Despite the strong rebound seen during November, this year has been a tough year – in flow terms – for both Emerging and Developed Markets Equity Funds. With one month of 2020 to go, net redemptions from all EM Equity Funds totalled $32 billion, while DM Equity Funds have seen $171 billion flow out.

The net figure for DM Equity Funds would now be positive if a net $223 billion had not been pulled out of US Equity Funds. Although this group has been experiencing structural outflows for some time as retiring Baby Boomers rotate to less volatile asset classes, the sheer volume of the outflows is surprising given the performance of US equity markets.

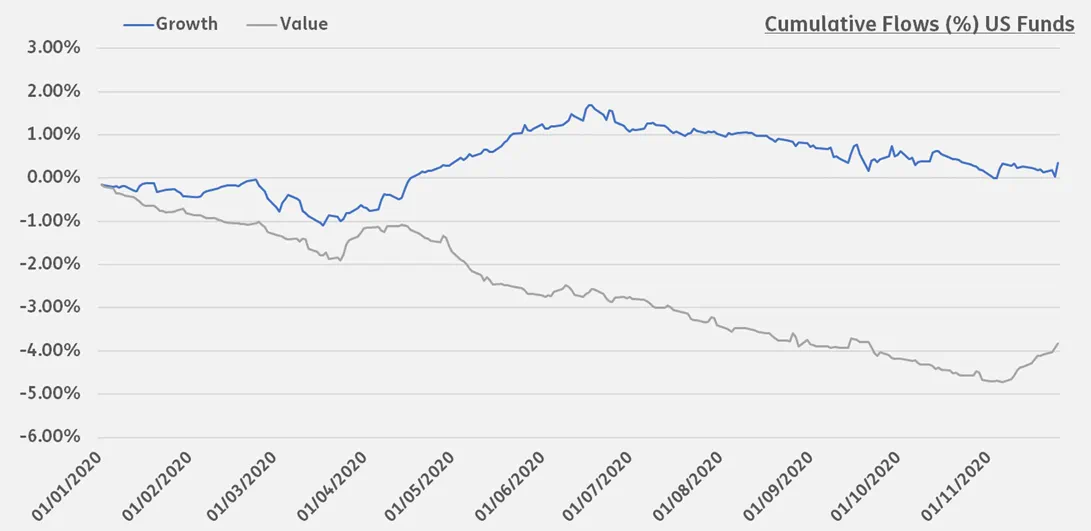

Digging deeper, it is the outflows from a particular style of fund that catch the eye. US Value Funds have experienced net redemptions equal to some 4% of their AUM at the start of 2020 – double the outflows recorded by US Growth Funds.

For investors who believe in value, the overall tide clearly continues to run against them. But, blindly rotating to other investment styles is not the answer. Applying the right quantitative tools is the best way to profit in this environment.

The needle is turning – but for how long?

Successful rotation between factors, especially value vs. growth, has always been a challenge for investors. Plenty of datasets and approaches have been tested by quantitative investors. More often than not, these efforts fail to achieve sustainable results when it comes to this particular rotation.

In this Quants Corner, we illustrate a simple strategy for rotating between value and growth stocks developed using the growth and value funds in the US tracked by EPFR.

As it happens, our work on this coincided with a rebound in the flows to US Value Funds. A wave of optimism driven by encouraging news about several of Covid-19 vaccines being developed translated into a collective inflow of over $100 billion for all Equity Funds.

While these inflows put smiles on many faces, the happiest investors were arguably value investors. After the first vaccine announcement by Pfizer, markets saw a significant rotation toward value stocks, which outperformed their growth counterparts by some 10% during November.

This development has a bearing on our strategy, which utilizes 120-day moving averages and a contrarian approach.

This factor still has a way to go

According to the literature, total flows to mutual funds increase the cross-sectional mispricing and anomalies seen in the market. The two main reasons for this are:

- The tendency for flows to persist, especially when following performance.

- The tendency of fund managers to scale their portfolios accordingly as they receive new inflows or outflows.

As the literature suggests, these two tendencies combined have the capacity to create significant price pressure on stocks and increase the size of some market anomalies.

We use the flow percentage [1] metric to capture these effects. That metric is defined as ‘the total flows to a given fund group divided by the total assets under management invested’. We then use these flow percentage factors to run a simple contrarian strategy.

When 120-day flows to US Growth Funds are higher than the US Value Funds, we go long on the Value factor and short the Growth factor, and vice-versa when Value Funds have attracted more money. The main idea is to stay on the other side of mutual fund flows when rotating between growth and value.

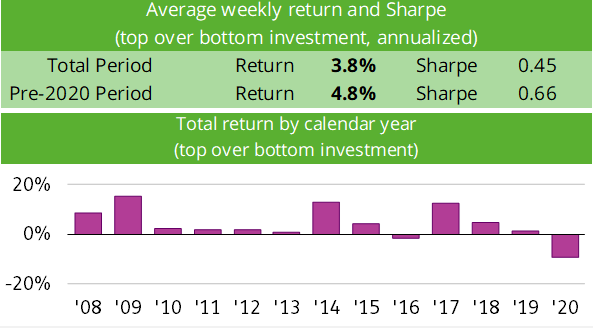

In the last 12 years, this simple strategy generated a Sharpe ratio of 0.45 and per-annum excess returns of 3.8%.

As in so many areas, 2020 has proved a significant outlier for this strategy, which has seen its largest drawdown in more than a decade. The strategy had a 4.8% per-annum return through the end of last year, with a 0.66 Sharpe ratio.

According to our model, the recent shift to value still has a way to go. The latest signal we get from the metric driving our strategy – which is a contrarian one — is to go long the Value factor.

While acknowledging this strategy’s unusual drawdown this year, we expect that a return to a more normal economic environment will mean better returns for this strategy in the medium term.

Did you find this useful? Get our EPFR Insights delivered to your inbox.