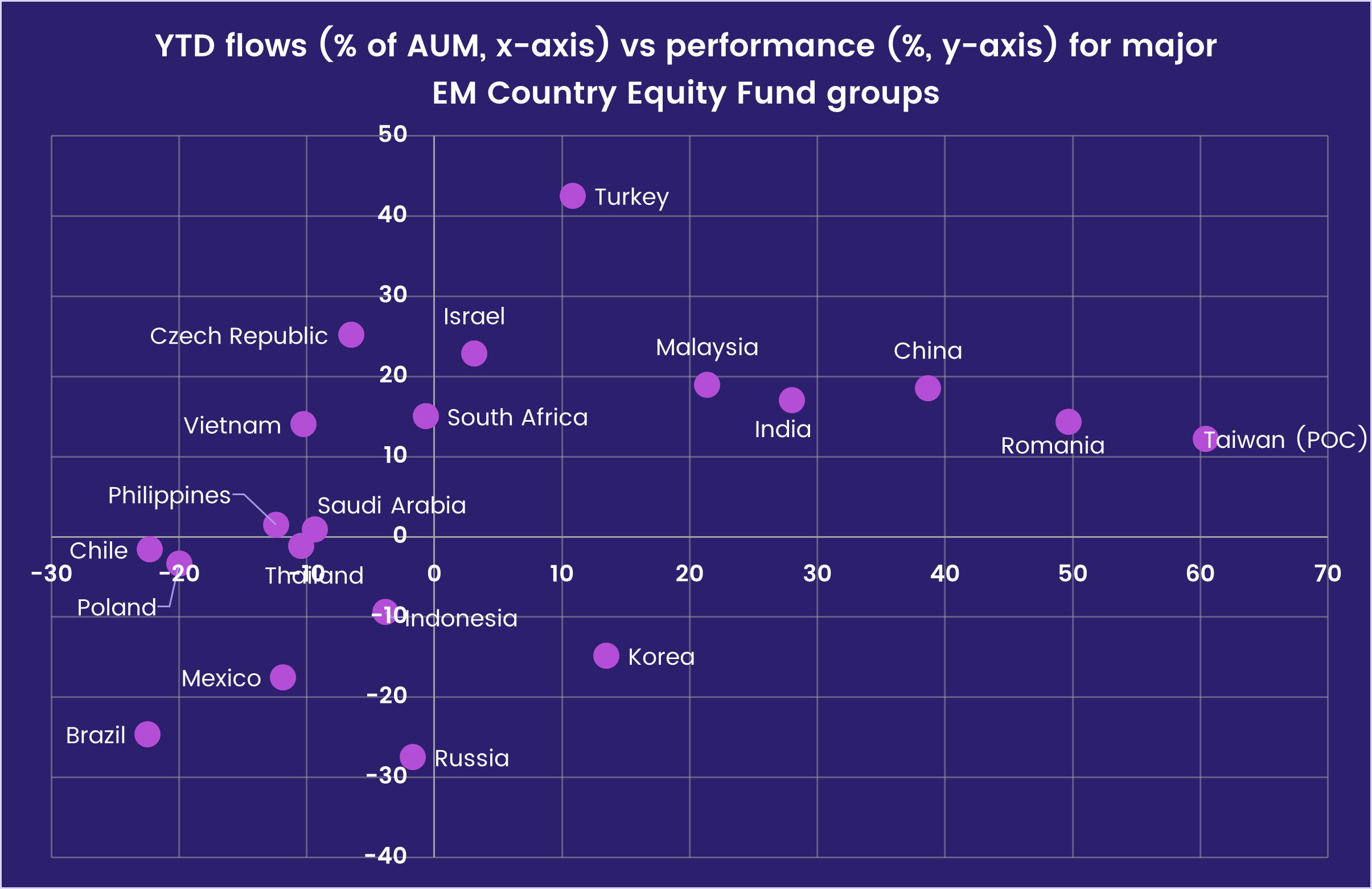

Although China Equity Funds posted their 11th outflow since mid-October, they ended 2024 having set a new full-year inflow mark, something also achieved by India Equity Funds and Taiwan (POC) Equity Funds. India’s growth, which has put the country on track to surpass Japan as the world’s fourth largest economy in terms of nominal GDP, and Taiwan’s central role in the artificial intelligence story kept the money flowing to both groups for much of the year.

The shadow cast by funds dedicated to Emerging Asian heavyweights left Latin America and EMEA Equity Funds struggling for attention. In the case of Latin America, the rise of statist, left-of-center governments, questions about Chinese demand for the region’s commodity exports and the uncertain short-term future for green energy projects and the demand for lithium and copper that come with them were among the headwinds. The final week of December saw Latin America Equity Funds chalk up their fifth-largest outflow of the year as redemptions from Brazil and Chile Equity Funds hit seven and 51-week highs, respectively.

Among the major groups by geographic focus, EMEA Equity Funds were the only ones to carry some momentum – in flow terms – into 2025. The overall group posted its third straight inflow, thereby extending its longest inflow streak since July, as investors continue to position themselves for some kind of ceasefire between Russia and Ukraine. Russia Equity Funds ended 2024 with their biggest inflow since the week after the invasion of Ukraine.

Developed Markets Equity Funds

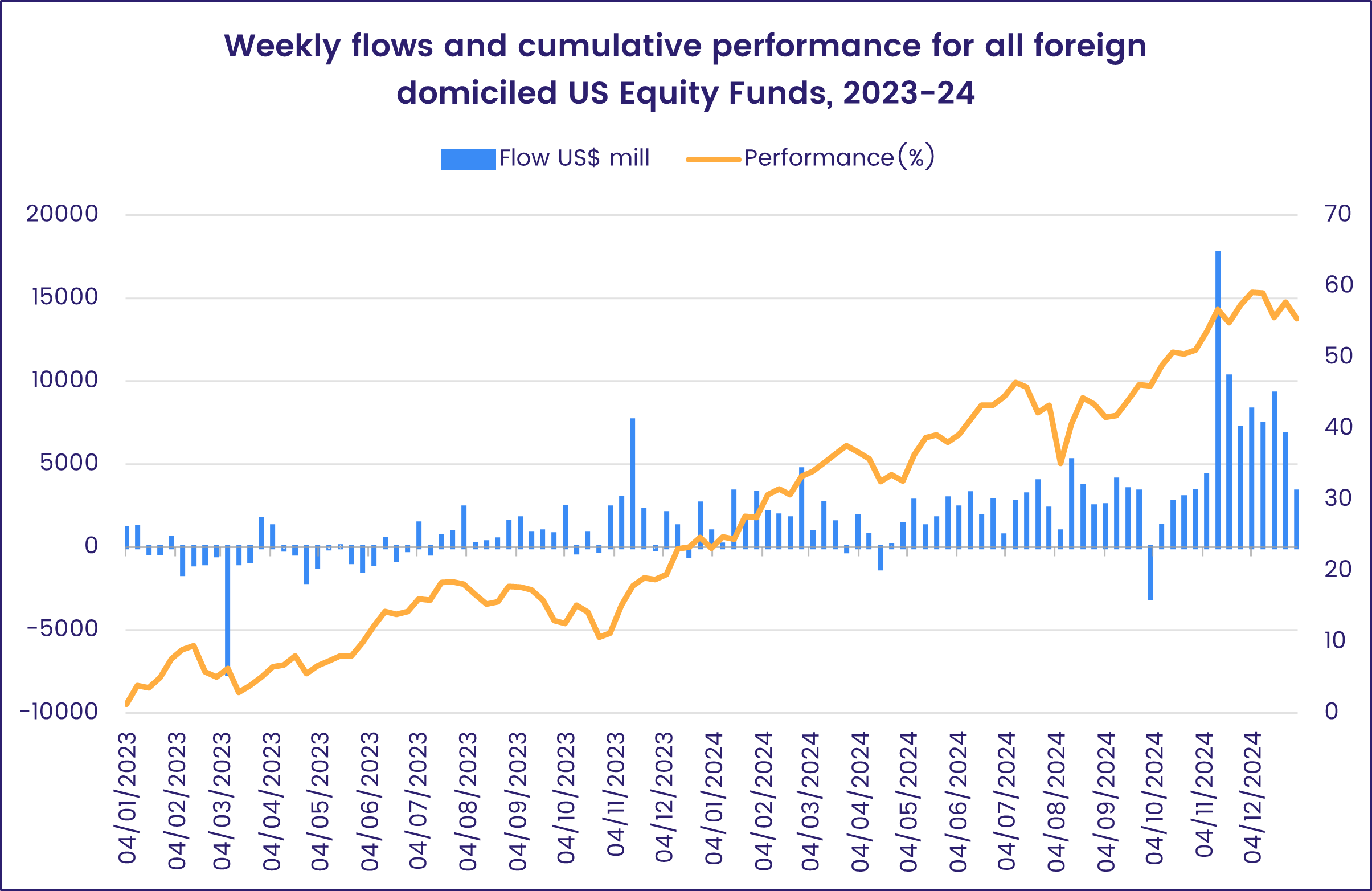

US Equity Funds ended 2024 at the gallop, absorbing another $25 billion and dragging the headline number for all EPFR-tracked Developed Markets Equity Funds into positive territory despite another week of outflows from both Japan and Europe Equity Funds. The overall number for the year ended up falling well off the record $777 billion that flowed in during 2021.

With major US stock indexes hitting multiple record highs during the year, the collective gain for all

US Equity Funds going into December was over 25%. At the individual fund level, performance ranged from a low of -98% to over 1,600%.

The top performers were dominated by leveraged single stock funds dedicated to either Nvidia or Palantir. In 2023, the range was -42% to 136%.

US Equity Funds ended 2024 with consecutive weekly flows into retail share classes for the first time since early February 2023 and the biggest flow into US Equity Collective Investment Trusts (CITs) since the first week of 3Q22. Foreign-domiciled funds added to their latest inflow streak, although flows are losing momentum.

Investors’ enthusiasm for US exposure was in stark contrast to their aversion to Europe-mandated funds, falling interest rates and expectations of a ceasefire between Russia and Ukraine notwithstanding.

Europe Equity Funds posted their 46th outflow over the past 52 weeks as energy prices moved higher, bank lending to both consumers and businesses remains subdued and

the regions two leading countries, Germany and France, mark time with what are effectively caretaker governments.

Global sector, Industry and Precious Metals Funds

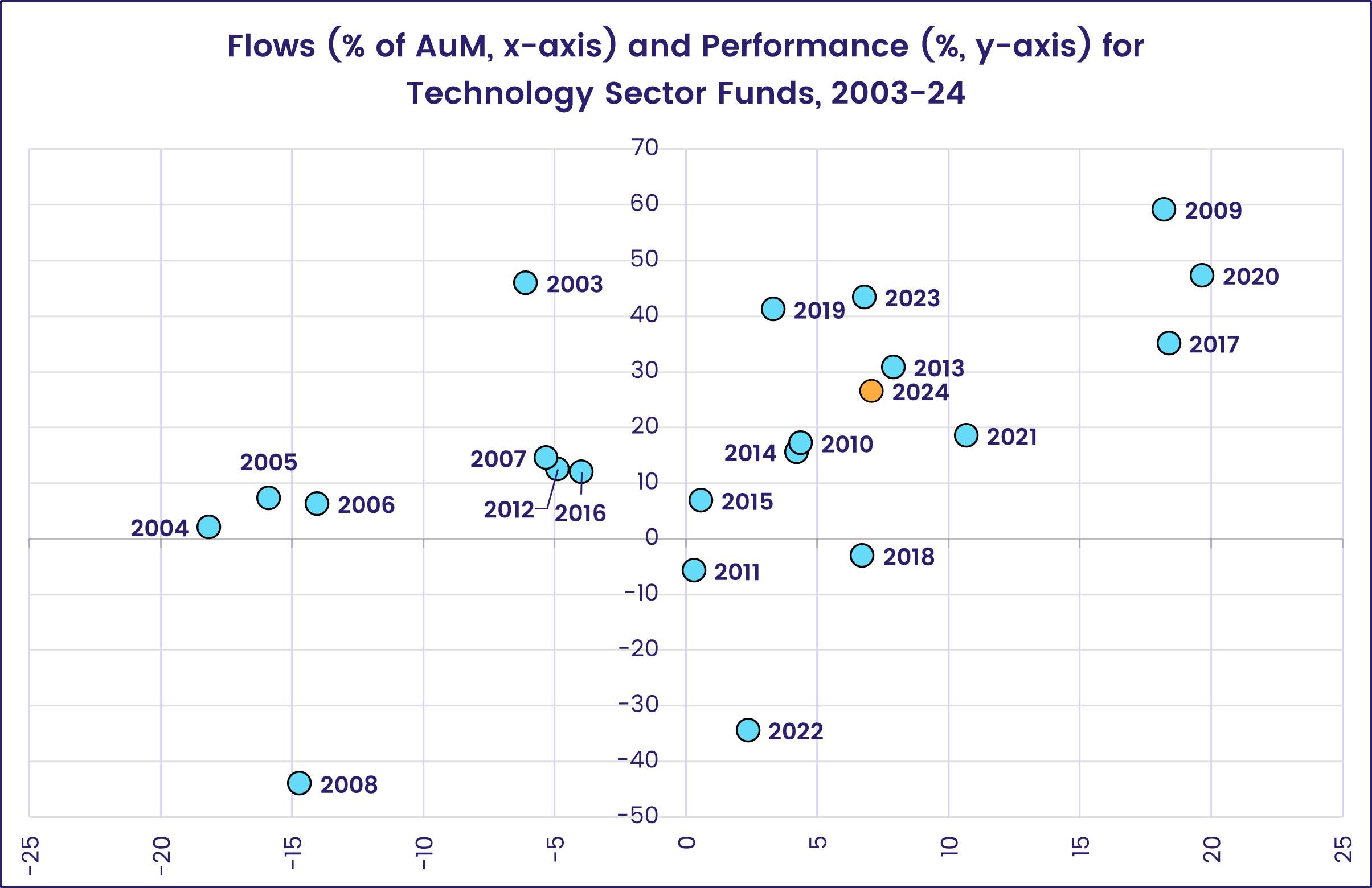

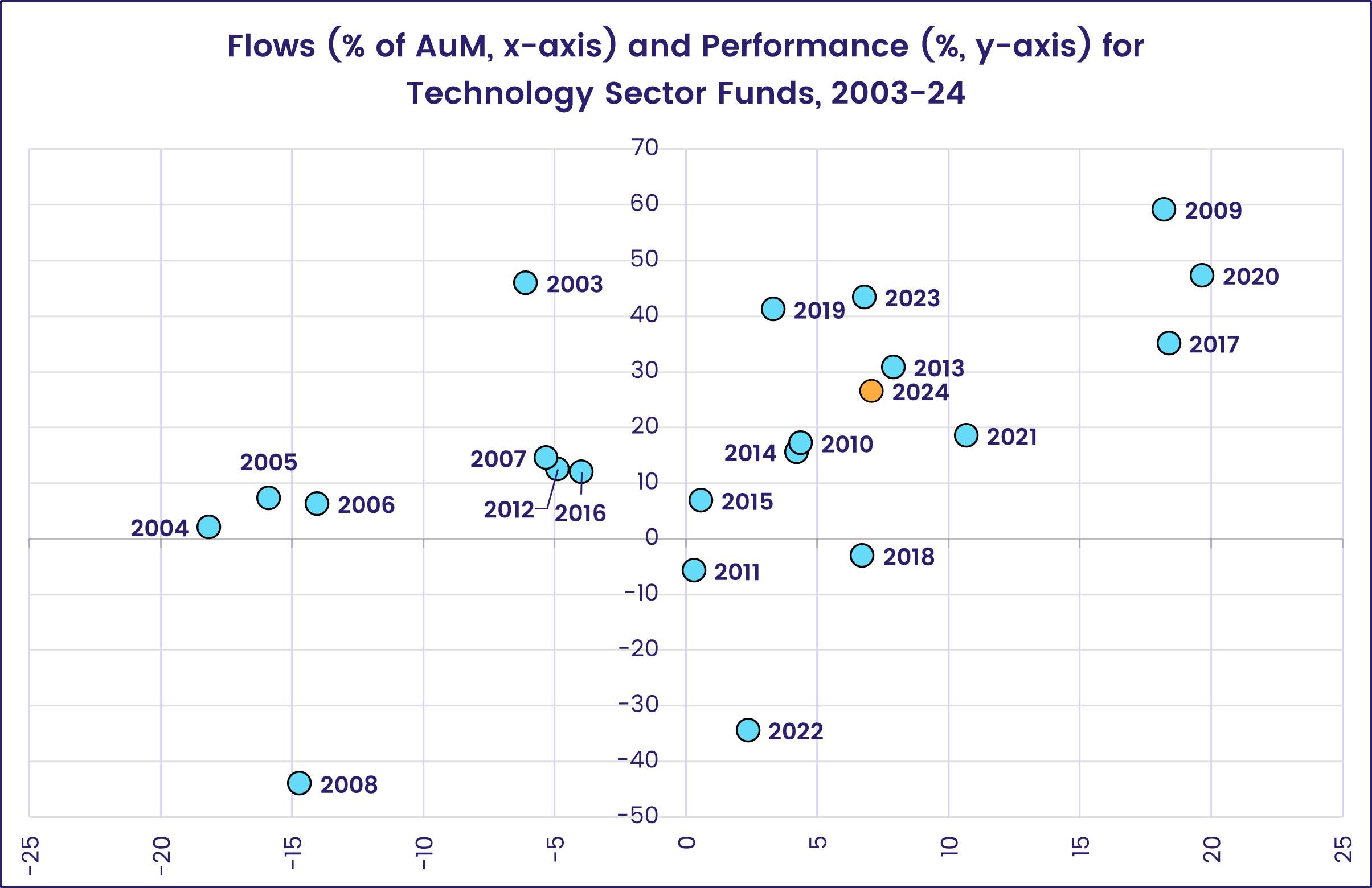

In the final week of 2024, just three of the 11 EPFR-tracked Sector Fund groups saw net inflows, all of which were below the $75 million mark. Redemptions for the remaining eight groups ranged from $250 million for Utilities Sector Funds to another $1.27 billion for Technology Sector Funds.

Full year inflows in 2024 for Technology Sector Funds would have topped $60 billion if it weren’t for the last five weeks, which saw consistent redemptions totaling $7.67 billion as the consensus for US interest rates in 2025 took a turn towards higher-for-longer, investors in Chinese indexes capitulated and the outlook for additional state support dimmed.

Drilling down, Artificial Intelligence Funds ended the year with eight consecutive inflows. The yearly total topped $6 billion – mostly due to the run-up in the first half of the year – which exceeded the previous year’s inflow by $1.5 billion. Despite recent weekly redemptions, Semiconductor & Chip Industry Funds have accounted for nearly half of this year’s inflow for all Technology Sector Funds. The subgroup nearly doubled its inflow record of $13 billion in 2022 as inflows climbed to over $22.4 billion during the past year. Meanwhile, redemptions hit an all-time high of $2.7 billion for Internet Funds in 2024, snapping a four-year streak of inflows.

Energy Sector Funds saw a record $21 billion flow out in 2024, topping the previous year by $1.1 billion. Driving a third of that headline number were those with SRI/ESG mandates, as outflows reached an all-time high of $7.2 billion. At the fund-level, looking among the top 20 with the heaviest overall redemptions this year, $5.4 billion collectively flowed out of seven funds with SRI/ESG mandates, another two funds focused on oil & gas accounted for $4 billion and three MLP energy funds surrendered a combined $1.5 billion.

Consumer Goods Sector Funds saw $14.2 billion flow out in 2024, topping their previous 2016 outflow record by roughly $4 billion. Contributing to the headline number were

Electric Vehicle (EV) Funds which experienced net redemptions of $2.5 billion during a year when the US and European Union imposed much higher tariffs on green vehicles from China, charging infrastructure struggle to be reliable, and sales growth stalled among many major EV companies.

Bond and other Fixed Income Funds

Provisional numbers indicated that EPFR-tracked Bond Funds limped into 2025 having set – by the skin of their teeth – a new full-year inflow record. But, after a year where expectations of interest rate cuts kept investors engaged, they are approaching the New Year in a much more cautious frame of mind. Over the horizon are a new US administration with no obvious plans to rein in the federal deficit, persistent inflation that is curbing central bankers’ appetite for further interest rate cuts and high yield spreads testing record lows.

The latest week’s collective inflow was the third-smallest of 2024, and encompassed the second outflow from US Bond Funds since late 4Q23, the end of Mortgage-Backed Bond Funds latest inflow streak and the extension of the longest run of consecutive outflows for High Yield Bond Funds in over 13 months.

Emerging Markets Bond Funds did end the year with an inflow, their first in 11 weeks, that was underpinned by the biggest flows into China Bond Funds since early 2022.

Short Term US Treasury Funds enjoyed another solid week, taking in over $1.5 billion, as investors remained cautious about their duration risk in the face of a US deficit running at over 6% of GDP. Foreign domiciled funds recorded bigger inflows than their domestically based counterparts for the second straight week.

While the US Federal Reserve is now expected to limit itself to two 0.25% rate cuts in 2025, the European Central Bank is seen as a good candidate for 100 basis points of easing over the next 12 months. Europe Bond Funds added to their record-setting total, with corporate debt funds accounting for the biggest share of the full-year headline number for the first time since 2019.

The major EPFR-tracked multi asset fund groups started 2024 by posting inflows. They ended it by posting outflows, with Balanced Funds seeing money flow out for 49th time year-to-date and redemptions from Total Return Funds hitting a 61-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.