Insights

Proprietary market data and analysis

Quant Insights

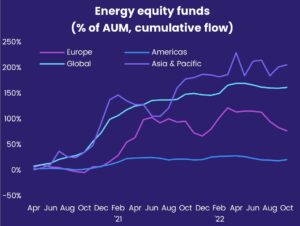

Energy funds in a time of war

This blog will examine the impact the conflict between Russia and Ukraine has had on global energy markets and the calls investors have made during...

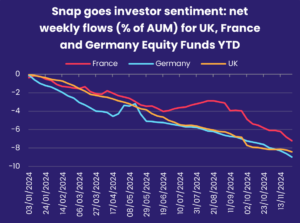

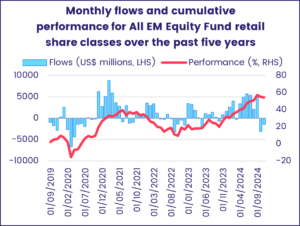

Retail flows: The wisdom of “dumb money”

In this blog, we utilize some of EPFR’s oldest strategies to test the predictive powers of the retail flows captured in the universe of 150,000...

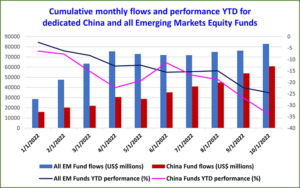

Separating the wheat from the chaff in China

Of the $82 billion that investors committed to all EPFR-tracked Emerging Markets Equity Funds through the first 10 months of 2022, three-quarters...

Economist Insights

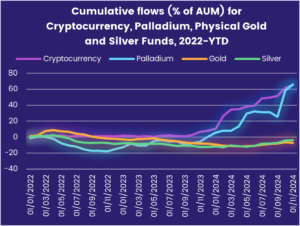

Money flows to the eye of future storms

US President-elect Donald Trump has made it clear he has little truck with the logic of climate change. But investors expect Trump’s presidency will...

AI theme reasserts itself in mid-November

Having steered over $200 billion into US Equity, Money Market and Bond Funds over a two-week period, investors took stock during the third week of...

Post-election realignment continues apace

Investors committed another $151 billion to all US Equity, Money Market and Bond Funds during the second week of November as they adjusted their...

Multimedia

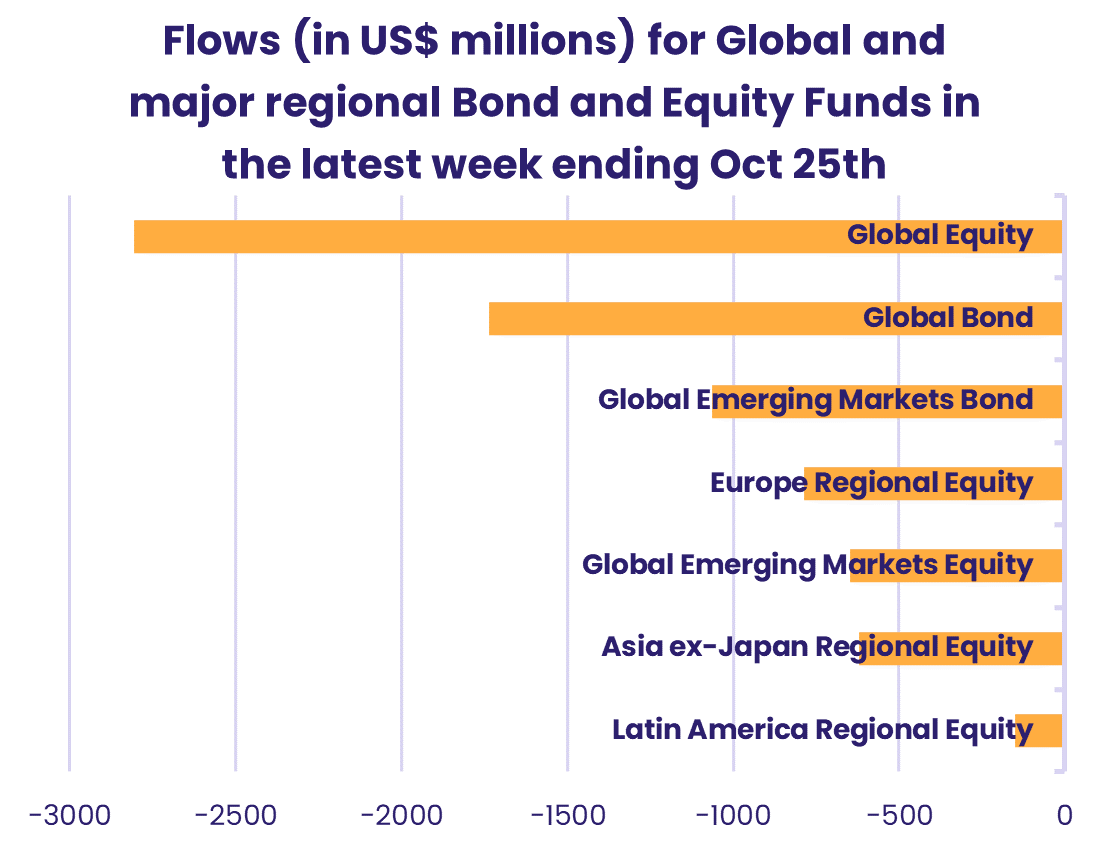

Weekly fund flows highlights – 30th October 2023

EPFR’s Steve Muzzlewhite explains how rising geopolitical tensions caused investor sentiment to shift away from bond flows and equity fund...

Weekly fund flows highlights – 9th October 2023

How did US equity fund flows respond to the US nonfarm payroll exceeding expectations, with over 300,000 new jobs being created? Join Steve...

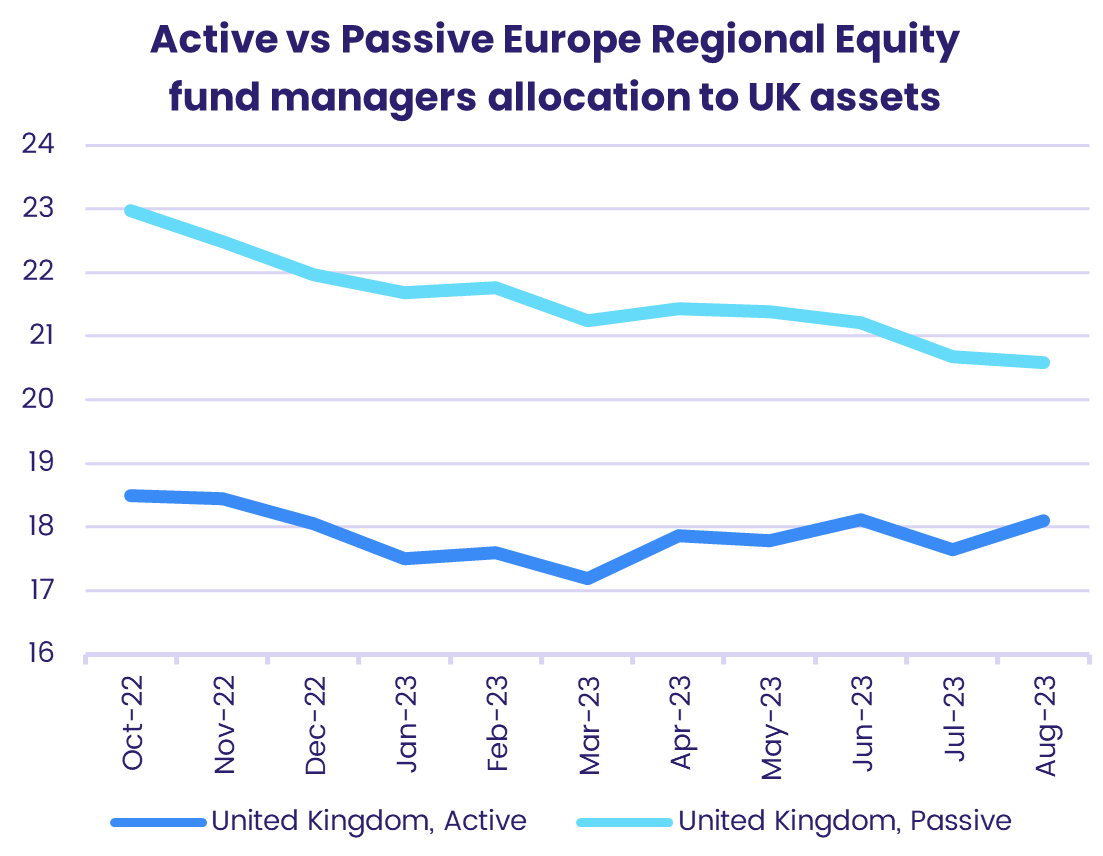

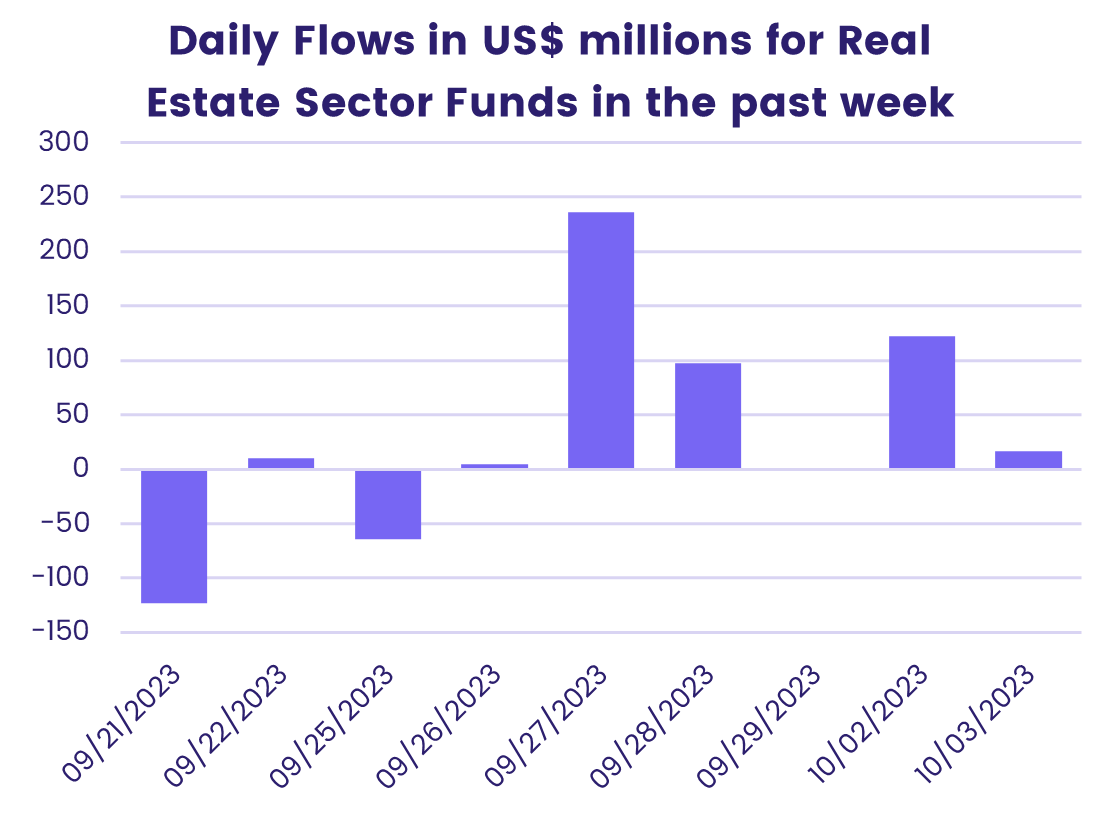

Weekly fund flows highlights – 2nd October 2023

With Q3 2023 coming to an end, Research Associate, Kirsten Longbottom, shares our latest EPFR fund flows and asset allocations data. This week, we...

Papers

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.