A recession in the second half of the year, triggered by the impact of current interest rates on the real estate sector and the banks that lend to it, is a fearful scenario for investors. This was reflected in the flows for EPFR-tracked Sector Funds during the week ending May 10, with a combined $3.8 billion redeemed from Financial, Real Estate, Energy and Commodities Sector Funds.

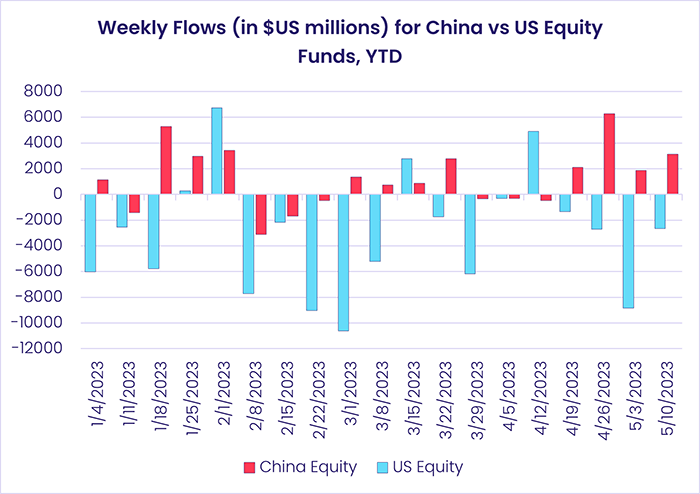

Strategies for riding out a downturn in the US and elsewhere include buying into China’s rebound story and the potential of artificial intelligence, taking refuge in gold and going to cash. Money Market Funds absorbed another $13.8 billion, over $3 billion flowed into Technology Sector and China Equity Funds and Gold Funds recorded their second-largest inflow during the past 12 months.

Investors also shrugged off concerns about the US debt ceiling standoff and the stickiness of European inflation, committing solid sums to US and Europe Bond Funds. They were not so forgiving of the higher costs and minimal outperformance offered by many Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. SRI/ESG Equity Funds, which posted no weekly outflows in 2021 and 10 last year, chalked up their fifth outflow of 2023.

At the single country and asset class fund level, flows into Chile Equity Funds climbed to their highest level since mid-3Q22, Japan Equity Funds absorbed over $800 million this week, and redemptions from Spain Bond Funds hit a 10-week high. Dividend Funds posted consecutive weekly outflows for the first time since mid-December and Cryptocurrency Funds chalked up their third straight outflow.

Emerging markets equity funds

The first full week of May saw Emerging Markets Equity Funds record their fourth straight inflow and their 17th in the past 21 weeks as investors continue to buy into the post-Covid lockdown recovery they expect in China. All four of the major regional groups reported a net inflow during the latest reporting period. EMEA Equity Funds snapped a five-week outflow streak with their seventh inflow of the 19 weeks year-to-date, GEM Equity Funds extended their inflow streak to seven weeks and $4.8 billion total and Latin America Equity Funds took in their third inflow of the past four weeks.

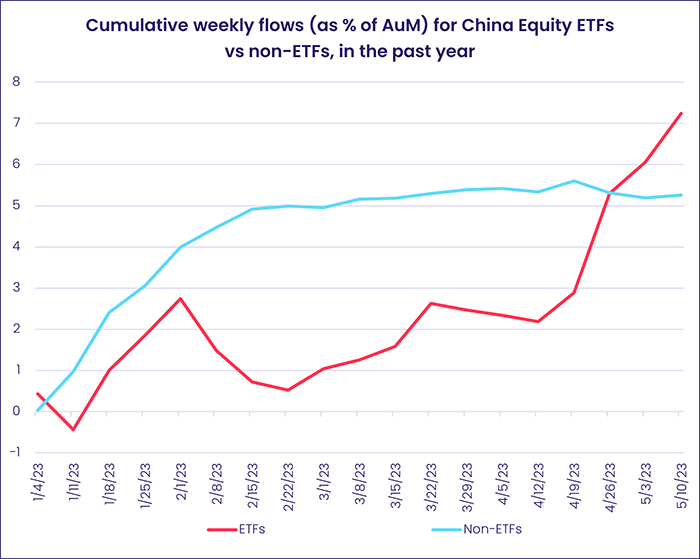

There was a shift in the focus of China-oriented investors, with Large Cap China Equity Funds snapping an eight-week inflow streak while Small Cap Funds racked up their third consecutive inflow. Those investors are also steering their money into ETFs rather than actively managed funds. Since mid-April, investors have added $13.4 billion (or 5% of assets) to China Equity ETFs while flows into non-ETFs have leveled out.

Among the other Asia ex-Japan Country Fund groups, India Equity Funds recorded the third highest total of their current eight-week inflow streak, Taiwan Equity Funds took in fresh money for the third straight week and Korea Equity Funds suffered their third outflow in the last four weeks and ninth in the past 11 weeks.

Turkey Equity Funds again stood out in the EMEA Equity Fund universe, posting their third straight inflow ahead of a general election that poses the biggest challenge incumbent President Recep Tayyip Erdogan has faced during his two decades in office. South Africa Equity Funds also absorbed fresh money, snapping a four-week outflow streak with only their third inflow since mid-January, as the rand’s depreciation versus the US dollar made South African assets even cheaper for overseas investors.

Flows into Mexico Equity Funds climbed for a third consecutive week as slowing inflation opens the door for Mexico’s central bank to shift to a neutral stance on interest rates. Elsewhere, Chile Equity Funds recorded their largest inflow since early September of last year as investors keyed in on the country’s recent growth.

Developed markets equity funds

With markets digesting the latest US, UK and Eurozone interest rate hikes, EPFR-tracked Developed Markets Equity Funds ended the first full week in May by posting their fourth consecutive outflow and 10th in the past 12 weeks. Investors showed some appetite for diversified exposure, committing over $2 billion to Global Equity Funds, and steered over $800 million into Japan Equity Funds. But that was not enough to offset redemptions from US, Canada, Europe, Pacific Regional and Australia Equity Funds.

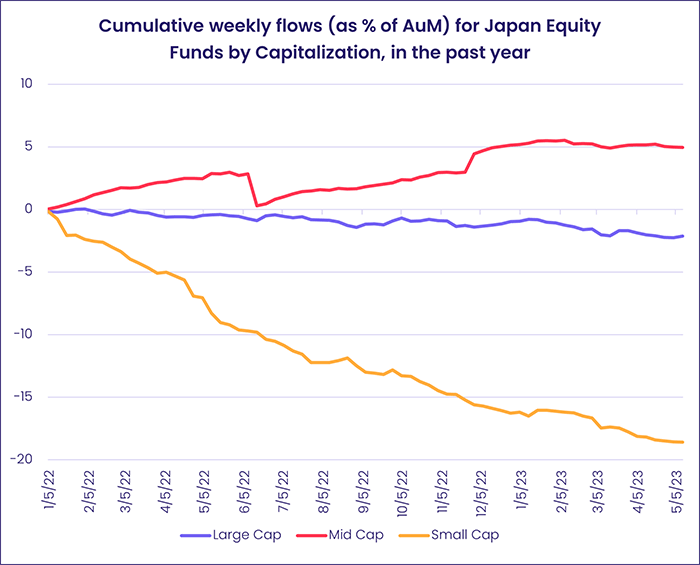

The flows into Japan Equity Funds – the most in seven weeks – came despite concerns the country may be swapping deflation for stagflation. Flows over the past six months have favored funds with mid-cap mandates. During the latest week, Japan SRI/ESG Equity Funds snapped a 12-week inflow streak and Japan Dividend Funds posted their seventh inflow in the last nine weeks.

There was little interest in more exposure to developed Asia’s other markets. Outflows for Australia and New Zealand Equity Funds climbed to nine and five-week highs, respectively, while Singapore Equity Funds ran their current outflow streak to four weeks, the longest stretch since mid-December 2022.

Redemptions from US Dividend Funds climbed to a seven week high and US SRI/ESG Equity Funds posted their third straight outflow as investors tried to read the inflationary and interest rate tea leaves. Headline inflation in the US fell to 4.9% in April, easing for the 11th consecutive month, but the US Federal Reserve continues to downplay the chances of any rate cuts this year.

Sentiment towards Europe remains cool despite the recent gains by key indexes and the easing of energy costs. Europe Equity Funds posted their ninth straight outflow. Funds dedicated to two non-EU markets, Switzerland and the UK, surrendered a combined $1.2 billion during a week when the Bank of England raised its key interest rate by another 0.25% and Credit Suisse bondholders sued Swiss regulators over their handling of the bank’s collapse in March.

Global sector, industry and precious metals funds

As the 1Q23 earnings season winds down in the US and the hoped-for ‘pivot’ on interest rates by the US Federal Reserve remains elusive, investors took – with one major exception – a largely defensive approach to their sector commitments during the week ending May 10. The five groups that absorbed fresh money included Utilities, Telecoms and Consumer Goods Sector Funds while money flowed out of Energy, Financial, Real Estate and Commodities Sector Funds.

Technology Sector Funds were the exception to this pattern. This group took in over $3 billion, their biggest weekly total since mid-December which extended their current inflow streak to four weeks and $6.3 billion. During the latest week, six of the top 10 funds ranked by inflows had semiconductor mandates. China-dedicated funds dominated the overall flow picture, though US Tech Sector Funds did record an inflow of nearly $500 million.

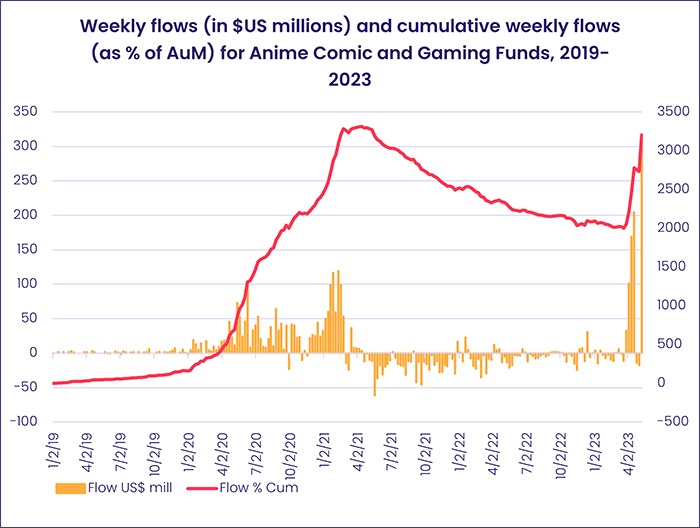

Looking at technology sub-groups, there has been a marked increase in appetite for Anime, Comic, Gaming and E-sports Funds. Prior to 2020 there was little interest in these funds but, once the pandemic hit and millions of people spent vastly more time at home and online, flows grew exponentially before tailing off in 2Q21. During the past week Anime Comic and Gaming Funds chalked up their fifth inflow in the past seven weeks, with the latest an all-time high of $311 million as investors look for ways to benefit from the accelerating interest in artificial intelligence (AI) and its applications.

Elsewhere, flows into Telecoms and Utilities Sector Funds reached four and five-week highs and Consumer Goods Sector Funds posted their ninth inflow during the past 10 weeks. Among the sector groups reporting outflows, Energy Sector Funds ran their current redemption streak to four weeks and $3.2 billion, Financials Sector Funds’ latest outflow was the largest in just shy of a year and Real Estate Sector Funds recorded their biggest outflow in over four months.

Bond and other fixed income funds

EPFR-tracked Bond Funds took in another $6.3 billion during the week ending May 10 as the desire for safety trumped widespread uncertainty about inflation, interest rates, the outcome of the latest US debt ceiling debate and the health of the global economy. This group has now posted inflows 17 of the 19 weeks year-to-date. Retail share classes, however, posted their 10th outflow of the year.

The latest week saw funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates record their 16th inflow of the year. But, overall, flows have been trending down since late January.

At the asset class level, Inflation Protected Bond Funds equaled their longest-ever outflow streak, flows to Mortgage-Backed Bond Funds bounced back to a seven-week high, Municipal Bond Funds posted only their third inflow since mid-February and High Yield Bond Funds saw over $2 billion flow out as the junk bond default rate climbs.

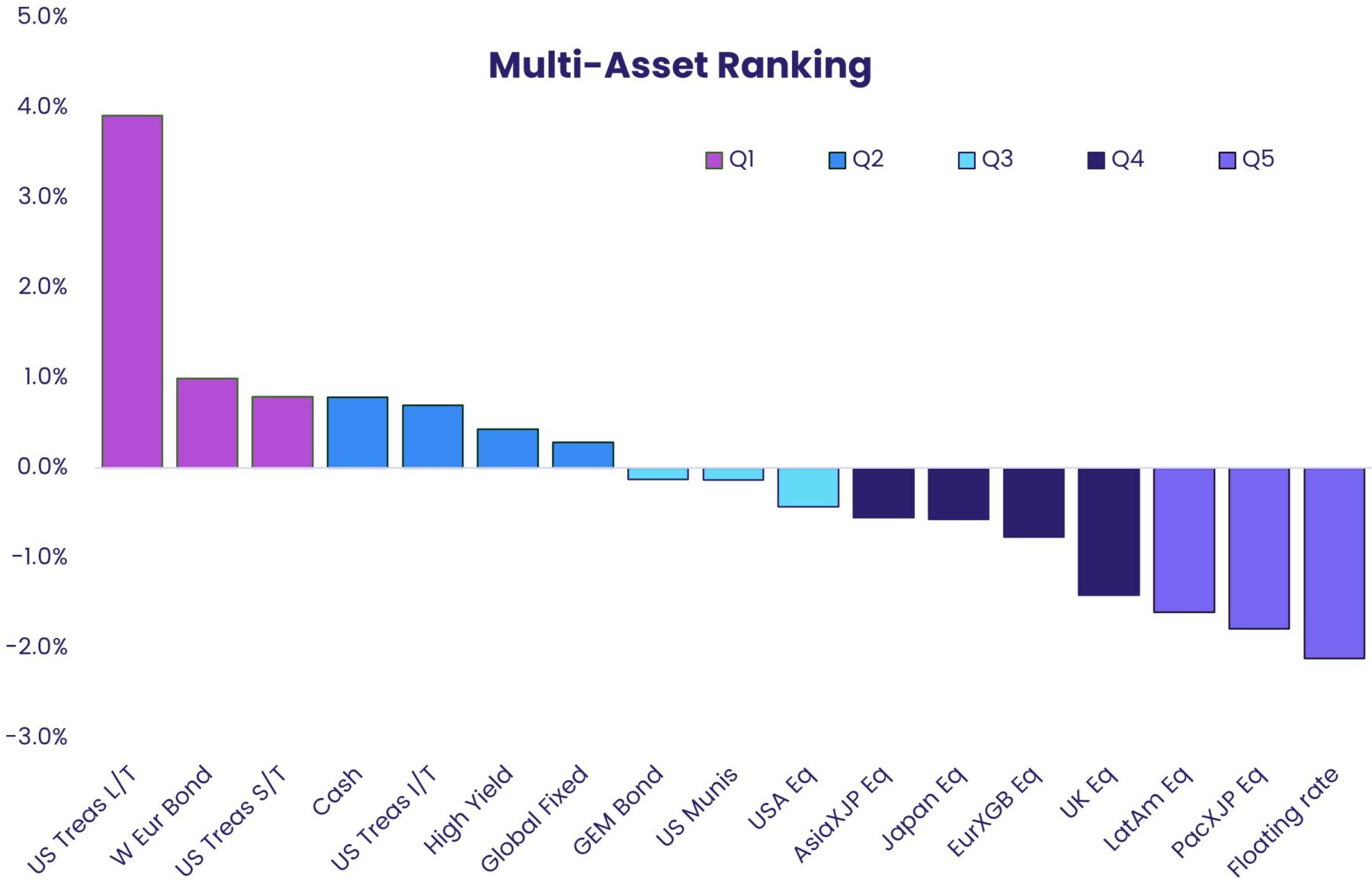

Junk bonds remain in the second quintile of EPFR’s weekly Multi Asset Rankings, while bank loan and floating rate debt anchor the bottom of the table.

European debt, meanwhile, has been climbing those rankings as a region noted for its stock of negative-yielding bonds increasingly offers positive returns. Europe Bond Funds posted their eighth consecutive inflow and their 10th in the past 12 weeks. At the country level, redemptions from Spain Bond Funds jumped to a nine-week high while UK Bond Funds posted their second largest inflow since the beginning of 4Q21.

Emerging Markets Bond Funds posted their 11th outflow in the past three months as redemptions from funds with hard currency mandates more than offset flows into Local Currency EM Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.