Investors committed another $151 billion to all US Equity, Money Market and Bond Funds during the second week of November as they adjusted their expectations in light of the Nov. 5 election. That contest saw former president Donald Trump win another term and the Republicans secure majorities in both houses of Congress.

The latest week was also marked by record-setting flows into Cryptocurrency and Momentum Funds, the first signs of the expected pivot from fixed income asset classes to equity in the wake of the US Federal Reserve’s interest rate cut in late September and further redemptions from funds with European and emerging markets mandates.

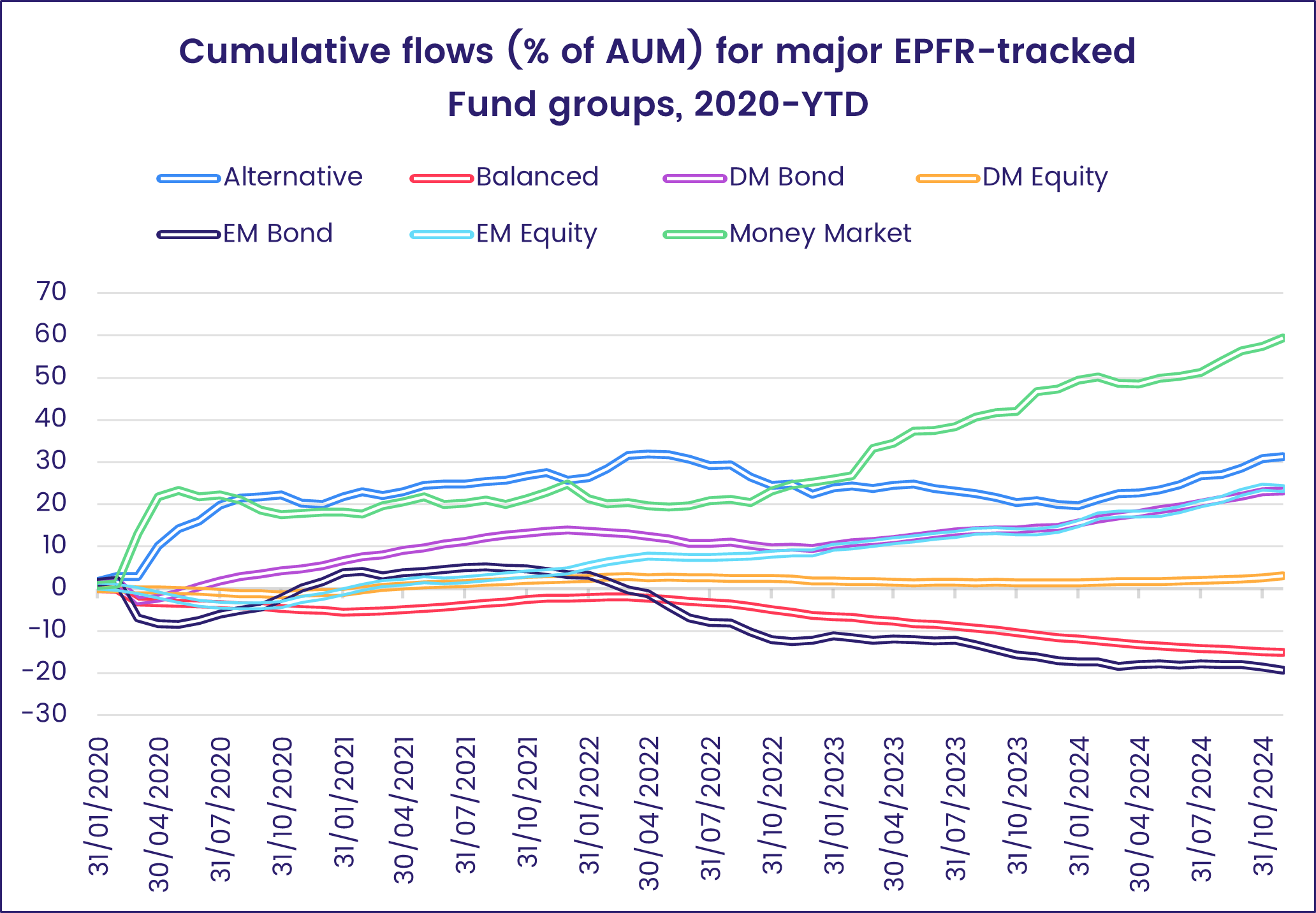

Overall, EPFR-tracked Equity Funds posted their biggest collective inflow since the second week of March, with flows into Dividend Equity Funds hitting a 32-week high, while Bond Funds attracted the smallest amount of fresh money since their current inflow streak started in late 2023. Investors steered another $4.9 billion into Alternative Funds and $97.6 billion into Money Market Funds while redemptions from Balanced Funds totaled $619 million.

At the single country and asset class fund level, flows into Turkey Money Market and Russia Equity Funds climbed to nine and 22-week highs, respectively, another $487 million flowed into Canada Bond Funds and New Zealand Equity Funds recorded their biggest outflow since late January. Physical Gold Funds chalked up their biggest outflow since late 3Q22, Total Return Funds experienced net redemptions for the first time in four months and flows into Catastrophe Bond Funds hit a 22-week high.

Emerging Markets Equity Funds

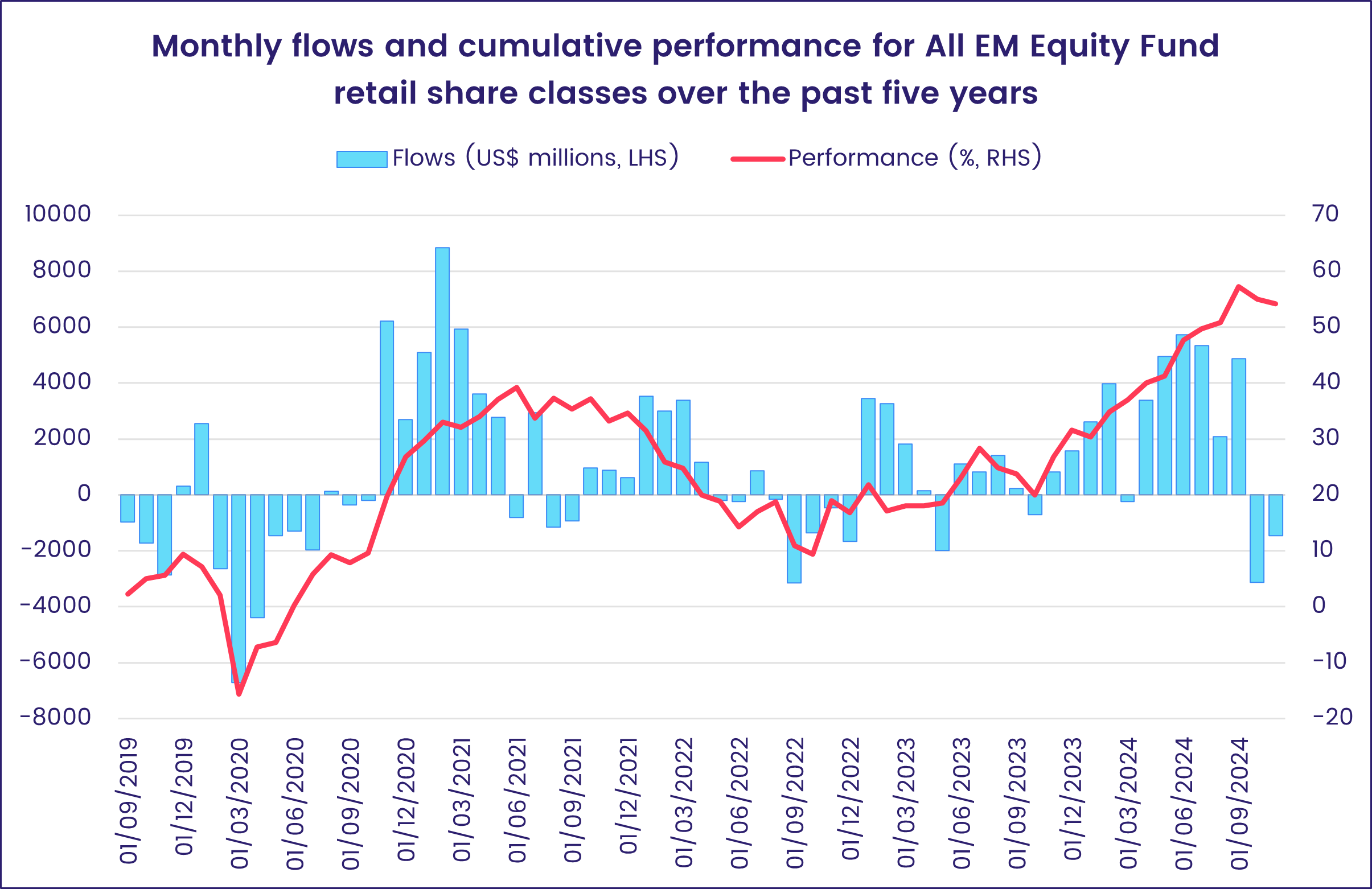

Disappointment with the latest Chinese stimulus measures and the prospect of more tariffs when US President-elect Donald Trump takes office next year ramped up the pressure on EPFR-tracked Emerging Markets Equity Funds during the second week of November. All of the major groups by geographic focus recorded outflows that ranged from $190 million – a new record – for Frontier Markets Funds to $5.2 billion for Asia ex-Japan Equity Funds.

Retail share classes were hit hard during the week ending Nov. 13, experiencing their heaviest redemptions since late 3Q22 when markets were braced for further US interest rate hikes.

Investor fatigue with Brazil’s lack of fiscal discipline, recurring inflation and reliance on Chinese demand for its commodity exports hit Brazil Equity Funds in mid-November, with outflows climbing to their highest level since the third week of February. Allied to redemptions from Chile, Mexico and Latin America Regional Equity Funds, that pushed the headline number for all Latin America Equity Funds to a 31-week high.

EMEA Equity Funds also saw over $200 million flow out, with the main driver a single fund in the Middle East Regional Fund group. Romania Equity Funds did record their 70th inflow since the beginning of 2Q23, but South Africa, Turkey and Saudi Arabia Equity Funds all posted outflows.

Among the Asia ex-Japan Country Fund groups, China Equity Funds posted their fifth straight outflow during a week when Chinese policymakers announced further stimulus measures focused on local government debt, the reality of a second Trump administration in the US set in and inflation data showed producer pricing power remains weak. Redemptions from foreign domiciled China Equity Funds hit a level last seen in early 3Q15 and funds with mandates to invest in Chinese state-owned enterprises (SOE) posted their 12th outflow over the past 15 weeks.

Investors retained their appetite for the other Greater China markets, with Hong Kong (SAR) Equity Funds posting their 21st inflow since the beginning of June and Taiwan (POC) Equity Funds extending an inflow streak stretching back to mid-June.

Developed Markets Equity Funds

Flows into US Equity Funds continued their post-election surge during the second week of November as investors scrambled to position themselves for Republican Donald Trump’s second stint in the White House. Allied to strong flows into Global and Canada Equity Funds and more modest commitments to Japan Equity Funds, this lifted the headline number for all EPFR-tracked Developed Markets Equity Funds to a 191-week high.

The latest flows into US Equity Funds included only the third week of net retail inflows, the biggest inflow for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates in exactly a year and a 10th inflow over the past 12 weeks for US Dividend Equity Funds.

Appetite for US stocks is also fueling a surge in selling by corporate insiders. Analysis by Senior Liquidity Analyst Winston Chua shows the ratio of selling to buying of company shares by officers required to Form 4 with the SEC running at 50-to-1 over the past 12 weeks, compared to 13-to-1 during the first half of the year.

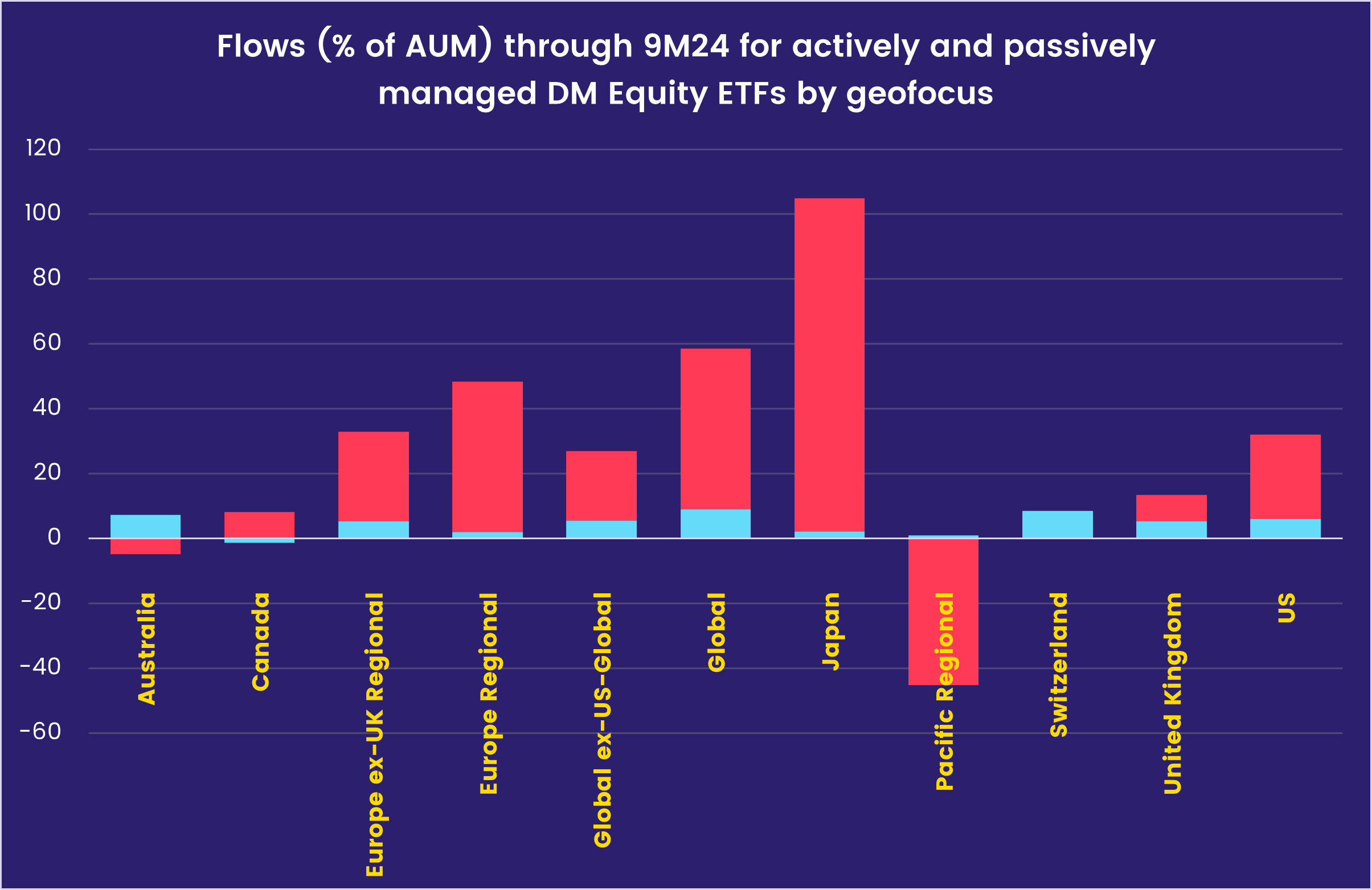

Investors, meanwhile, are gravitating to actively managed US Equity ETFs which, through the end of the third quarter, have attracted nearly six times the amount of fresh money that their passively managed counterparts have pulled in

This preference for actively managed ETFs is also evident among Japan Equity Funds, which recorded a small collective inflow during the second week of November. A snap election in October has left the country with a minority government that is working on another stimulus package to bolster the country’s fragile consumer sentiment.

Meanwhile, another G10 nation – Germany – is preparing for a snap election, following in the footsteps of Japan, France and the UK. Germany’s lack of political cohesion at a time when its economy faces multiple challenges has created another headwind for Europe Equity Funds, which saw over $3 billion flow out during the latest week. At the country level, UK Equity Funds did post consecutive weekly inflows for the first time since early 1Q23 while outflows from Norway and Switzerland Equity Funds hit 26 and 73-week highs, respectively.

Global Equity Funds, the largest of the major diversified Developed Markets Equity Fund groups, posted their biggest inflow since 1Q22 despite extending their longest run of retail redemptions in over two years.

Global sector, Industry and Precious Metals Funds

For the first time in five weeks, the number of EPFR-tracked Sector Funds reporting inflows outweighed those with outflows as six of the 11 major groups took in fresh money, ranging from $67 million for Infrastructure Sector Funds to another $2.5 billion for Financials Sector Funds.

With US President-elect Donald Trump promising a more sympathetic approach to fossil fuels, China announcing more stimulus measures and the COP29 summit on climate change taking place in Azerbaijan, the energy sector was front and center during the week ending Nov. 13. Energy Sector Funds with SRI/ESG mandates posted their biggest collective outflow since EPFR started tracking these funds in 2006.

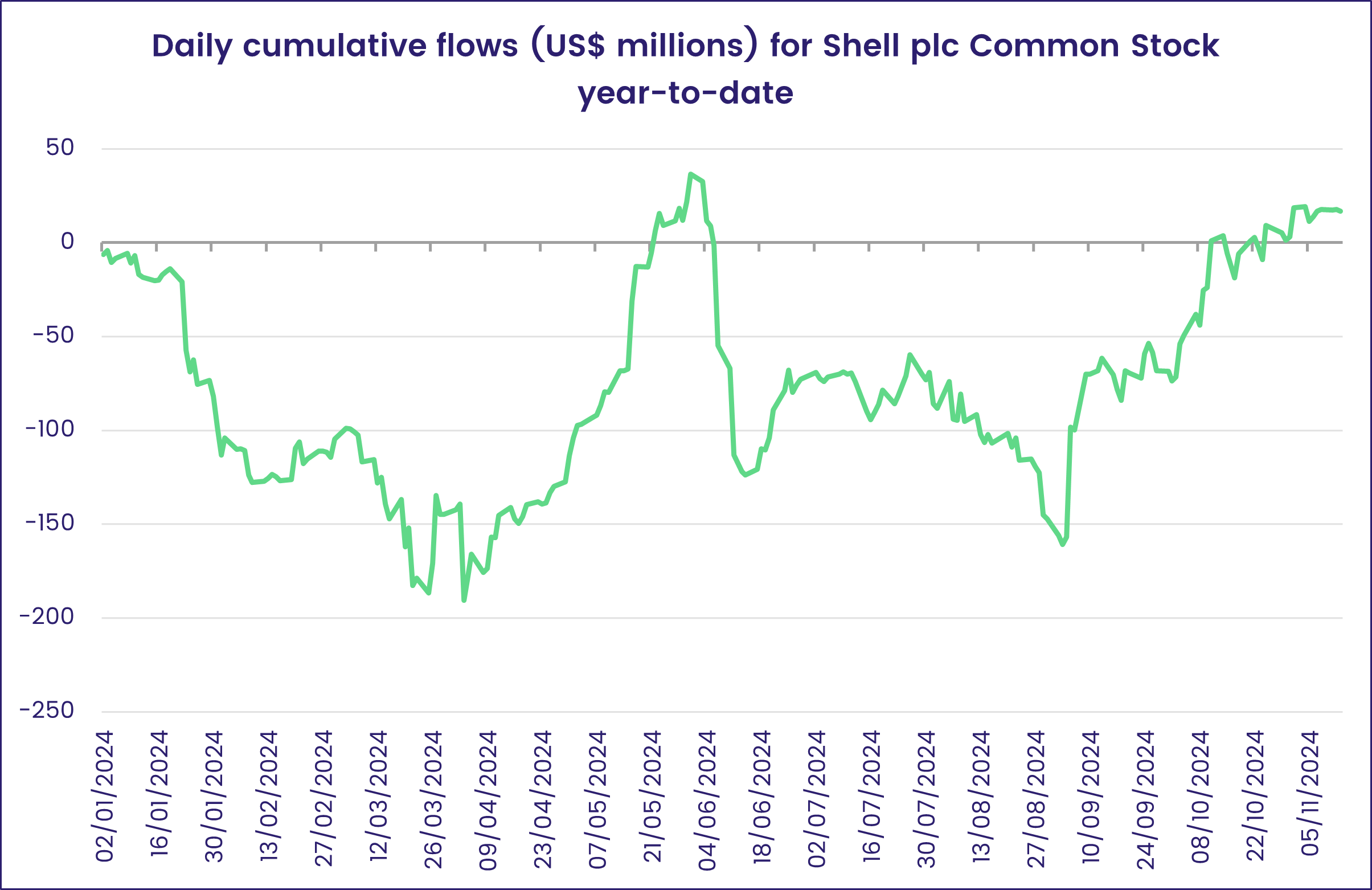

Though Energy Sector Funds did, overall, extend their redemption streak, it was the smallest outflow of the past five weeks as Oil & Gas Funds took in fresh money. Inflows for that subgroup climbed to roughly $330 million this week, the most since late last year, as oil major Shell won its appeal against a major 2021 ruling on its carbon emissions.

Among the groups posting outflows were Technology Sector Funds, which saw three major themes – semiconductors, leverage and Chinese innovation – turn against them. A subset of Semiconductor & Chip Industry Funds saw outflows reach a 21-week high at over $1.1 billion while another $1.2 billion flowed out of a single China-dedicated ETF benchmarked to track the top 50 companies listed on the STAR market (Shanghai Stock Exchange Science and Technology Innovation Board). Leveraged Technology Sector Funds posted their first outflow in four weeks at nearly $300 million with single-stock focused ETFs on Nvidia and COIN taking the biggest hit.

Some technology tailwinds continue to blow. Software Funds offset half of those outflows with record-setting inflows at over $900 million, surpassing their previous all-time high of $790 million in this week a year ago. Internet Funds chalked up their second consecutive week of inflows and their fifth of the past eight weeks, Artificial Intelligence Funds absorbed a 15-week high inflow, and Cybersecurity Funds took in a small inflow after two weeks of outflows.

Bond and other Fixed Income Funds

Although their year-to-date run of inflows survived, EPFR-tracked Bond Funds ended the second week of November having recorded their smallest collective inflow since late 4Q23.

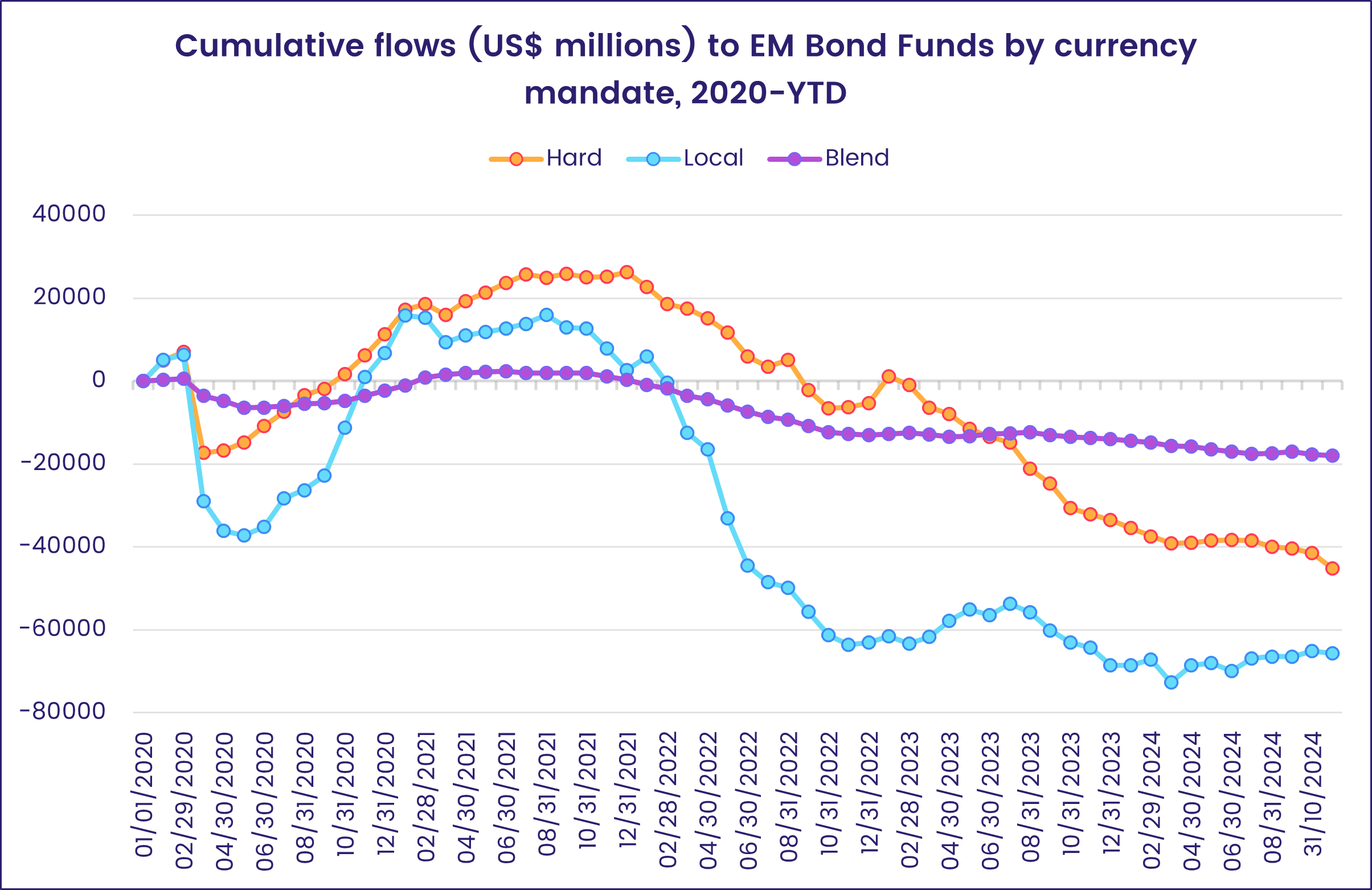

The perception that the policies advocated by the incoming Trump administration mean even higher US borrowing requirements and a squeeze on global trade that will complicate European and emerging markets debt calculations hit sentiment towards several major groups. Europe Bond Funds posted their first outflow since mid-August, and only their third YTD, while Emerging Markets Bond Funds chalked up their fourth consecutive outflow.

At the asset class level, flows into High Yield Bond Funds exceeded $2.5 billion and Bank Loan Funds posted their biggest inflow since the first week of 2Q22. Convertible Bonds eked out their seventh inflow over the past nine weeks while Convertible Contingent (CoCo) Bond Funds tallied consecutive weekly inflows for the first time since mid-March. Green Bond Funds recorded their biggest outflow in over four years and Total Return Funds saw a 17-week, $45 billion run of inflows come to an end.

Redemptions from Hard and Local Currency Emerging Markets Bond Funds were in the same ballpark, with investors generally avoiding diversified exposure but committing fresh money to China and Thailand Bond Funds, with the latter pulling in over $600 million.

Europe Bond Funds posted their latest outflow, which included only their second week of net retail redemptions during the past 12 months, against a backdrop of central bank policy meetings that saw the Bank of England and Sweden’s Riksbank cut their key rates while Norway’s central bank left its rate unchanged. Investors pulled the largest collective sum out of Europe Sovereign Bond Funds in exactly two years while corporate debt funds racked up their 13th straight inflow.

At the country level, both Spain and Denmark Bond Funds set new outflow records while redemptions from Germany Bond Funds climbed to an 18-week high.

Another cut in US interest rates, this time by 25 basis points, was marked by lackluster flows into most US Bond Fund groups. Intermediate term funds extended an inflow streak that started in late June while Long Term US Bond Funds chalked up their biggest outflow of the year so far.

Did you find this useful? Get our EPFR Insights delivered to your inbox.