Insights

Proprietary market data and analysis

Quant Insights

Quants Corner – In 2021, backing those closest to the light

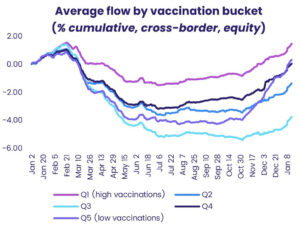

Mapping fund flows to the progression of a truly global pandemic is something that EPFR – thankfully – has not had to deal with for most of its...

Quants Corner – Animal spirits arise in retail investors

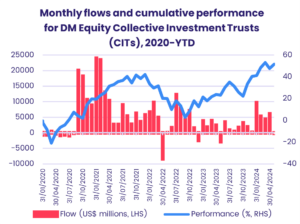

After years of pulling money out of equity funds, retail investors are starting to step back in. EPFR-tracked Equity Funds ended 2020 with eight...

Quants Corner – ESG: The climate has changed

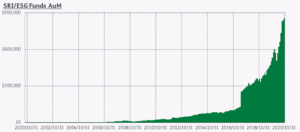

EPFR started tracking equity fund flows in the first quarter of 1996. It started tracking its first funds with socially responsible (SRI) or...

Economist Insights

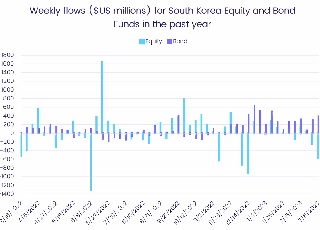

Funds benchmarked to Bitcoin drive alternatives

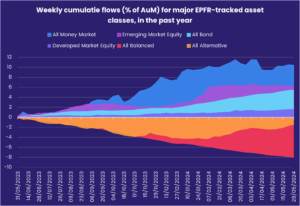

With election results for South Africa, India and Mexico looming and key central bank meetings on the horizon, investors generally took a...

Soft landing story facing trade barriers

A ‘soft landing’ for the global economy, with inflation broadly tamed while avoiding a recession, remains the dominant narrative in asset markets,...

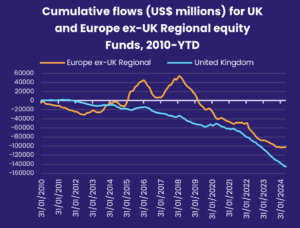

Green shoots for Europe stock funds

With the Bank of England and the European Central Bank widely expected to follow the example of their Swedish and Swiss counterparts, and start...

Multimedia

Market insights: Investor sentiment following SVB’s collapse – Macro and micro perspectives

A week after Silicon Valley Bank’s collapse, we use EPFR Fund Flows and Allocations data to measure the real impact on investor...

Weekly fund flows highlights – 20 March 2023

EPFR’s Steve Muzzlewhite uses our Fund Flows and Allocations data for an update on US bond funds and Japan’s equity funds.

Weekly fund flows highlights – 13 March 2023

We use EPFR Fund Flows data to analyze investor sentiment following Silicon Valley Bank’s collapse (SVB), and Federal Reserve Jerome Powell’s speech...

Papers

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.