As expected, the fourth week of July ended with the Federal Reserve hiking US interest rates by another 75 basis points. For a market that feared June’s inflation number – a 40-year high – might justify a 100 basis points hike, the smaller increase was greeted with relief and a modest jump in risk appetite.

Among EPFR-tracked fund groups, flows into High Yield Bond Funds snapped a six-week redemption streak with their fourth biggest weekly inflow since the beginning of 2021, outflows from Emerging Markets Bond Funds fell to their lowest level since the second week of April and flows into Alternative Funds jumped to an eight-week high.

Europe Equity and Bond Funds experienced another week of net redemptions as Russia continued to limit natural gas exports to the region and investors digested the European Central Bank’s larger than expected rate hike at the start of the reporting period.

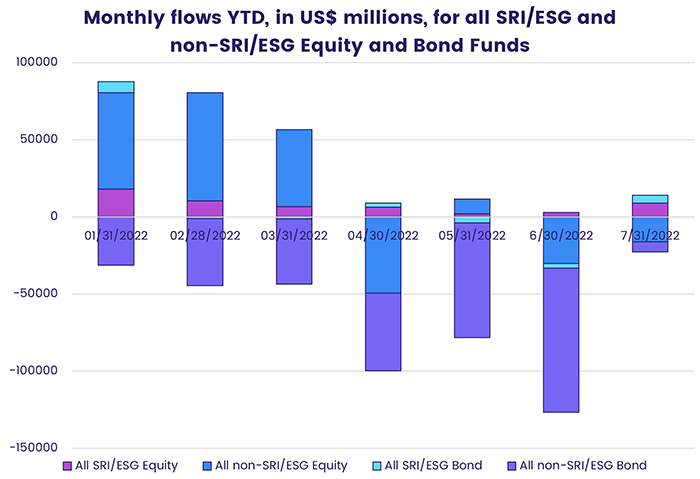

Overall, the week ending July 27 saw Equity Funds post a collective inflow of $5.5 billion while Bond Funds absorbed $3.4 billion and Money Market Funds $27 billion. Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest inflow since early February and Dividend Equity Funds since the fourth week of April.

At the single country and asset class fund levels, Inflation Protected Bond Funds chalked up their biggest outflow since early May, investors pulled money out of Bank Loan Funds for the seventh straight week and Cryptocurrency Funds snapped a five-week redemption streak. Outflows from Spain Equity Funds hit a 16-week high, China Bond Funds experienced net redemptions for the 23rd time since the beginning of February and UK Bond Funds chalked up their biggest weekly outflow in over 18 months.

Emerging Markets Equity Funds

Another strong week for China Equity Funds, especially those with socially responsible (SRI) or environmental, social and governance (ESG) mandates, enabled EPFR-tracked Emerging Markets Equity Funds to emerge from the week ending July 27 with their 20th inflow year-to-date.

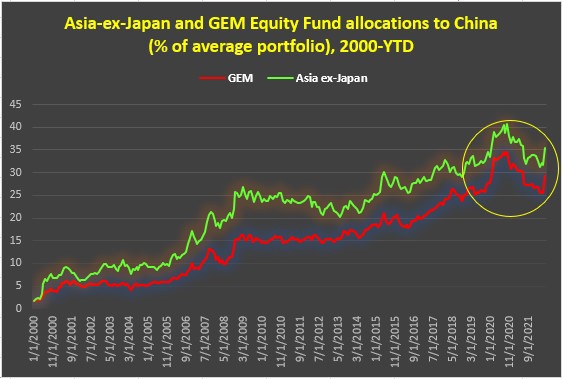

Although China’s economy remains under pressure from the dislocations caused by the country’s ‘zero Covid’ policies, investors are responding to the country’s relatively low levels of inflation, large internal market, plans to boost infrastructure spending and the expectation that any interest rates move will be down. China Equity Funds have absorbed fresh money for eight straight weeks and 25 of the 30 weeks year-to-date. Fund manager allocations to this market jumped sharply during the final month of 2Q22.

Going forward, flows into China Equity Funds will reflect a change in EPFR’s fund classifications. An internal review determined that for some Hong Kong-traded assets, the classification of ‘China’ better resembles the country of risk. As a result of this assessment, several Greater China Regional Funds whose allocation to China now surpasses the threshold for regional funds will be reclassified as China Equity Funds.

Among the Latin America Country Fund groups, Brazil Equity Funds recorded their fifth straight outflow while Mexico Equity Funds posted their first outflow since early June – and biggest since late April – as investors translated slower US growth into weaker Mexican GDP numbers. Chile Equity Funds posted their 24th outflow YTD ahead of a September vote on a proposed constitution widely viewed as markedly less business-friendly than the current version.

Money flowed out of EMEA Equity Funds for the seventh time in the past eight weeks as the Russian assault on Ukraine grinds on and the price of oil hovered around the $100 a barrel mark, well down from the recent peaks seen in early March and early June.

Did you find this useful? Get our EPFR Insights delivered to your inbox.