EU and UK regulators are planning to scrutinize the role and transparency of environmental, social and governance (ESG) ratings providers. It is a potential can of worms, but they must open it.

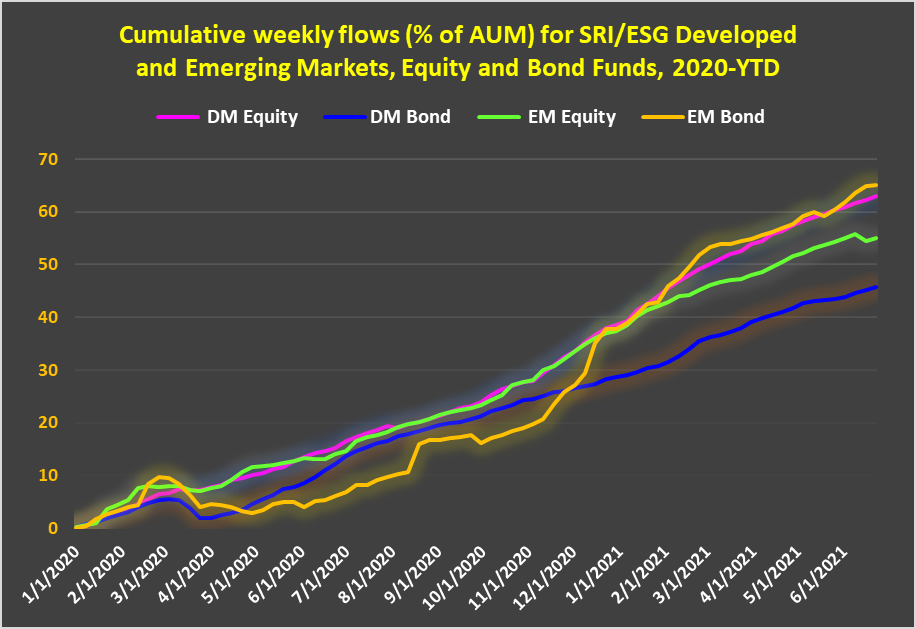

As ESG investments keep growing in popularity, many fund managers and financial advisers rely on ratings providers when picking funds and shares. Dramatic demand for these assets shows no sign of abating — socially responsible and ESG equity funds have just posted their 24th weekly inflow so far this year, according to EPFR data.

Watchdogs looking to protect sustainable investors have tightened the rules governing companies, fund managers and financial advisers. But ESG ratings agencies, whose grading of corporations and funds is a key step in the selection process for portfolio managers and fund selectors, have so far evaded similar regulation.

It’s a green (washed) world

The radar these ESG rating firms have been flying under is beginning to pick them up. In a 2019 article, fund manager Schroders criticized third-party sustainability ratings for “rewarding greenwashing [claiming false environmental credentials] rather than a genuine commitment to sustainability.”

When it comes to greenwashing, some funds have been accused of stuffing ‘green’ companies into their top ten stocks to get an ESG rating but not showing the same commitment in their other holdings. Others have been able to find ways to get ESG ratings despite having a less than thorough approach towards sustainability throughout the investment process.

Schroders also said agencies were opaque and inconsistent in the way they scored companies — “so, when you compare scores from providers you get very different results and it’s hard to know how the companies came up with those numbers.”

Other managers have criticized ratings data for being too static or out of date. They may rate a company as having poor ESG credentials based on historical data even though it is making committed efforts to improve.

Last year, the Organization for Economic Co-Operation and Development (OECD) also called for a range of improvements, including in transparency and standardization of ESG rating methodologies. “Widely different outputs across major ESG rating providers can create confusion among institutional investors, fund managers, and retail investors as to what constitutes a high ESG-rated company,” said the OECD.

“If left unaddressed, this persistent opacity could undermine investor confidence in ESG scores and indices, and in portfolios built on these products,” the OECD concluded.

Can do better

To address these issues the UK’s regulator, the Financial Conduct Authority (FCA), is considering whether to require fund selectors to verify the quality of any ESG data, including ratings, used in their investment process.

If the FCA moves forward, fund selectors will need to prove they understand the source of data and articulate, clearly and accessibly, how it is used. The FCA already expects fund selectors to avoid using ratings mechanistically without understanding the methodology used.

The FCA will also likely look at the role of ratings providers themselves, including their internal governance and the transparency of their ESG judgements.

Meanwhile, the Dutch and French financial regulators have called on the European Commission to draft legislation for ESG data and ratings providers. Their proposals include requirements around transparency of methodology, managing conflicts of interest, internal control processes and enhanced dialogue with companies subject to sustainability ratings.

The European Securities and Markets Authority (ESMA) has also written to the EC with a suggested legal framework for ESG ratings and assessment tools.

ESMA highlighted that the lack of regulation and supervision of ESG ratings and other assessment tools increases the risks of mis-selling and greenwashing.

Will do better

If ESMA gets its way, the larger, more systemic ratings entities will be subject to a full suite of organizational and conflict of interest requirements that reflect their growing importance in sustainable finance. The EC is expected to address this in its upcoming Renewed Sustainable Finance Strategy, due in July.

Julia Dreblow, founder at consultant SRI Services and information hub Fund EcoMarket, says that “there has been an explosion of interest in ESG among ratings agencies. This is good as all investors need better information on ESG to make investment decisions. The main challenge is that investors often want that information to be simple and reflect their own criteria.”

“But ESG issues are complex,” notes Dreblow, “and reliable primary data from companies are often not yet available. This situation is improving and that will continue. But for now, we recommend looking at multiple sources and considering methodologies and appropriateness carefully.”

When it comes to regulators, “I’ve told them that verifying ratings agency data is super difficult as many fund managers do not understand the topic well enough,” says Dreblow. “Governments have tasked regulators with supporting net-zero carbon emission targets. But it will be hard for them to do that if the people they regulate do not understand the data they use.”

Lots of cooks trying to make one green dish

The combined effect of multiple requirements set by governments, regulators and standard setters can often result in unintended consequences — such as privileged asset classes and bureaucratic turf battles — that undermine their good intentions. This is a real risk in the ESG space, where the myriad existing standards have already created a baffling alphabet soup of benchmarks and measurements.

Nonetheless, some of the most important emerging reporting standards such as the Task Force on Climate-related Financial Disclosures (TCFD) should help, as should the sustainability taxonomies that the UK and EU are working on.

Expected new rules from the Securities and Exchange Commission in the US should also make a difference – providing they use the same general principles.

Rather than wait for a wave of directives and new standards, some ratings agencies are moving towards higher ground under their own steam. Bloomberg, for example, makes information on its scores, data and analytics available on its website.

Taking pre-emptive control could become the easiest path for these companies.

Did you find this useful? Get our EPFR Insights delivered to your inbox.