Investors pulled money out of all the major EPFR-tracked fund groups during the final week of June as they closed the books on a quarter that saw inflation in Europe hit record highs, energy prices soar, the US Federal Reserve deliver their biggest rate hike at a single meeting since 1994 and the benchmark S&P Index endure its worst opening half of any year since 1970.

A few pockets of resistance continue to hold out. Infrastructure Sector Funds posted their 19th consecutive inflow, Dividend Equity Funds attracted fresh money for the 24th time year-to-date, flows into China Equity Funds hit an eight-week high and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow since mid-April.

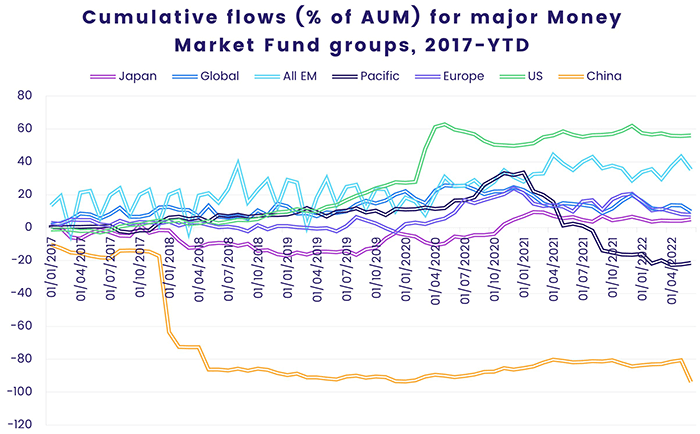

Although investors took on more exposure to Chinese equity and ended China Bond Funds 19-week outflow streak, China Money Market Funds experienced their heaviest redemptions since early 2Q20. Both individuals and businesses are tapping savings and cash reserves to offset the costs imposed by China’s draconian anti-Covid lockdowns.

Overall, the final week of 2Q22 saw a net $18.3 billion flow out of all EPFR-tracked Money Market Funds while redemptions from Bond Funds totaled $16.9 billion. Investors also pulled $2.2 billion from Balanced Funds, $2.6 billion – a 27-week high – from Alternative Funds and $5.7 billion from Equity Funds.

At the single country and asset class fund levels, Italy Equity Funds posted their biggest weekly outflow since late 2Q18, redemptions from Russia Bond Funds hit a year-to-date high and Brazil Equity Funds saw a four-week run of inflows come to an end. Cryptocurrency Funds extended their longest redemption streak since early 4Q18, over $3 billion flowed out of both High Yield and Total Return Bond Funds, Mortgage-Backed Bond Funds recorded their ninth straight outflow and Inflation Protected Bond Funds recorded their biggest inflow since the first week of April.

Did you find this useful? Get our EPFR Insights delivered to your inbox.