Although the 2024 US presidential election looks likely to be a re-run of the 2020 contest, it still meets the classic definition – irregular, deviating from the normal – of the word anomalous. From the age of the incumbent to the Republican challenger Donald Trump’s legal baggage and lack of decorum, everything about this election seems unusual.

This raises the possibility that this year’s presidential race will weigh on markets, asset classes, investor sentiment and portfolio construction – something that is anticipated every four years but frequently plays out as a whimper rather than a roar.

If this time is different, however, can we utilize fund flows and allocations data to navigate the pre-election uncertainty? As it happens, there is already something in EPFR’s tool kit.

Back to the future

Early last year, we explored anomalous flows into ETFs and their linkage to political and geopolitical events.

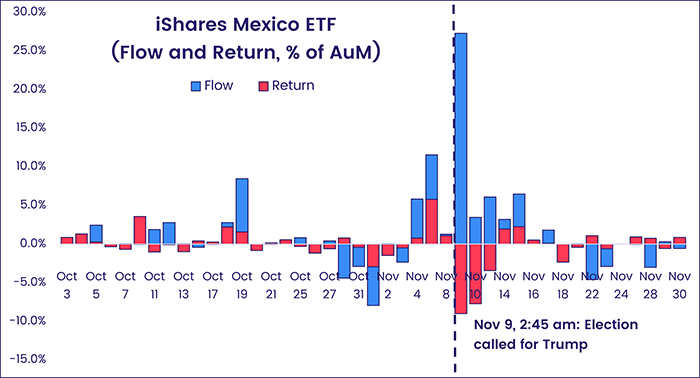

A classic example of this occurred in the aftermath of the 2016 US Presidential election which took place on November 8th. The day after the election, at 2:45 in the morning in New York, television networks called the election for then-candidate Donald Trump against the Democratic contender, Hillary Clinton. That day, there was a 27% percent inflow (in AUM terms) into the iShares Mexico ETF even as its value dropped by 9%.

In a previous Quants Corner: “When ETF flows confound expectations”, we linked this kind of anomalous flow, contrary to fundamentals, to high demand for the ETF units in order to express short interest.

For the purposes of that analysis, we defined flows into or out of a fund as anomalous whenever:

- flows, as a percentage of assets, exceeded 3%.

- fund return was -3% or lower.

- the spread between flow and return was at least 35%.

Turning our focus now to Trump-sensitive funds, we looked for all funds where the first two conditions applied over the 9th through the 11th of November 2016, when the market reacted to the Presidential election. We identified 66 such funds.

Standing the test of time?

Although those funds satisfied the criteria we established when applied to past events, the acid test is their response over the ensuing 12 months to the trials, triumphs, and tribulations of Trump and, to a lesser extent, President Biden. Are they, indeed, a useful guide as the 2024 election approaches?

Of the original 66 identified in 1Q23, only 43 were still reporting monthly flows to EPFR on the 31st of January this year. Of these, 32 are ETFs, which is consistent with the role shorting plays in our process. Only two of the 32 ETFs are actively managed and one of the mutual funds is passive. All but five of these funds have equity mandates.

Drilling down further, 22 of the funds in our pool are Emerging Markets Equity Funds, which is not surprising in light of Trump’s antipathy to developing nations. Only five have an investment focus on the US. Again, this is to be expected from an “America first” candidate.

In terms of styles and sectors, half are large cap core while 14 are dedicated sector funds.

Moving the needle

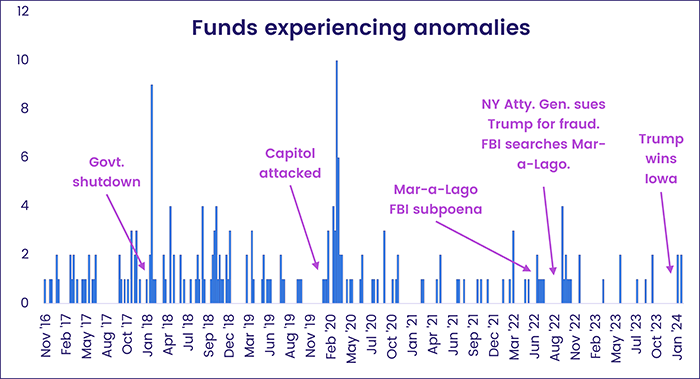

For each of these 66 funds, we looked at weekly flows after November 9, 2016. Each week, a fund counted as behaving anomalously whenever it experienced an inflow that week exceeding 3% of assets while simultaneously falling 3% or more in value. The chart below shows the number of anomalies.

As you can see from the chart, these funds behave strangely just after the occurrence of Trump-centric events.

To set a baseline, the average weekly anomaly count is 0.6 while the median is zero. But just after the 3-day government shutdown ended on the 22nd of January 2018, on Trump’s watch, nine funds experienced anomalies. Two years later, just after the Capitol was attacked, 10 funds behaved anomalously.

Similar spikes took place after the FBI subpoena asking for footage of the Mar-a-Lago document storage room, New York’s attorney general sued the Trump Organization for fraud, the FBI searched Mar-a-Lago, and when Trump won the Iowa caucuses.

Based on their history of being sensitive to Trump-related events, our original premise still holds: the flow and return of these funds can be used as a guide to market behavior with the 2024 US Presidential election approaching.

Check out more EPFR content pieces touching on politics:

- 21 September 2022, Quants Corner: “Hong Kong and Singapore: A tale of two cities”, by Vikram Srimurthy

- 29 October 2020, Quants Corner: “The run-up to election day: Reading the fund tea leaves”, by Vikram Srimurthy

- 12 November 2019, Quants Corner: “Capture wisdom crowds ahead of UK elections”, by Sayad Baronyan

Did you find this useful? Get our EPFR Insights delivered to your inbox.