Late August found markets and investors chewing on a new nugget of ‘Fed-speak.’ What does “some pain,” which US Federal Reserve Chairman Jerome Powell promised in his speech at the Davos forum, translate into?

With plenty of economic pain already on the doorstep thanks to the wider impacts of China’s zero-Covid policies and Russia’s invasion of Ukraine, the prospect of more – even if it is in the service of taming inflation – has little appeal. Investors responded by pulling another $9.7 billion out of EPFR-tracked Equity Funds, the biggest weekly outflow in over two months, and hitting Bond, Balanced and Alternative Funds with net redemptions.

Among the groups caught up in the latest tactical retreat were Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which posted consecutive weekly outflows for the first time since mid-June and for only the fourth time since the beginning of 2018. Year-to-date these funds have collectively outperformed their non-SRI/ESG counterparts by just over 1%.

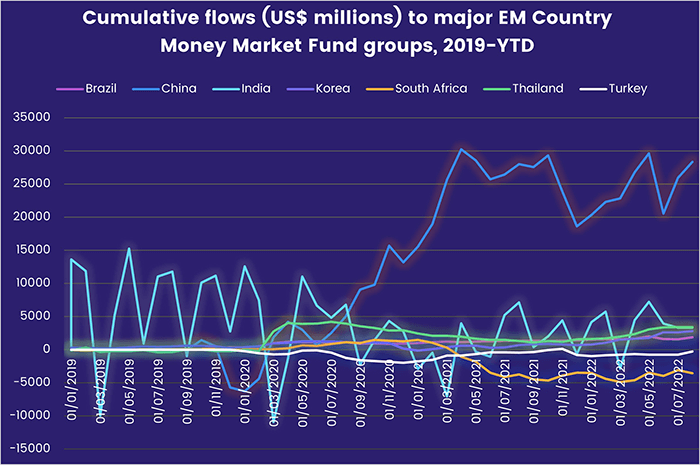

Money Market Funds were the only major group to record an inflow for the week, ending their longest redemption streak since 4Q20, as flows into US Money Market Funds offset redemptions from Europe MM Funds. Among the major emerging markets groups, China MM Funds chalked up their ninth straight inflow as they extended their longest run of inflows in over 20 months.

At the asset class and single country fund levels, redemptions from France Bond Funds hit a 19-week high and Italy Bond Funds saw their longest inflow streak since 4Q21 come to an end while flows into Sweden Equity and Bond Funds hit 16 and 36-week highs, respectively. Outflows from both Municipal and High Yield Bond Funds climbed to 11-week highs, Convertible Bond Funds recorded their 32nd outflow YTD and investors pulled money out of Cryptocurrency Funds for the third time in the past four weeks.

Global Sector and Precious Metals Funds

EPFR-tracked Sector Fund groups side-stepped some of the monetary angst during the final week of August, with seven of the 11 major groups recording inflows ranging from $51 million to $1.4 billion.

Technology Sector Funds were the group seeing the greatest conviction, in cash terms, with inflows hitting a 20-week high. US Technology Sector Funds accounted for over three-quarters of the headline number for all funds, while those dedicated to China extended a four-week inflow streak and Global Technology Sector Funds recorded their second straight outflow and 29th weekly redemption YTD. Of the top 10 funds ranked by inflows for the week, half are focused on semiconductor plays.

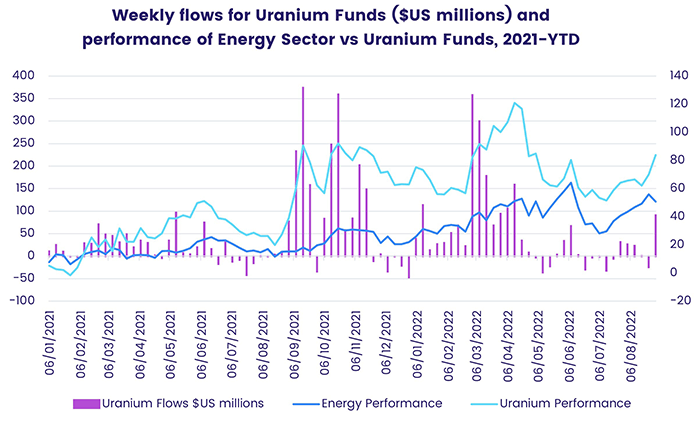

Elsewhere, Energy Sector Funds ended a three-week, $545 million outflow streak during a week where drought-stricken California passed a massive climate and clean energy package and Tesla’s Elon Musk stated countries should refrain from shutting down nuclear power plants. Coincidentally or not, the fund recording the biggest inflow for the week has a uranium mandate.

Isolating dedicated Uranium Funds, EPFR data shows that these funds have outperformed the broader Energy Sector Fund group over the past 20 months. Year-to-date, Uranium Funds have brought in $1.79 billion compared to $2.76 billion for all Energy Sector Funds.

Real Estate Sector Funds also snapped a six-week outflow streak that saw $1.4 billion flow out. This week’s inflow was a 13-week high, and was largely driven by funds dedicated to the US and Europe despite the headwinds facing housing markets in those markets.

Did you find this useful? Get our EPFR Insights delivered to your inbox.