With the Syrian civil war reaching – at least for now – a prompt resolution, China adopting a looser monetary stance, and both the US Federal Reserve and European Central Bank expected to cut interest rates by another 25 basis points before the New Year, investors found some things to cheer about during the first full week of December.

Against this backdrop, EPFR-tracked China Equity Funds recorded their biggest inflow since the first week of October, Hong Kong Equity Funds took in fresh money for the seventh week running and flows into Turkey Equity Funds hit a six-week high. On the fixed income side, Europe Bond Funds tallied their sixth-largest inflow of 2024 as year-to-date flows into all Bond Funds pushed into record-setting territory.

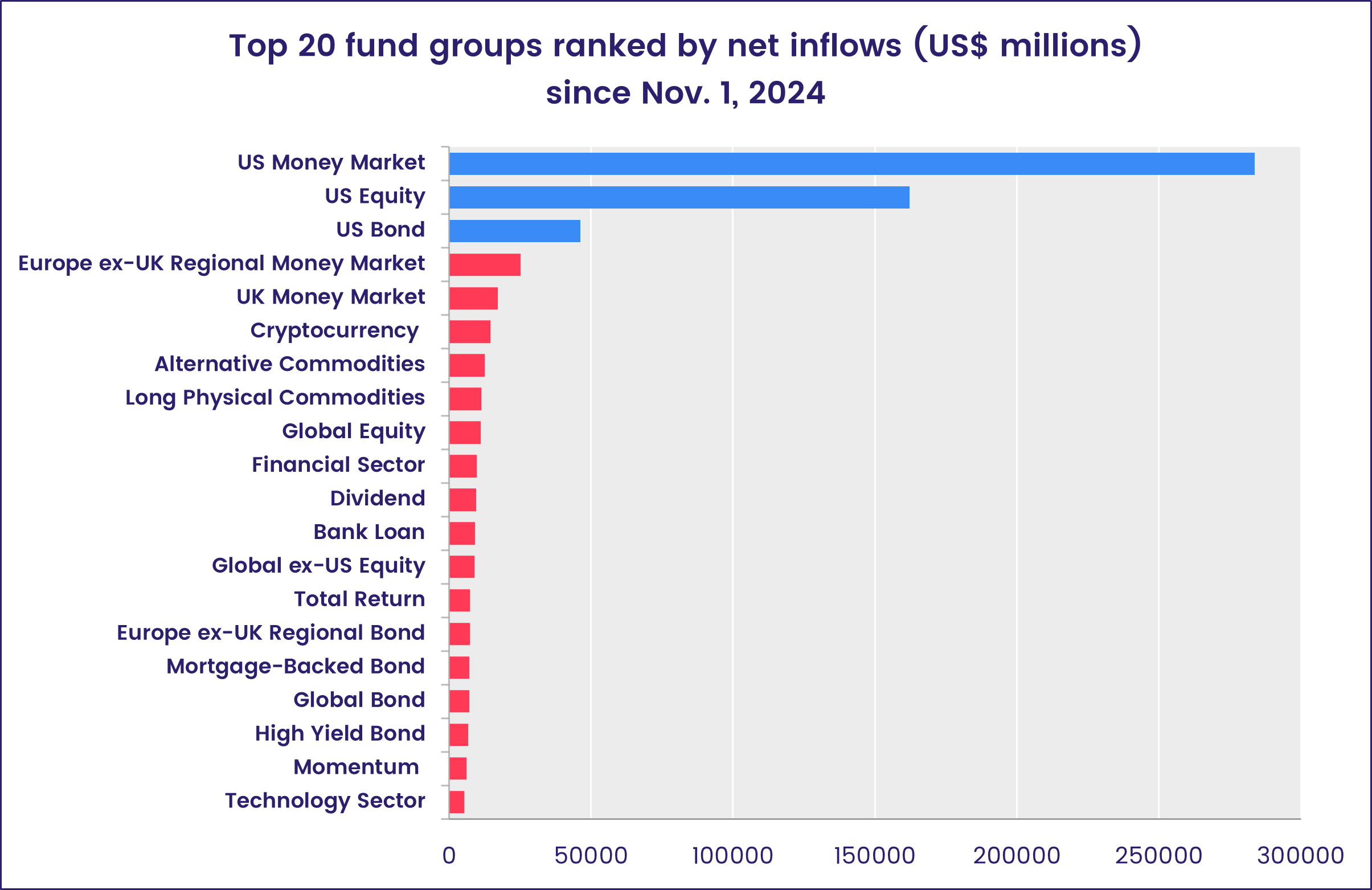

US-mandated funds remained in pole position when it came to flows, with US Equity and Bond Funds pulling in another $19.8 billion between them during the week ending Dec. 11. Since the beginning of November, the combined weekly flows into these two groups total $208 billion while US Money Market Funds have absorbed a net $283 billion.

At the asset class and single country fund levels, flows into Bear and Mortgage-Backed Bond Funds hit 10 and 31-week highs respectively, Cryptocurrency Funds absorbed another $4.1 billion and Physical Silver Funds experienced their biggest outflow since mid-April. Korea Money Market Funds recorded their biggest inflow in over seven months, flows into Spain Bond Funds hit a level last seen in late January and Greece Equity Funds tallied their largest outflow since late 1Q20.

Emerging Markets Equity Funds

There was a strong response to the policy shift by Chinese monetary authorities from ‘prudent’ to ‘moderately loose’, with more than $5 billion flowing into China Equity Funds during the week ending Dec. 11. That lifted all EPFR-tracked Emerging Markets Equity Funds to their biggest collective inflow since the first week of October despite outflows from Latin America and the diversified Global Emerging Markets (GEM) Equity Funds that totaled $170 million and $1.5 billion, respectively.

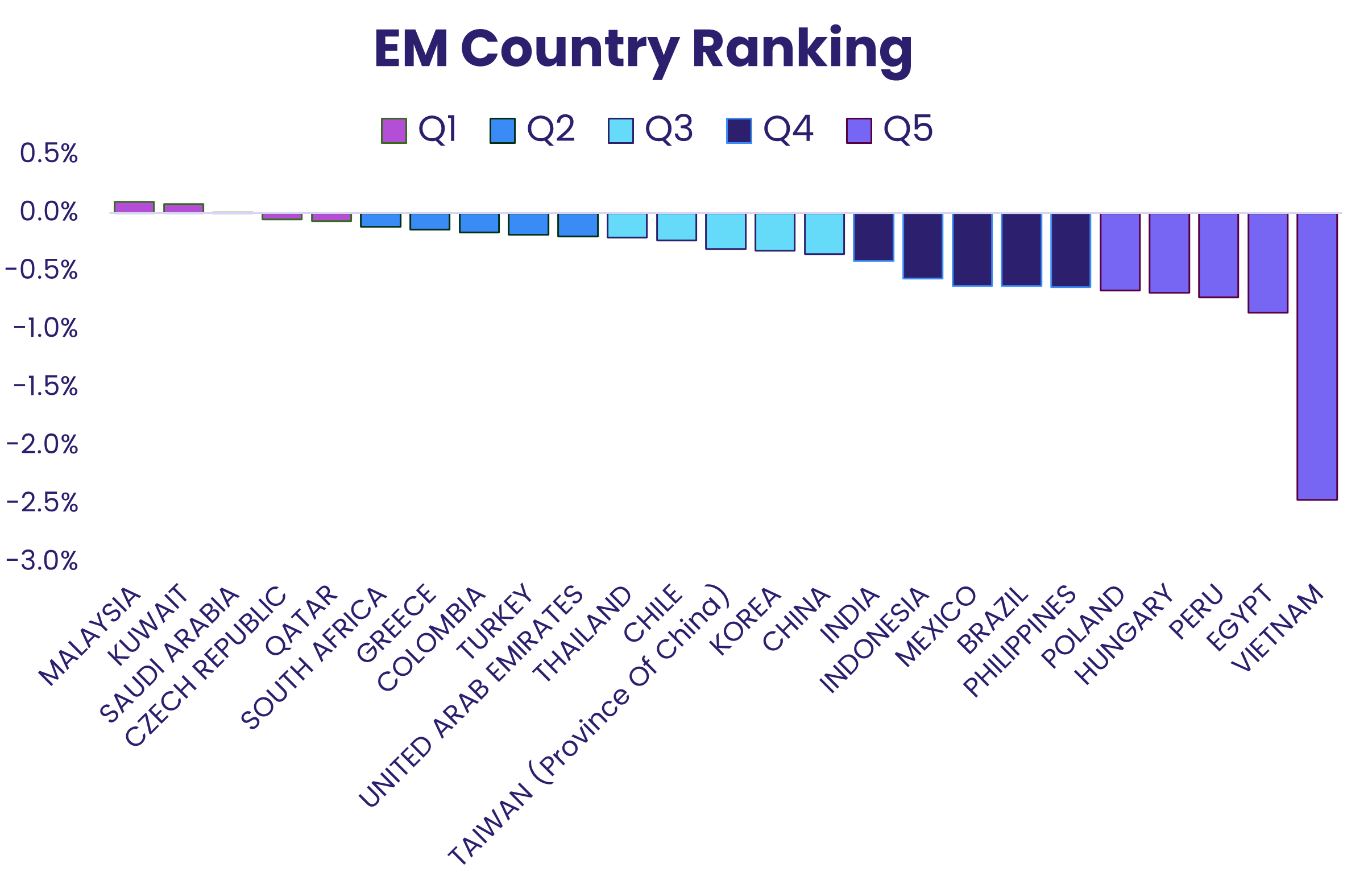

The rebound in flows to China may also reflect a more sanguine view of the outlook for global trade during US President-elect Donald Trump’s second term. The latest EPFR EM country rankings, based on flows from funds with multi-country mandates, suggest that managers currently see more value in energy and resource plays (Saudi Arabia, Malaysia, Kuwait) than they do in revisiting the supply chain relocation story (Vietnam, Mexico). The big trade-dependent Asian markets, meanwhile, are in the middle of the pack.

Investors mirrored manager sentiment towards Mexico during the latest week, with dedicated Mexico Equity Funds posting their biggest outflow since early July. Investors are waiting to see how new Mexican President Claudia Sheinbaum responds to slowing economic growth, a fiscal deficit that is running at over 5% of GDP and declining oil revenues. Meanwhile, flows into Argentina Equity Funds exceeded 3% of their total AUM for the seventh straight week.

EMEA Equity Funds posted their first inflow since early September despite forecasts that oil prices will stay around $70 a barrel for much of next year. While Saudi Arabia Equity Funds posted their fifth outflow during the past six weeks, flows into Turkey Equity Funds picked up steam as the latest twist in neighboring Syria’s long-running civil war resulted in a rapid and unequivocal victory for the anti-government forces.

Also largely resolved during the latest week was South Korea’s flirtation with martial law. Korea Equity Funds posted their second largest inflow since the beginning of the third quarter. But diversified fund managers were already cooling to Korea before President Yoon Suk Yeol’s short-lived declaration on Dec. 3. Coming into November the average GEM Equity Fund allocation for this market was at its lowest level since mid-3Q19 while Korea’s weighting among Asia ex-Japan Regional Equity Funds had fallen to a level last seen in 4Q98.

Developed Markets Equity Funds

The week ending Dec. 11 saw two major US equity indices post new record highs and the bulk of the fresh money committed to EPFR-tracked Developed Markets Equity Funds go to US-mandated funds. Most of the other major groups experienced net redemptions that ranged from $53 million for Australia Equity Funds to $3.4 billion for Japan Equity Funds.

Having pulled in over $20 billion during the first four months of 2024, Japan Equity Funds have struggled in the face of concerns about the impact of a stronger currency on the country’s export competitiveness, the likelihood of further barriers to global trade and domestic politics. Since the snap election held in late October, Japan Equity Funds have seen flows steadily decline, with the latest week’s outflow the fourth biggest so far this year. Dividend, leveraged and SRI/ESG-mandated funds all experienced net redemptions.

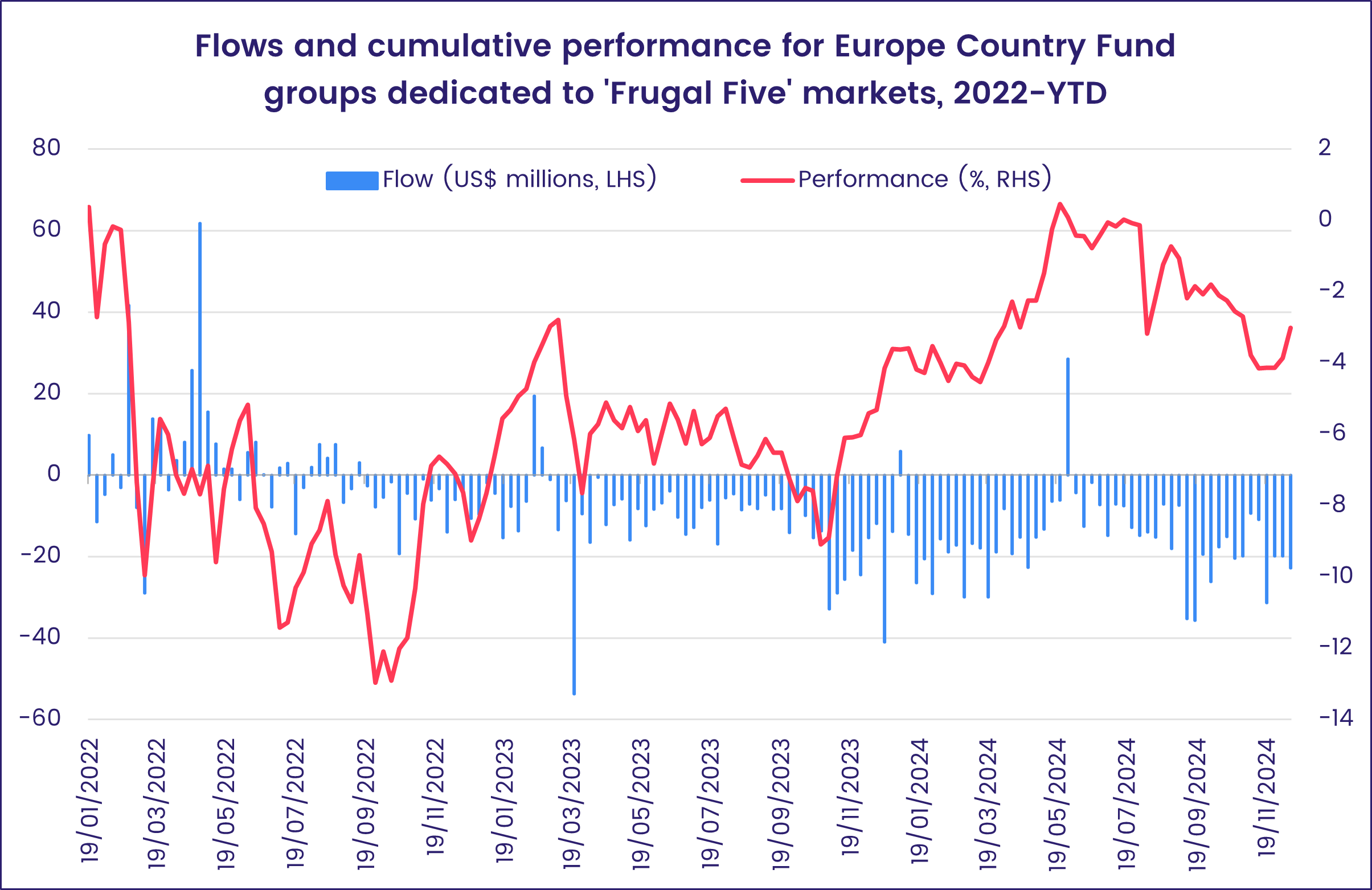

Also hit by further outflows were Europe Equity Funds, which posted their 11th consecutive outflow and 43rd year-to-date. With the current focus on the troubled economic states of the European Union’s twin ‘pillars’, redemptions from France and Germany Equity Funds hit 10 and 28-week highs, respectively. In the spite of the attention being paid to France’s fiscal deficit, funds dedicated to the so-called Frugal Five markets – Sweden, Denmark, Austria, Finland and the Netherlands – have not been popular since 2Q22.

US Equity Funds recorded another solid headline number as flows into US Equity ETFs more than offset the biggest outflows from actively managed funds in exactly a year. Some of those outflows were related to funds going ex-dividend, but non-ETFs have only posted one weekly inflow so far this year.

American stocks continue to enjoy a significant tailwind from the aggressive shrinkage of many companies free-float. EPFR’s liquidity team has documented over $1.3 trillion of announced stock buybacks so far this year, a new record.

Global Equity Funds, the largest of the major diversified Developed Markets Equity Fund groups, saw their five-week run of inflows come to an end. Funds with ex-US mandates accounted for the bulk of the redemptions.

Global sector, Industry and Precious Metals Funds

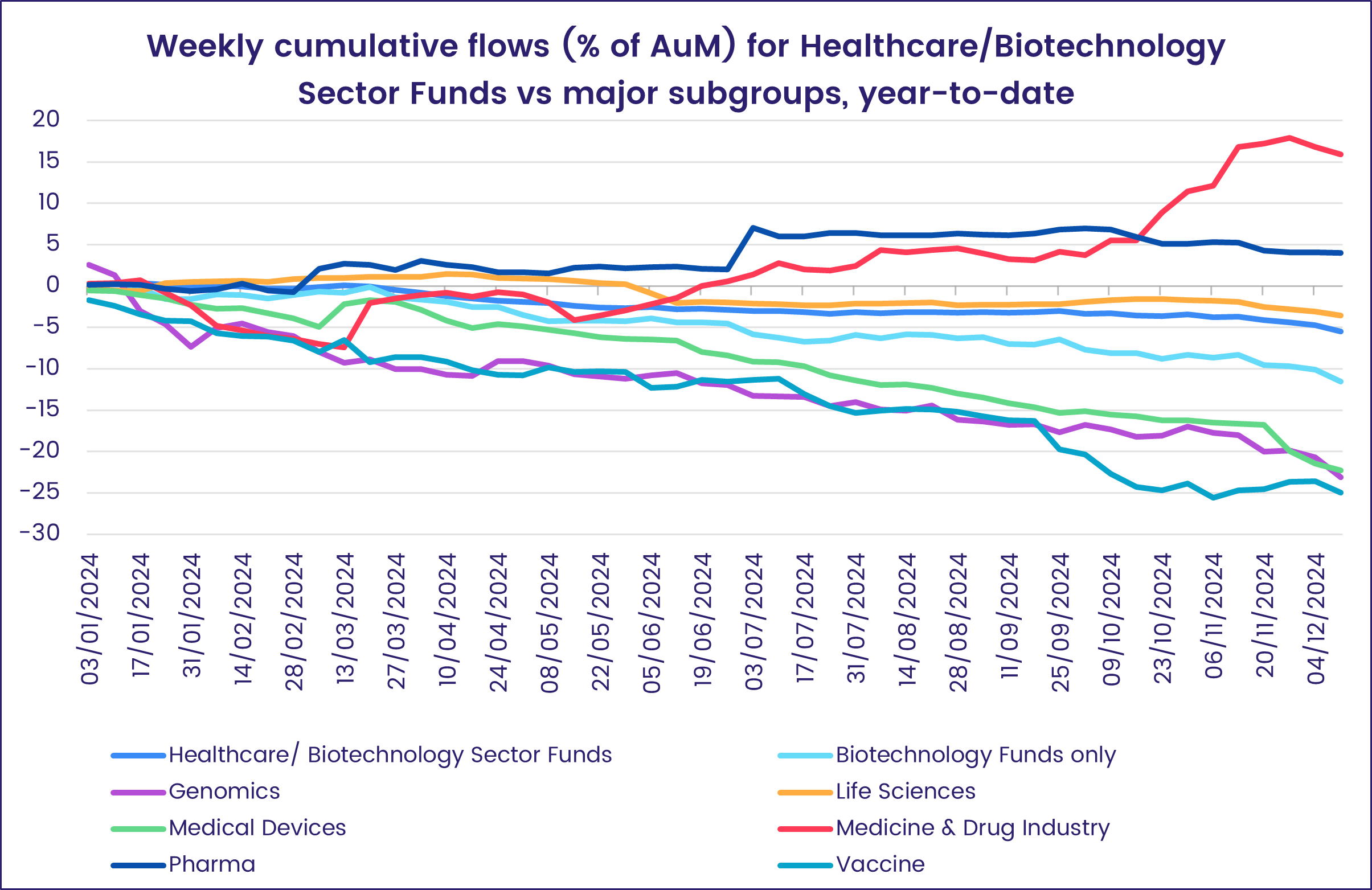

In mid-December, the total redeemed from six of the 11 EPFR-tracked Sector Fund groups hit over $5 billion while inflows for the remaining five groups fell comfortably below the $1 billion mark ($885 million). Healthcare and Technology Sector Funds each accounted for almost a third of the total redemptions while Energy Sector Funds saw over $700 million flow out. Consumer Goods, Real Estate and Utilities Sector Funds also experienced net redemptions.

Healthcare/Biotechnology Sector Funds saw $1.7 billion redeemed during the week ending Dec. 11, their biggest outflow since early 1Q23, as investors digested the murder of UnitedHealthcare’s CEO. Flows year-to-date among the major Healthcare/Biotechnology subgroups have been mixed. Medicine & Drug Industry Funds have taken in roughly 15% of assets ($660 million) and Pharma Funds are set to post their fifth straight – and largest – yearly inflow while dedicated Biotechnology Fund outflows have climbed to $5 billion – still shy of their 2019 record of nearly $7 billion – and over $2 billion has flowed out of Medical Device Funds.

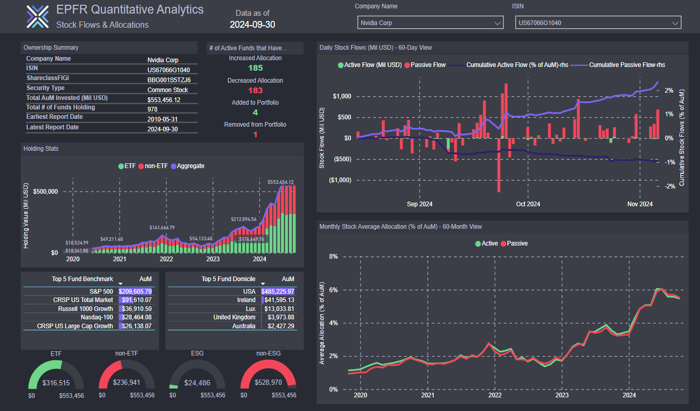

Redemptions for Technology Sector Funds also exceeded $1.5 billion, just $250 more than the previous week. At the individual fund level, the fund with the heaviest outflows for the week was one tracking a US semiconductor benchmark, the second was dedicated to Taiwan (POC) with $420 million flowing out and further down the list, two leveraged 2x ETFs benchmarked to Nvidia and MicroStrategy Stock Price saw a collective $340 million redeemed.

It was a bumpy week of technology and artificial intelligence (AI) bellwether Nvidia, with China instigating an anti-trust investigation and the US Supreme Court opting to let a class action lawsuit alleging securities fraud to proceed.

Financials Sector Funds did extend their inflow streak but Real Estate Sector Funds saw another $405 million flow out.

On the metals side, Copper Mining Funds enjoyed a fourth straight week of inflows over $100 million, Physical Gold Funds brought in just their second inflow of the past three or six weeks though both were above $600 million, while Physical Silver Funds suffered their heaviest outflows since mid-April after experiencing just two redemptions during the last 11 weeks.

Bond and other Fixed Income Funds

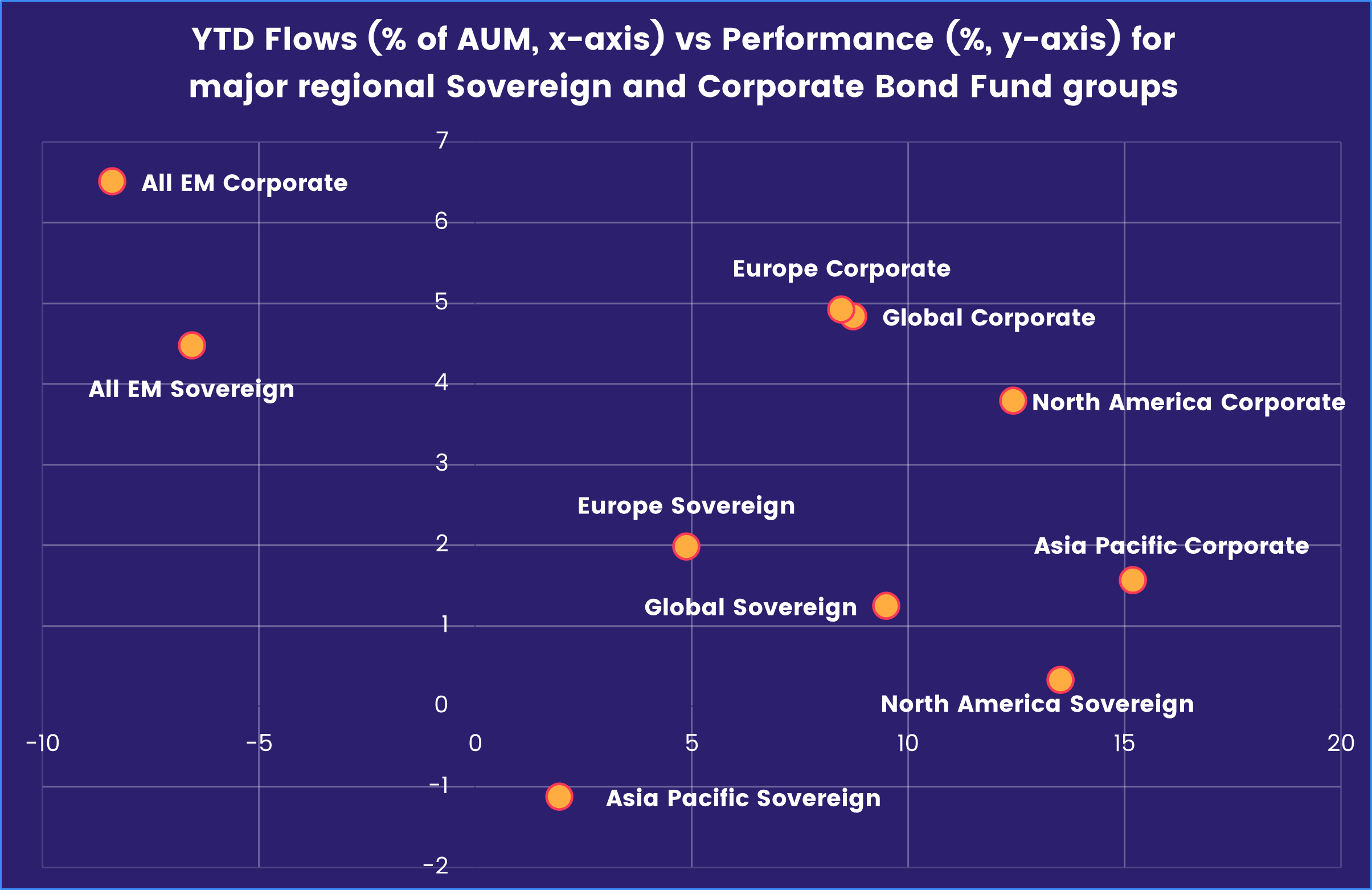

The first full week of December saw year-to-date flows into all EPFR-tracked Bond Funds hit 102% of the full-year record set in 2021 ahead of multiple central bank policy meetings. Among the major groups by geographic focus, only Asia Pacific and Emerging Markets Bond Funds recorded an outflow while US Bond Funds maintained their year-to-date inflow streak and another $3.6 billion flowed into Europe Bond Funds.

Barring an abrupt switch in the final weeks of the year, Corporate Bond Funds will take in more fresh money than their sovereign counterparts for the first time since 2020.

At the asset class level, flows into Mortgage-Backed Bond Funds hit their highest total in seven months, Bank Loan Funds pulled in over $1 billion for the sixth straight week and Convertible Bond Funds recorded their biggest inflow since the first week of October. Inflation Protected Bond Funds attracted fresh money for the third time during the past four weeks, with the latest headline number the largest in six weeks.

The US inflation rate in November was up slightly from October but left expectations of another 0.25% cut in the US interest rates later this month intact. US Bond Funds racked up their 51st consecutive inflow, with Intermediate Term Mixed and Short Term Sovereign Funds attracting the largest amounts while Long Term Sovereign Bond Funds posted their biggest outflow since 1Q20. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their third outflow over the past four weeks and their biggest in over seven months.

European markets got the 0.25% rate cut they were expecting the day after the latest reporting period ended. Flows to Europe Bond Funds favored those with corporate mandates and showed strong conviction at the country level. In the wake of French minority governments loss of a no confidence vote, redemptions from France Bond Funds hit a record high while UK Bond Funds extended their longest inflow streak since a 16-week run ended in 1Q23.

Investors pulled money out of Emerging Markets Bond Funds for an eighth straight week. China Bond Funds posted their biggest inflow and Korea Bond Funds their biggest outflow since the first week of the quarter, Frontier Markets Bond Funds recorded inflows for the 11th time during the past 13 weeks and Sharia Bond Funds for the ninth time during the past 11 weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.