US Money Market Funds kicked off April by recording their fourth straight inflow in excess of $50 billion as investors sought alternatives to commercial bank products and sought clarity on the trajectory of US monetary policy. Those investors also pulled money out of US Equity Funds for the eighth time in the past nine weeks, hit Financial Sector Funds with their biggest weekly outflow since mid-2Q22 and extended Inflation Protected Bond Funds’ longest outflow streak since 2013.

The week ending April 5 did see some signs of increased risk appetite, especially among fixed income investors. Flows into High Yield Bond Funds climbed to a 35-week high and Frontier Markets Bond Funds recorded their biggest inflow since early November while Alternative Funds took in over $2 billion for the first time in over two months.

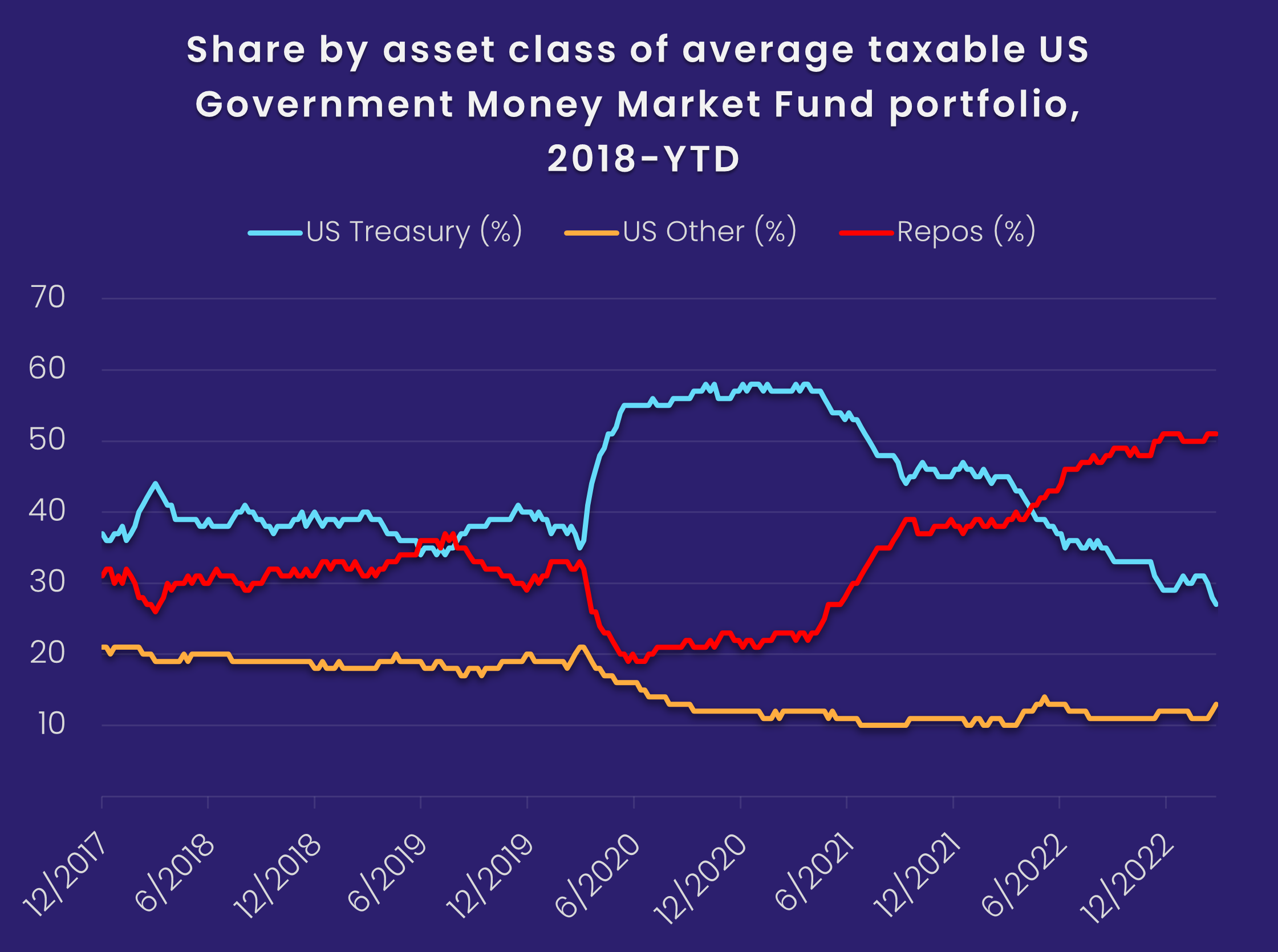

The latest influx of cash to US Money Market Funds took their total since the final week of February past the $450 billion mark. The bulk of that money is going into funds whose asset mix is limited to government paper. Analysis of US Government Money Market Fund allocations by EPFR’s iMoneyNet team shows that transactions with US Federal Reserve’s reverse repurchase (repo) facility now account for the biggest element of the average portfolio, supplanting US Treasuries purchased and sold on the open market.

Overall, the week ending March 29 saw all EPFR-tracked Bond Funds absorb a net $2.4 billion. Investors pulled $5.1 billion out of Equity Funds, with Alternative Funds surrendering $1.2 billion and Balanced Funds $2.3 billion. Money Market Funds took in $60 billion, US Money Market Funds extended their current three-week, $311 billion inflow streak and Europe Money Market Funds took in fresh money for the fourth week running.

Overall, all EPFR-tracked Money Market Funds posted a collective inflow of $87 billion during the first week of April, with flows to Europe Money Market Funds hitting a 13-week high, while Balanced Funds posted their third inflow year-to-date and Alternative Funds absorbed a net $2.6 billion. Investors steered over $14 billion into Bond Funds – an 11-week high – and removed $910 million from all Equity Funds.

At the single country and asset class fund level, flows into South Africa Bond Funds hit a record high, New Zealand Equity Funds chalked up their biggest outflow since late 3Q21 and Korea Equity Funds extended their longest redemption streak in over a year. Cryptocurrency and Gold Funds recorded their third and fourth consecutive inflows, respectively, while Silver Funds posted their second biggest inflow in the past eight months.

Emerging markets equity funds

Combined redemptions of nearly $1 billion from China and Korea Equity Funds during early April more than offset modest flows into the diversified Global Emerging Markets (GEM) Equity Funds. As a result, EPFR-tracked Emerging Markets Equity Funds started the month with a collective outflow despite taking in fresh retail money for the first time in a month.

The first week of 2Q23 did see EM Dividend Funds extend a run of inflows stretching back to early December and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates chalked up their 20th consecutive inflow.

China Equity Funds posted consecutive weekly outflows for the third time so far this year as Sino-US tensions climbed again as a result of Taiwanese President Tsai Ing-wen’s visit to the US. China, which views Taiwan as a renegade province, has threatened to retaliate. Taiwan (POC) Equity Funds, meanwhile, posted their first outflow since January and biggest since mid-December.

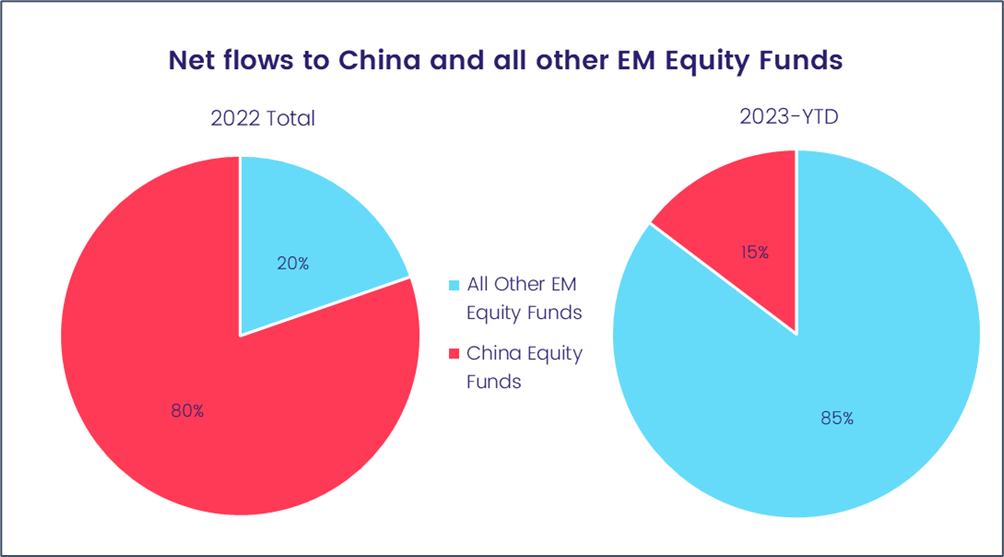

Despite the broad expectations of stronger Chinese growth this year, flows to China Equity Funds in 2023 have not – at least for now – left the same footprint on the flow total for all EM Equity Funds that they did last year.

EMEA Equity Funds also posted a modest outflow during the first week of April. OPEC’s recent decision to cut output again, in order to keep a floor under oil prices, did little for fund groups dedicated to major oil-producing nations. Middle East Regional, Russia, UAE and Kuwait Equity Funds all posted outflows while flows into Saudi Arabia, Nigeria and Qatar Equity Funds were under $1 million.

There was little appetite for both regional and country-level exposure to Latin America, with Mexico Equity Funds extending their longest redemption streak since 3Q22 and Argentina Equity Funds posting their biggest outflow in over seven months. GEM Equity Funds’ average allocation to the region, which peaked at a 58-month high in 4Q22, has fallen for three of the past four months.

Developed markets equity funds

With the latest US jobs report and the start of the first quarter earnings season on the near horizon, flows to EPFR-tracked Developed Markets Equity Funds were subdued in early April as investors waited for fresh clues about the health of the world’s largest economy and the likelihood of further interest rate hikes. Although flows into the diversified Global Equity Funds climbed to a seven-week high, that was not enough to compensate for the outflows from US, Canada, Japan and Europe Equity Funds.

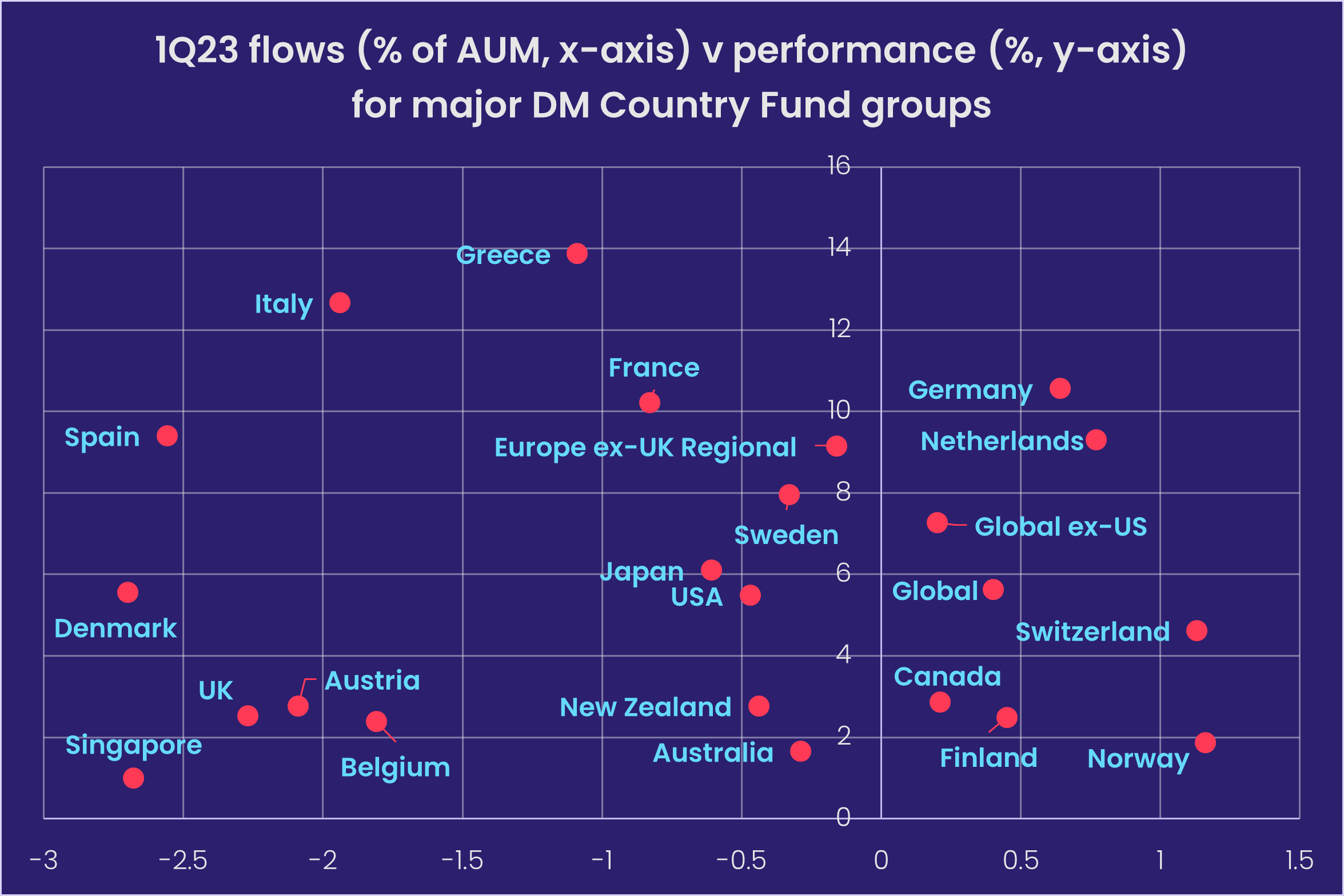

Preliminary figures for the first quarter show that investors were not chasing performance. The four groups turning in the best collective performance, Italy, France and Greece Equity Funds, recorded outflows for the quarter. Only Germany Equity Funds saw money come in.

During the latest week, redemptions from several Europe Country Fund groups dragged the headline number for all Europe Equity Funds into the red. With Eurozone growth doing better than expected on the back of a rebound in demand for services. The former posted their biggest weekly outflow since late 3Q21 while UK Equity Funds saw money flow out for the 13th straight week.

Japan Equity Funds saw their two-week run of inflows come to an end during a week when oil prices jumped in the wake of OPEC’s decision to cut production. Japan imports nearly all the oil it uses. Elsewhere in the region, flows into Australia Equity Funds hit an eight-week high as the Bank of Australia decided to pause its tightening cycle and New Zealand Equity Funds experienced their heaviest redemptions since late 3Q21.

For the eighth time in the past nine weeks, US Equity Funds recorded a collective outflow. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates snapped their longest run of outflows since early 2018.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, were the only group to see significant retail interest in early April. The bulk of the fresh money went to funds with fully global rather than ex-US mandates.

Global sector, industry and precious metals funds

With the 1Q23 corporate earnings season a week away from kicking off, investors positioned themselves in early April for the first round of reports which will come disproportionately from major US financial plays. Of the 11 major EPFR-tracked Sector Fund groups, seven posted inflows while Financial Sector Funds topped the list of those that experienced net redemptions.

With investors reassessing the ability of banks to hold onto cheap deposits, the potential for new regulatory requirements and other consequences of the recent bank failures in the US, redemptions for Financials Sector Funds climbed to a 46-week high of $1.8 billion, tripling the previous week’s outflow. Six of the top 10 funds ranked by outflows for the week had ‘bank’ in their name and the Regional Banks Fund group recorded their heaviest outflow in 14 weeks.

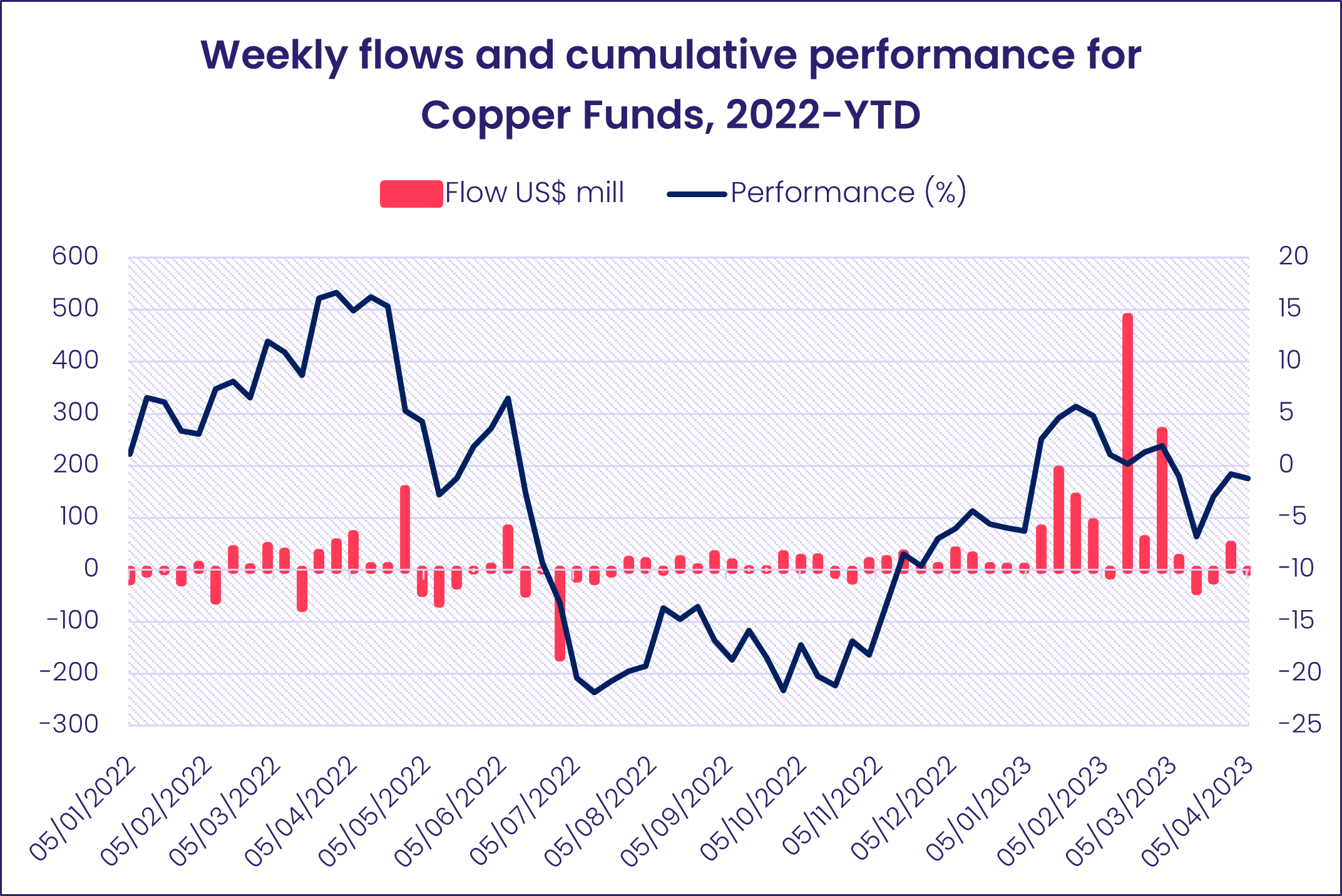

The ability and willingness of banks to lend have obvious implications for future growth. The latest data suggests growing caution rather than outright panic, with Industrial Sector Funds eking out their seventh inflow in the past 10 weeks, Energy Sector Funds taking in a net $208 million and Consumer Goods Sector Funds posting their fifth straight inflow. But Commodities Sector Funds posted modest outflows and flows into Copper Funds, usually a bellwether for optimism about economic growth, continue to wane.

Elsewhere, Technology Sector Funds snapped their six-week, $3.2 billion inflow streak during the week ending April 5. The over $350 million flowing into US Technology Sector Funds for the fourth straight week was not enough to offset the heaviest redemptions seen by China Technology Sector Funds since the end of 2Q22.

Real Estate Sector Funds with global mandates were the biggest contributor to this group’s largest inflow since the first week of last June. Japan and Europe ex-UK Regional Real Estate Sector Funds also attracted inflows, while US, Switzerland, Canada, UK and China Real Estate Sector Funds saw a combined $150 million outflow. Providing lower portfolio risk and higher returns, REIT Funds have grabbed investors’ attention in recent weeks, with weekly inflows rising to their highest level since mid-4Q22.

Demand for Gold Funds has risen over the past weeks as they posted their fourth consecutive inflow. This is the longest stretch of inflows since a 14-week run ended in mid-2Q22. Silver Funds also saw a healthy quarter of a million dollar inflow which is the most in 10 weeks.

Bond and other fixed income funds

Flows into all EPFR-tracked Bond Funds climbed to their highest level since the third week of the year as investors, given hope by the Australian central bank’s decision to pause its tightening cycle, positioned themselves for slower economic growth and lower interest rates. Flows into Europe, US and Canada Bond Funds hit nine, 12 and 17-week highs, respectively, and investors steered $1.4 billion into Global Bond Funds.

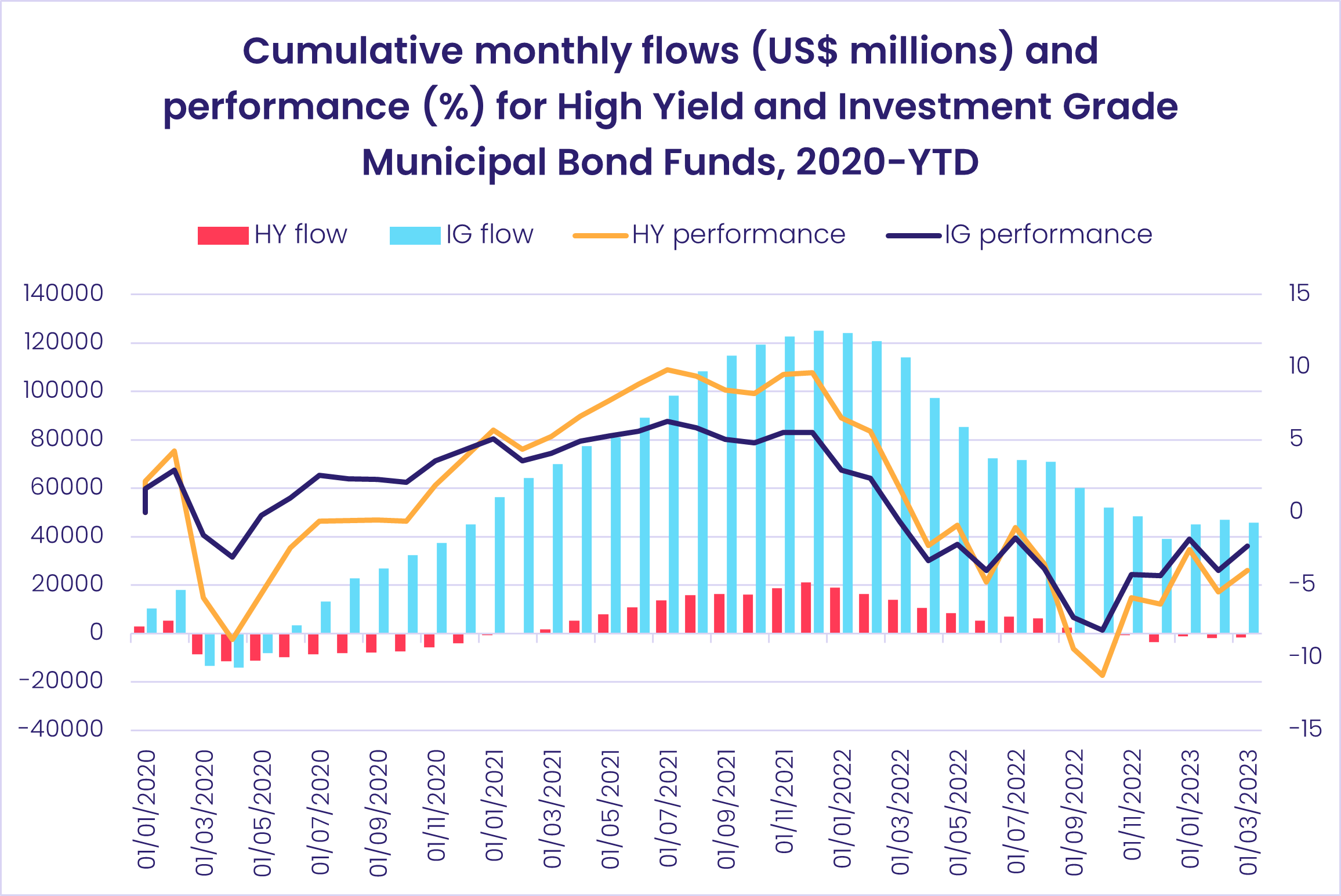

At the asset class level, High Yield Bond Fund flows rebounded during the first week of April to their highest level in eight months, Convertible Bond Funds posted only their second inflow since early December, redemptions from Inflation Protected Bond Funds climbed to a level last seen in early May 2022 and Municipal Bond Funds chalked up their sixth outflow in the past seven weeks.

Elsewhere, Mortgage-Backed Bond Funds chalked up only their third outflow so far this year, Convertible Bond Funds posted up their 30th outflow in the past 34 weeks and Inflation Protected Bond Funds extended their longest outflow streak since a 37-week run ended in 2013.

Among the major groups by geographic focus, both Asia Pacific and Emerging Markets Bond Funds posted outflows. In the case of the former, Japan Bond Funds were the biggest contributor to the headline number as they posted their fourth redemption in the past five weeks. Markets continue to test the Bank of Japan’s yield control policy as leadership of the Japanese central bank changes for the first time in a decade.

It was a busy week at the country level for Emerging Markets Bond Funds which recorded their eighth consecutive outflow. Mexico Bond Funds posted their second largest outflow since 2Q14 and Colombia Bond Funds their biggest since mid-2Q21 while previously high-flying Korea Bond Funds chalked up their second outflow in the past three weeks. On the other hand, flows into Thailand and South Africa Bond Funds hit 13-week and record highs, respectively.

Investors looking to Europe favored Europe Bond Funds with sovereign mandates over their corporate counterparts for the fourth week running. Switzerland Bond Funds were the only country-level group to see significant inflows.

US Corporate Bond Funds posted their biggest collective inflow 2Q20 while US Sovereign Bond Funds posted their 12th inflow in the 14 weeks year-to-date. The flicker of retail interest seen between mid-January and late February has faded away with money flowing out of retail share classes each of the past five weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.