Insights

Proprietary market data and analysis

Quant Insights

Another vote for divided government?

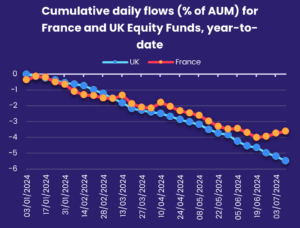

During the first week of July, the UK held, and France concluded, general elections that resulted in significant changes to both countries’...

EM Debt Markets: Finding a jewel in GEM allocations

The decade that started in 2020 has, so far, been a bumpy one for emerging markets bonds and those that invest in them. The Covid pandemic, interest...

Is there still hope for Middle Earth?

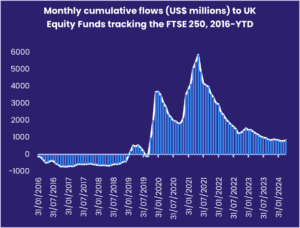

Cheerleaders for the UK’s stock market are thin on the ground these days. They are even thinner when it comes to the small and mid-cap spaces, with...

Economist Insights

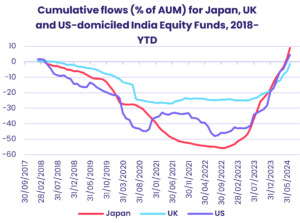

Fund flows prove resilient as noise levels rise

During WWII, civilians were constantly reminded that “loose lips sink ships.” In early 3Q24, it appeared that loose lips can also sink chips as...

Risk appetite climbs in early July

With US inflation behaving itself, French and British elections in the rearview mirror and another corporate earnings season that is expected to...

At the halfway point, glass half full

Investors spent the first few days of the third quarter trying to link the potential outcomes of snap elections in the UK and France, and shifts in...

Multimedia

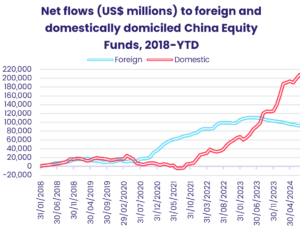

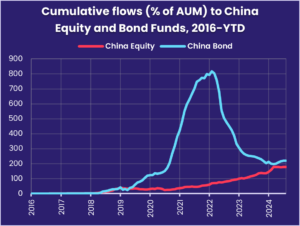

Market Insights: Searching for an anchor: Market sentiment towards China

Among the shifts evident in EPFR’s data coming into the third quarter was a recovery in sentiment towards, and flows into, China-mandated...

Market Insights: Latest trends for ESG and Electric Vehicle Funds

This year, funds with SRI/ESG mandates are well off the pace seen in 2021 when the current full-year inflow record was set, despite taking in fresh...

Market Insights: Central Banks Update

With the G7 Central Banks meeting this week in Italy and global markets expecting the long-anticipated central bank ‘pivots’ to start lowering...

Papers

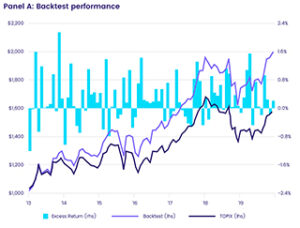

EPFR Papers: Estimating asymmetric price impact

This paper studies the asymmetric price impacts mutual fund and ETF flows have on individual stocks in demand-based asset pricing.

A rising tide lifts some (Japanese) boats: The Bank of Japan’s ETF purchases and their impact on market signals for individual stocks

The Bank of Japan has been the pace-setter among central banks when it comes to purchasing non-government financial securities. It was the first...

Oil bonds still have fuel in the tank – but how long will it last?

Fixed income markets are abuzz about the spectacular demand for new green bonds. Flows into fixed income funds with socially responsible investing...