Hawkish remarks by US Federal Reserve policymakers going into the final week of August put the brakes on what investors are hoping is the next leg of a bull market. Worried that they may be walking into another 75 basis points hike in US interest rates next month, those investors call a halt to the rebuilding of positions exited during the second quarter.

For EPFR-tracked funds, this meant a reversal in the flows for many groups. Bond Funds saw their longest run of inflows year-to-date come to an end, Technology Sector Funds posted their biggest outflow since mid-4Q21, redemptions from High Yield Bond Funds climbed to a 10-week high and both of the major multi-asset fund groups posted outflows for the first time since late July.

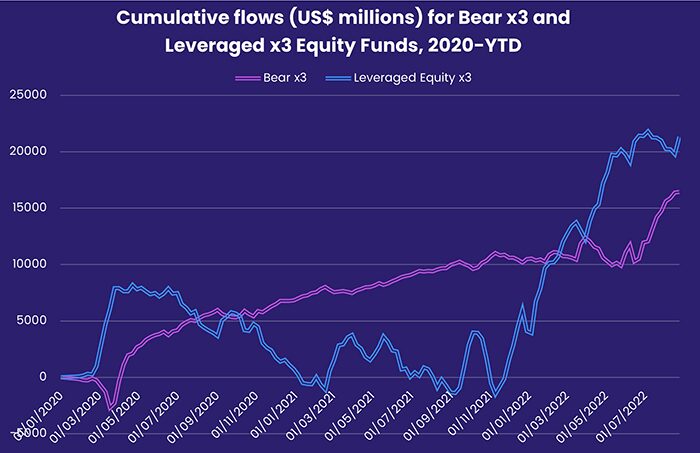

Meanwhile, flows to funds utilizing aggressive leverage to magnify bets on market direction have shifted to funds that aim to profit from falling markets. Since mid-June, Bear x3 Funds have attracted inflows equal to 85% of their AUM at the start of the run.

Overall, the week ending August 24 saw investors pull a net $5.1 billion from EPFR-tracked Equity Funds, $4.2 billion from Money Market Funds and $1.1 billion from both Balanced and Bond Funds while Alternative Funds, on the strength of commitments to Derivatives and Currency Funds, posted their third straight inflow and fourth in the past five weeks. Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their fifth outflow year-to-date and biggest since early March.

At the single country and asset class fund levels, Inflation Protected Bond Funds snapped their longest run of outflows since 1Q20, redemptions from Municipal Bond Funds climbed to an eight-week high and High Yield Bond Funds recorded their biggest outflow of the quarter-to-date. Sweden, Portugal and Australia Equity Funds posted their biggest outflows since 2Q22, 2Q21 and 2Q16, respectively, while Italy Bond Funds extended their longest run of inflows since 4Q21.

Did you find this useful? Get our EPFR Insights delivered to your inbox.