Retail efforts to squeeze real and perceived institutional short positions dominated the headlines for the second week running in early February. EPFR-tracked Silver Funds were carried along for the ride, setting a new inflow record during a week when retail investors switched their attention from GameStop shares and pushed the price of the precious metal up to an eight-year high.

Retail investors also steered significant amounts of money towards fund groups offering exposure to the global reflation story expected during second half of the year, when better weather and widespread vaccination programs give consumers the scope to unleash more than a year’s worth of pent-up demand. Global Equity Funds posted retail inflows for the 24th time in the past 26 weeks and Technology Sector Funds – which also set a new inflow mark — for the 40th time since the beginning of 2Q20 while China Equity Funds absorbed fresh retail money for the 33rd consecutive week.

There was less interest during the latest week in hedging against the inflation this anticipated surge in demand could bring, with flows to Inflation Protected and Bank Loan Funds moderating, and more interest in picking up yield by way of exposure to junk bonds, emerging markets and municipal debt and total return strategies.

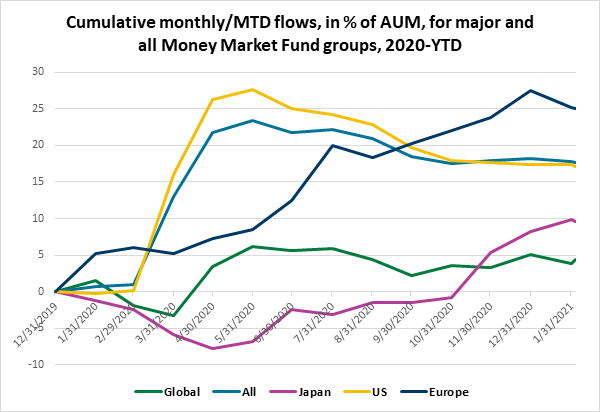

Overall, the week ending February 3 saw EPFR-tracked Bond Funds post their biggest collective inflow since early October while Alternative Funds took in $866 million, Balanced Funds $916 million and Equity Funds $9 billion. Outflows from Money Market Funds hit a year-to-date high of over $30 billion, with Europe Money Market Funds experiencing their heaviest redemptions since late 1Q20.

Did you find this useful? Get our EPFR Insights delivered to your inbox.