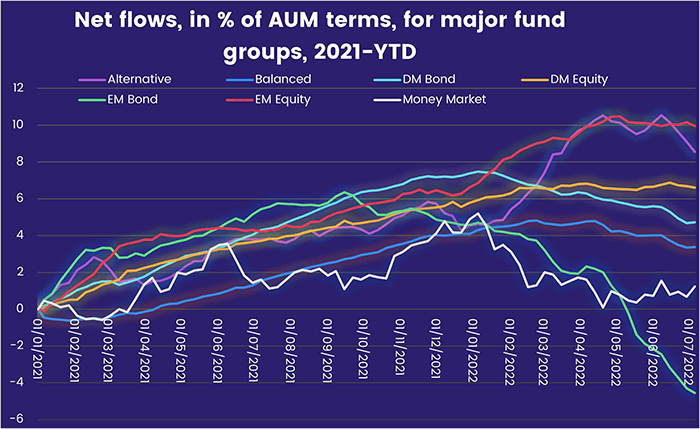

Flows during the first week of the third quarter favored liquidity, with EPFR-tracked Money Market Funds recording their biggest inflow year-to-date. But there were a few signs that investors are willing to test what have been stormy waters for much of the past four months. Flows into Balanced Funds hit a 13-week high, Bond Funds recorded only their fourth inflow of 2022 and US Equity Funds took in fresh money for the eighth time in the past nine weeks.

Overall, however, the prospect by month’s end of another 75 basis point interest rate hike by the US Federal Reserve and the first hike by the European Central Bank (ECB) in 11 years kept risk appetite at low levels. Redemptions from Alternative Funds hit a level last seen in 1Q20, Emerging Markets Bond Funds extended their longest run of outflows since 4Q18 and investors pulled money out of Global Emerging Markets (GEM) Equity Funds for the 12th time in the past 13 weeks.

Overall, a net $4.6 billion flowed out of EPFR-tracked Equity Funds during the week ending July 6 despite Dividend Equity Funds racking up their ninth consecutive inflow. Redemptions from Alternative Funds totaled $4.1 billion while Balanced Funds absorbed $599 million, Bond Funds $2.4 billion and Money Market Funds $62.5 billion.

At the asset class and single country fund levels, Cryptocurrency Funds extended their longest redemption streak since EPFR started tracking them in 2018, Municipal Bond Funds posted their third inflow since mid-January and Inflation Protected Bond Funds recorded their fourth inflow in the past five weeks. Redemptions from Australia and Japan Bond Funds climbed to 18 and 76-week highs, Taiwan (POC) Equity Funds saw their 15-week inflow streak come to an end and Thailand Equity Funds posted their 24th outflow in the 27 weeks year-to-date.

Did you find this useful? Get our EPFR Insights delivered to your inbox.