Uncertainty about the impending US presidential election, the mixed reaction to Chinese efforts to kickstart key elements of the world’s second-largest economy and ongoing conflicts in Ukraine and the Middle East prompted investors to look for “shock proofing” during the final week of October.

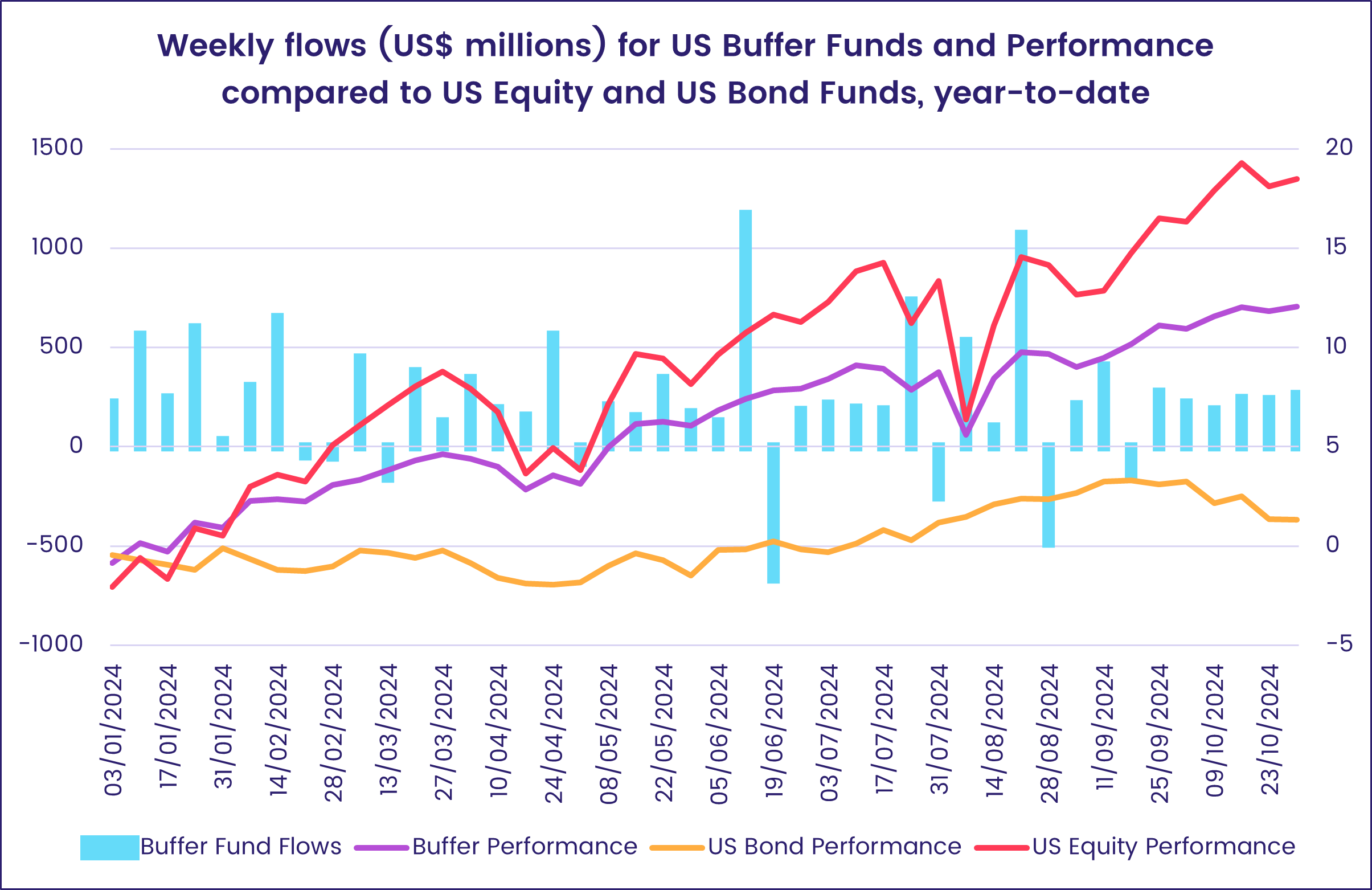

In practice, this meant steering more money into dedicated US Sovereign and Municipal Bond, Japan Equity, Total Return, Physical Gold, Derivatives and Cryptocurrency Funds. Flows into Inflation Protected Bond Funds hit their second highest weekly total so far this year and Buffer Funds attracted another $282 million as they extended their current inflow streak to six weeks and $1.5 billion total.

Buffer Funds, which offer specific levels of downside protection over predetermined periods, have pulled in some $40 billion over the past five years with inflows accelerating sharply since 2022.

Overall, the week ending Oct. 30 saw all EPFR-tracked Bond Funds attract a net $17.9 billion while Alternative Funds absorbed $4.2 billion and Money Market Funds $9.5 billion. Investors pulled $1.4 billion out of Equity Funds, with both of the major globally-mandated groups seeing over $1 billion redeemed, and $1.9 billion out of Balanced Funds.

At the single country and asset class fund level, redemptions from Convertible Bond Funds hit a 53-week high, Physical Gold Funds absorbed fresh money for the 11th time over the past 12 weeks and Copper Funds for the 11th time since the final week of July. UK Money Market Funds posted their biggest weekly outflow since late 3Q22, Australia Bond Funds extended an inflow streak stretching back to late March and Finland Equity Funds recorded their biggest inflow since mid-January.

Emerging Markets Equity Funds

During September, Asia ex-Japan Equity Funds accounted for $32.2 billion of the $36.8 billion absorbed by all EPFR-tracked Emerging Markets Equity Funds. The past three weeks, however, have seen this pattern go into reverse with heavy redemptions from Emerging Asia-mandated funds pulling the headline number for all EM Funds into negative territory.

The latest week saw investors pull over $4 billion from Asia ex-Japan Equity Funds, extending their longest outflow streak since 4Q23, as China Equity Funds experienced further redemptions, India Equity Funds posted consecutive weekly outflows for the first time in 19 months and investors pulled money out of Asia ex-Japan Regional Equity Funds for the 39th week year-to-date.

Although the latest outflows from dedicated China Equity Funds took the three-week total up to $14.7 billion, that is still just over a third of the more than $40 billion that flowed in during the first week of October. Investors anticipate further measures will be announced after a key legislative committee meets in early November.

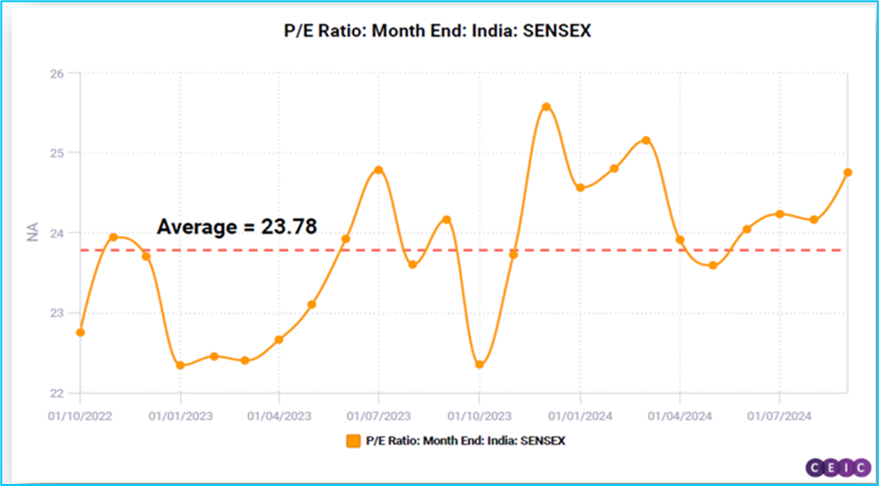

India Equity Funds, meanwhile, are seeing some profit taking after a 19-month run that saw over $90 billion flow in while the country’s benchmark equity index gained some 40%. Average price-to-earnings ratios for Sensex-listed stocks have dropped below their two-year average, after data from EPFR’s sister company CEIC showed valuations coming into October north of that line.

Latin America Equity Funds chalked up another collective outflow as redemptions from Mexico Equity Funds hit a 14-week high. The possibility of another Trump administration in the US, weak oil prices and major changes to Mexico’s judiciary that critics believe will reduce its ability to check the current government have sapped investor sentiment towards this NAFTA member.

The usual mixture of headwinds, from war to energy prices, continue to limit appetite for exposure to the EMEA universe of markets. During the latest week Poland Equity Funds posted their biggest weekly outflow since late 3Q13 with two overseas domiciled ETFs driving the headline number.

Developed Markets Equity Funds

With the US presidential election now less than a week away, the new British government’s first budget to digest and corporate earnings reports still coming in at a brisk clip, investors largely took a wait-and-see approach to developed markets during the final week of October. Overall flows into all Developed Markets Equity Funds came in at 0.03% of the group’s AuM as modest flows into US, Canada and Australia Equity Funds and strong flows into Japan Equity Funds offset the second largest outflow from Europe Equity Funds year-to-date and the biggest outflow from Global Equity Funds since the third week of April.

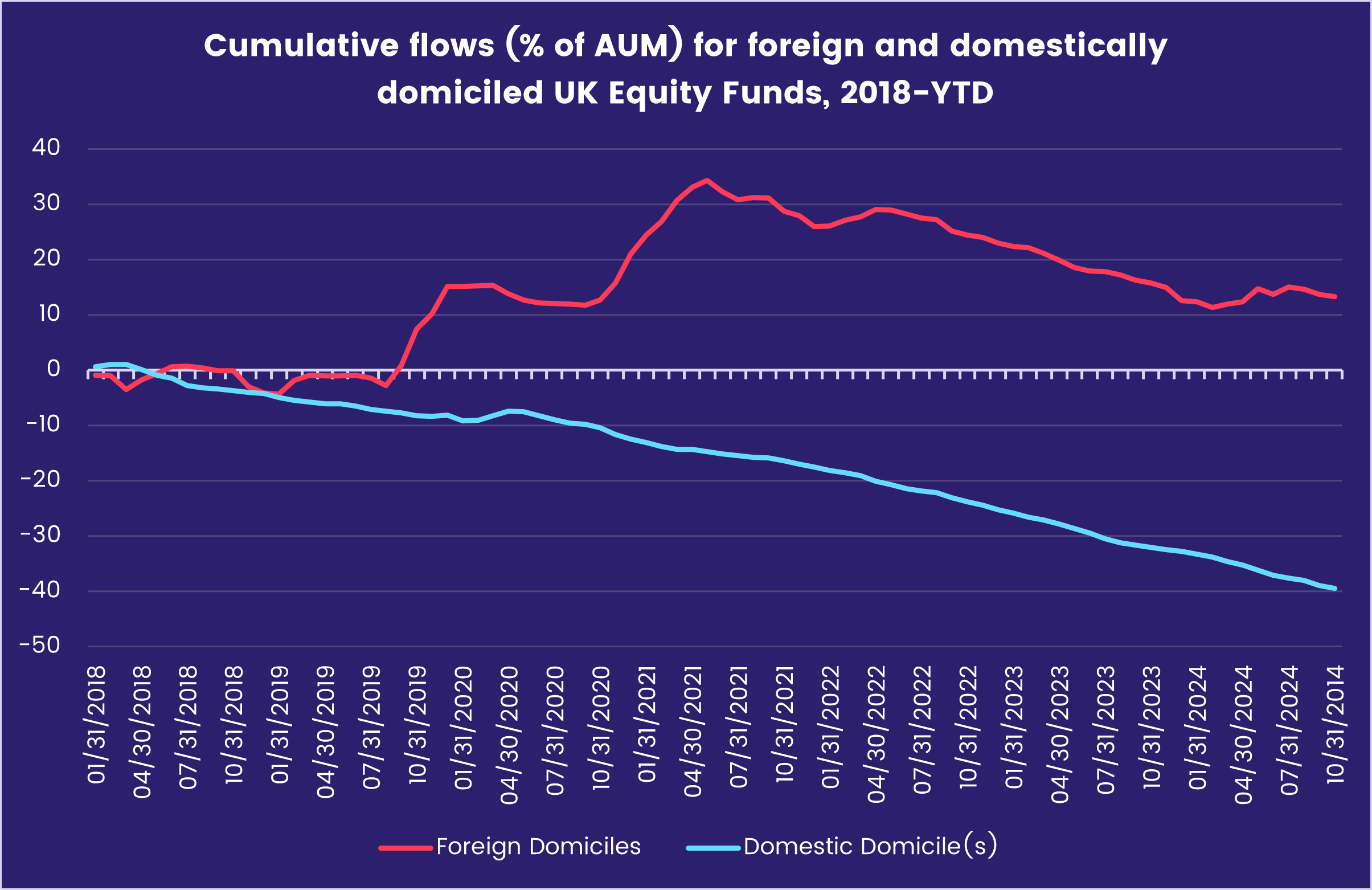

Despite the attention paid to the ruling Labour Party’s first budget in 14 years, which hiked the UK’s overall tax burden by an estimated $51 billion annually, the main driver of the headline number for all Europe Equity Funds were the two main regional groups rather. Redemptions from UK Equity Funds, the 42nd over the 43 weeks year-to-date, totaled $268 million. Elsewhere, Switzerland Equity Funds posted their first outflow since early September and redemptions from both Germany and Italy Equity Funds climbed to 22-week highs.

US Equity Funds recorded their fourth consecutive inflow during a week when key indexes again tested their record highs. Retail share classes and leveraged funds experienced further redemptions but flows into US Dividend Funds hit their highest level since mid-March and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their sixth inflow over the past eight weeks.

Research by Senior Liquidity Analyst Winston Chua indicates that the supply and demand equation for US stocks has shifted significantly in recent weeks. With a big sale of new shares by aerospace giant Boeing and a reduction in the volume of share buybacks announced, the corporate buy/sell ratio for outstanding shares, which has averaged 6-to-1 over the previous 12 months, dropped in October to a three-year low of 1.6-to-1.

While the focus of most US-oriented investors is squarely on next week’s presidential election, Japanese investors are weighing the outcome of this week’s snap election which left the ruling Liberal Democratic Party (LDP) without a majority in parliament’s lower house. Strong flows into domestically domiciled Japan Equity ETFs more than offset an 11th consecutive outflow from funds based overseas.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, posted only their sixth outflow of 2024. Funds managed for growth experienced their heaviest redemptions in over 10 months.

Global sector, Industry and Precious Metals Funds

Sector-oriented investors assessing the 3Q24 US corporate earnings season during the final week of October ran the spectrum from Alphabet-driven optimism to skepticism fueled by Microsoft and Meta Platform’s earnings disappointments. In turn, for the third week running the number of EPFR-tracked Sector Fund groups reporting outflows were far greater than those with inflows. Only three of the 11 major groups – Financials, Industrials and Healthcare/Biotechnology Sector Funds – attracted fresh money.

Though October started well for Technology Sector Funds, posting their third-largest weekly inflow on record at over $7.4 billion, flows have since headed in the opposite direction, with $5.6 billion flowing out over the past three weeks. Clear, unequivocal predictions about the future profitability of AI applications and cloud infrastructure have been elusive during the current reporting season.

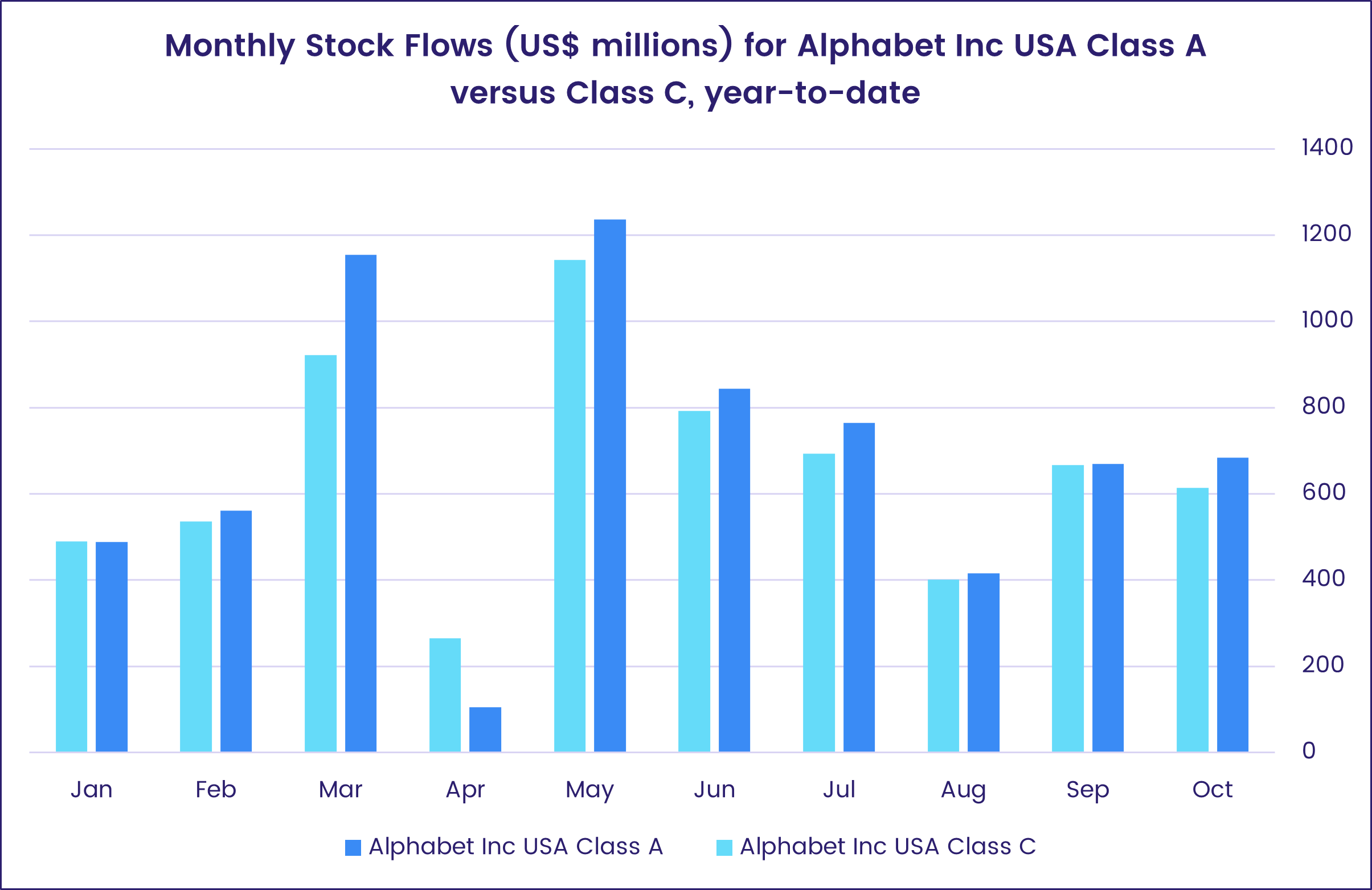

At the stock level, flows in the run-up to Alphabet’s earnings report were generally positive, though they faltered on the day of the report. Through its Stock Flows database, EPFR tracks Alphabet Inc Class A and C stocks, giving a view into those held by regular investors with conventional voting rights (A) or those typically held by employees with no voting rights (C).

Flows for Industrials Sector Funds have swung between positive and negative for eight straight weeks, with the latest inflow more than double last week’s outflows. Two funds dominated the headline number with an ETF benchmarked to the S&P Aerospace and Defense Sector pulling in $400 million (16.5% of the fund’s assets) and another US-dedicated ETF adding $260 million (1% of assets) to the total.

Among the major Industrial Sector Fund subgroups, Aerospace & Defense Funds posted their biggest inflows since late 3Q22, and the fifth-largest since EPFR started tracking these funds in 2006. This inflow came ahead of workers at Boeing voting on an improved contract offer Monday (Nov 4) that includes a bump in pay and bigger signing bonuses.

Real Estate Sector Funds have posted three straight weeks of outflows, with the latest the biggest since early May. A global REIT mutual fund and a US-dedicated property trust fund played the biggest role in pulling the headline number down this week, while a few Europe regional funds were also dumped.

Despite the surge in demand for confectionary around Halloween, Cocoa and Sugar Funds have struggled to attract inflows with the former suffering five yearly outflows since EPFR started tracking them in 2019 and Sugar Funds on track to extend their redemption streak to six years.

Bond and other Fixed Income Funds

Flows into EPFR-tracked Bond Funds held up during the final week of October despite the concern, reflected in US, UK and other sovereign yields, about the trajectory of sovereign debt in most of the world’s major economies. Led by US Bond Funds, the overall group absorbed a further $17.9 billion that left their total for the year so far at 90% of 2021’s full year record.

Of the major groups by geographic focus, only Emerging Markets Bond Funds experienced net redemptions – the biggest in 31 weeks – while Australia, Europe, US and Canada Bond Funds all posted above average inflows.

At the asset class level, Convertible Bond Funds posted their biggest outflow in just over a year, Municipal Bond Funds extended their longest inflow streak since 2021 and flows into Inflation Protected Bond Funds hit their highest level since the first week of August.

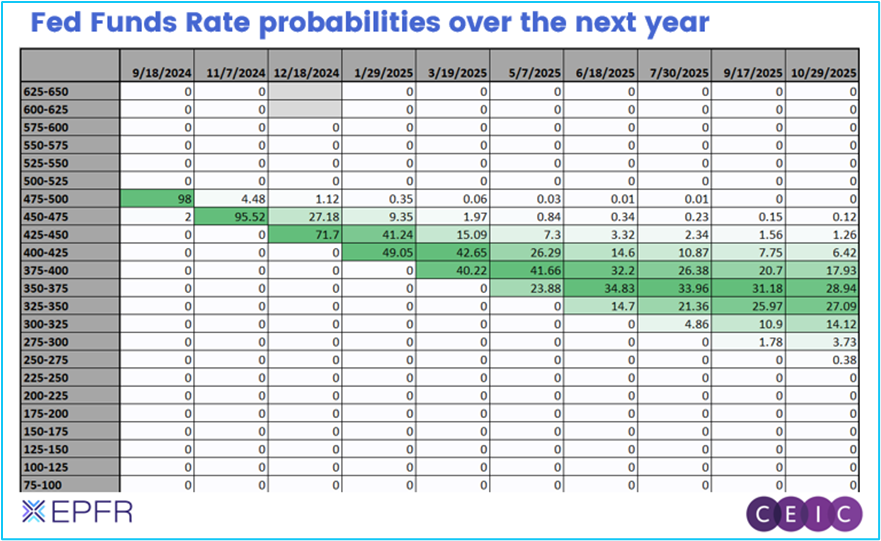

Although US Bond Funds pulled in a healthy $14.7 billion and the latest reading of the closely watched Personal Consumption Expenditures (PCE) index cane in at 2.1%, two lackluster Treasury auctions and the fourth inflow over the past six weeks for US Treasury Inflation Protected Securities (TIPS) Funds added to the more cautious outlook for US interest rates. The chart below, derived from data curated by EPFR’s sister company CEIC, still predicts further 0.25% cuts this month and next, but puts the chances of only 50 basis points worth of cuts in the first 10 months of next year at 18%.

Slower easing of US monetary policy is another headwind for emerging markets debt. The bulk of the latest week’s redemptions from Emerging Markets Bond Funds came from those with hard currency mandates.

Europe Corporate Bond Funds outgained the sovereign counterparts, which recorded their biggest inflow since mid-1Q22 the previous week, for the 10th time during the past 12 weeks. At the country level, UK Bond Funds extended their longest inflow streak in over 15 months.

Did you find this useful? Get our EPFR Insights delivered to your inbox.