Insights

Proprietary market data and analysis

Quant Insights

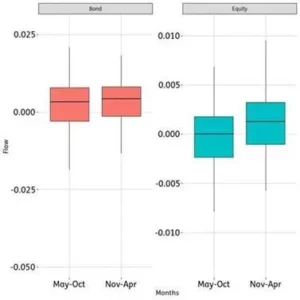

Are we going to see a melt-down instead of a melt-up in May?

The well-known phrase is originally linked to an old-English saying: “Sell in May and go away and come on back on St. Leger’s Day”. St...

Utilizing EPFR data to find answers to key asset management questions

This week, in Quants Corner, we will be looking at how EPFR Flow and Allocation Data can help answer some of the more difficult questions in the...

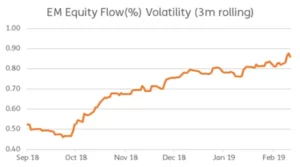

Factor-driven strategies: Momentum and low-volatility using EPFR data

Since the start of 2019, inconclusive US-China trade talks, uncertainty around Brexit, softening German economic data and worries about emerging...

Economist Insights

For US funds, the money keeps rolling in

Investors continued to give thanks for US assets during the third week of November. Combined flows into US Equity, Bond and Money Market Funds hit...

Investors like what they see in US tea leaves

Do 4.9% third quarter GDP growth, the lowest core CPI reading in two years and an unemployment rate at a 21-month high add up to a soft landing for...

Risk appetite rebounds in early November

After several weeks of shunning exposure to riskier asset classes in favor of cash, gold and US sovereign debt, investors shed some of their caution...

Multimedia

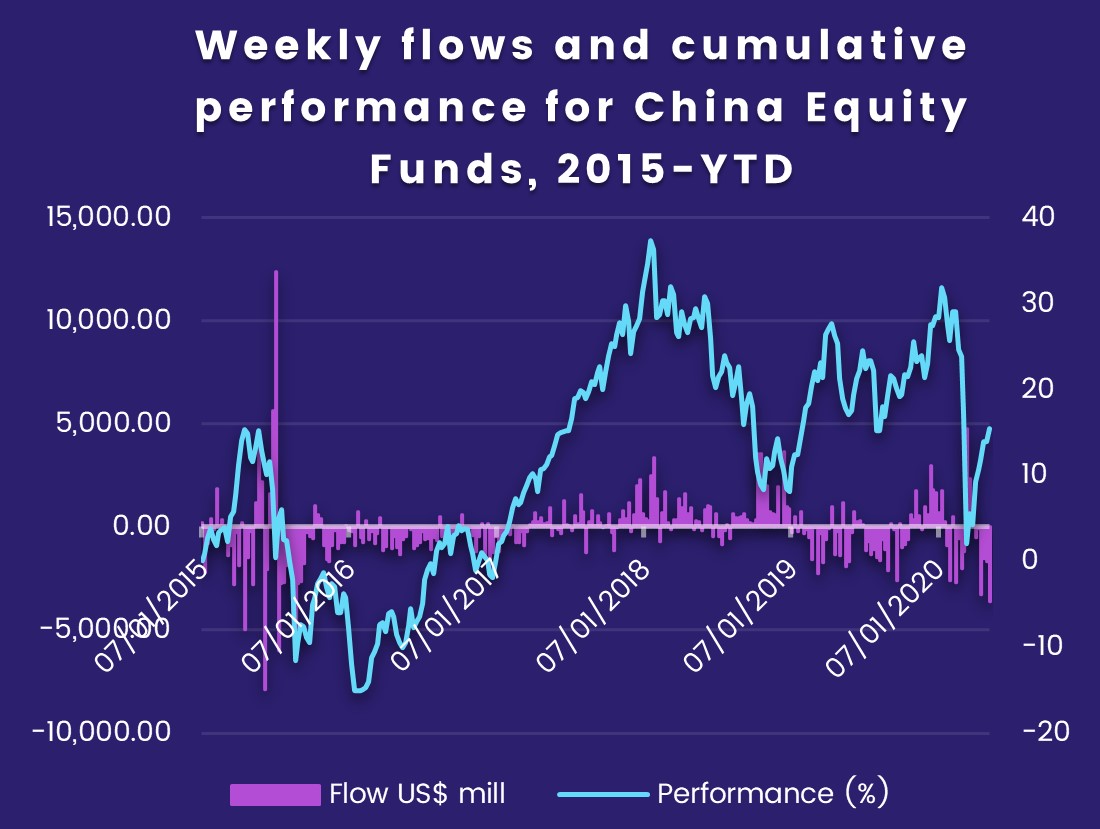

China’s economic recovery: Trailblazers or uncharted territory

China is ahead of the rest of the world in its financial recovery. But, what, if anything, can we learn from China’s recovery path to date? How is...

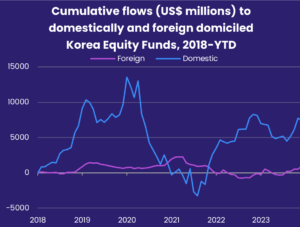

Dealing a full deck: Utilize share classes for reliable China exposure

At the end of February, China’s average share of EPFR-tracked Global Emerging Markets Equity Funds exceeded 30% for the first time. The milestone is...

EPFR explainer video

EPFR data helps portfolio managers, asset allocators, strategists and research teams generate alpha by giving them a clear picture of where money is...

Papers

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.